Dividend Recapitalization Activity Shows Signs of Renewed Life

Sep 2023

| The dividend recapitalization market slowed down in 2nd half of 2022 as companies digested rising interest rates. However, in recent months, there has been an uptick in volume as borrowers reconsider utilizing dividend recap transactions for a variety of reasons and recalculate the impact a leveraged dividend has on their shareholders.

In our latest perspective, Lincoln International explores the current market environment, provides an overview of dividend recaps and why they are an attractive option and discusses how solvency opinions can mitigate risk in these transactions. |

Summary

-

Lincoln International explores the current market environment, provides an overview of dividend recaps and why they are an attractive option and discusses how solvency opinions can mitigate risk in these transactions.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Dividend Recap Market Environment

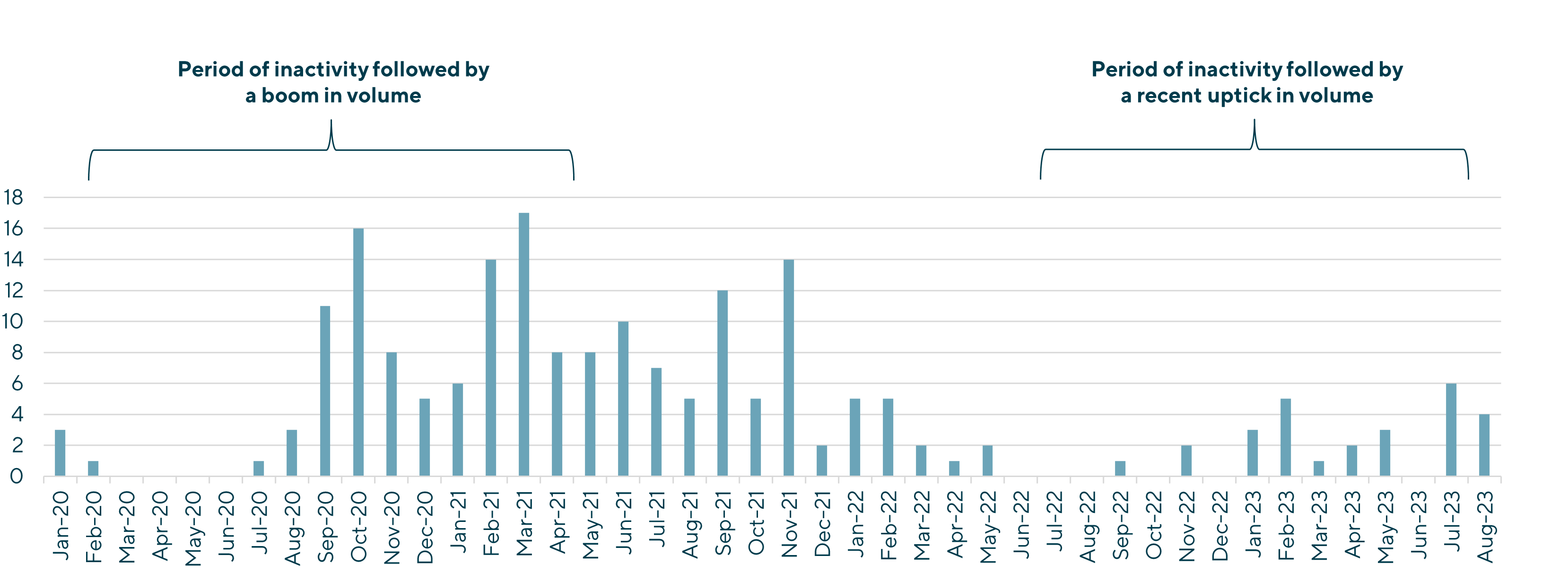

Number of Dividend Recapitalizations

Source: S&P LCD Comps; August 2023 data as of August 24, 2023

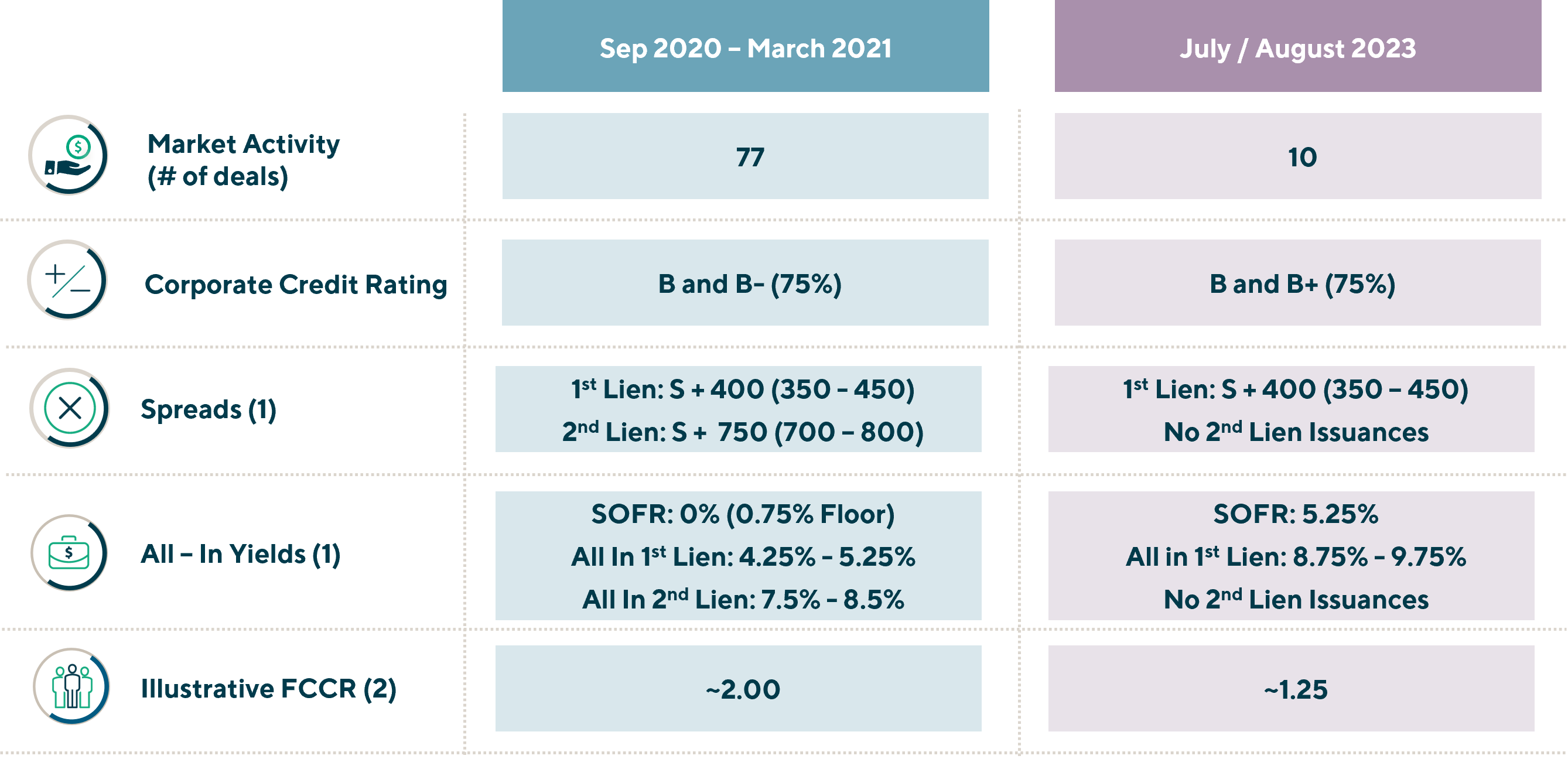

What Does the Current Environment for Dividend Recaps Look Like Compared to the Last Time the Market Opened?

Source: S&P LCD Comps, Lincoln

(1) Reflects syndicated market pricing

(2) Illustrative example based on 50% LTV

Dividend Recaps Overview

Why should a board consider a dividend recap?

- Current leverage level is below “market”, including situations where a sponsor over-equitized the initial purchase due to lower leverage availability

- Company is generating strong free cash flow and has the ability to service a higher level of debt while maintaining appropriate fixed-charge coverage

- Avenue to provide liquidity to shareholders in an M&A environment where a full sale is not optimal

- Balance sheet recapitalization simultaneous with general partner-led continuation vehicle transaction

- Allows owners to take “chips off the table” and de-risk fund returns today while preserving upside returns through a future M&A exit

- Potential alternative to a full sale or initial public offering (IPO) in the event the board / management believes appropriate value has not been achieved through the sale / IPO process

|

“Dividend recap transactions were traditionally underwritten with a focus on loan-to-value (LTV) with debt service metrics being less of a concern. Today, total leverage and fixed charge coverage ratios will carry equal weighting in assessing a company’s debt capacity for a debt-driven recap. As a rule of thumb, new-money acquisitions were historically levered to approximately 60% LTV, while dividend recap transactions often peaked at approximately 50% LTV (or 0.50x to 0.75x lower than buyout leverage). In recent weeks, the leveraged buyout market has shifted to approximately 45% to 50% LTV resulting in dividend recap transactions capping out at approximately 40% to 45% LTV. Moreover, the disruption in the markets has resulted in a lack of transparency around enterprise values if there has not been a market-clearing process, causing a heightened focus on the “V” in “LTV.” Consequently, lenders are exercising more caution on how much they will lend in a recap.”

Christine Tiseo, Managing Director and co-head of Lincoln’s Capital Advisory Group |

Use of Solvency Opinions to Mitigate Risks is Inherent in Any Dividend Transaction

Risks

In the event the borrower becomes distressed or insolvent in the future, creditors may allege the dividend was a fraudulent conveyance.

- Directors: Could face significant personal liability

- Potential “Unwinding”: Shareholders could be forced to return dividend and / or settle litigation

- Secured Lenders: Secured claims may need to settle for significant discounts, despite previously negotiated collateral

|

“Our clients obtain solvency opinions for many reasons, but the personal liability that members of the board of directors could face is often the leading one.”

Chris Gregory, Managing Director in Lincoln’s Valuations & Opinions Group who leads fairness and solvency opinions |

The Lincoln Difference

Lincoln’s Valuations & Opinions Group, which performs 4,500+ valuations per quarter as part of an investment bank with highly active M&A and Capital Advisory Groups that closed 350+ transactions in 2022, brings real world experience and deep industry expertise to every one of its fairness and solvency opinions engagements. In addition, the portfolio valuation work performed on behalf of over 100 alternate asset managers has earned Lincoln a sterling reputation and credibility within the institutional LP community.

Contributors

I enhance my clients’ decision making and governance processes by providing independent and objective financial advice in a highly responsive manner.

Chris Gregory

Managing Director & Co-head of Transaction Opinions

New York

We structure creative financing solutions for complex transactions in order to maximize optionality and value for our clients.

Alexander Stevenson

Managing Director & Co-head of Capital Advisory

Los Angeles

I strive to be a strong advocate for my clients and offer a fresh and creative perspective to financing situations that exceed expectations and provide the flexibility needed to grow their businesses.

Christine Tiseo

Managing Director & Co-head of Capital Advisory

ChicagoMeet Professionals with Complementary Expertise

I find immense fulfillment in enabling clients to achieve their objectives and navigate the complexities of today's ever-changing landscape.

Chris Croft

Managing Director & Co-head of Transaction Opinions

New York

I enjoy sharing insights about market and valuation trends with my clients, while also leading a differentiated and high-touch process.

Brian Garfield

Managing Director & Head of U.S. Portfolio Valuations

New York

I enhance my clients’ decision making and governance processes by providing independent and objective financial advice in a highly responsive manner.

Chris Gregory

Managing Director & Co-head of Transaction Opinions

New York

I enjoy the opportunity to provide clients with insightful and unbiased advice that will help them make the most informed decisions possible.

Ron Kahn

Managing Director & Co-head of Valuations & Opinions

Chicago