Pet Trends Impacting M&A in 2022

Aug 2022

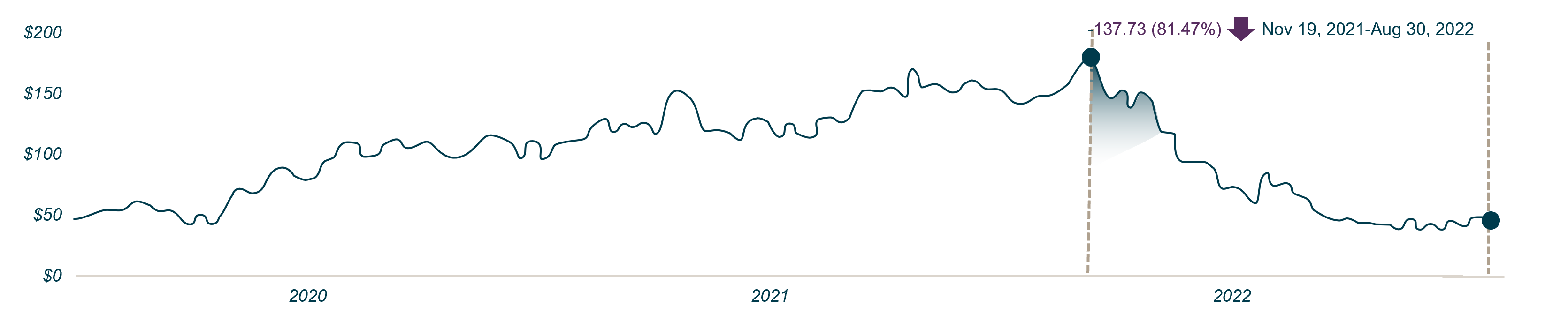

The pet industry has evolved significantly over the past few years with several trends impacting the way pet product brands, manufacturers, retailers, customers and investors view the sector. In 2020, stay at home regulations driven by COVID-19 led to a step function increase in pet adoptions fueling significant growth opportunities for pet companies who had supply chain capacity to capitalize on this unexpected momentum.

As 2021 approached and pet adoptions continued to accelerate, consumers drove increased demand for pet products and services while pet businesses grappled with supply chain challenges and the complex problem of maintaining inventory to avoid out-of-stocks. As a result of the growth in the category, investors started deploying additional capital throughout the industry to acquire brands that were market leaders and / or were experiencing significant growth (including transactions Lincoln worked on with Pethonesty, Solid Gold and Manna Pro).

This year kicked off right where 2021 left off, but as inflation escalated and consumers were forced to focus their spending on essentials (e.g., gas, groceries), the pet mergers and acquisitions (M&A) market has continued to evolve as investors became wary of companies that could not demonstrate the ability to drive continued growth while maintaining margins and profitability. As we look forward, some key trends that investors are keeping front of mind as they assess opportunities are:

Summary

-

Lincoln International’s experts offer some key trends that investors are keeping top-of-mind as they assess opportunities.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Revenue Growth vs. Profitability

|

Direct-to-consumer (DTC) Evolution

|

Channel Conflict Insights

|

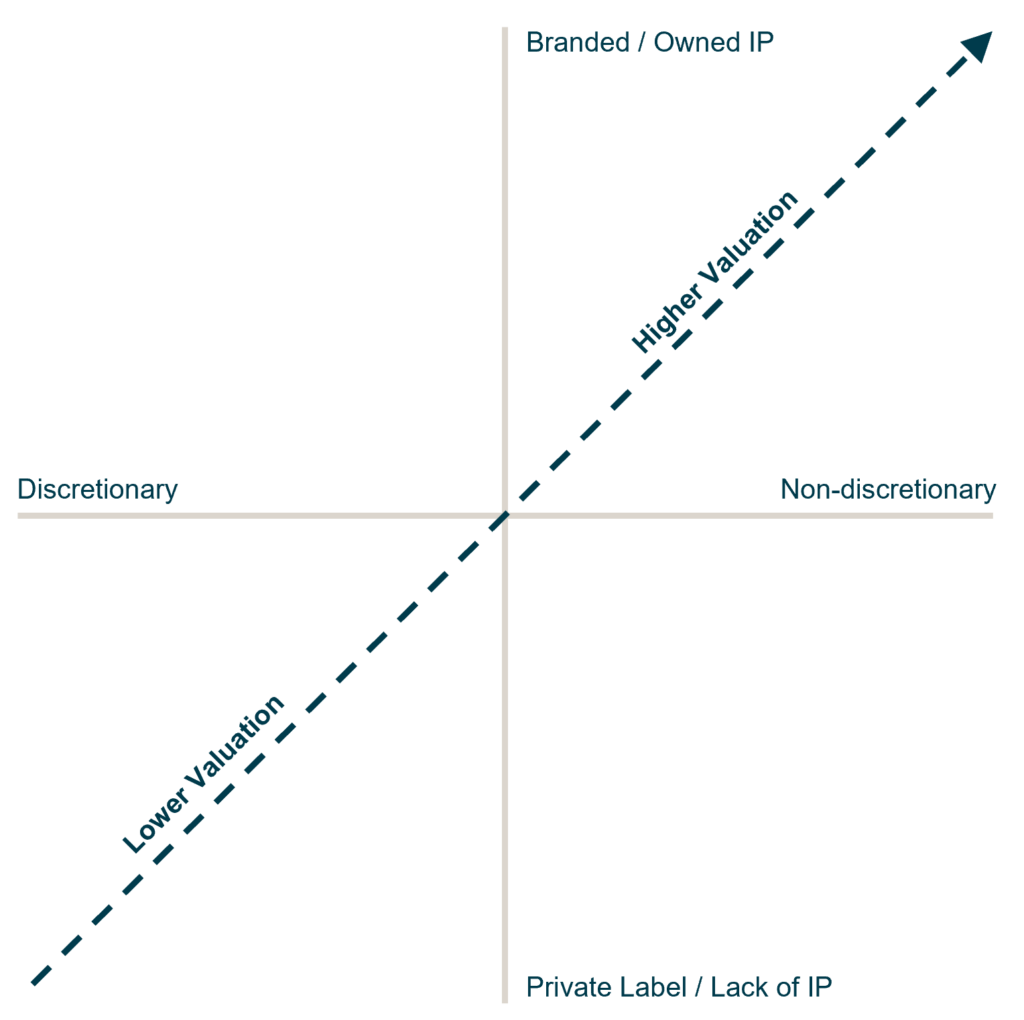

The Pet Company Valuation Spectrum

|

| Lincoln Insights

We have broad experience across the pet sector, selling companies for premium and outlier valuations based on both revenue and EBITDA multiples. The depth of our experience over a number of years and different M&A environments provides us with unique insights on how to best position pet companies to maximize value and terms for sellers. As the pet M&A environment continues to evolve, we are excited to share our perspectives and experience with companies as they assess their strategic alternatives and the best time to explore a transaction. |

Contributors

I take a long-term approach to building relationships and understanding clients' businesses in order to provide timely and relevant advice.

Alex Masters

Managing Director & Co-head of Consumer, Europe

LondonMeet Professionals with Complementary Expertise in Consumer

It’s an exciting time to advise clients in the consumer sector. Major changes in consumer preferences and how products are purchased create a rich environment for business owners and investors to succeed.

Dirk Damegger

Managing Director & Co-head of Consumer, Europe

Frankfurt

I have a hands-on approach and bring energy, creativity and passion to every client transaction.

Eddie Krule

Managing Director

Chicago

I design strategies and offer solutions that fit the unique ambitions of each client I serve.

Brian Little

Managing Director

Los Angeles