Plant-based Alternatives are Poised for Growth

May 2023

| Lincoln International was pleased to host the Plant-based Potential: The Rapid Rise of Alternative Foods and Growth Opportunities Ahead panel at the Food & Drink Expo in Birmingham, UK. During the panel, industry experts revealed key plant-based food trends. In the below perspective, we outline select key takeaways and insights on the market. |

Summary

-

Lincoln International hosted a panel with plant-based food industry experts on key trends in the sector at the Food & Drink Expo in Birmingham, UK.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Select Plant-based Food Trends

Present and Future Performance

Like many other industries, the plant-based food market is underperforming due to several underlying macro factors. Retail performance has declined since COVID-19 lockdowns as customers are eating out more with less opportunity to explore new foods at home. Similarly, as the market boomed during COVID-19, the high influx of low-quality plant-based alternatives has deterred repeat purchases. More recently, factors like inflation magnified by the Ukraine conflict have played a role in the market’s decline.

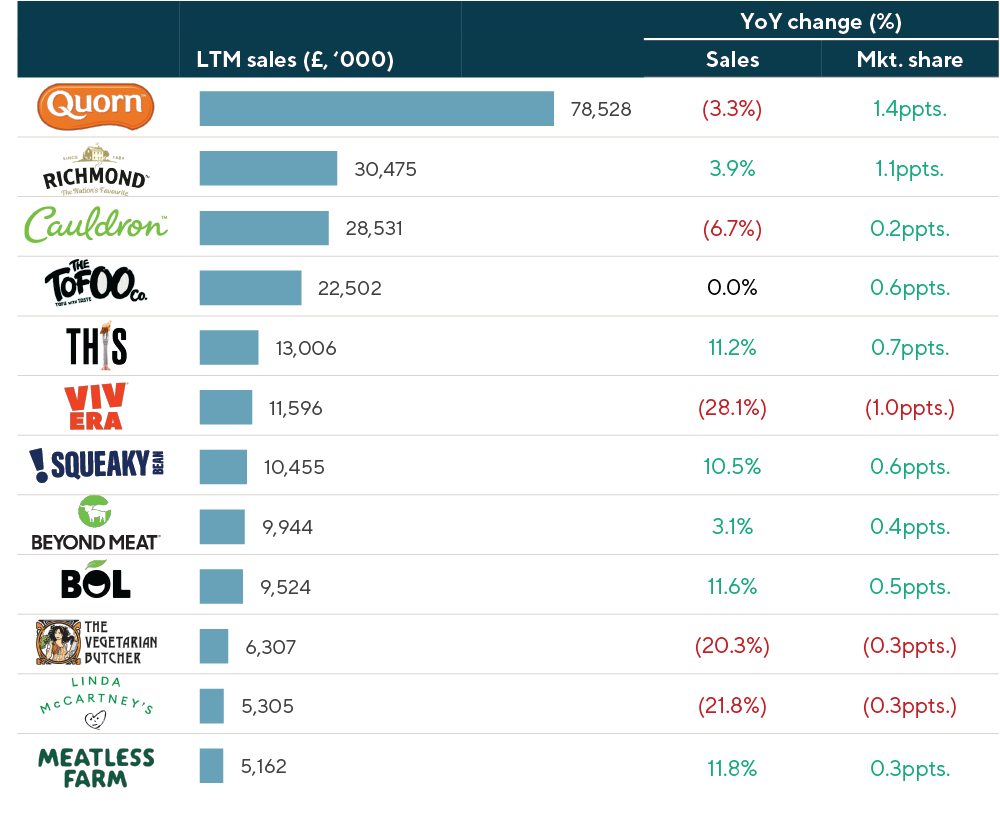

However, there have been upsides and performance is mixed by brand with some select players still seeing growth as they are standing out to consumers due to improved taste, quality and a strong consumer menage. These tend to be brands that resonate with consumers as well as those brands delivering high-quality products.

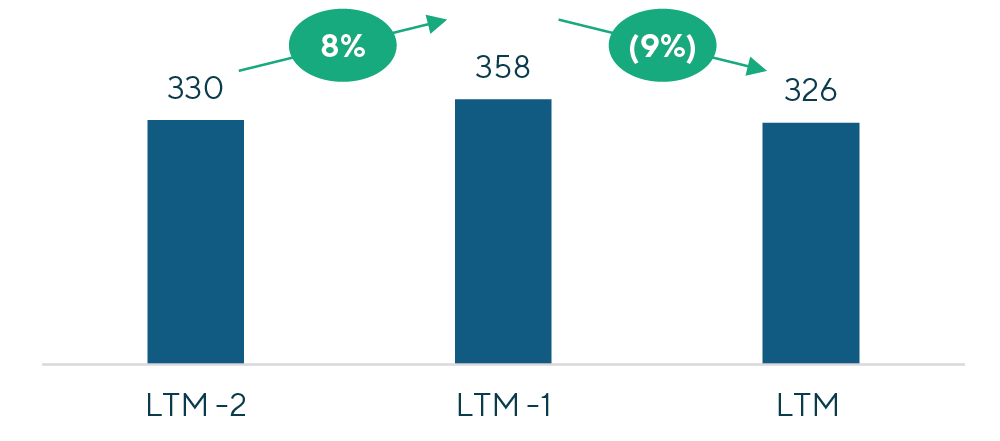

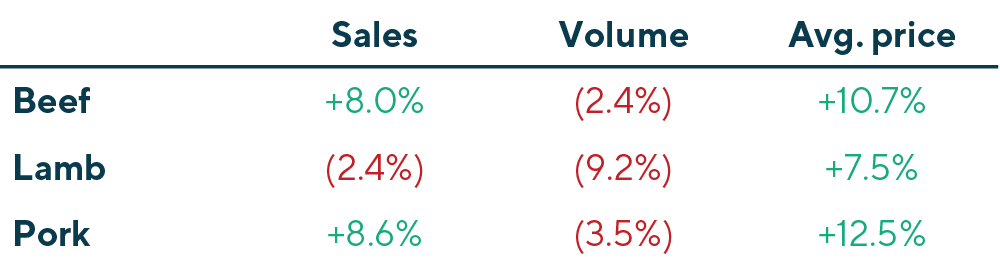

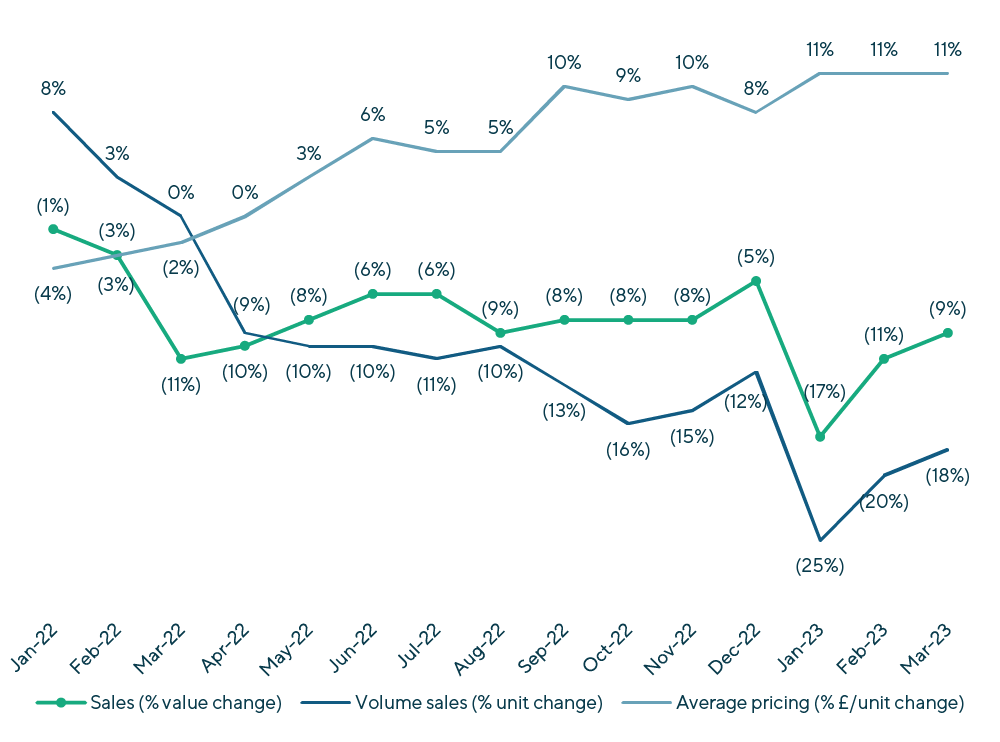

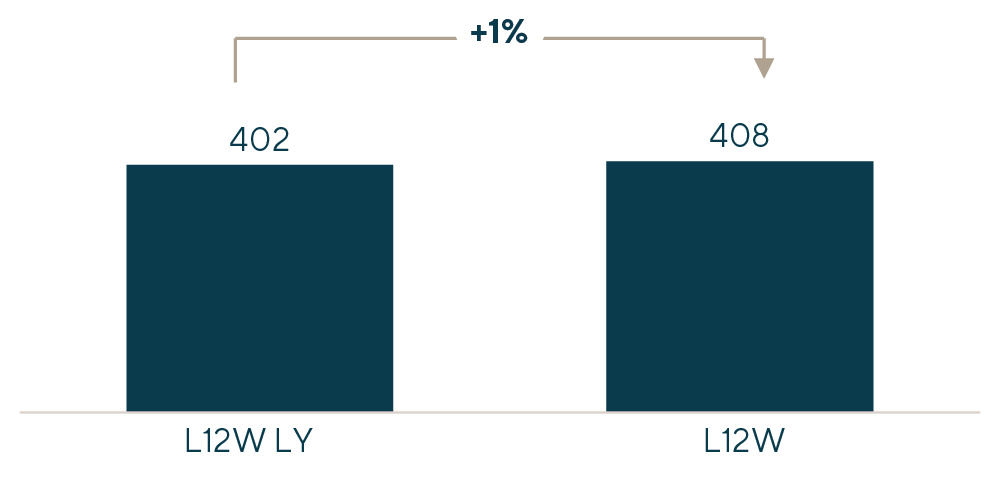

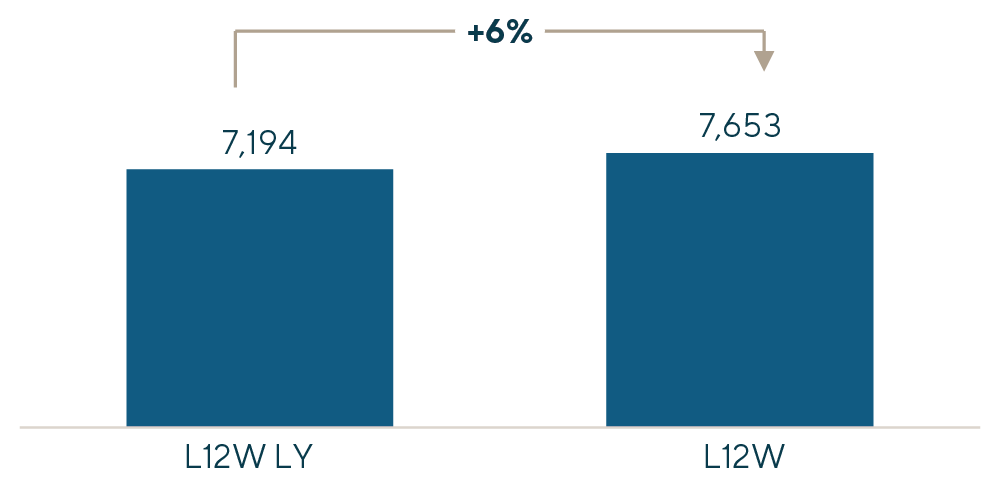

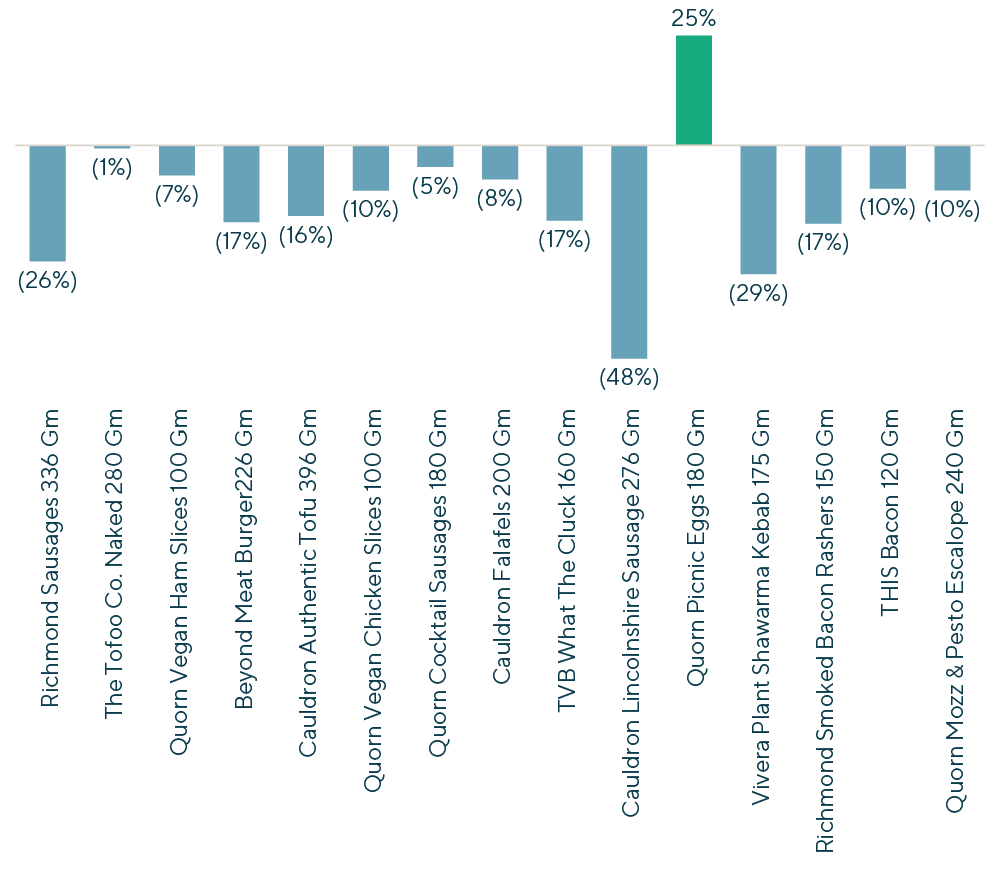

| UK market landscape for chilled meat substitutes and format types

Source: Nielsen NIQ 52 w/e 26 March 2023 |

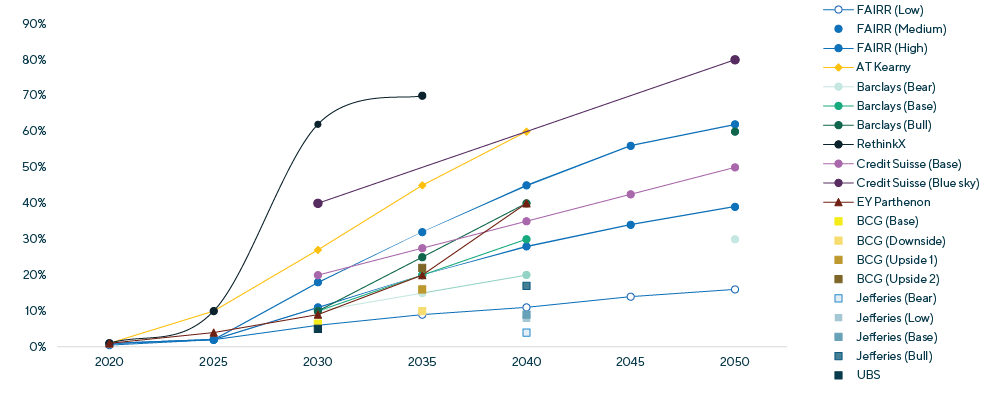

Despite current mixed performance, according to a range of sources, alternative proteins are forecasted to take a significant share of meat substitution by 2050 – from 15% to 80% – and will lead to significant growth in the plant-based food market over the coming years, primarily driven by the long-term sustainability issues caused by meat consumption.

| Alternative proteins; forecasts range from 15% to 80% meat substitution (global market share of alternative protein)  Source: Synthesis Capital Source: Synthesis Capital |

Consumers

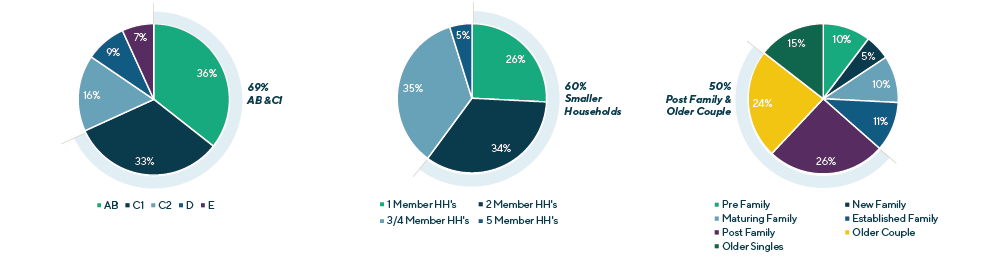

Vegetarians and vegans by definition are already consuming plant-based diets. The growth in plant-based consumption will be driven by flexitarians and meat eaters looking to make alternative choices. Additionally, according to Nielsen Homescan, the majority of consumers that spend on plant-based alternatives are part of wealthier, smaller and older households. Given that they are not as restricted by their diet, or spending power, these consumers are more easily influenced away from meat purchases. For the plant-based alternative market to continue on its projected growth trajectory, i) attracting a wider consumer base and ii) increasing the frequency of meat substitution will be the keys to success.

New Alternatives

Lab-grown or cultured meat is currently in the early stages of development, however, how consumers will respond, the overall cost of production as well as the environmental impact remain of question. The food sector does account for one-third of all global emissions so lab-grown alternatives do have a real impetus for climate change. In the short term, owing to slow technological development, it is more likely that this option will be used as a flavoring or ingredient in current plant-based foods before any widespread adoption.

How Brands Can SucceedTo succeed in the long term, brands need to attract a wider customer base – including younger consumers – and engaging them on a repeat basis relies on several factors. Plant-based food brands must achieve a better price parity than meat; plant-based food is more expensive than meat so if retailers take less on the margin, the price should decrease and the product will become more attractive to a wider customer base. |

Contributors

I take a long-term approach to building relationships and understanding clients' businesses in order to provide timely and relevant advice.

Alex Masters

Managing Director & European Co-head of Consumer

LondonMeet Professionals with Complementary Expertise in Consumer

It’s an exciting time to advise clients in the consumer sector. Major changes in consumer preferences and how products are purchased create a rich environment for business owners and investors to succeed.

Dirk Damegger

Managing Director & European Co-head of Consumer

Frankfurt

I have a hands-on approach and bring energy, creativity and passion to every client transaction.

Eddie Krule

Managing Director

ChicagoRelated Perspectives in Consumer

Lincoln International Managing Directors Recognized as Emerging Leaders

Lincoln International is pleased to share that The M&A Advisor named Managing Directors Adam Gifford, Brian Goodwin, Eddie Krule and Scott Molinaro as recipients in the Emerging Leaders Awards. These… Read More

Food & Beverage Market Update Q1 2024

The M&A market remained somewhat challenged during the first quarter; however, we experienced improved dealmaking conditions.

Consumer, Business and Economic Trends Align to Drive New Interest in Recommerce

Back in 2021, the recommerce industry seemed to have finally hit its stride, with the sector experiencing a surge in transactions, valuations and deal sizes. At the brink of becoming… Read More

The Fitness Investment Landscape

State of the Fitness Market: presented by L.E.K. Consulting Fitness Market Stabilization and Return to Growth Few industries were as negatively impacted by COVID-19 as the in-person fitness industry. Deemed… Read More