M&A Activity Remains Strong for Companies Supporting Employer-Sponsored Health Benefits

Feb 2022

| Employer-sponsored, self-funded medical plans have grown in popularity since the implementation of ERISA in the 1970s and now cover nearly two-thirds of all employees and one-third of all Americans. Medical third-party administrators (medical TPAs), which oversee these plans on behalf of employers, have played an increasingly prominent role in advancing this trend and leading innovation. This in turn has driven strong interest from the investment community in both medical TPAs and related service and technology providers. Both private equity and strategic buyers have become increasingly active in the broader self-funded medical ecosystem, a trend Lincoln expects to continue. In this Lincoln perspective, we look at some of the key macro trends that are driving the self-funded market and how they will impact near-and longer-term M&A activity across service and technology providers. We also review recent transactions and key players in the space. |

Summary

-

Lincoln International shares insights into key macro trends that are driving the self-funded market and how they will impact near-and longer-term M&A activity across service and technology providers.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

LABOR MARKETS AND EMPLOYER-SPONSORED HEALTHCARE RESILIENT AMID COVID-19

Prior to COVID-19, participation in self-funded medical plans experienced decades of uninterrupted growth. Labor markets were disrupted by the pandemic – particularly facility-based services – but stabilized as a result of the Paycheck Protection Program as well as the adaptability of employers and employees. The number of employees and plan members covered by an employer-sponsored medical plan once again continued to grow after the initial shock of COVID-19 and has continued into 2022. Employers increasingly recognize that employees value quality, accessible medical coverage and consider this a standard part of a competitive compensation plan.

COST OF EMPLOYER-SPONSORED MEDICAL COVERAGE CONTINUES TO GROW

As the demand for medical coverage has increased the costs of providing this benefit have also gone up. The average per-employee cost of employer-sponsored health insurance was $14,542 in 2021, up 6.3% from 2020. This rise in cost is attributable to multiple factors including an aging population, an increasing prevalence of chronic and difficult-to-treat medical conditions, growth in specialty retail prescription drug prices and increasing care utilization. The cost of employer-sponsored medical coverage is expected to increase by 4.7% annually from 2022 through 2027, presenting a long-term challenge for plan sponsors and members.

Average Annual Worker and Employer Premium Contribution For Family Coverage

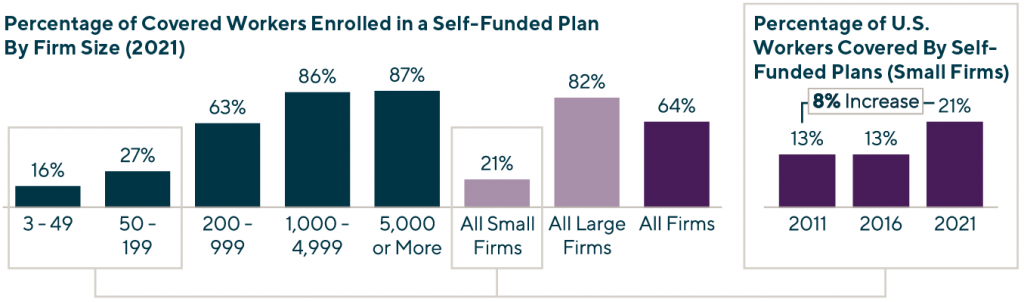

SELF-FUNDED MEDICAL PLANS REPRESENT A GROWING SHARE OF EMPLOYER-SPONSORED COVERAGE

Rising healthcare costs and the demand for increased plan flexibility have driven growth in the self-funded market. The number of participants in self-funded plans has increased by 33 million in the past 20 years to over 100 million plan members today. The number of plan members covered through self-funding is widely expected to continue growing over the years and decades to follow.

CONTINUED DEVELOPMENT OF STOP LOSS AND LEVEL FUNDED MARKETS ALLOWS SMALLER EMPLOYERS TO EFFECTIVELY SELF INSURE

Stop loss markets have become increasingly accessible to small- and mid-sized (SMB) employers, allowing these groups to effectively sponsor self-funded plans with acceptable risk. The growth in popularity of level-funded plans has allowed employers to achieve many of the benefits of self-funding with a more limited and sustainable risk profile.

MEDICAL TPAS AND ANCILLARY SERVICE & TECHNOLOGY PROVIDERS POISED TO PLAY A BIGGER ROLE

Service and technology providers that support the self-funded market — from medical TPAs to data analytic solutions to software providers — are well positioned to play a critical and ever-growing role in allowing employers to control medical inflation and drive positive population health outcomes. Medical TPAs have seen a shift from simple back-office claims adjudication and processing to the forefront of employer-sponsored healthcare and have continued to bring additional value-add services and technology in house. Network- and reference-based pricing (RBP) providers are expanding their portfolio of solutions to improve access to healthcare while simultaneously lowering costs. Technology solution providers are increasingly utilizing big data to create actionable analytics that have a direct impact on plan costs and member health.

LINCOLN PERSPECTIVE

The underlying supply and demand factors that drive the self-funded ecosystem are expected to accelerate in the near-term and remain stable in the long-term. The result of which will be an active, dynamic and growing M&A market for this sector.

For existing and prospective investors in the self-funded services and technology space, Lincoln recommends noting the following near-term market conditions and opportunities:

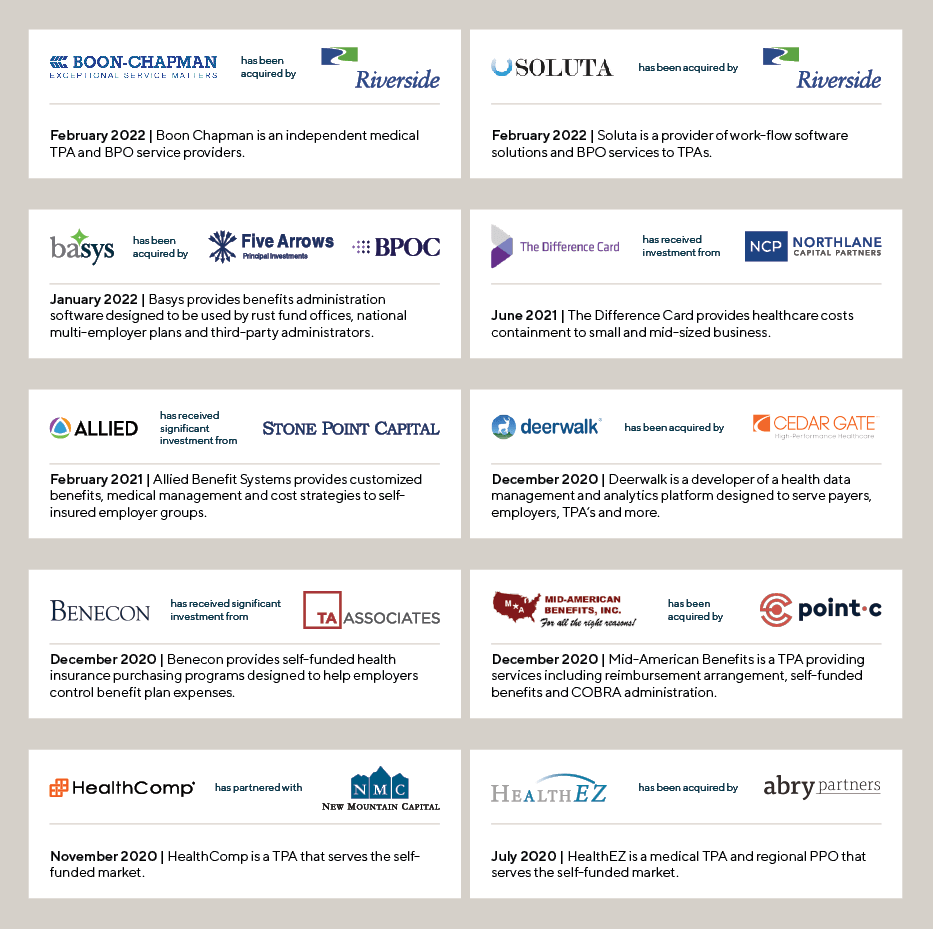

| Private equity will continue to pursue high-quality platforms for investment Private equity investment in the self-funded space has accelerated in recent years, with notable platform investments in HealthEZ (Abry), HealthComp (New Mountain), Allied Benefit Systems (Stone Point), Benecon (TA Associates) and Boon-Chapman/Soluta (The Riverside Company). Numerous other sponsors are expected to pursue their own platform investments in this relatively fragmented market. |

| Sponsor-backed platforms and publicly traded strategics will see accelerated tuck-in M&A activity We predict M&A to rapidly accelerate among platform investments as sponsors pursue inorganic growth initiatives early in their hold periods. Strategics are expected to become more active in this space as they focus on building out their capacity to serve the SMB market. Non-traditional players, like PBMs and ancillary benefits administrators, will seek to diversify services and enter the market. Healthcare technology providers will continue to be active in this space. |

| Prolonged M&A activity in the Self-Funded Medical Space The combination of well-capitalized strategic and financial buyers, coupled with an aging generation of founders, owners and operators seeking to exit, has laid the groundwork for sustained M&A activity in the self-funded space for years to come. We expect the highly fragmented market to consolidate as aging founders exit to larger platforms, and sponsor-backed platforms continue to trade up market. |

| Service and Technology Providers Will Continue to Expand Services and Overlap Solutions Medical TPAs and ancillary service and technology providers will seek to add complementary solutions to their platform. Care management, payment technology, population health management, prescription drug benefit management and member engagement represent key areas of focus. Look for increased diversification in the push to become a holistic solution to the self-funded market. |

| Continued development SMB market Claims volatility and plan diseconomies have historically limited smaller employers from participating in self-funding. The continued development of stop loss products and the widespread adoption of level funded plans have made self-funding more accessible, economical and sustainable for small employers. We expect to see the continued growth and increased adoption of self-funding and level funding in the SMB market. |

| Reference-based pricing (RBP) will play a growing role in the self-funded market RBP has proven to be an effective and sustainable strategy to lower overall claims costs and reduce medical inflation. RBP works well for groups that have lower plan costs and utilization or for employers with a key geographic provider. In these situations, traditional networks may be costly and ineffective and RBP can be an effective means to reduce costs while offering quality coverage and access to providers. |

Sources: www.kff.org/report-section/ehbs-2021-summary-of-findings | www.spbatpa.org | www.ebri.org/docs/default-source/ebri-issue-brief/ebri_ib_540_selfinsurance-30sep21.pdf

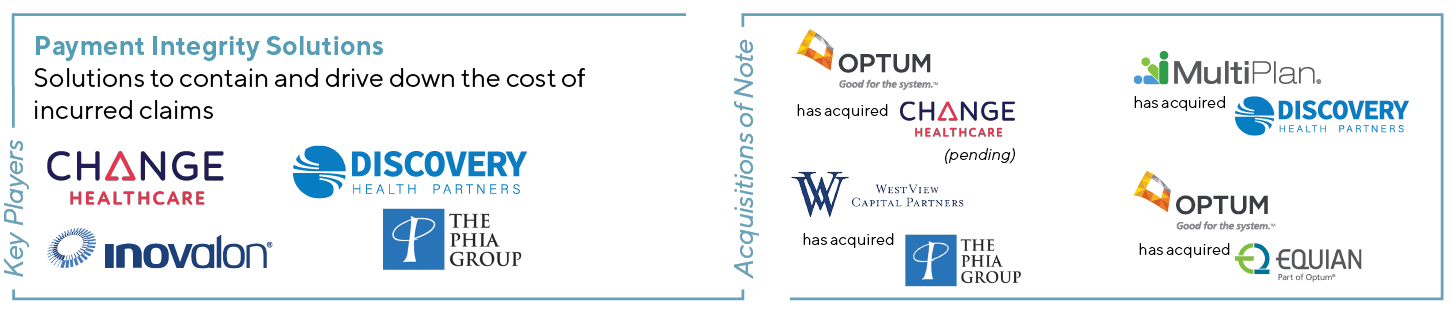

KEY PLAYERS AND SELECT ACQUISITIONS ACROSS THE SELF-FUNDED MEDICAL INSURANCE ECOSYSTEM

There has been substantial investment across the entire self-funded medical ecosystem with a focus on services to date. The pivot towards investing in analytics, population health management and other technology solutions is just beginning to materialize.

KEY TRANSACTIONS IN SELF-FUNDED, EMPLOYER-SPONSORED ECOSYSTEM SINCE COVID-19

There has been substantial investment across the entire self-funded medical ecosystem with a focus on services to date. The pivot towards investing in analytics, population health management and other technology solutions is just beginning to materialize.

Contributors

Meet Professionals with Complementary Expertise

It’s extremely rewarding to work in one of the largest and most diverse global business sectors helping support clients to realize their goals.

Matthew Lee

Managing Director, Head of UK & Co-head of Healthcare, Europe

London

I enjoy working closely with clients to overcome challenging situations and to develop strategies to meet their business goals.

Dirk-Oliver Löffler

Managing Director & Co-head of Healthcare, Europe

Frankfurt

My goal is to bring the best of Lincoln to each and every transaction, ensuring the topmost outcomes for our clients.

Roderick O’Neill

Managing Director & Co-head of Healthcare

New York