Q3 2022 Lincoln Private Market Index

Lincoln Private Market Index Modestly Increases, but Private Markets are Beginning to Cool OffLincoln International’s 21st edition of the Lincoln Private Market Index (Lincoln PMI) reveals that in Q3 2022, private market enterprise values increased 1.9%. This quarter, the Lincoln LPMI increased due to modest improvement in fundamental performance in the private markets, partially offset the sixth straight quarter of multiple contraction. Whereas the Lincoln PMI increased 1.9%, the S&P 500 EV declined by 4.6% during Q3, reflecting the S&P 500’s significantly more volatile enterprise value (EV) multiples. While most industries in the Lincoln PMI increased in the current quarter, consumer companies’ enterprise values decreased, as consumer discretionary companies would likely be most directly impacted by a recessionary environment. About the Lincoln Private Market IndexThe Lincoln PMI is the only index measuring changes in the enterprise values of private companies over time – and a barometer of the performance of private companies generally. The Lincoln PMI enables private equity firms and other investors to benchmark how private company investments are performing against peers, and how this performance correlates to the S&P 500. Lincoln designed the Lincoln PMI to solve this problem by measuring the quarterly change in enterprise values for private companies primarily owned by private equity firms. Enterprise value is the sum of a company’s equity value and debt. |

-

Quarterly Overview

- 21st Edition: Covers Q3 2022

- Measures quarterly changes in the enterprise values of approximately 900 private companies, based on a population of approximately 3,800 companies primarily owned by private equity firms with a median EBITDA of approximately $30-35 million

- Analyzes the impact from the change in company earnings versus market valuation multiples

- Assess the change in value for six industry sectors

- Click here to download a printable version of this report.

Results

Private Markets Remain Insulated Amidst Public Market Volatility

(NOTE: Both the Lincoln PMI and S&P 500 EV returns above reflect enterprise values)

(S&P 500 EV excludes financial companies for which enterprise value is generally not meaningful; however, including such companies produces similar results)

| Q3 ’22 | YTD | LTM | |

| Lincoln PMI | 1.9% | 3.2% | 7.2% |

| S&P 500 EV | (4.6%) | (22.3%) | (14.8%) |

| Industry | Q3 ’22 | YTD | LTM |

| Bus Services | 3.8% | 7.9% | 18.7% |

| Consumer | (1.8%) | (0.3%) | 4.1% |

| Energy | 5.7% | 13.5% | 26.4% |

| Healthcare | 0.4% | (0.2%) | 2.6% |

| Industrials | 4.5% | 12.2% | 13.0% |

| Technology | 1.0% | (0.7%) | 60.6% |

| ~35%+ |

| Expansion of Lincoln PMI valuation multiples since Q1 2014 |

Summary

The Lincoln PMI

General Observations

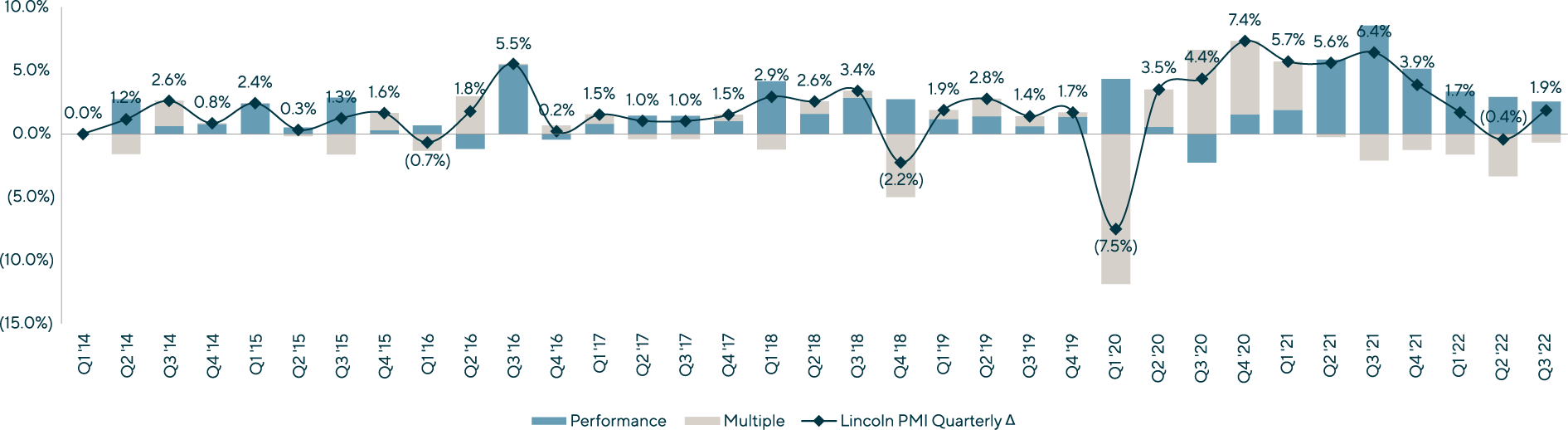

- Private company enterprise values increased in Q3 2022 from near-record levels in Q2 2022 as the Lincoln PMI increased 1.9%. The index has increased 36.6% from pre-pandemic levels observed in Q4 2019 but growth has slowed for over a year.

- Despite similar growth in 2021, the Lincoln PMI and S&P 500 EV experienced diverging performance in 2022 as multiple contraction in the public markets drove a much greater decline in the S&P 500 EV relative to the Lincoln PMI.

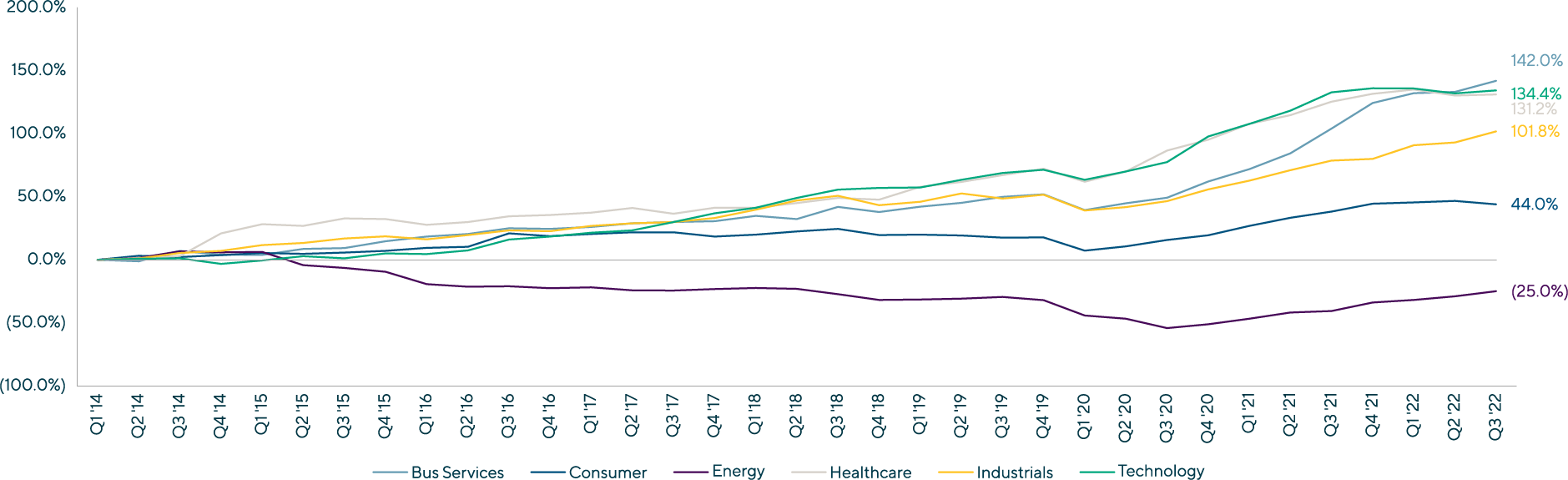

- Since its inception in Q1 2014, the Lincoln PMI has shown that private company enterprise value multiples have been less volatile than public company multiples and that earnings are the primary factor driving long term value creation.

Enterprise Value Results

- In Q3 2022, private market valuations continued to hinge on whether companies can execute on projected growth while also mitigating recessionary pressures.

- In Q3 2022, both the Lincoln PMI and S&P 500 EV indices benefited from improved operating results; however, multiple contraction was significantly more material in the public markets.

Industry Breakdown on an enterprise value basis

- Despite ongoing volatility and multiple compression in the public markets, the consumer industry was the only industry within the Lincoln PMI to undergo a decline in the current quarter.

- In the current quarter, private company valuations for business services and industrials industries increased at an accelerated rate, while formerly safe spaces such as healthcare and technology saw more modest growth.

- Although growth slowed across most industries, energy continued to rebound at an accelerated rate given heightened demand relative and supply chain pressures resulting in part from the conflict in Ukraine, which drove an increase in oil and gas prices.

In Summary, we believe the Lincoln PMI

|

Methodology

Source of Data and Sample Size

On a quarterly basis, Lincoln determines the enterprise fair value of over 3,800 portfolio companies for over 125 sponsors (i.e., private equity groups and lenders to private equity groups). These portfolio companies report quarterly financial results to the sponsor or lender. Lincoln obtains this information and determines the appropriate enterprise value multiple so as to compute the enterprise value in accordance with the fair value measurement principles of generally accepted accounting principles. In assessing enterprise value, Lincoln relies on well accepted valuation methodologies such as the market approach and income approach considering each company’s historical and projected performance and other qualitative and quantitative factors. Finally, each valuation is then vetted by auditors, company management, boards of directors and regulators. Upon concluding each quarterly valuation cycle, Lincoln aggregates the underlying financial performance and enterprise value data for analysis.

To construct the Lincoln PMI, Lincoln selects a subsection of the companies valued each quarter, including private companies each generating earnings before interest, taxes, depreciation and amortization of less than $100.0 million, disregarding venture-stage businesses and non-operating entities, such as special purpose entities that own real estate and specialty finance assets.

For more information, visit www.lincolninternational.com/services/valuations-and-opinions/lincolnpmi

| 3,800 Portfolio companies are evaluated by Lincoln on a quarterly basis to determine their Enterprise Fair Value |

125+ Sponsors participate in Lincoln PMI i.e. private equity groups & lenders to private equity groups |

Academic Advisors

Professor Steven Kaplan

Professor Steven Kaplan is a Senior Advisor to Lincoln’s Valuations and Opinions Group. He is the Neubauer Family Distinguished Service Professor of Entrepreneurship and Finance and Kessenich E.P. Faculty Director at the Polsky Center for Entrepreneurship and Innovation at the University of Chicago Booth School of Business. Among other courses, Professor Kaplan teaches advanced Master of Business Administration and executive courses in entrepreneurial finance and private equity, corporate finance, corporate governance and wealth management. Professor Kaplan conducts research on a wide array of issues in private equity, venture capital, corporate governance, boards of directors, mergers and acquisitions and corporate finance. He has been a member of the Chicago Booth faculty since 1988.

Professor Kaplan serves on the board of Morningstar and several fund and company advisory boards. He is also a Research Associate at the National Bureau of Economic Research and an Associate Editor of the Journal of Financial Economics.

Professor Kaplan received a Bachelor of Arts, summa cum laude, in applied mathematics and economics from Harvard College and earned a Doctor of Philosophy in business economics from

Harvard University.

Professor Michael Minnis

Professor Michael Minnis is a Senior Advisor to Lincoln’s Valuations and Opinions Group. He is a Professor of Accounting at the University of Chicago Booth School of Business, where he researches the role of accounting information in allocating investment efficiently by both managers and capital providers. His recent research focuses on understanding the role of privately held companies in the U.S. economy and how these firms use financial reporting to access, deploy and manage capital. He particularly enjoys identifying unique data and methods to empirically examine issues in a novel way.

In January 2018, Professor Minnis became a member of the Private Company Council, the primary advisory council to the Financial Accounting Standards Board (FASB) on private company issues. Professor Minnis received his Ph.D. from the University of Michigan and his Bachelor of Science from the University of Illinois, where he graduated with highest honors.

Meet Our Senior Team

I find immense fulfillment in enabling clients to achieve their objectives and navigate the complexities of today's ever-changing landscape.

Chris Croft

Managing Director & Co-head of Transaction Opinions

New York

I enjoy sharing insights about market and valuation trends with my clients, while also leading a differentiated and high-touch process.

Brian Garfield

Managing Director & Head of U.S. Portfolio Valuations

New York

I enhance my clients’ decision making and governance processes by providing independent and objective financial advice in a highly responsive manner.

Chris Gregory

Managing Director & Co-head of Transaction Opinions

New York

I enjoy the opportunity to provide clients with insightful and unbiased advice that will help them make the most informed decisions possible.

Ron Kahn

Managing Director & Co-head of Valuations & Opinions

ChicagoRelated Perspectives

IMPORTANT DISCLOSURE: The Lincoln Private Market Index (LPMI) is an informational indicator only and does not constitute investment advice or an offer to sell or a solicitation to buy any security. It is not possible to directly invest in the LPMI. Some of the statements above contain opinions based upon certain assumptions regarding the data used to create the LPMI, and these opinions and assumptions may prove incorrect. Actual results could vary materially from those implied or expressed in such statements for any reason. The LPMI has been created on the basis of information provided by third-party sources that are believed to be reliable, but Lincoln International has not conducted an independent verification of such information. Lincoln International makes no warranty or representation as to the accuracy or completeness of such third-party information.

The LPMI should not be construed as an offer to sell or buy, or a solicitation to sell or buy, any products linked to the performance of the LPMI. The use of the LPMI in any manner, including for benchmarking purposes, is not endorsed or recommended by Lincoln International and Lincoln International is not responsible for any use made of the LPMI. Lincoln International does not guarantee the accuracy and/or completeness of the LPMI and Lincoln International shall not have any liability for any errors or omissions therein. None of Lincoln International, any of its affiliates or subsidiaries, nor any of its directors, officers, employees, representatives, delegates or agents shall have any responsibility to any person (whether as a result of negligence or otherwise) for any determination made or anything done (or omitted to be determined or done) in respect of the LPMI and any use to which any person may put the LPMI. Lincoln International has no obligation to update the LPMI and has no obligation to investors with respect to any product based on the performance of the LPMI. Any investment in such a product will not acquire an interest in the LPMI. Lincoln International is not an investment adviser and will not provide any financial advice relating to a product linked to the performance of the LPMI. Investors should read any such product offering documentation and consult with their own legal, financial and tax advisors before investing in any such product.