No Surprises Act Changes U.S. Healthcare System

Aug 2023

| The implementation of the No Surprises Act (NSA)’s out-of-network (OON) billing restrictions, coupled with its disclosure and transparency requirements, has resulted in significant changes to healthcare financing and consumption across payors, providers and plan members that will be felt for years to come.

In this perspective, Lincoln International provides an overview of the NSA and explores both its short-term and long-term effects that will impact the U.S. healthcare system. |

Summary

-

Lincoln International provides an overview of the NSA and explores both its short-term and long-term effects that will impact the U.S. healthcare system.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

No Surprises Act Overview

In 2020, U.S. Congress passed the NSA to address three major, interrelated pain points in commercial healthcare spending: (i) excessive OON rates, (ii) providers balance billing patients for large, unexpected OON claims and (iii) a general lack of pricing transparency amongst providers. These three issues have enabled financial hardship for healthcare consumers and outsized medical inflation in the economy. Commercial or group health insurance(1) participants, including both the plan members (employees and their dependents) and plan sponsors (employers), have borne the brunt of this, although that is beginning to change. The NSA – which became effective January 1, 2022, and has still not been fully implemented – has had an immediate impact in certain areas such as balance billing. The effects of pricing transparency and commercial in-network reimbursement are only now beginning to take hold.

The NSA addresses surprise medical bills that arise from patients receiving care in emergency situations or inadvertently with OON providers by eliminating the ability for providers to “balance bill”. The NSA also establishes a mechanism to resolve the resulting reimbursement disputes between payors and providers in the event of an OON claim. Additionally, the NSA also requires a broad spectrum of pricing disclosures from providers for certain common services. Several key provisions in the NSA that have a significant impact on payors and providers(2)(3) are outlined below:

OON Billing Restrictions

| Protects patients from receiving “surprise” medical bills from OON providers at in-network facilities (anesthesiologists) or in certain emergency situations (emergency department, air medical transport)

Providers can only bill patients the “in-network” cost share (e.g., the copay or deductible) and cannot “balance bill” patients the remaining OON charge not reimbursed by the payor Example:

The impact of OON restrictions has been multifactorial

|

How the NSA’s Transparency Requirements Impact Commercial Reimbursement

In addition to the restrictions around OON billing, the NSA introduced important transparency requirements in an effort to remove the opaqueness in commercial insurance reimbursement. As the NSA transparency provisions have come into effect, the substantial variation in pricing for common services (particularly for facility or hospital based) has become apparent. Two examples below illustrate the wide variation in reimbursement levels:

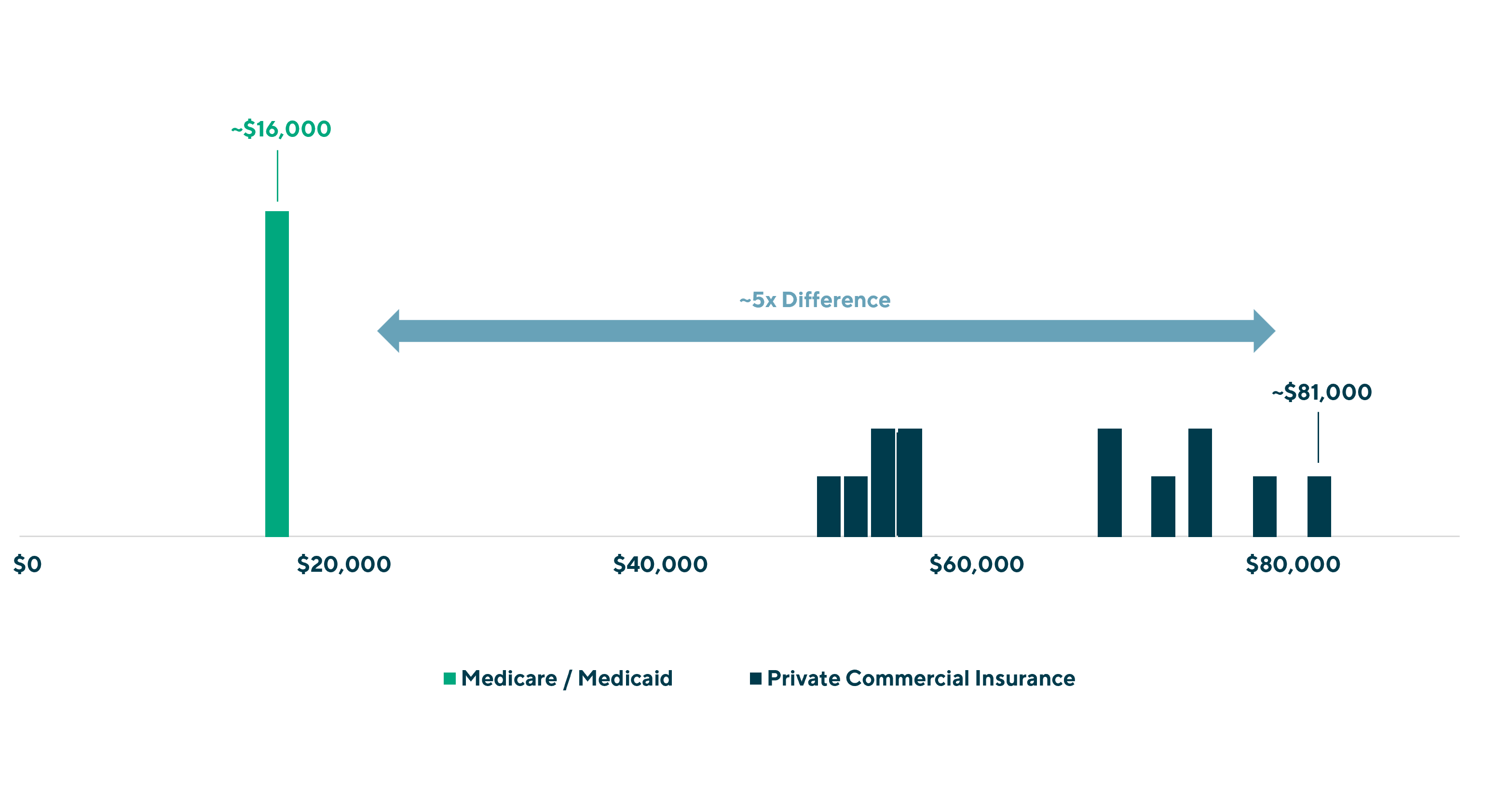

| A Knee Replacement at Sutter Health(6)

|

In this example, commercial insurance plans are paying up to five times Medicare and Medicaid reimbursement, and often times even higher than “cash pay” or what an uninsured patient would be billed by the hospital(7). This variation is present despite Sutter performing the same procedure, at the same facility with the same group of physicians with commercial networks purportedly having the scale and expertise to negotiate competitive rates.

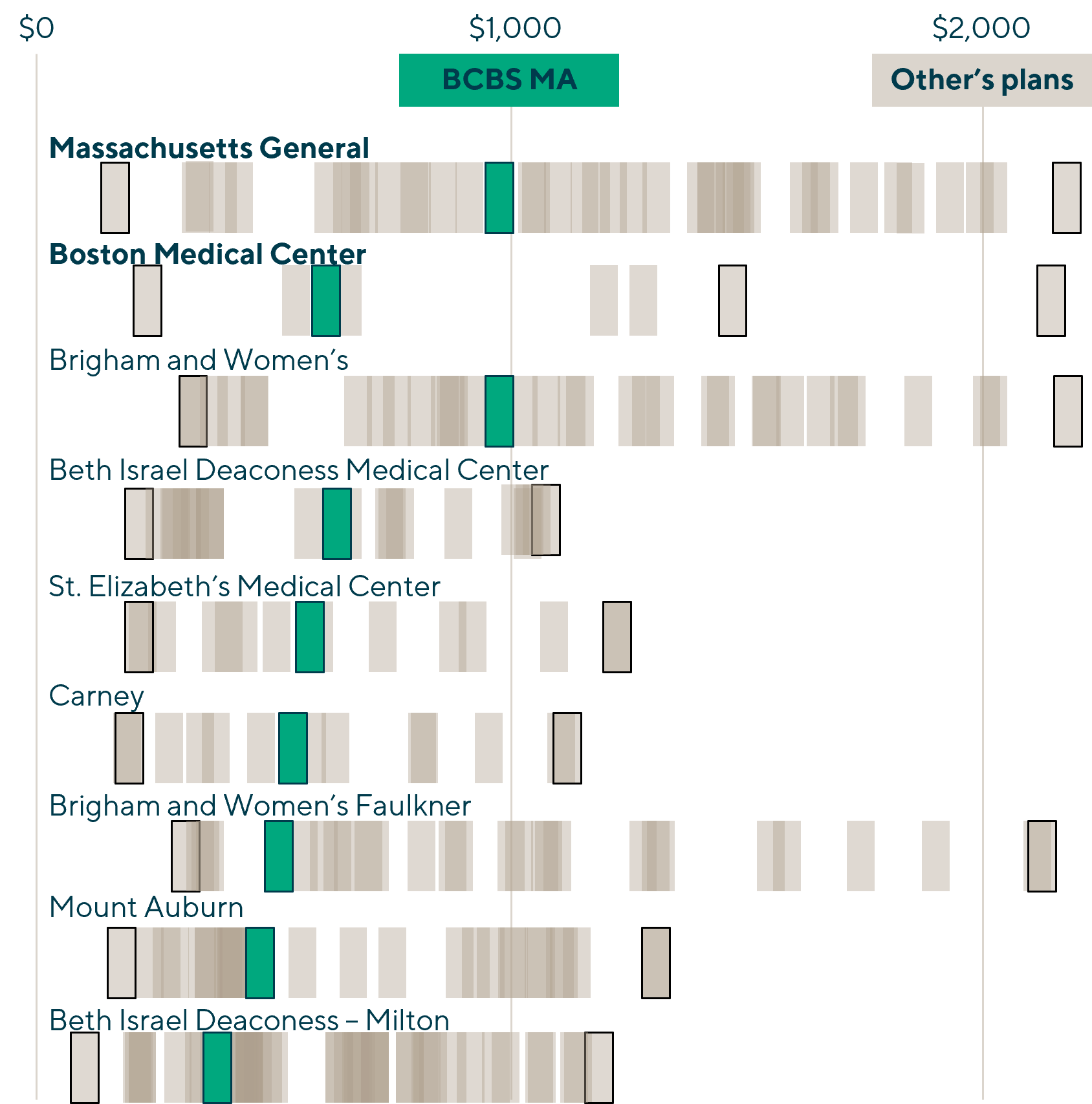

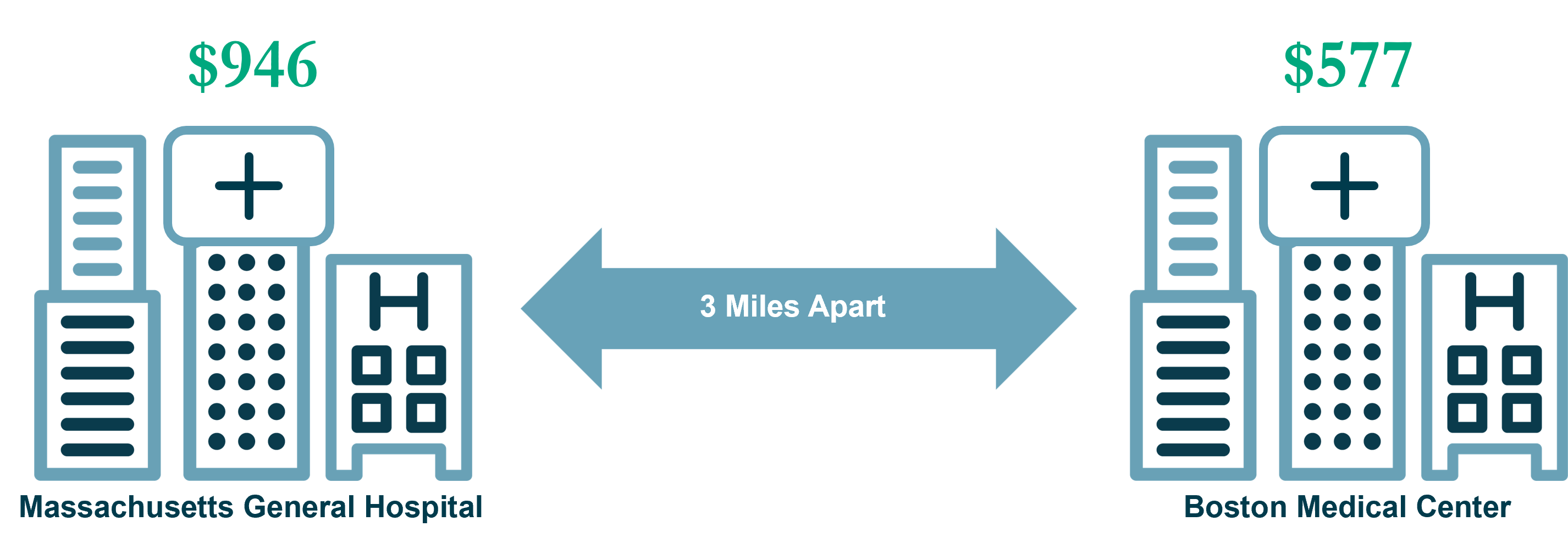

An Emergency Room Visit in Boston(8)

Another example of the wide variation in pricing exposed by the NSA can be seen by comparing a common service in a specific geography. The same insurance network (Blue Cross Blue Shield of Massachusetts [BCBS MA]) has negotiated two materially different rates with two very similar providers:

|

In addition to cross-facility pricing differentiation (same insurance network, substantial reimbursement differences) the emergency room (ER) visit is subject to the same variation in cross-insurance differentiation (same facility, vastly different reimbursement rates amongst commercial payors) across all facilities in the Boston area. For example, Aetna would have reimbursed $2,170 at Mass Gen, or more than two times BCBS MA’s rate, while Medicare would reimburse at $422, less than half BCBS MA and nearly one fifth of Aetna.

In a competitive, efficient market with well-informed and properly incentivized participants, one would expect a tight band of pricing around undifferentiated, common services with any variation largely driven by quality . The large differences shown in the knee replacement and ER example above cannot be explained or justified by normal volume discounts, marketing strategies or pricing discrimination. As further information on reimbursement rates is disclosed, the value of a standard network is called into question. Payors – particularly employers that ultimately foot the bill – have become increasingly aware of this dynamic and focused on reducing or even eliminating the delta.

Group Health Insurance Inflation Persists and Is Heating Up

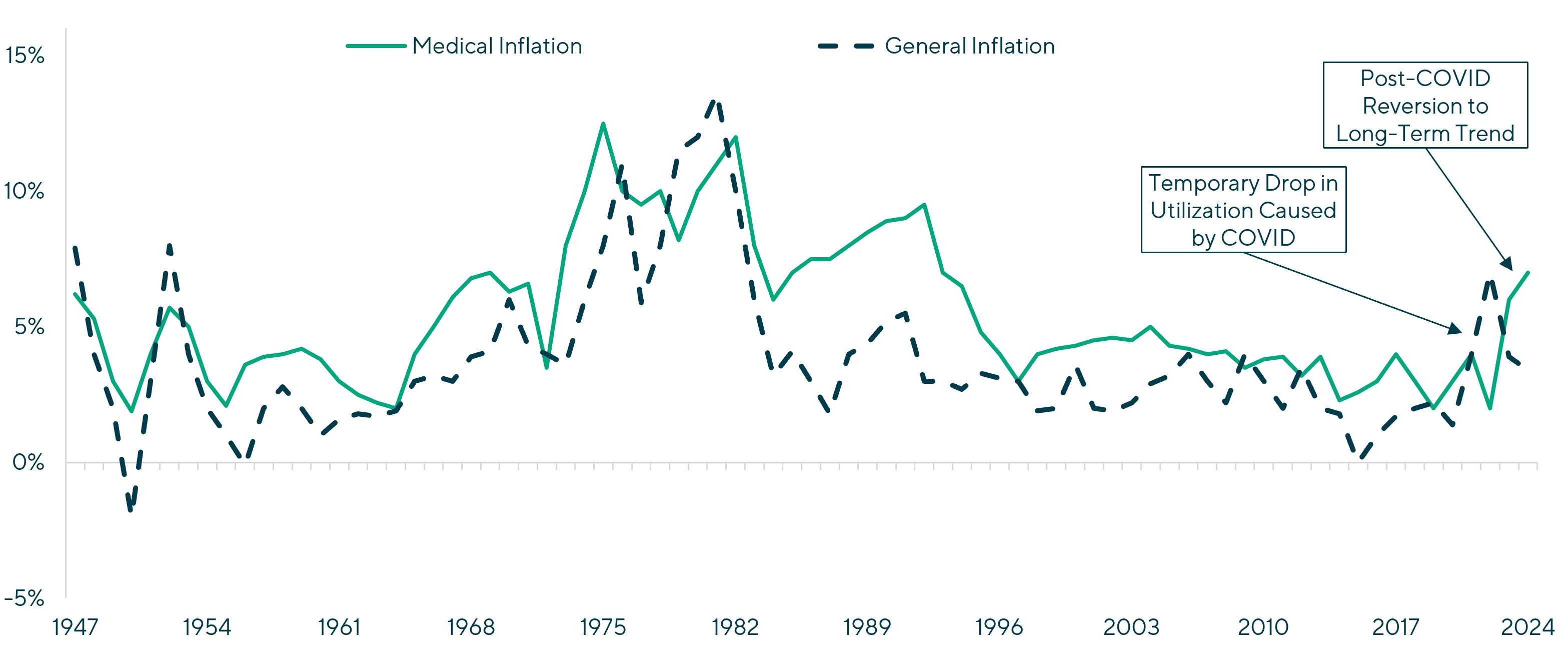

The cost of group health insurance continues to increase at a rate well above inflation, and is driven by underlying medical cost growth(9) and the implicit cost subsidization of Medicare and Medicaid(10)(11).

| Annual Medical vs. General Inflation since 1947

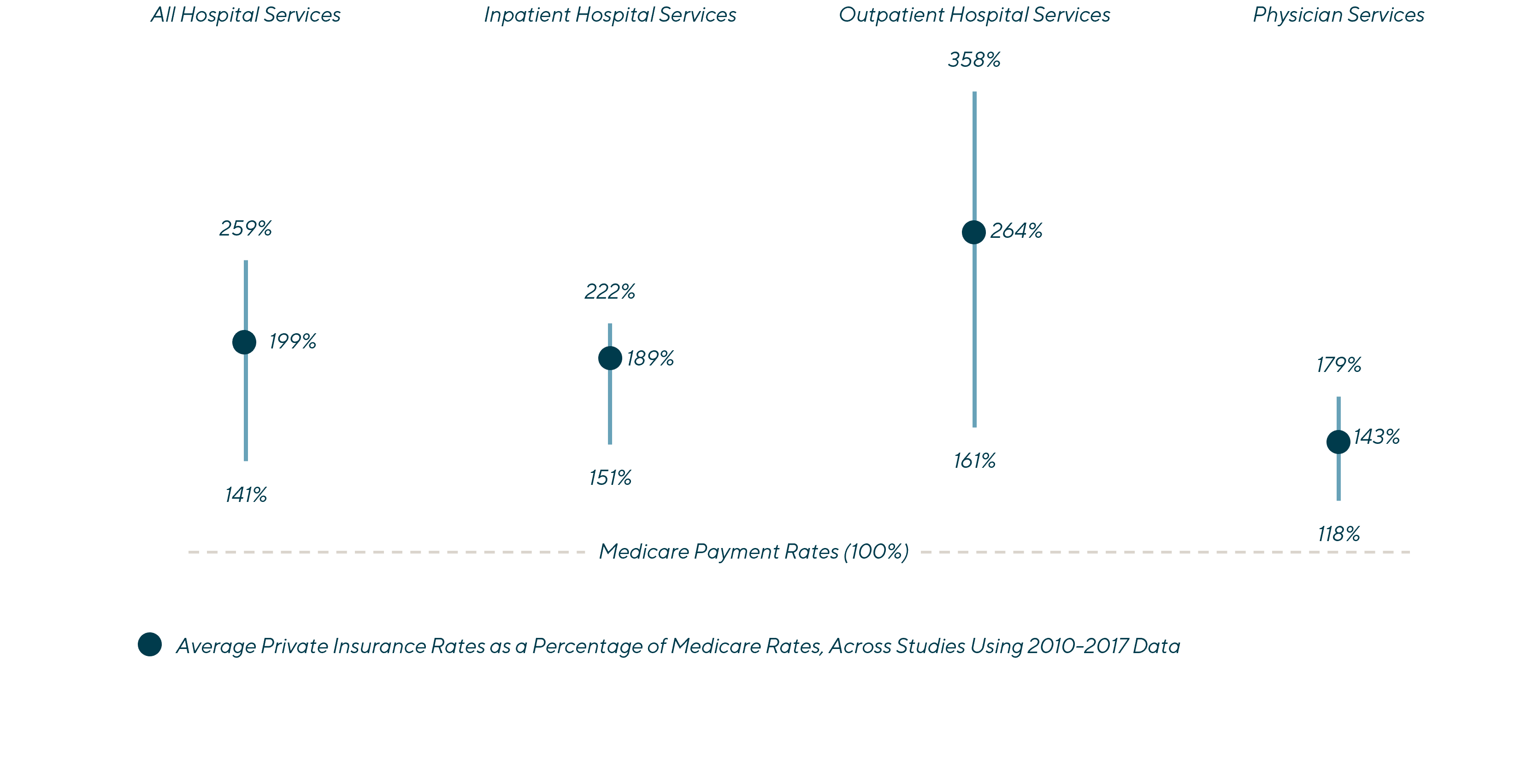

Private Payment Rates are Higher than Medicare Rates for Hospital and Physician Services

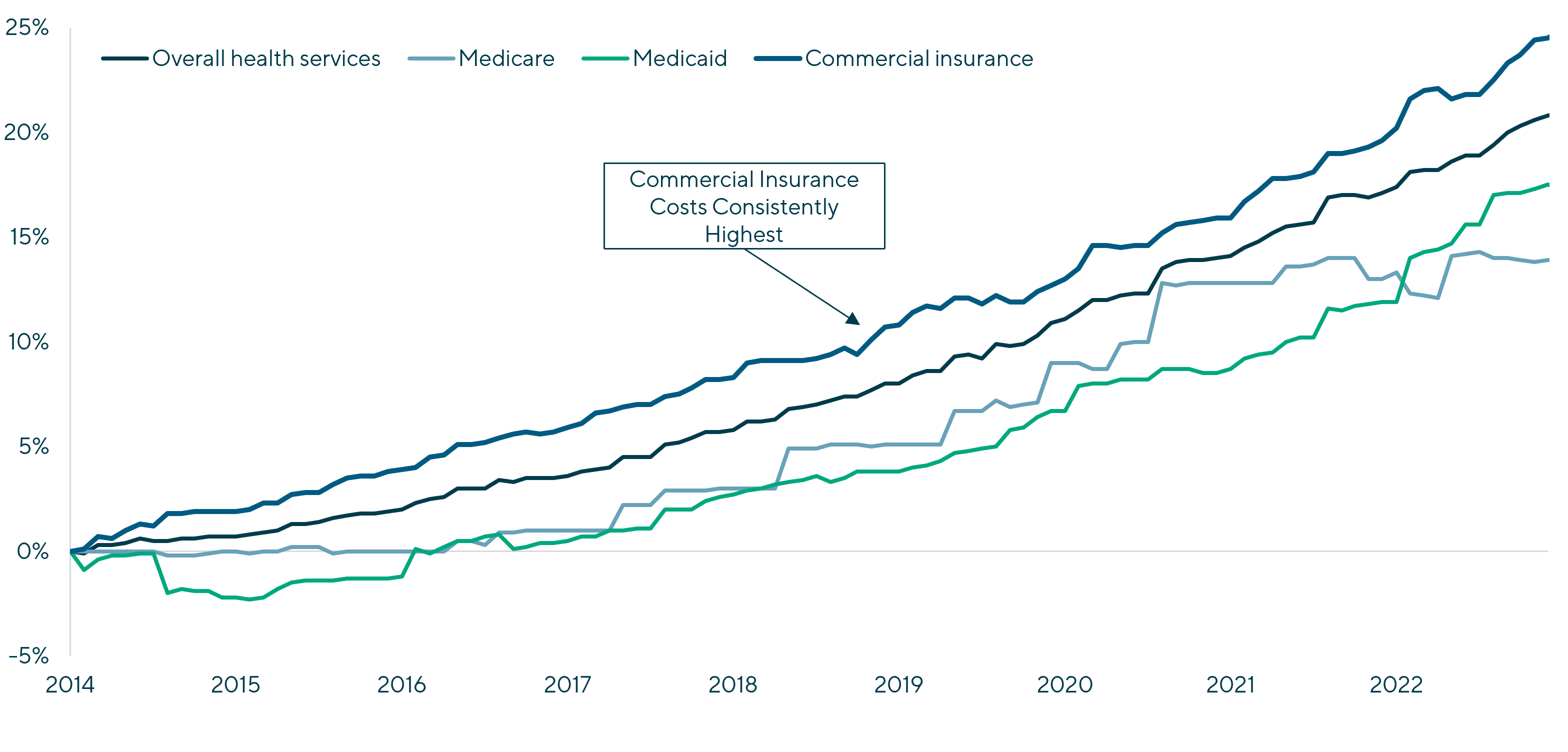

Prices Paid by Private Insurance Generally Outpace Those Paid by Public Programs

|

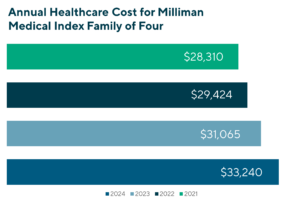

The opaqueness in commercial reimbursement, coupled with the disintermediation of the ultimate consumer of healthcare (the plan member) from the payor (the plan sponsor or the employer), has benefited providers and resulted in excessive reimbursement rates, misutilization and over utilization. The end result is the average cost of covering a family of four is now more than $31,000 per year(12) and expected to rise by 7% in 2024(13).

Unless these trends are proactively and aggressively addressed, the cost of group health insurance will continue increasing above both inflation and wage growth and represent an ever-growing share of employee compensation.

The NSA Will Further Accelerate Major Changes in Group Insurance Markets

Group health insurance has reached an inflection point with plan sponsors (employers) prepared to aggressively pursue a broad spectrum of cost containment and care management strategies to drive down the cost of coverage while improving member outcomes. Employers are best positioned to drive change for a number of reasons, including: (i) meaningful financial incentives, (ii) a stable member population to manage; (iii) access to, and the ability to act on, complex reimbursement data and (iv) access to a growing number highly-innovative payor-services solutions.

The following key themes represent Lincoln’s view on how the impact of NSA will drive significant changes in group health insurance and help elevate mergers and acquisitions (M&A) activity in the self-funded insurance sector:

| Employers, Not Plan Members, Will Be the Leading Drivers of Change: Attempts at incentivizing the plan member to make better purchasing decisions through high-deductible plans and consumer-directed health plans are insufficient to drive significant change on their own. Further, restrictions on balance billing have placed increased importance on payors for reimbursement. As the plan sponsor, employers will need to be drivers of real change to (i) drive down claim costs (ii) bend the cost curve and (iii) improve population health / member outcomes. |

| Shift Towards Increased Price Transparency and Actionable Data: Providers are grudgingly being forced to share all reimbursement data, with regulators now administering material fines for non-compliance. Payor-services solution providers are increasingly focusing on using this data in a variety of highly impactful ways, including: (i) repricing, (ii) direct contracting, (iii) network rate negotiation, (iv) member steerage; and reference-based pricing, amongst other cost containment and care management strategies. The data disclosed through the transparency requirements will have a meaningful impact on commercial insurance strategies. |

| Traditional Networks Will Lose Dominant Position: Transparency requirements continue to reveal the inadequacies and inconsistencies of traditional networks. With additional information, payors will increasingly turn to direct contracting, narrow networks, specialty networks, reference-based-pricing, value-based care and other non-traditional preferred provider organization alternatives. Administrative services only(ASO by traditional health insurance carriers) will also become less attractive as plan sponsors seek the flexibility of independent third-party administrator and cost containment / care management solutions. |

| Commercial Insurance Begins Transition from Fee-For-Service to Value-Based Care (VBC): Historically, Medicare Advantage and Managed Medicaid have more fully embraced VBC solutions. As time goes on, commercial insurance will continue to implement care management solutions that will finally shift risk and utilization to full-blown VBC solutions. |

| Narrowing the Gap of Public and Private Reimbursement: Commercial insurance has subsidized public insurance for decades, and in recent years this trend has accelerated. With transparency, the gap between public and private has become increasingly apparent. Providers will aggressively push back against this as most lose money on Medicare and Medicaid and their business models are built assuming private insurance funds the difference; however, given the dollars at stake, commercial insurance payors cannot allow this to continue. Eventually, Medicare and Medicaid will need to stand on their own, with Medicare Advantage and Managed Medicaid being obvious solutions. |

Growing Demand for Innovative, Impactful Market Solutions: Plan sponsors will increasingly seek service providers that can demonstrably control costs and improve underlying population trends. The following solutions will be of particularly high demand:

|

Notes and References:

- Commercial, group private healthcare insurance within this perspective refers to employer-sponsored insurance, not Medicare, Medicare Advantage, Medicaid, Managed Medicaid, Affordable Care Act or individual U65

- https://www.aha.org/system/files/media/file/2021/01/detailed-summary-of-no-surprises-act-advisory-1-14-21.pdf

- https://www.kff.org/health-reform/issue-brief/no-surprises-act-implementation-what-to-expect-in-2022/

- The QPA is generally defined as the median contracted or in-network rate as of January 31, 2019, indexed for inflation. Effectively this is the reference rate to which payors reimburse providers and patient cost share is determined for OON claims

- The independent dispute resolution works with payors and providers in disputed cases to determine the reference QPA or median in-network rate to which an OON claim will be reimbursed at

- https://www.wsj.com/video/series/wsj-explains/same-surgery-different-price-why-hospital-bills-vary-so-much/AEB3F724-93E9-4564-BEC5-1B5E6989926C

- https://www.fiercehealthcare.com/payers/study-finds-half-cash-prices-below-commercial-rates-more-2000-hospitals

- https://www.wsj.com/articles/boston-hospital-prices-healthcare-insurance-cost-11639576524

- https://www.milliman.com/en/insight/medical-inflation-drivers-and-patterns

- https://www.kff.org/medicare/issue-brief/how-much-more-than-medicare-do-private-insurers-pay-a-review-of-the-literature/

- https://www.healthsystemtracker.org/brief/how-does-medical-inflation-compare-to-inflation-in-the-rest-of-the-economy/#Cumulative%20percent%20change%20in%20Producer%20Price%20Index%20(PPI)%20for%20health%20care%20services,%20June%202014%20-%20February%202023.%20not%20seasonally%20adjusted

- https://us.milliman.com/en/insight/2023-milliman-medical-index

- https://www.pwc.com/us/en/industries/health-industries/library/behind-the-numbers.html

Contributors

Meet Professionals with Complementary Expertise in Healthcare

It’s extremely rewarding to work in one of the largest and most diverse global business sectors helping support clients to realize their goals.

Matthew Lee

Managing Director, Head of UK & Co-head of Healthcare, Europe

London

I enjoy working closely with clients to overcome challenging situations and to develop strategies to meet their business goals.

Dirk-Oliver Löffler

Managing Director & Co-head of Healthcare, Europe

Frankfurt

My goal is to bring the best of Lincoln to each and every transaction, ensuring the topmost outcomes for our clients.

Roderick O’Neill

Managing Director & Co-head of Healthcare

New York