Capital Advisory

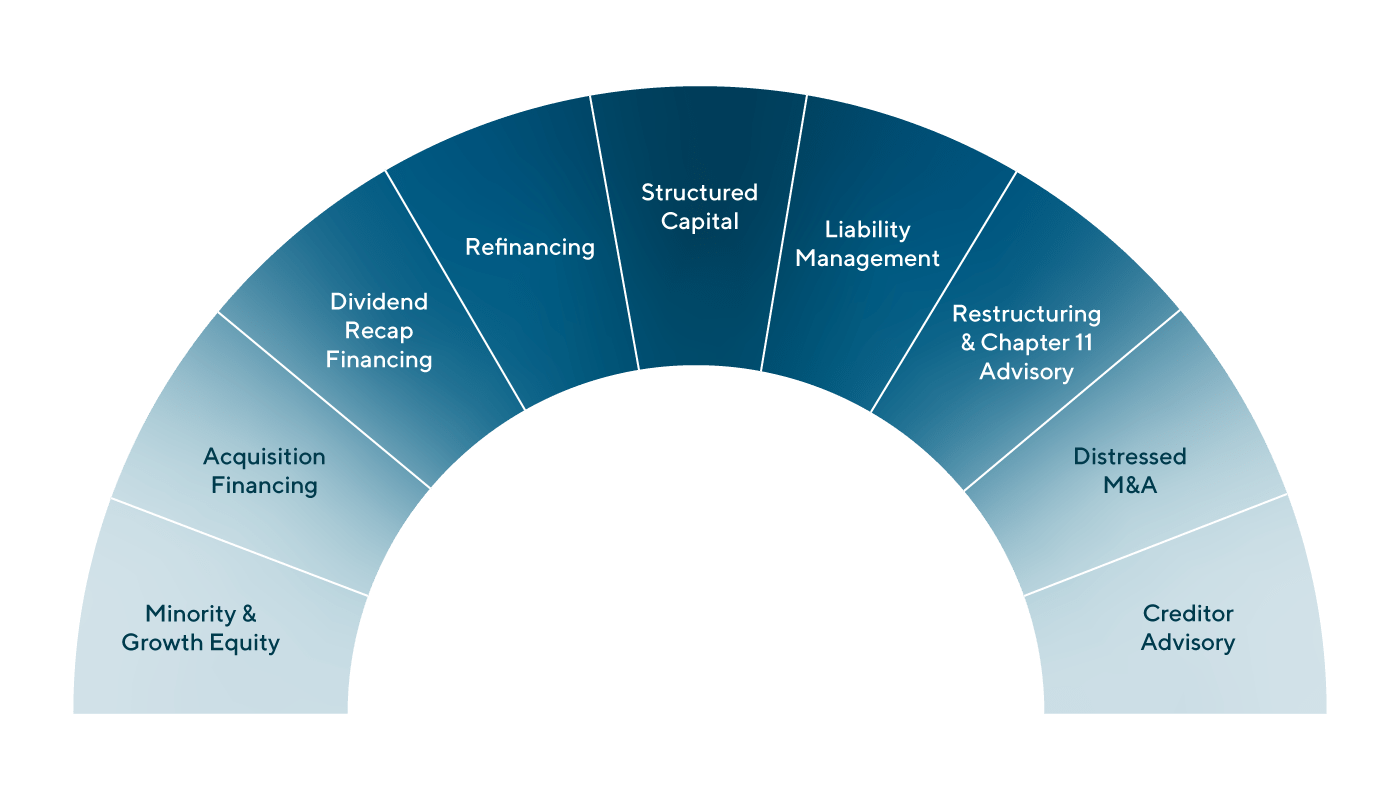

Our integrated team of product experts deliver comprehensive, yet tailored, advisory services spanning the entire capital structure.

Deep Capital Markets & Restructuring Expertise

Extensive relationships and vast experience across the private capital markets uniquely positions Lincoln to execute all types of financing and capital advisory engagements. Whether arranging debt financing, raising minority or growth equity, placing structured capital or providing advisory services involving liability management or financial restructuring to solve capital structure challenges, our collaborative, cross-functional capital advisory team leverages the entire Lincoln platform to achieve the best outcome for each and every client.

What We Do

Perspectives & Publications

Recent Transactions

Meet our Senior Team in Capital Advisory

By linking my experience in debt advisory and mergers and acquisitions, I look forward to delivering flexible and innovative financing solutions to make an impact that matters with long-term target clients, as Lincoln does best.

Daniele Candiani

Managing Director & Co-head of Capital Advisory, Europe

Milan

I build trust with clients by putting their interests first at all times.

Aude Doyen

Managing Director & Co-head of Capital Advisory, Europe

London

I take an active role in every stage of the transaction process in order to achieve the goals of my clients.

Iván Marina

Managing Director | CEO Spain

Madrid