pemacom | Outlook for the German M&A Market in 2023

Nov 2023

Originally published by pemacom on September, 19, 2023.

1. Challenging Economic Environment

Following a weak second half of 2022, the number of M&A deals will continue to decline in the current year 2023. A positive trend reversal appears realistic in 2024 at the earliest and assumes a noticeable economic recovery of the German economy.

Summary

-

Lincoln International’s Dr. Michael Drill offers an outlook on the German mergers and acquisitions market in 2023 with pemacom.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

After years of growth, fears of recession, falling consumer confidence, renewed increases in key interest rates and ongoing sanctions against Russia have abruptly put the brakes on the long booming business of mergers and acquisitions. After all, in times of enormous uncertainty, it is not easy to reach an agreement between buyer and seller on a company valuation. In addition, corporations have become cautious and are discreetly holding back on risky, large-scale takeovers. The general mood on corporate floors and in the private equity scene is currently very subdued. At the same time, the supply of attractive target companies has also deteriorated.

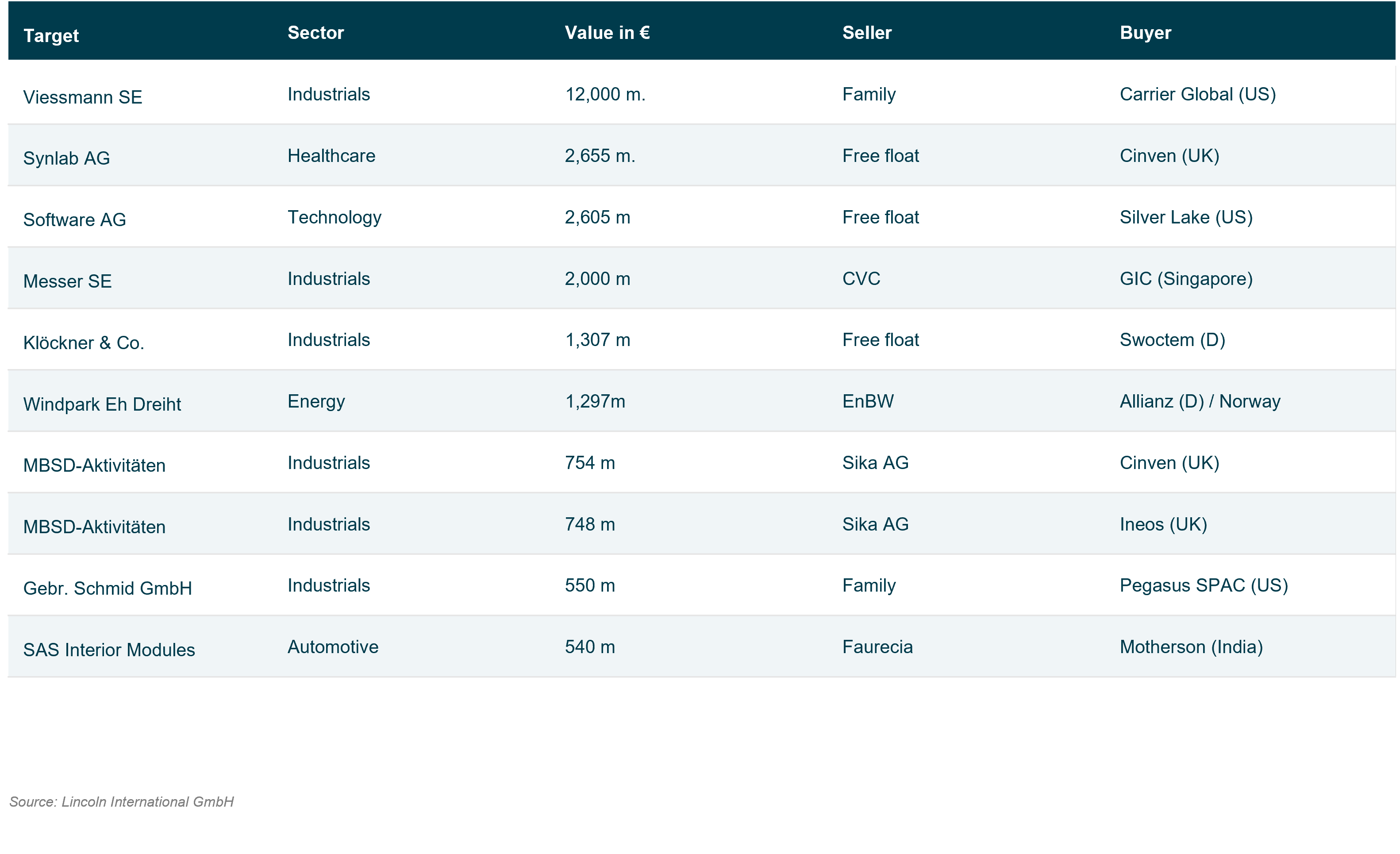

Figure One: Top 10 Deals with German Target Companies 1 – 6 2023

2. Various Deal Drivers with Positive Impact on M&A

Despite this catastrophic environment, however, there are still numerous drivers for mergers and acquisitions (see figure two). The need for critical mass and the growing importance of digital business models are forcing many medium-sized companies to adopt bold acquisition strategies or to sell to a larger or financially strong partner. Financial investors have very high cash holdings and are therefore under enormous investment pressure to find suitable acquisition candidates for the money they have raised. And the persistently high share prices of major listed companies are also forcing management boards to actively consider acquisitions. After all, in many places the current valuations can only be justified in the long term if the companies grow not only organically, but also inorganically.

Challenges in the core business require German conglomerates to constantly review their corporate portfolios. Further reasons for the increasingly rapid “turning” of group portfolios are the increasing pressure from activist major shareholders. As a consequence, many companies can no longer afford to postpone portfolio adjustments.

In the coming years, ESG issues will continue to gain importance, especially among large corporations, private equity firms and financing banks. Environmental compliance, diversity promotion and exemplary business practices are becoming increasingly important in acquisition and divestment decisions. M&A is becoming an important management tool to raise one’s ESG profile.

Figure Two: Drivers for the German M&A Market

- Need for critical company size on a global level

- Digitalization as a critical competitive factor

- Selling companies out of necessity / distressed situation

- Review of corporate portfolios and corporate carve-outs

- High stock market valuations force corporations to make acquisitions

- Shareholder activism and ESG force corporations into divestments

- Reducing dependencies on China

- Supply chain management

- Declining private consumption patterns

- Continued investment pressure in private equity

Source: Lincoln International GmbH

3. Different Deal Activity by Sectors

Mergers and acquisitions will take place in almost all industries, with the share of non-cyclical industries continuing to increase at the expense of cyclical industrial sectors.

We see above-average M&A activity in the technology sector, particularly in the areas of software, digitalization and medical technology (MedTech), as well as in healthcare and renewable energies. These sectors have already grown strongly in recent years and will continue to see high demand due to advancing digitalization and a growing focus on sustainability. In addition, these business models are characterized by their crisis resistance and stability, making them particularly attractive to financial investors. We also expect a special boom in M&A in the retail sector, which is coming under increasing pressure, and in the weakening automotive supply industry. These sectors in particular offer opportunities through distressed M&A, turnarounds or restructurings. By contrast, we see a weakening trend in energy-intensive industries, in the machinery and plant engineering sector and in the chemicals sector.

We expect the share of cross-border deals to remain high at around 70% in 2023. As in previous years, foreigners will acquire more companies in Germany than vice versa. The most important buyer and target nation for German companies is clearly the US by a wide margin. The current relatively high purchase prices are likely to come under pressure due to the declining earnings momentum of many companies. Finally, we expect most transactions to take place in the so-called mid-cap segment, while large elephant marriages in the double-digit billion range, such as the recent acquisition of heating manufacturer Viessmann by US air conditioning company Carrier Global, will be the exception.

Figure Three: 10 Theses on the German M&A Market 2023

- Number of deals with German targets about 20% below previous year

- Mid-cap segment significantly more active than large cap segment (deals > EUR 1 bn)

- Strategic buyers increasingly prevail over financial investors

- Valuation multiples are slightly declining despite “asset inflation”

- Strongly varying transaction dynamics according to sectors

- The US remains most important buyer and target nation for German companies

- Corporate divestments by DAX and MDAX companies on the rise

- Holding period of private equity investments increases

- ESG plays an increasingly important role in M&A processes and decisions

- Acquisition finance becomes more restrictive and expensive

Source: Lincoln International GmbH

4. Sustained Slowdown in Deal Activity Expected

As no overall economic recovery is expected in Germany in the coming 12 months, we expect deal activity for smaller and mid-sized transactions at a level around 20% lower than in 2022. Our discussions with large corporations, financial investors, family shareholders and financing banks confirm this outlook. As a result, we therefore expect a total of around 1,600 M&A transactions with German participation in 2023.

There will be opportunities for corporates and for private equity to find strong businesses at a reasonable valuation. However, the market will not be as robust as it was in recent years. Dealmakers are learning to live with higher uncertainty. Buyers need to be calculated and entrepreneurial if they want to make successful deals. They should be mindful of potential risk while looking for opportunities and preparing to strike a deal when the moment is right. Debt will be one of the most important factors for any deal in the second half of the year, and it will come at a premium. For anyone considering a sale, it’s best to be properly prepared and understand the available options in the debt markets.

Contributor

Building long-term relationships is key for me personally – I want to be the advisor of trust for my clients.

Dr. Michael Drill

Managing Director | Head of Germany

FrankfurtMeet Professionals with Complementary Expertise

I am a rigorous advocate for my clients with a hands-on, communicative approach, focused on delivering intense advocacy and outlier results.

Sean Bennis

Managing Director & U.S. Co-head of Industrials

Chicago

I am enthusiastic about creating sustainable growth and the highest value for our clients and strive to leave a positive footprint beyond any successful M&A transaction.

Friedrich Bieselt

Managing Director & European Head of Business Services

Frankfurt

I enjoy leading clients and realizing their objectives, while structuring solutions to issues that are both intriguing and challenging.

Øyvind Bjordal

Managing Director | Head of Switzerland

Zurich

I am inspired by working with entrepreneurs and innovators who feel passionately about what they are creating.

William Bowmer

Managing Director & U.S. Co-head of TMT

San Francisco

I deliver a hands-on approach to provide strategic advice to my clients throughout the transaction and beyond.

Chris Brooks

Managing Director & European Co-head of TMT

London

My goal is to inspire and motivate our people to make a true impact with their clients, their colleagues and their communities.

Robert Brown

CEO | Managing Director | GP-Director

ChicagoRelated Perspectives

Packaging Quarterly Review Q2 2024

Over the last several years, the packaging industry has undergone significant transformations driven by rapid advancements in technology. From the introduction of innovative materials and sustainable practices to automation and… Read More

Investors in Healthcare | Q&A with Lincoln Professionals

Originally posted by Investors in Healthcare on July 25, 2024. Lincoln International, the U.S.-headquartered global investment banking advisor, is a well-known name in the European healthcare markets, providing advice to… Read More

Industrials Strength: Acceleration in Global Industrials M&A

Lincoln Industrials closed 28 transactions globally thus far in 2024. Across our industrials offering – from aerospace and defense to mobility, engineered components to building products, and infrastructure to specialty… Read More

Lincoln International adds TJ Monico as Managing Director

Lincoln International, a global investment banking advisory firm, is pleased to announce that TJ Monico has joined as a Managing Director to help lead the firm’s distribution practice. TJ has more than… Read More