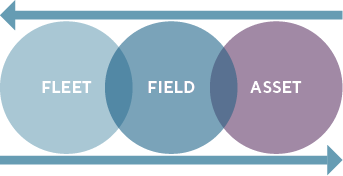

Fleet, Field and Asset Management Software: Convergence Creates Investment Opportunities

May 2021

Maintaining equipment, vehicles and other assets while also optimizing performance of employees and the work they do is a daunting task for any organization. To address this challenge, both large organizations and small and medium businesses (SMBs) are looking to software solutions to manage resources in a cohesive way.

Investor interest in software related to efficient fleet, field service and asset management has been steadily growing for some time. Now, investors are increasingly interested in merging these offerings into a holistic platform. The convergence of these platforms allows data and information to flow seamlessly between assets or equipment in the field, field workers who use or service this equipment and the fleet vehicles they drive. This helps optimize field asset operations, identify asset issues or failures in advance and efficiently service or repair assets by sending the right technician with the right skills and tools in the right vehicle to service the asset on the very first truck roll.

Summary

-

Lincoln International's expert from the Technology, Media & Telecom Group provides perspective around the convergence of offerings and opportunities for investors in fleet management, field service management and asset management software categories.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Individual Offerings Defined

| Fleet management software helps coordinate and optimize work in multiple locations, improves driver safety, helps avoid costly mistakes and optimizes vehicle management, including inspections and routine service. | Field service management software helps manage work orders and optimize the field service personnel who are responsible for repair, maintenance and inspection work. | Asset management software allows employees to monitor and optimize physical assets, ranging in complexity from a pipe in the ground or a HVAC unit on a roof, to an entire manufacturing facility or a large-scale solar or wind farm. |

Shift Towards Holistic Offerings

The convergence of two or more of these offerings creates value by connecting data in a seamless way to efficiently manage vehicles, workers and/or equipment. The formation of this digital thread provides the greatest opportunity for investors because when merged, the solutions enhance one another—generating value and differentiation from other competitive offerings in the market.

This convergence can happen organically through innovation or through acquisition. A common combination to date has been fleet management and field service software, offering capabilities to better manage employees, the work they do and the vehicles they drive. For example, the 2020 acquisition of ServiceBridge, field service management, by GPS Insight, fleet management; or Azuga, a fleet management company that developed their own field service solution. Another common combination is field service and asset management software, offering capabilities to ensure employees efficiently and even proactively execute repairs and maintenance. For example, PowerFactors, an asset management company, built their own field service add-on module or IFS, an asset management software provider, has aggressively acquired over five different field service management players over the last four years.

Lincoln PerspectiveFor private equity and strategic buyers interested in the space, now is the time to acquire target companies as consolidation is underway in each individual category. Additionally, a “super-consolidation” trend across categories is now starting as these software offerings converge to create new value for customers and solve challenges in a cohesive way. As investors express increased interest across categories and consolidation occurs, valuations are being driven higher. Lincoln International identified the following considerations for buyers contemplating a purchase of a fleet management, field service management or asset management software company.

|

||||||||||||

Contributors

Meet Professionals with Complementary Expertise

I am inspired by working with entrepreneurs and innovators who feel passionately about what they are creating.

William Bowmer

Managing Director & U.S. Co-head of TMT

San Francisco

I deliver a hands-on approach to provide strategic advice to my clients throughout the transaction and beyond.

Chris Brooks

Managing Director & European Co-head of TMT

LondonRelated Perspectives

Filtering the Noise: a Deep Dive into IT Services’ Key Valuation Drivers

This article was first published by TMT Finance on 9 July 2024: Filtering the noise: a deep dive into IT services’ key valuation drivers | TMT Finance The information technology… Read More

S&P Global Market Intelligence Webinar | M&A in Focus: Value Creation in a Higher-for-Longer World

Originally aired by S&P Global on Wednesday, July 26. Chaim Lubin, Managing Director in Lincoln’s Technology, Media and Telecom (TMT) Group, recently participated on a panel where industry experts discussed… Read More

Cybersecurity: Insights from Spring 2024’s Premier Conferences

Lincoln International attended several of the foremost cybersecurity conferences globally in recent months. These gatherings are crucial as they bring together experts, executives, government officials and thought leaders to evaluate… Read More

Cybersecurity Report: Year-End 2023 & Q1 2024

In 2023, cybersecurity M&A activity saw a significant decline in both volume and value, reaching its lowest point since 2014, attributed to factors such as high interest rates, inflation and… Read More