How Consumer Products & Services Companies Are Viewing M&A Outlook for 2023

Jun 2023

In today’s dealmaking environment, uncertainty and caution reign supreme. Consumer confidence has seen declines as high inflation and recession fears dominate. At the same time, investors continue to look for ways to put their capital to work, aligning their investments with recession-resilient opportunities and strong management teams. In fact, data from Lincoln’s Private Market Index showed that in Q1 2023, the Consumer sector valuations were up (slightly) for the first time since Q2 2022 – signs of some welcome green shoots.

To gauge the minds of dealmakers today, Lincoln International conducted a survey of more than 350 private equity (PE) investors in the consumer sector. Below we unpack the key results, including the impact of economic uncertainty on deal flow, factors that could refresh the mergers and acquisitions (M&A) market, trends driving change and the most attractive categories for investor dollars.

Summary

-

Lincoln International conducted a survey of more than 350 private equity (PE) investors in the consumer sector.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

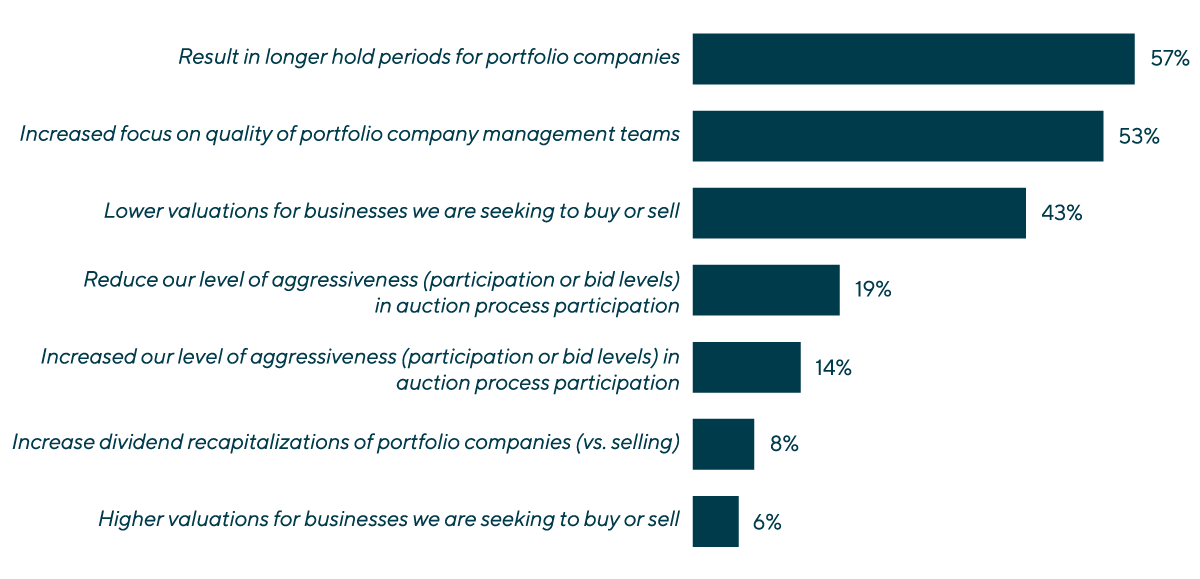

Hold On & Look InwardNearly 60% of respondents to the survey indicated that they will have longer hold periods for their portfolio companies in 2023 as a result of the economic environment. For PE investors in consumer, the challenging economic conditions have caused many to redirect attention that would otherwise be given to M&A toward optimizing performance within their existing portfolio companies. In fact, 53% of respondents reported an increased focus on the quality of management teams, indicating that company leadership is more important than ever in successfully navigating macroeconomic uncertainty and preparing for future growth. Valuations are also down in this environment, creating a misalignment between buyer and seller expectations as companies feel the impact of the inflationary environment on their bottom lines. Buyers are increasingly stretching out the due diligence phase and exercising extra caution to ensure they align their capital with the ripest opportunities—and on the right timeline. |

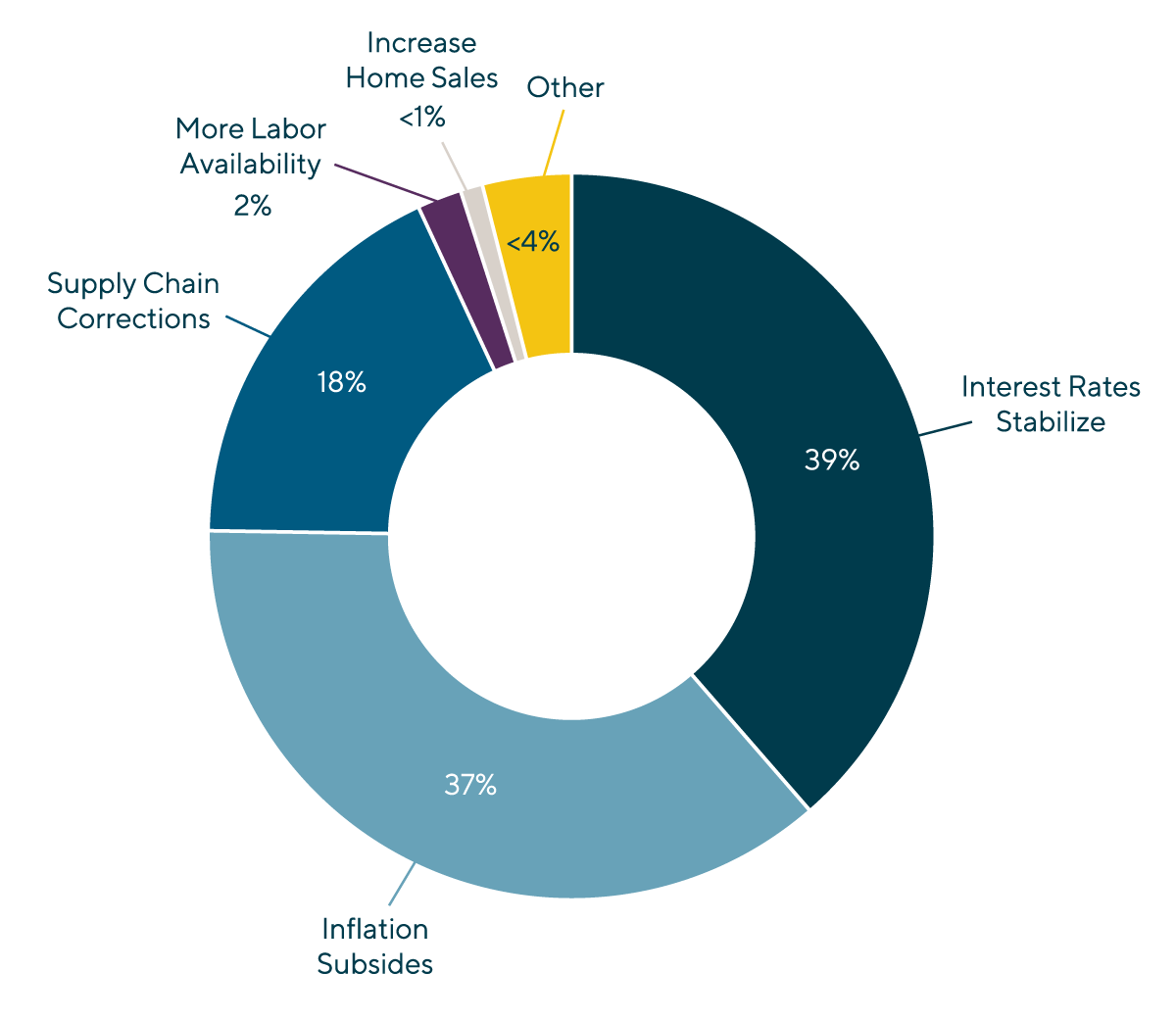

Indicators of an M&A ReboundWhen it comes to factors that can revitalize the M&A market in consumer this year, respondents overwhelmingly agree that interest rate stabilization and inflation subsiding will be the difference makers. Investor eyes remain trained on the Federal Reserve, whose rate hike campaign over the last year has caused delayed deal timelines, decreased debt availability and increased caution across the board. The rising interest rates also put more pressure on companies that were already struggling to make debt service payments. Supply chain issues have been a key concern over the past several years. 18% of surveyed investors agreed that ongoing supply chain corrections post-pandemic will restore confidence around steady state business performance indicators. As companies sell through excess, high-cost inventory purchased at the peak of the supply chain crisis, earnings will continue to show softness. However, we anticipate a meaningful uptick in the profitability of these businesses in Q4 and Q1, which should give sellers and buyers more confidence in transacting. It is clear that there remains a backlog of pent-up demand from both sellers and buyers to transact as soon as the markets support doing so. Sellers that delayed transactions for this past year generally have increased pressure to sell. Many buyers with coffers full of cash for deals are frustrated by the difficulty they see in finding deal flow. Because of these factors, we have confidence in the long-term outlook for the M&A markets. The main unknown is how soon these catalysts will help the market get back to a normalized level. |

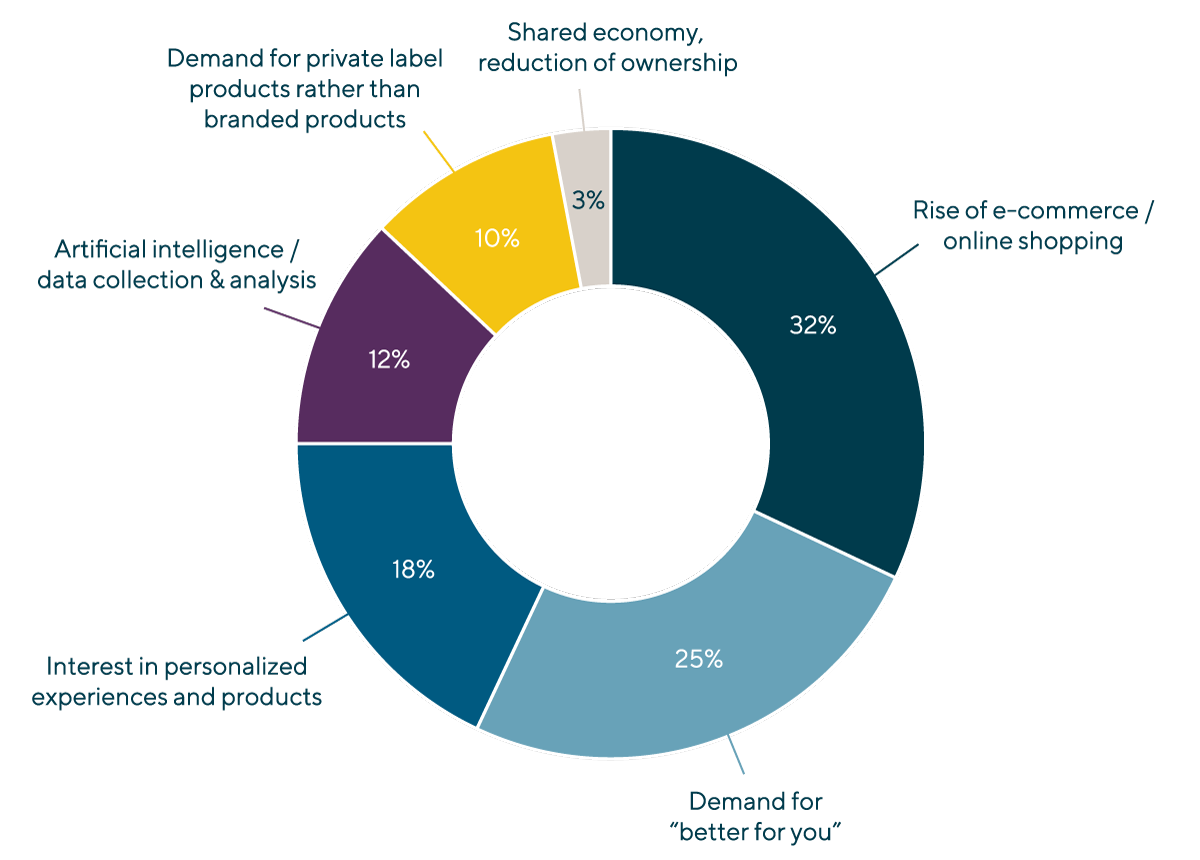

Online Remains On-TrendThe global e-commerce market that experienced spikes in 2020 during pandemic-induced lockdowns continues to grow, albeit at a slower pace. For consumer businesses, a solid and efficient e-commerce strategy has become a non-negotiable attribute for most prospective buyers. More than any other trend, 32% of respondents selected e-commerce and the rise of online shopping as the dynamic causing the most change in the consumer sector. In addition to a move to e-commerce channels, “better for you” products and services continue to be top-of-mind for consumers in the post-pandemic era, with 25% of respondents indicating the trend will continue to drive change across the sector. Consumers prioritizing their health and wellness has translated into new opportunities for investor dollars not just in food and beverage, but across a host of consumer subsectors, such as beauty, that are offering innovative offerings to align with “better for you.” |

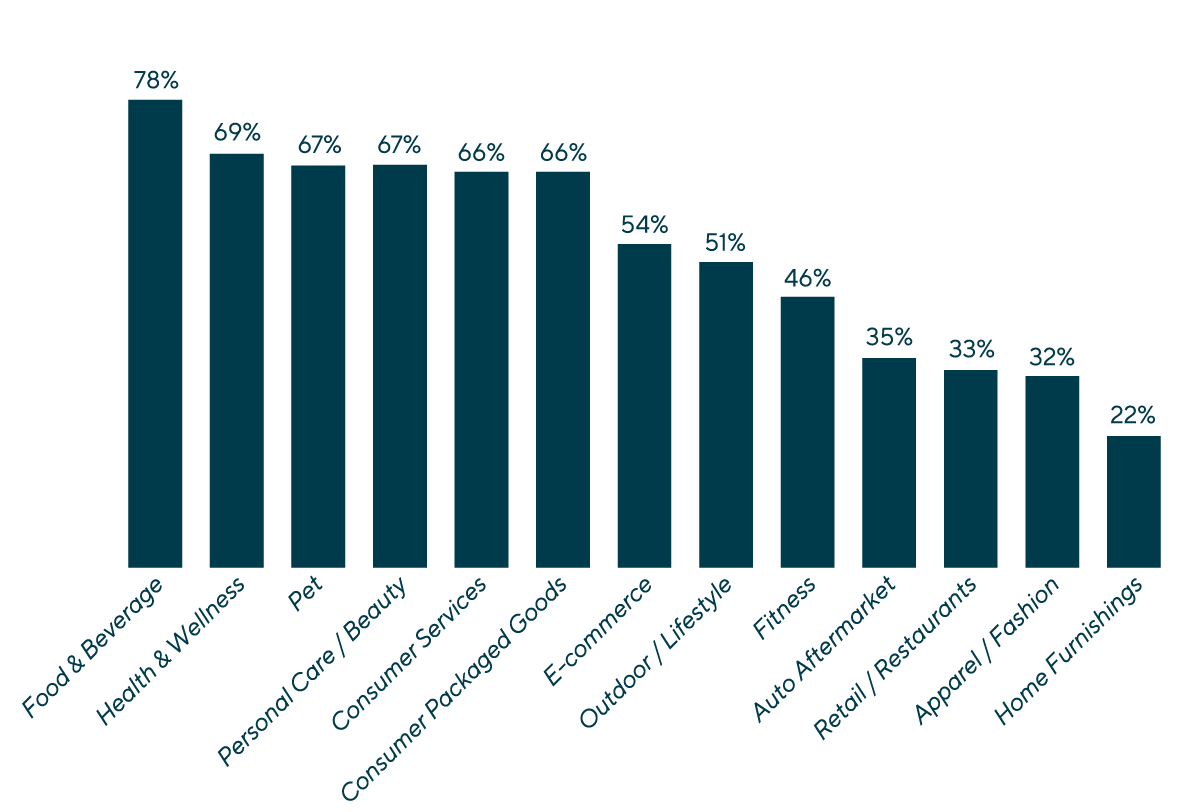

Most Likely Subsectors for InvestmentDealmakers see opportunity in food and beverage, health and wellness, pet and personal care / beauty, all categories that exhibit qualities of recession resilience and steady consumer spending. While the retail / restaurants and auto aftermarket sectors performed well prior to 2020, the pandemic drove shifts across the sector – leading to near-term boosts that have now stabilized, or entire behavior pattern changes that require strategic rethinking to address. That said, dealmakers plan to pursue a wide range of categories in their investment strategies in 2023, with 100 or more respondents selecting each category. |

American & European Consumer Group Heads

Through honest advice, passionate client service and hands-on execution, I strive to deliver outlier results for my clients.

Christopher Petrossian

Managing Director & U.S. Co-head of Consumer

Los Angeles

My passion is positioning high-quality businesses for maximum valuation. I thoroughly enjoy partnering with business owners to reach their goals through life-changing transactions.

Christopher Stradling

Managing Director & U.S. Co-head of Consumer

Chicago

It’s an exciting time to advise clients in the consumer sector. Major changes in consumer preferences and how products are purchased create a rich environment for business owners and investors to succeed.

Dirk Damegger

Managing Director & European Co-head of Consumer

Frankfurt

I take a long-term approach to building relationships and understanding clients' businesses in order to provide timely and relevant advice.

Alex Masters

Managing Director & European Co-head of Consumer

LondonMeet Professionals with Complementary Expertise in Consumer

It’s an exciting time to advise clients in the consumer sector. Major changes in consumer preferences and how products are purchased create a rich environment for business owners and investors to succeed.

Dirk Damegger

Managing Director & European Co-head of Consumer

Frankfurt

I have a hands-on approach and bring energy, creativity and passion to every client transaction.

Eddie Krule

Managing Director

ChicagoRelated Perspectives in Consumer

Lincoln International Managing Directors Recognized as Emerging Leaders

Lincoln International is pleased to share that The M&A Advisor named Managing Directors Adam Gifford, Brian Goodwin, Eddie Krule and Scott Molinaro as recipients in the Emerging Leaders Awards. These… Read More

Food & Beverage Market Update Q1 2024

The M&A market remained somewhat challenged during the first quarter; however, we experienced improved dealmaking conditions.

Consumer, Business and Economic Trends Align to Drive New Interest in Recommerce

Back in 2021, the recommerce industry seemed to have finally hit its stride, with the sector experiencing a surge in transactions, valuations and deal sizes. At the brink of becoming… Read More

The Fitness Investment Landscape

State of the Fitness Market: presented by L.E.K. Consulting Fitness Market Stabilization and Return to Growth Few industries were as negatively impacted by COVID-19 as the in-person fitness industry. Deemed… Read More