Lincoln International Releases Third Quarter Middle Market Index, Shows Tenth Consecutive Quarter of Enterprise Value Growth

Lincoln MMI demonstrates that privately held middle market companies are generating returns comparable to major public stock market indices, but with less volatility

Lincoln International, a leading global, mid-market investment bank, today released the third quarter 2018 issue of its Lincoln Middle Market Index (Lincoln MMI). The Lincoln MMI is a unique index measuring middle market enterprise values. The first-of-its-kind index provides a useful benchmarking tool for investors in private companies and private equity firms, allowing them to track how comparable enterprise values change over time and correlate to the public stock market.

Key observations of the Q3 2018 Lincoln MMI include:

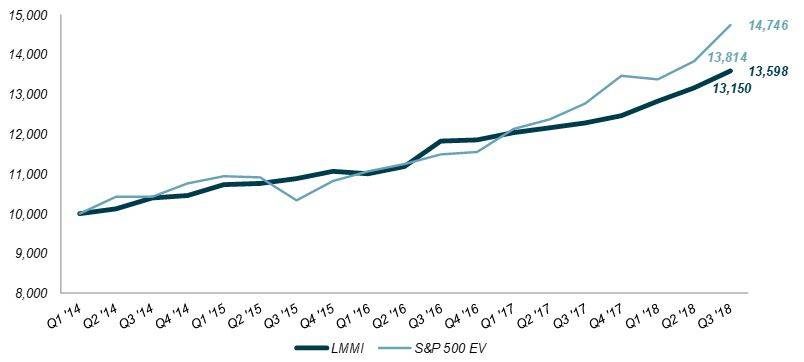

- Year-to-date middle market enterprise value growth through Q3 2018 of 9.2% approximates that of the S&P 500 of 9.4%, as both Lincoln MMI and S&P 500 EV values increased in Q3 prior to the October 2018 correction.

- While performance and multiples both improved for the Lincoln MMI and the S&P 500, multiple expansion was more pronounced in the public markets.

- Lincoln MMI 2018 Q3 growth of 3.4% was the second highest quarterly growth since inception and the strongest growth since Q3 2016.

- The Lincoln MMI continues to demonstrate that valuations of U.S. middle market companies are less volatile because of lower volatility in enterprise value multiples compared to the S&P 500; in the long run, earnings remain the driver of enterprise value growth for all companies.

“For the quarter ending September 30, 2018, middle market growth was the highest in two years and the second highest since the first quarter of 2014. The continued, steady enterprise value growth of the middle market was driven by improved earnings as earnings have increased in each of the last seven quarters,” said Steve Kaplan, Neubauer Distinguished Service Professor of Entrepreneurship and Finance at the University of Chicago Booth School of Business, who assists and advises Lincoln about the index.

“The strong overall performance of the Lincoln MMI in Q3 2018 was driven primarily by business service companies as well as healthcare, industrial, and technology companies,” Ron Kahn, Managing Director and head of Lincoln’s Valuations & Opinions Group added, “Despite the risks of greater tariffs, interest rates, and political uncertainty, valuations continued to expand through September 30, 2018 as both earnings and multiples improved this quarter. We are certainly aware that through September 30, 2018, we were in a period of strong stock market performance and this quarter’s results do not reflect the unanticipated stock market correction of October 2018.”

Kahn continued, “The Lincoln MMI enables investors in private companies and private equity firms the ability to compare or benchmark their investments against an index comprised of hundreds of privately held companies. Moreover, the Lincoln MMIdemonstrates that privately held middle market companies generate returns comparable to major public stock market indices but with less volatility.”

Industry Sub-indices & Key Observations:

Lincoln breaks down the Lincoln MMI into six industries (business services, consumer, energy, healthcare, industrials, and technology), providing unique insight into how the performance of middle market companies varies by sector.

- Middle market technology companies have increased in value for ten consecutive quarters, averaging quarterly growth of over 4.0% and making technology the strongest performing industry since Q2 2017.

- While private companies in the business services, healthcare, industrials, and technology sectors experienced strong third quarter performance, business service companies grew over 7.0%, which was 3.0% more than any other industry.

- Consumer enterprise value growth continues to lag behind that of all other industries except energy, thus dragging overall middle market performance.

About the Lincoln Middle Market Index

The Lincoln MMI is the only index that tracks changes in the enterprise value of U.S. privately held middle market companies, primarily owned by private equity firms.

The Lincoln MMI seeks to measure the variation in middle market companies’ enterprise values by analyzing the aggregate change in both company earnings as well as the prevailing market multiples of over 400 middle market companies, each generating less than $100 million in annual earnings. The Lincoln MMI is calculated using anonymized data on an aggregated basis by Lincoln’s Valuations & Opinions Group, which offers unique insights into the financial performance of thousands of portfolio investments of financial sponsors, business development companies, and private debt funds.

The methodology was determined by Lincoln in collaboration with Professors Steven Kaplan and Michael Minnis of the University of Chicago Booth School of Business. While other indices track changes to a company’s revenue or earnings, the Lincoln MMI is different in that it tracks the total value of these companies. Significantly, the large number of middle market companies used to create the Lincoln MMI helps ensure that the confidentiality of all company-specific information used in the Index is maintained.

Starting with a benchmark value of 10,000 as of March 31, 2014, the Lincoln MMI increased to 13,598 as of September 30, 2018, resulting in an annual compounded growth rate of 7.1 percent per year since inception.

Relationship of the Lincoln MMI to the S&P 500

(Note: Both the Lincoln and S&P 500 EV returns above reflect enterprise values)

For more information, visit An Overview of the Middle Market Index

Important Disclosure

The Lincoln Middle Market Index is an informational indicator only, and does not constitute investment advice or an offer to sell or a solicitation to buy any security. It is not possible to directly invest in the Lincoln Middle Market Index. Some of the statements above contain opinions based upon certain assumptions regarding the data used to create the Lincoln Middle Market Index, and these opinions and assumptions may prove incorrect. Actual results could vary materially from those implied or expressed in such statements for any reason. The Lincoln Middle Market Index has been created on the basis of information provided by third-party sources that are believed to be reliable, but Lincoln International has not conducted an independent verification of such information. Lincoln International makes no warranty or representation as to the accuracy or completeness of such third-party information.

Summary

-

Lincoln International's Middle Market Index (Lincoln MMI) reports middle market company performance in Q3 2018.

- Click here to download the full LMMI report

Meet our Senior Team in Valuations & Opinions

I find immense fulfillment in enabling clients to achieve their objectives and navigate the complexities of today's ever-changing landscape.

Chris Croft

Managing Director & Co-head of Transaction Opinions

New York

I enjoy sharing insights about market and valuation trends with my clients, while also leading a differentiated and high-touch process.

Brian Garfield

Managing Director & Head of U.S. Portfolio Valuations

New York

I enhance my clients’ decision making and governance processes by providing independent and objective financial advice in a highly responsive manner.

Chris Gregory

Managing Director & Co-head of Transaction Opinions

New York

I enjoy the opportunity to provide clients with insightful and unbiased advice that will help them make the most informed decisions possible.

Ron Kahn

Managing Director & Co-head of Valuations & Opinions

Chicago