Affiliate Party Transaction Fairness Opinions During Down-Round Financing

May 2020

The economic ripple effects of COVID-19 are already being felt in private equity (PE) portfolios around the world. While some portfolio companies are expected to successfully weather this challenging time without requiring incremental capital by working through liquidity constraints with lenders, other companies will face existential distress. In the middle of this spectrum are companies that need to raise incremental capital to survive COVID-19.

Those companies may not be able to turn to their incumbent bank or non-bank lenders, which are facing liquidity challenges of their own. Lenders are preserving capital in anticipation of the deteriorating credit quality of their existing borrowers and the effects this will have on fund-level credit facilities. In addition to struggles with traditional lending options, many of the Small Business Administration (SBA) options included in the CARES Act are not currently available to private equity portfolio companies due to SBA Affiliation Rules.

The rescue capital providers who are open for business include special situation investors that specialize in distressed situations who can close quickly. But speed comes at a high cost: not only is this capital expensive from a return perspective, but may come with a board seat and a voice at the table on top of the complication of the capital structure with the introduction of structured equity or mezzanine debt.

As an alternative to a third-party funded capital infusion, portfolio companies may choose to raise capital from their private equity sponsor. The advantages to this sponsor funded recapitalization are clear: avoidance of new stakeholders, lack of information asymmetry, speed to close, ability to put capital to work in a challenging environment and lower transaction costs. However, the drawbacks to these affiliate party transactions are also clear and present challenges for GPs to navigate. In circumstances where a portfolio company is owned by a fund that is fully drawn, the GP may choose, despite the inherent conflicts, to fund the capital infusion from a newer vintage successor fund.

The risks of cross-fund investing are enhanced in the current environment due to (i) difficulties in determining the COVID-19 impact on portfolio company value today in part due to uncertainty surrounding the timing and magnitude of the recovery, and (ii) the substantial dilution to the predecessor fund which is often inherent in distressed capital infusion transactions. As a result, now more than ever sponsors are turning to independent financial advisors to assist in the valuation and security structuring process, and to provide a fairness opinion for the benefit of the GP, LPACs, funds and other investors.

Common affiliate party transactions include:

|

The benefit of an independent fairness opinion to GPs and portfolio company board members include:

|

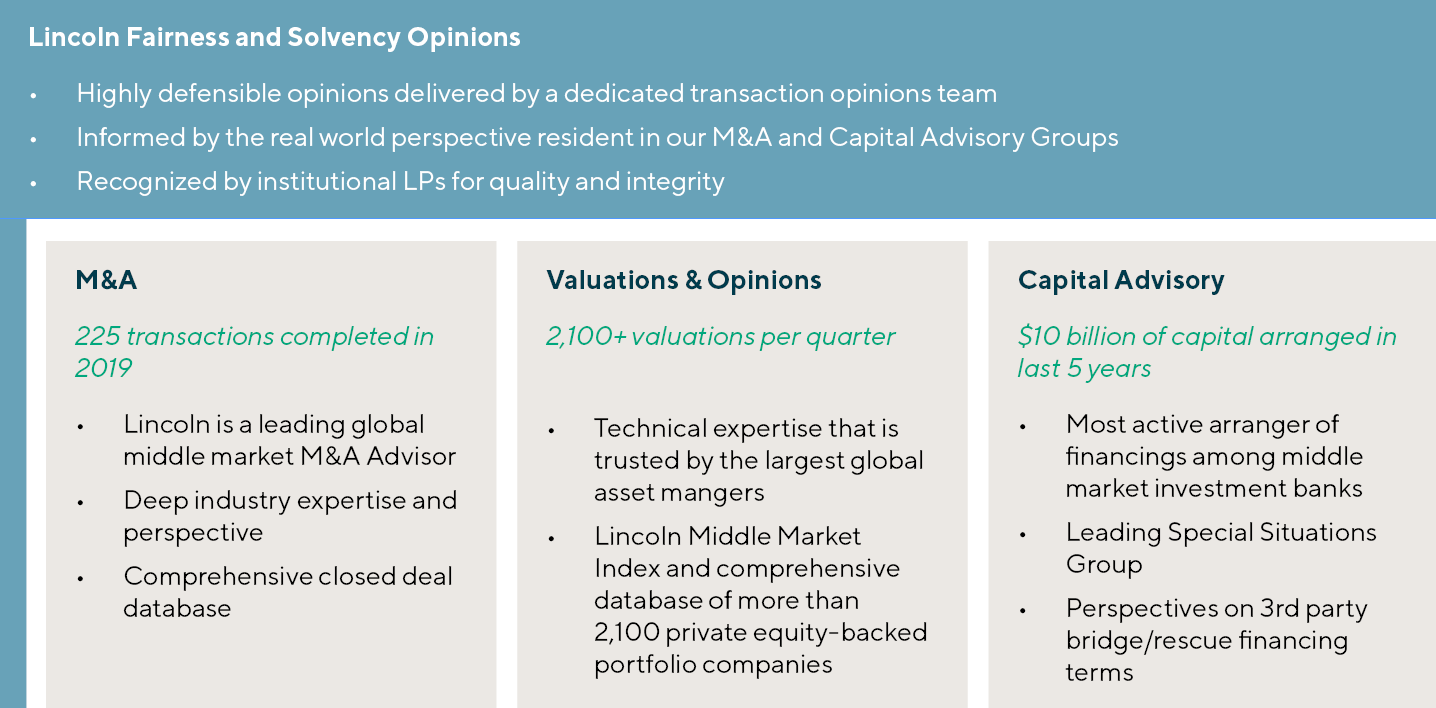

The Lincoln Difference:

Lincoln’s Valuations & Opinions Group, as part of an investment bank with highly active M&A and Capital Advisory Groups, brings real world experience and deep industry expertise to every one of its Fairness Opinion engagements. In addition, the portfolio valuation work we perform on behalf of over 100 alternative asset managers has earned Lincoln a sterling reputation and credibility within the institutional LP community.

Summary

-

Lincoln International's Valuations & Opinions Group discuss how to navigate the Coronavirus (COVID-19) and the importance of a fairness opinion during this uncertain time.

- Lincoln International hosted a webcast with Latham & Watkins to discuss capital infusion transactions and implications of COVID-19. To view full webinar, submit form here.

- Click here to download a printable version of this perspective.

-

Lincoln International has created a Playbook to support business leaders in documenting and articulating their COVID-19 response. To request a copy, click here. - Sign up to receive Lincoln's perspectives

Contributors

Meet our Senior Team in Valuations & Opinions

Related Perspectives

Lincoln International launches Europe’s first private credit market quarterly benchmark

Private credit returns in Europe outperform broadly syndicated loan market over last five years London, 10 April, 2024. Lincoln International has launched Europe’s first private credit market quarterly benchmark, the… Read More

The Lead Left | Podcast: Private Capital Call

Originally posted by The Lead Left on April 2, 2024. Ron Kahn, Managing Director and co-head of Lincoln’s Valuations & Opinions Group, shares insights on current market trends, including the positive… Read More

“Leader to Leader” Series

The Leader to Leader video series turns up the dial on rich conversations with prominent leaders – from business owners and entrepreneurs to investors and CEOs – highlighting their stories… Read More

S&P Global | Private Markets 360° Podcast: Valuation Insights

Originally posted by S&P Global on March 21, 2024. Ron Kahn, Managing Director and co-head of Lincoln’s Valuations & Opinions Group, recently delved into the creation of the Lincoln Private… Read More