Surging Medical Inflation Fuels Continued Interest in Self-Funding and Cost Containment

Nov 2022

| During the past 18 months, inflation has accelerated to levels not seen since the early 1980s. The cost of energy, food and other staples has increased rapidly and is expected to remain elevated. Medical insurance inflation, however, has been relatively muted, trending below CPI for the past two years. That trend will reverse sharply in 2023, particularly for the Group Health Insurance (GHI) market, as employer-sponsored plans are set to receive substantial price increases with upcoming renewals. Left unaddressed, GHI inflation will remain well above CPI for the foreseeable future. In this perspective, we explore the following key GHI market and industry dynamics: (i) underlying trends that are driving medical inflation in the GHI market, (ii) how employers are looking to TPAs and cost containment solutions to help control current costs and long-term inflation and (iii) the impact on recent and expected M&A activity as both strategic and financial buyers remain highly active and bullish on this sector. |

Summary

-

Lincoln International healthcare experts examine the impact of inflation on the healthcare insurance market.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Group Health Insurance Cost Increases Will Accelerate In 2023 And Beyond

The cost of GHI is driven primarily by three factors: (i) broader medical and pharmaceutical cost inflation, (ii) utilization of healthcare services and Rx, and (iii) cross subsidization between private insurance and government-funded insurance, particularly Medicare, given its prominent national payor status. Timing differences and multi-year contracts can result in a mismatch or lag between underlying cost trends and the current-year cost of GHI. Eventually the factors converge, and the underlying cost pressures manifest in higher insurance costs for employers and plan members.

Medical and Pharmaceutical Cost Inflation

Over the past two decades, underlying medical cost trends have consistently increased at a rate higher than inflation, driven by a multitude of long-term factors. New drug prices have grown rapidly due to the ever-increasing cost to bring new products to market (currently estimated at $1B to launch a new drug) and the widespread adoption of precision medicine – expensive therapeutics that target smaller addressable populations for highly specific interventions. Wage inflation, labor supply shortages, supply chain challenges and growing demand for services from an aging (and more acute) population is also placing incredible pressure on reimbursements and driving up pricing for healthcare.

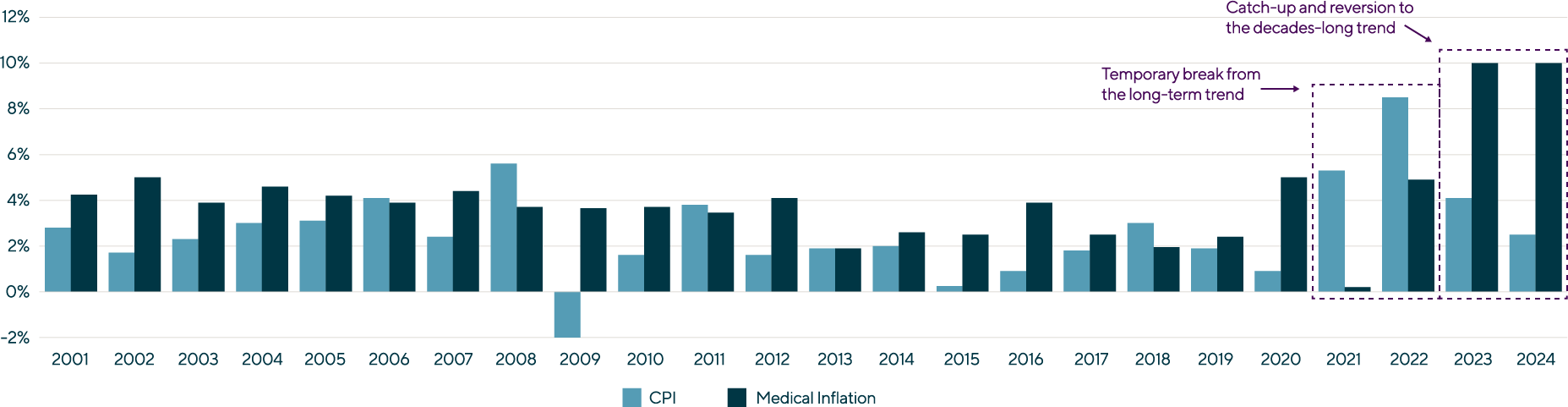

Annual CPI and Medical Inflation: 2001 – 2024 (projected)(1) |

The CPI / medical inflation trend temporarily abated in 2021 and 2022, driven by COVID-19 and unprecedented levels of federal funding support flooding the market to ensure the stability of the healthcare system to support the pandemic. With Washington discontinuing its subsidies, this trend is expected to fully revert in 2023 and 2024 as contracts and other pricing factors reset.

Healthcare Services and Rx Utilization

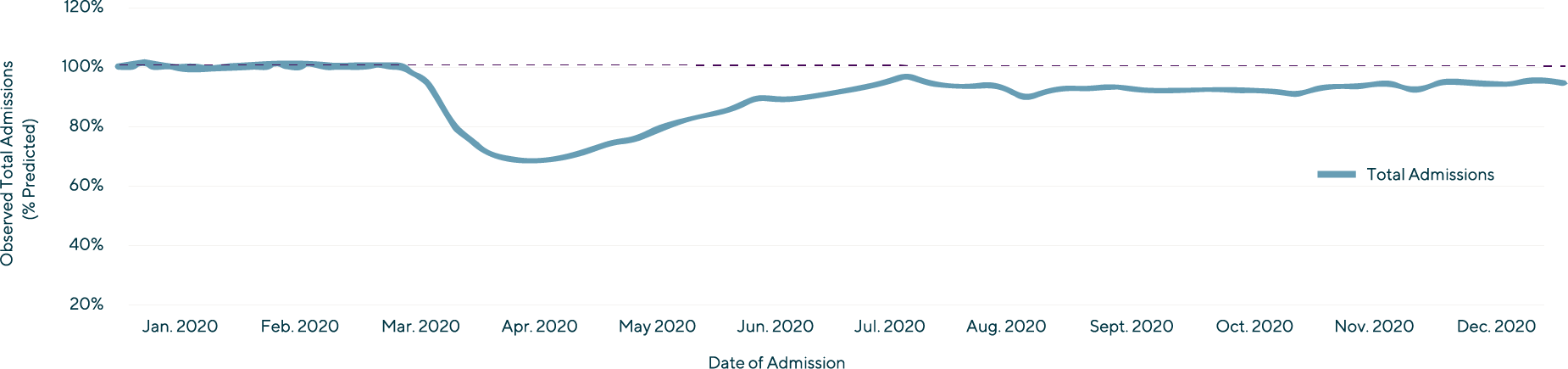

Healthcare services utilization saw a sharp fall off during the initial phase of COVID-19 due to plan members: (i) delaying elective procedures, (ii) shifting utilization to lower cost delivery models like telehealth and (iii) delaying preventative care.

Trend in Observed Total Hospital Admissions as a Percent of Predicted Admissions (December 29, 2019 – December 5, 2020)(2) |

The overall lower utilization of care in 2020 and 2021 artificially and temporarily reduced medical inflation. As a result, there will be heightened utilization in the near-term reflecting both the delayed care and complications from missed preventative visits.

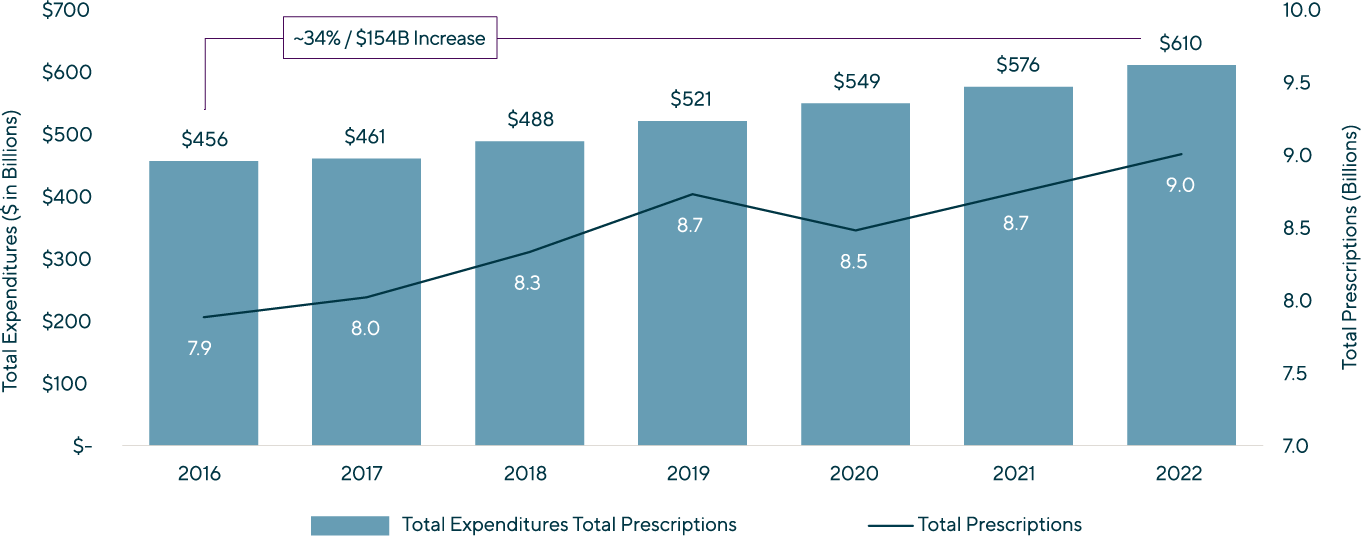

Prescription drug utilization remained at trend during COVID as plan members increased the utilization of mail-order pharmacy offerings and received more care within the home. From 2016 – 2022, total Rx expenditures grew at a 5% CAGR, while total scripts grew at a 2% CAGR as price increases were the primary driver of Rx spend growth.

Prescription Drug Expenditures and Prescriptions, 2016 – 2022(3,4) |

Cross Subsidization of Medicare

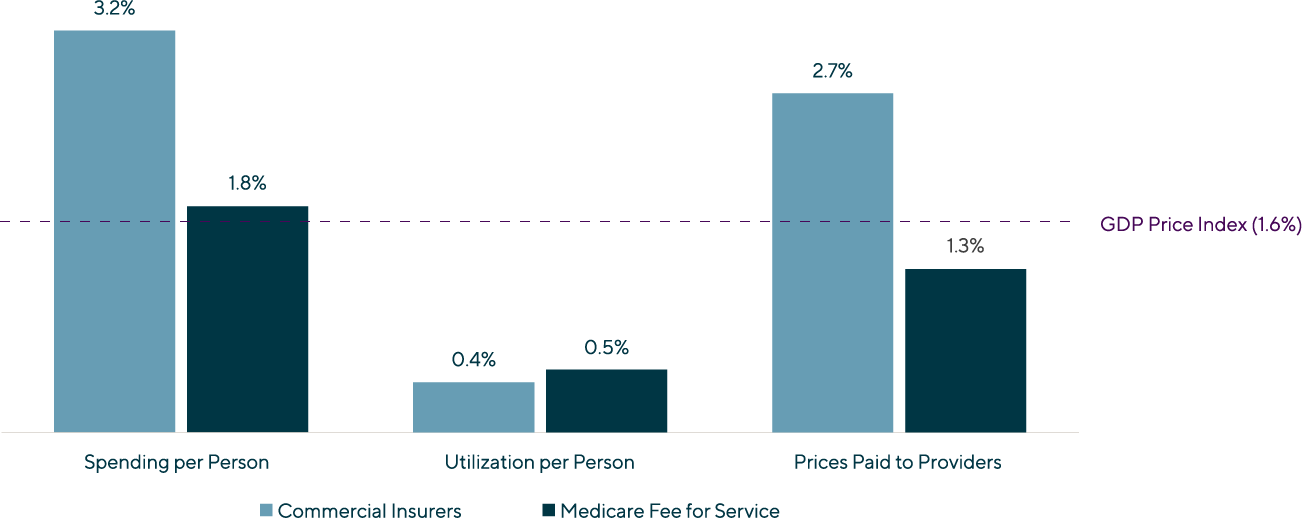

Medical costs are ultimately paid for through reimbursement from two broad payor groups: Government (Medicare, Medicaid, VA) and private insurance, primarily GHI. As the underlying costs of medical care increase, reimbursement cuts or reimbursement increases below trend by one payor group must be subsidized by another payor group. Private insurance currently pays a disproportionately higher percentage per capita compared to Medicare for like services.

Average Annual Growth Rates of Spending, Utilization and Prices for Hospitals’ and Physicians’ Services, 2013 – 2018(5) |

Historically, Medicare – the largest and most important payor in the U.S. healthcare system – has reimbursed significantly below GHI. Currently, GHI reimburses on average at 250% of Medicare. The GHI / Medicare disparity is expected to increase due to price cuts from sequestration, strained public finances and enhanced Rx price controls from the Inflation Reduction Act all putting downward pressure on Medicare reimbursement.

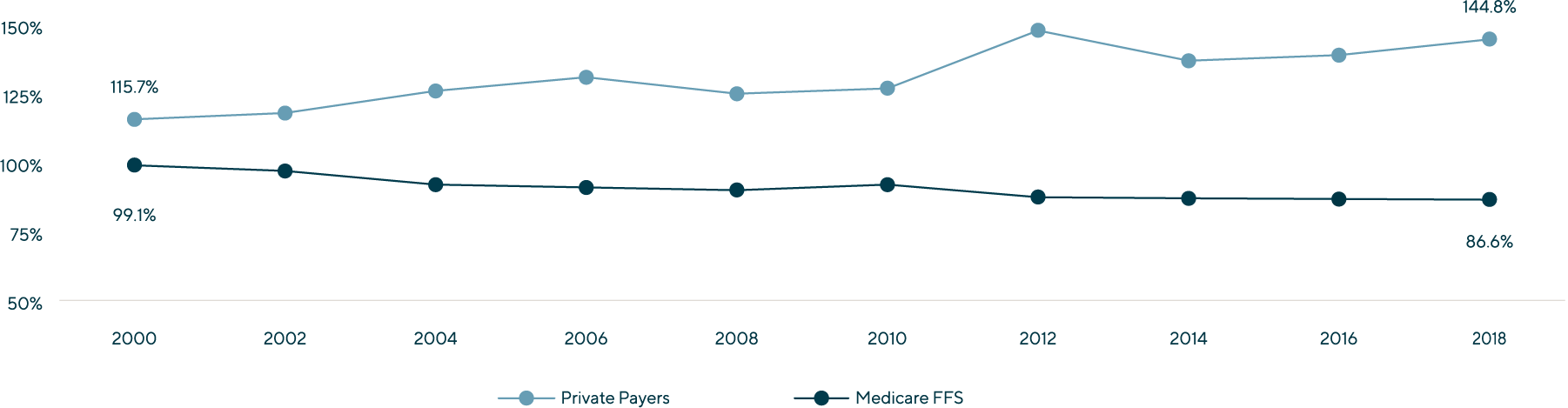

Payment-to-Cost Ratios for Hospitals, 2000 – 2018(5) |

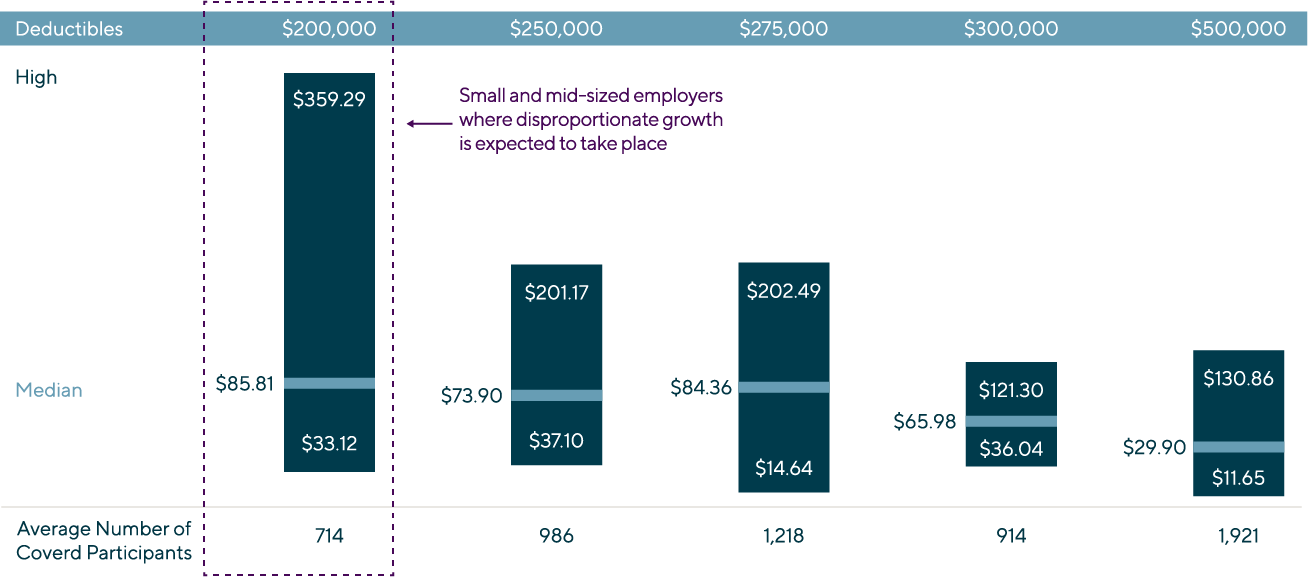

Stop Loss Premiums Will Increase by ~10% in 2023

GHI stop loss premiums have seen steady increases of ~10% over the past several years, despite lower GHI and underlying medical inflation. Stop loss increases have been driven by a growing number of $100,000+ claims, increased frequency of $1M+ specialty drugs and growing demand for stop loss coverage at the lower end of the SMB employer market. Given stop loss covers specific and aggregate claims above a certain threshold, increases in underlying medical inflation magnify stop loss premium increases. This, coupled with ever-growing demand from smaller employers, will keep stop loss premium growth at or above 10% for the foreseeable future.

Growth at the Lower End of the Employer Market Will Further Increase Stop Loss Premiums(6) |

Group Health Insurance Set to Receive Substantial Price Increases in 2023 and 2024

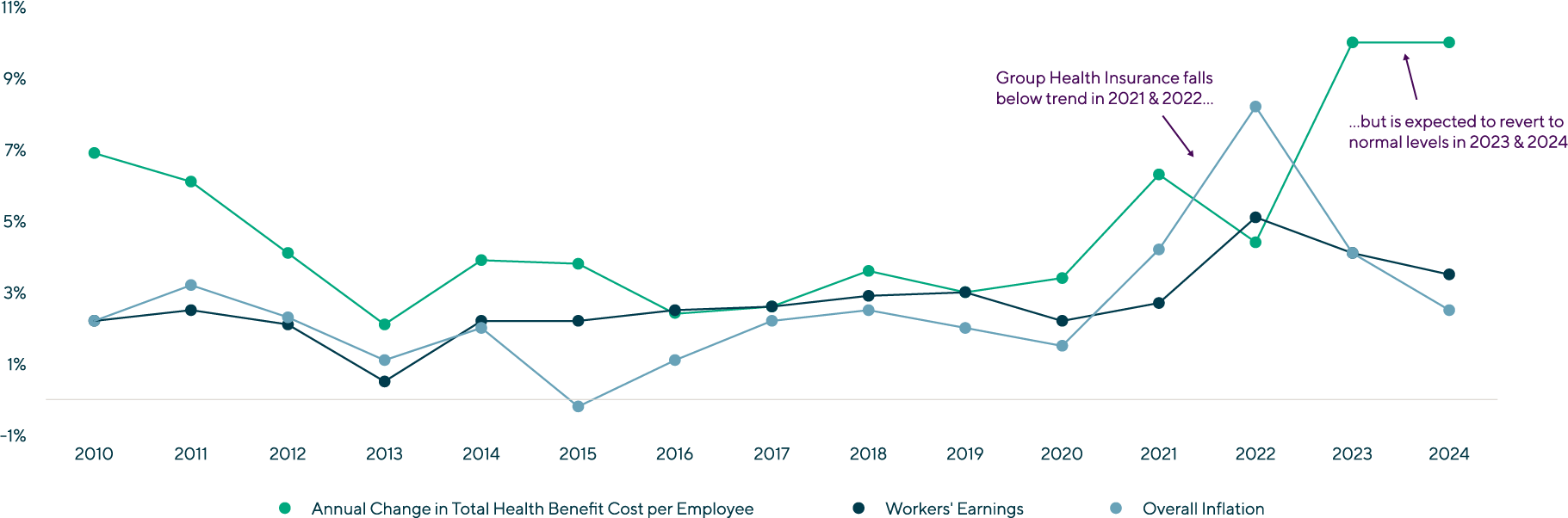

The cost for employers to provide quality medical coverage to employees and dependents has become an ever-growing share of overall compensation as GHI price increases have consistently grown above wage increases. This trend temporarily reverted in 2021 and 2022 – for reasons discussed above – and will revert back to the norm in 2023 and beyond. Left unaddressed, GHI will represent an ever-growing share of an employee’s total compensation.

Change in Health Benefit Cost per Employee, Workers’ Earnings and CPI(7) |

Employer plan sponsors are looking at plan equivalent price increases of ~10% for 2023 as the fall renewal season gets underway, with some renewals coming in well above that mark. The largest commercial insurance plan in the U.S., the Federal Employees Health Benefits Program (FEHBP), announced premiums will increase by 8.7% in 2023, compared to 3.8% in 2022. FEHBP covers 8 million plan members and has the strongest negotiation power among all commercial plans, which has allowed it to stay below overall GHI trend. This points to at least a 10% increase to all other GHI plans that have less bargaining power.

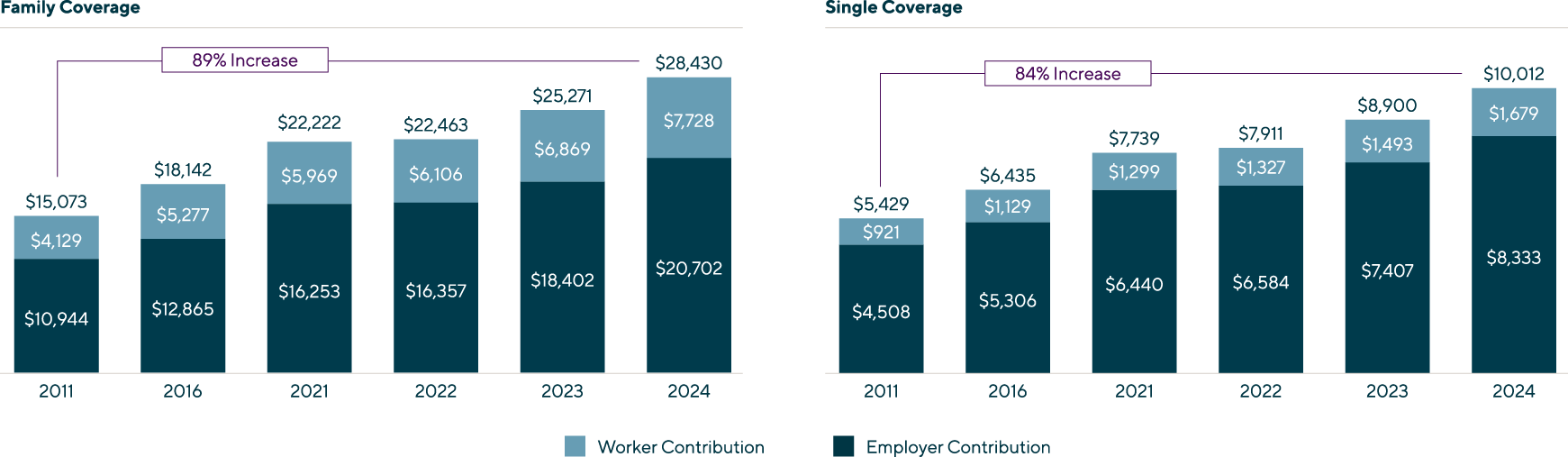

The Cost of Employer-Sponsored Coverage Continues to Rise(8) |

| Employers will have limited ability to pass on costs above trend to employees as articulated by KFF President and CEO Drew Altmant, “Employers are already concerned about what they pay for health premiums, but this could be the calm before the storm, as recent inflation suggest that larger increased are imminent. Given the tight labor market and rising wages, it will be tough for employers to shift costs onto workers when costs spike.” |

Lincoln Perspective

Near-term and longer-term industry dynamics will continue to drive the self-insured employer ecosystem of medical TPAs and cost containment businesses as employers seek innovative, sustainable solutions with tangible ROIs. The result will be continued high demand from both the private equity and strategic buyer universe.

The following key themes represent Lincoln International’s view on the M&A market for this highly active, and increasingly important, sector of healthcare services.

|

1 |

Self-Funding Growth will be Led by Small and Midsized Business (SMB)In the U.S. in 2022, 65% of all employees eligible for health benefits were enrolled in a self-funded plan sponsored by their employer, up from 44% over the past 20 years. Large employers (1,000 employees and over) were the most likely to engage in self-funding, eschewing fully insured plans, with nearly 90% of employees covered by a plan sponsored by the employer. Self-insurance adoption rates among SMBs trails larger companies. Penetration of self-insurance structures varies by size among employers with 200-999 lives (59%), 50-199 lives (30%) and 3-49 lives (11%). The market disruption of COVID, coupled with a transitory period of low medical inflation, temporarily slowed the inexorable shift to self-funding, particularly among SMB employers. With COVID mostly in the rearview and elevated medical inflation fast approaching, interest among employers in self-funding is greater than ever. Coupled with an expanding universe of high-quality solutions – from administration, to stop loss, to medical management – self-funding represents an ever more attractive long-term alternative to fully-insured. |

|

2 |

Shifting Costs through Increased Contributions and Higher Deductibles is LimitedDuring the past 20 years, employee contributions as a share of total cost has remained remarkably steady, increasing from 14% (1999) to 17% (2022) for single coverage and 27% (1999) to 28% (2022) for family coverage. Large employers tend to contribute a great share of cost (74%) for family coverage relative to small employers (64%), while both contribute ~83% of cost for employee-only coverage. Given the competitive labor market and importance of a quality and affordable plan, it is unlikely additional premium sharing, above and beyond medical inflation, can be passed down to employees. Despite seeing a rapid increase in adoption, going from 4% of covered workers in 2006 to 24% in 2014, growth in high-deductible health plans has stagnated at ~30% since 2016 and is not expected to grow as a share of plans in the coming years. The total plan cost savings from promoting “consumerism” has been limited at best. |

|

3 |

Health Insurance Plan Design and Funding Strategy are Becoming a More Strategic Corporate DecisionIn 2022, the average all-in cost of family GHI was $23k, which equates to nearly a third of overall compensation expense. As GHI inflation continues to outpace wage increases, this ratio will grow over time. Human capital (HR) will need to work collaboratively and creatively with finance (CFO) to craft a long-term strategy to address the need to control costs, while simultaneously limiting additional employee cost share and maintaining the overall quality of the healthcare plan. This will require increasingly sophisticated planning and a longer-term horizon (i.e., 5 years or longer) to effectively address. |

|

4 |

Plan Sponsors will be Focused on Both Short-Term and Long-Term SolutionsThe cost of GHI is set to increase substantially in 2023 and 2024 before reverting to the long-term trend of 2-3% above CPI and worker wage increases. This is not an acceptable outcome for either employers or plan members given the increasingly large share of compensation devoted to health insurance, with limited improvement in health outcomes. There is a clear need for both near-term and long-term cost containment – improving outcomes through more effectively managing existing claims or reducing the frequency, or severity, of certain types of morbidities. |

|

5 |

Aggressive Payment-Focused and Care-Focused Strategies will be Used to Contain CostsSelf-funding in and of itself is no longer an effective strategy to reduce costs in the short-run and control medical inflation in the long-run, to say nothing of improving plan member outcomes. As the industry continues to mature, medical TPAs and cost containment providers will need to effectively deploy a broad spectrum of solutions across the claims cycle.

The marketplace is answering the call for new approaches. A number of innovative startups and small companies are driving the frontier of innovation with next generation versions of tried-and-true models, as well as new tech-enabled approaches to afford SMB employers the same innovations available to larger employers. There will be no “one size fits all” approach, and each employer will determine directly (or with the assistance of their broker) the proper blend of in-sourced and outsourced solutions. Solutions providers will similarly seek to establish a continuum of capabilities to offer their customers more than just a single point solution. |

|

6 |

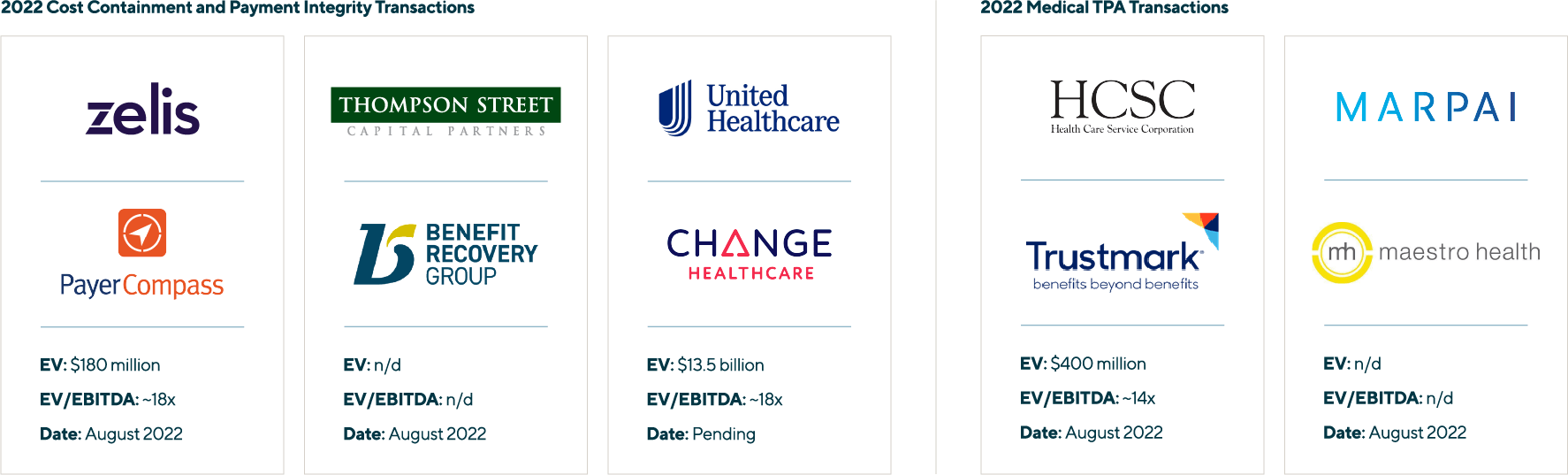

Near-Term M&A Activity will be Weighted Towards Consolidation vs New Platform InvestmentsM&A activity during 2016 – 2021 saw a wave of private equity investments in privately owned companies and the early stages of secondary PE to PE trades (see Lincoln’s February 2022 Perspective highlighting some of these transactions). Activity centered around platform investments by sponsors seeking to consolidate a quickly maturing sector. 2022 has thus far been weighted towards tuck-in / consolidation plays as larger sponsor-backed platforms position themselves to go to market in 2024 / 2025, leveraging expected synergies to beat out standalone buyers (see the overview of 2022 transactions below). This trend is expected to continue into 2023 leading into the next wave of platform transactions. As the industry has matured, and the dust has settled on past deals, buyers have become more discerning in evaluating assets. Not all TPAs or cost containment providers are the same, and two seemingly similar assets in terms of size or scale may trade for materially different multiples. Companies that can prove out a sustainable growth story and long-term value proposition are seeing high demand and attractive valuations, while more commoditized or undifferentiated players are seeing tepid interest and valuations. |

|

(1) Source: Peterson-KFF Health System Tracker | Overall Inflation Has Not Yet Flowed Through to the Health Sector

(2) Source: KFF | Trends in Overall and Non-COVID-19 Hospital Admissions

(3) Source: ASPE | Trends in Prescription Drug Spending, 2016-2021

(4) Source: National Library of Medicine | National Trends in Prescription Drug Expenditures and Projections for 2022

(5) Source: Congressional Budget Office | The Prices that Commercial Health Insurers and Medicare Pay for Hospitals’ and Physicians’ Services

(6) Source: Segal | Medical Stop-Loss Premiums Up Nearly 10% for 2022

(7) Source: SHRM | Medical Plan Costs Expected to See Bigger Rise in 2023

(8) Source: KFF | 2022 Employer Health Benefits Survey

Ancillary Sources:

CNBC | Workers Could See Average Raises of 4.1% in 2023 – the Largest Pay Bump since the Great Recession

KHM | 2021 Employee Health Benefits Survey

Society of Professional Benefit Administrators

EBRI | Trends in Self-Insured Health Plans Since the ACA

Contributors

Meet Professionals with Complementary Expertise in Healthcare

It’s extremely rewarding to work in one of the largest and most diverse global business sectors helping support clients to realize their goals.

Matthew Lee

Managing Director, Head of UK & European Co-head of Healthcare

London

I enjoy working closely with clients to overcome challenging situations and to develop strategies to meet their business goals.

Dirk-Oliver Löffler

Managing Director & Europe Co-head Healthcare

Frankfurt

My goal is to bring the best of Lincoln to each and every transaction, ensuring the topmost outcomes for our clients.

Roderick O’Neill

Managing Director & U.S. Co-head of Healthcare

New YorkRelated Perspectives

Investors in Healthcare | Q&A with Lincoln Professionals

Originally posted by Investors in Healthcare on July 25, 2024. Lincoln International, the U.S.-headquartered global investment banking advisor, is a well-known name in the European healthcare markets, providing advice to… Read More

Outlook in the EU: PE has Ophthalmology Sector in its Sights

Across Europe, private clinics and specialist outpatient healthcare providers such as ophthalmology practices have seen a wave of consolidation, which has led to the emergence of several pan-European and more… Read More

Real Deals | Maintaining Momentum: The Outlook for M&A in the Healthcare Sector

Originally posted by Real Deals on May 31, 2024. RD: Which sub-sector of healthcare is currently attracting the most investment? Dirk-Oliver Löffler: Provider business is still one of the core… Read More

PETS International | Consolidation Meets Regulation in the Veterinary Clinics Market

Originally posted by PETS International on April 5, 2024. Animal health is becoming a big business in Europe and the U.S. Thus, regulators are turning a closer eye to mergers… Read More