The State of Space

Jun 2024

| As the world population increases, technology evolves and the earth’s resources come under stress, the desire to explore and invest in the space frontier continues to grow. While space tourism captures the popular imagination as a means to participate in space exploration, it is just one of the vast use cases being developed and, in some cases proven out, by a host of companies looking to capitalize on the market. Other prominent use cases include near real-time intelligence gathering for militaries, precision farming, connecting vehicles and telecommunications. |

Summary

-

Lincoln's experts delve deep into the space industry's dynamics, including the role of SPACs, evolving valuations, the increasing interest from PE and an outlook.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Along with the demand for expanded connectivity across all parts of the globe, great innovation has occurred by companies spanning start-ups to mature organizations. Governments are pouring billions into the space sector, as are enterprises and individual billionaires. A small group of large GEO satellite providers is now outpaced by numerous companies set up to capitalize on smaller, closer lower orbit LEO satellite technology. These factors, among others, are driving a renewed focus on the space industry. Along with this activity come risks and uncertainties such as costs and malfunctions. Many rockets heading to space fail shortly after launch. It takes a tremendous amount of capital to not only develop cutting-edge technologies but also to execute successful missions.

This perspective explores the space industry, examining SPACs’ impact, the changing landscape of valuations, the growing involvement of private equity (PE) and future market prospects.

Emergence of SPACs

Special purpose acquisition vehicles (SPACs) have been around for decades but have seen a rapid rise in popularity. Given the need to be well capitalized, and the compelling upside if successful, many space companies utilized SPACs starting in 2021.

Recent SPACs

| Company | Year Public | EV via SPAC | Description |

| Amprius Technologies | 2022 | $939M | Energy storage including for satellites |

| Momentus | 2021 | $567M | Space infrastructure for space transport and satellites, services |

| Redwire | 2021 | $615M | Space systems and satellite components, launch and services |

| Terrain Orbital | 2022 | $1.8B | Small satellites and mission solutions for communications |

| Rocket Lab | 2021 | $4.1B | Mission-critical space infrastructure |

| Virgin Orbit | 2021 | $3.7B | Satellite launch services |

The Evolution of Valuations

The promise of rapid revenue and future profitability growth drove strong valuations out of the gate. However, being public places the expectation for companies to generate returns for shareholders through strong financial performance. In the private markets, where annual results often trump the importance of quarterly results, top or bottom-line misses can better survive scrutiny.

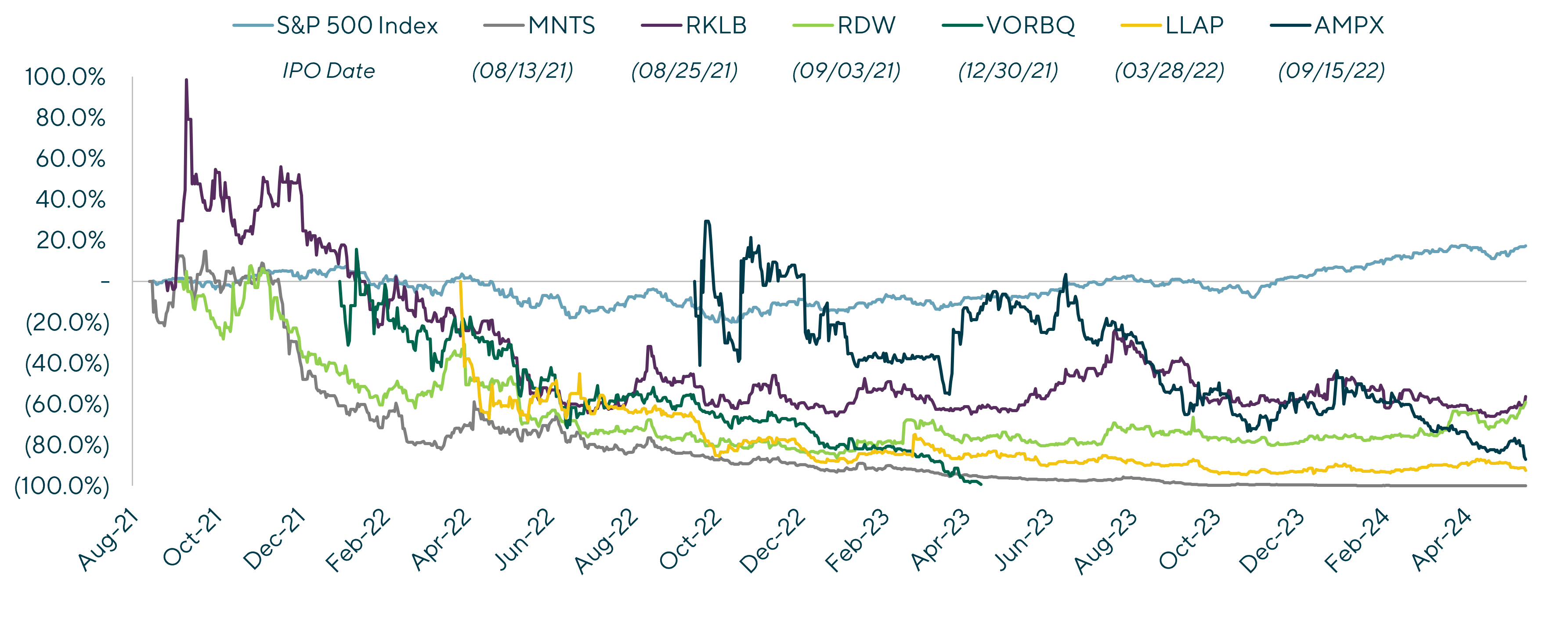

Stock Market Performance of Public Companies from IPO Date12

The share price underperformance of some space companies may be a mismatch of financial performance versus timing expectations given the growing competition, the rate of technology advancement and slower-than-expected adoption. However, long-term demand prospects remain bright, these companies are still solving huge challenges and societal goals and the interest in space has not waned.

Companies like SpaceX’s Starlink are bringing the internet to areas of the world that are inaccessible through traditional terrestrial infrastructure. Maxar is providing governments with high-resolution satellite imagery and Rocket Lab is enabling more frequent space launches.

Space-related activity is at an all-time high. That said, the question remains if companies operating in the sector are better suited to access the private markets.

PE in Space

In addition to governments, ultra-high-net-worth individuals and multi-billion-dollar enterprises funding space advancement, PE has emerged as a major player. AE Industrial, Arlington Capital Partners, The Jordan Company, Veritas and Trive Capital, in particular, have been leaders in the sector.

Precedent Transactions

| Financial Investor | Platform | Description | Acquirer Companies |

|

Complete solutions for mission design, spacecraft, launch, ground and operations |  |

|

|

Spaceplanes, space stations and propulsion systems | N/A | |

|

End-to-end space transportation | ||

(public but still major investor) |

Space infrastructure for civil, commercial and national security space |

|

|

|

|

Produces radio frequency amplification products for space |

Electron Devices and Narda Microwave-West Divisions

|

|

Satellite communications solutions | N/A | |

|

|

Provider of software-defined, cyber-secure and integrated satellite avionics | N/A |

| Ruggedized magnetic solutions for manned and unmanned space and others |   |

||

|

Manufacturer of complex sub-assemblies for launch vehicles and hypersonics |      |

|

|

|

Advanced electronics for space, defense and commercial operations in the harshest environments |

|

The growing list of PE-backed space companies indicates the overall market’s support by both equity and debt investors. Eventually, these companies will change hands or go public, further fueling deal activity as the market matures and companies continue to prove their strategies through financial performance.

Outlook on the Space Sector

The macro backdrop for space remains promising. McKinsey estimates that the global space economy will be worth $1.8 trillion in 2035 versus $630 billion in 2023.1 In some areas, demand will outpace supply. Oliver Wyman estimates that by 2030 MILSATCOM supply (in Gbps) will be unable to match demand by as much as 68%. OW also believes that by 2028 Starlink will be unable to meet demand over North America for commercial broadband despite a projected 5,980 satellites in orbit.2 Emerging companies and technologies will need to continue ramping up efforts to satisfy this demand, which creates the need for further public and private investment.

As the desire to explore space continues to grow, public and private investors will be interested in deploying capital and driving deal activity. In a sector where attracting capital is imperative to enable growth, mergers and acquisitions will continue to play a major role in defining the space industry.

Connect with a Lincoln expert below to discover how we can elevate your business to its next level of success.

1) McKinsey & Company. Space: The $1.8 trillion opportunity for global economic growth, Report, April 8, 2024.

2) Oliver Wyman. Space Market Excerpts, March 2024.

Contributors

Meet Professionals with Complementary Expertise in Aerospace & Defense

I strive to deliver value-added advice, leveraging deep industry knowledge and extensive industry relationships.

Guillaume Suizdak

Managing Director & Co-head of Industrials, Europe

Paris