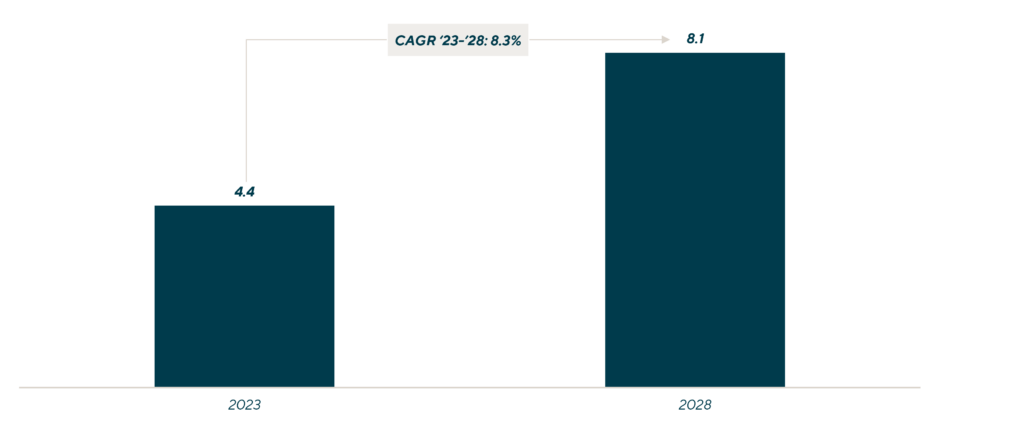

Investors Seek Protection in the Safety Workwear Market

Aug 2023

The safety workwear industry is a highly resilient and very attractive market that covers all personal protective equipment from head to toe, including helmets, goggles, gloves, shoes, protective clothing and fall protection. In many industries, such as construction, mining and manufacturing, companies are required by law to follow strict workplace safety standards and provide safety workwear to protect their employees. These products are also generally considered to be consumable and therefore are recurring and non-discretionary purchases. As such, the personal protective equipment (PPE) market will always have active sales even in challenging economies, which is an appealing attribute for investors.

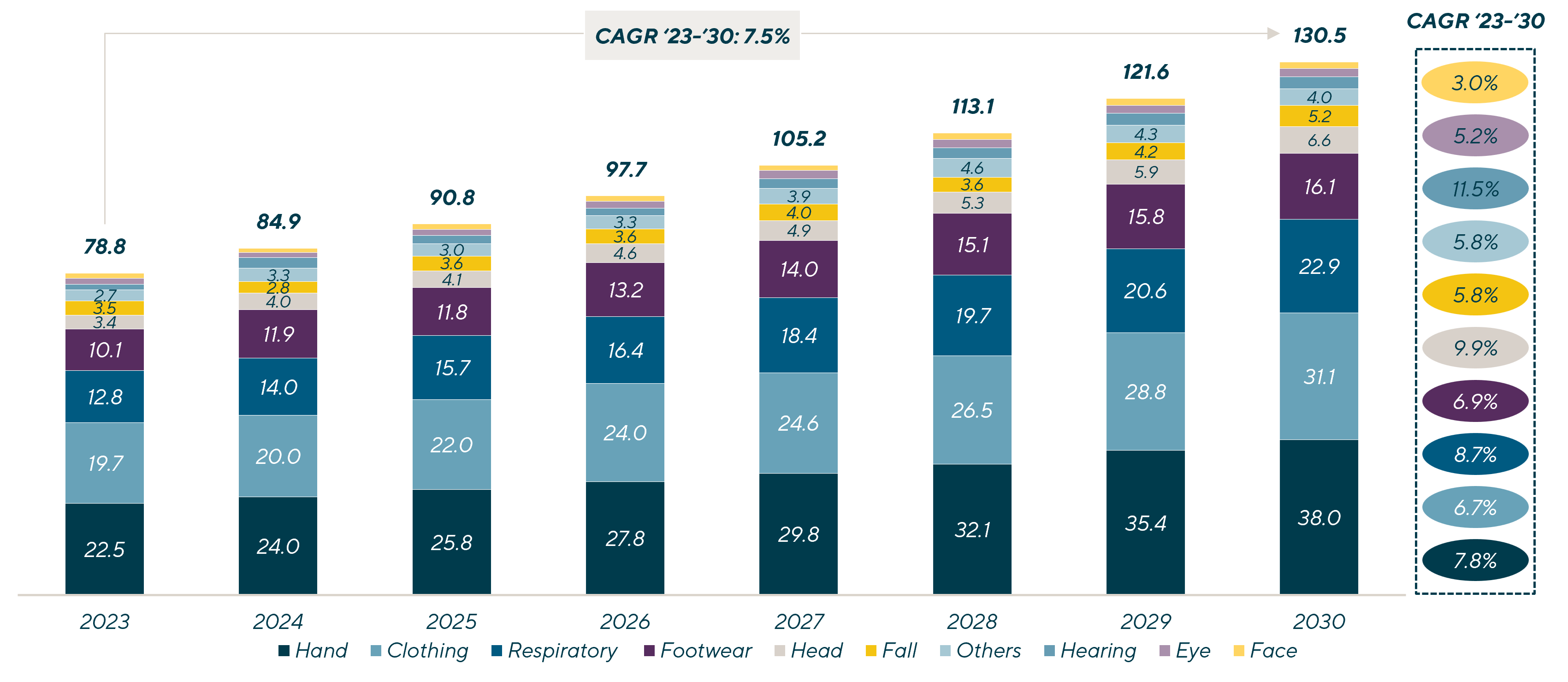

Global PPE Market Development by Subsectors1Forecasted trends 2023 – 2030 in USD billion |

Summary

-

Lincoln International outlines some additional safety workwear trends that are attractive to investors, including subsectors poised to grow and key mergers and acquisitions (M&A) considerations.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Below, Lincoln International outlines some additional safety workwear trends that are attractive to investors, including subsectors poised to grow and key mergers and acquisitions (M&A) considerations.

Top Trends Attracting Investors

Investors are interested in the safety workwear market for a multitude of reasons, including, but not limited to:

| Regulated Market Environment

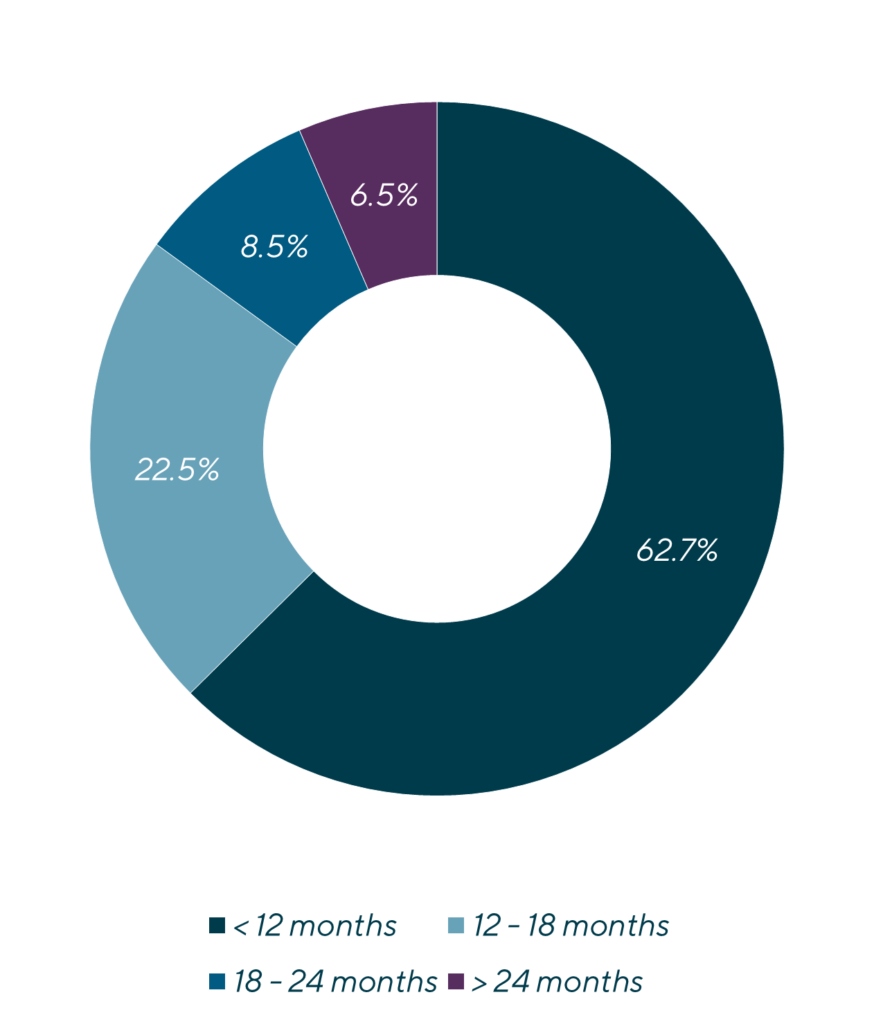

The safety workwear industry largely benefits from regulations that require many companies to provide protective equipment for their employees. By law, companies must not only provide protective equipment but must also maintain certain quality levels to adequately protect employees. Failure to do so does not only hurt the reputation of the brand but may result in a high cost of failure including fines and wrongful injury lawsuits. Furthermore, products must be replaced within a certain timeline to keep employees protected from worn-out equipment. For example, studies show that safety shoes must be replaced every seven to eight months to ensure maximum functionality and approximately 85% of all male safety footwear are in fact replaced within 18 months of usage. Additionally, the regulatory environment requires an increasing number of workers to be covered by PPE and a growing number of products for each employee. Given this, demand for safety workwear continues to grow in all economic conditions.

|

|||

| Emerging Markets

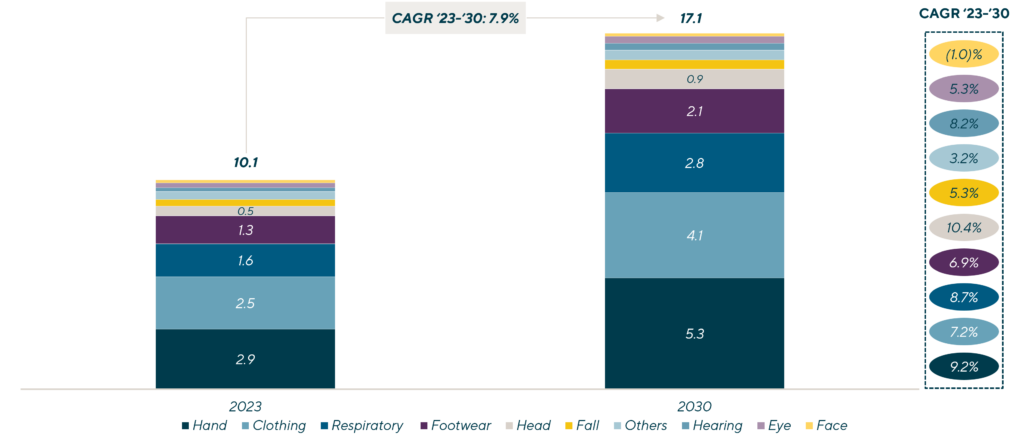

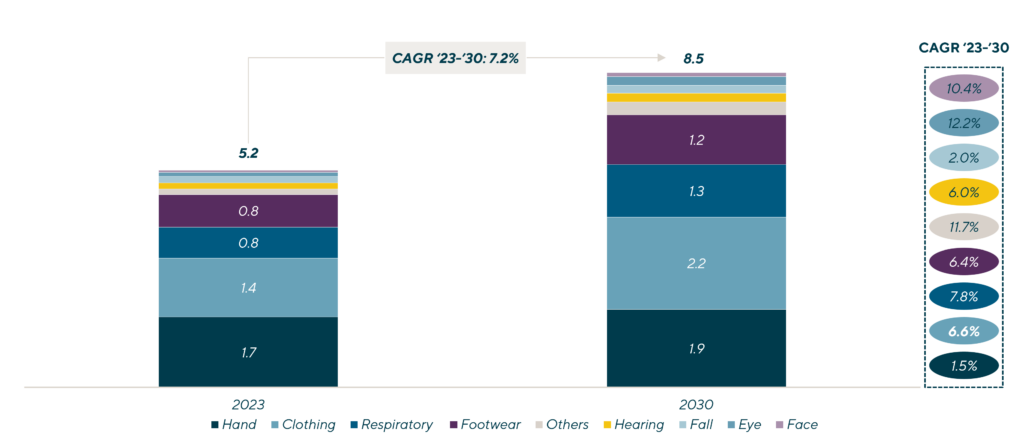

Safety regulation is a key topic that is becoming more established in emerging markets such as Southeast Asia. While the U.S. and Germany are set to continue their strong growth and dominate the market, the Southeast Asian countries are forecasted to have the strongest year-over-year growth on average by 2030. As regulations become more stringent and these countries increase their focus on the health and wellness of workers, demand for safety workwear in those geographies will expand exponentially.

|

|||

| Innovations

New innovations are also driving change in the market. Some items are inspired by sports and are driven by comfort and functionality, leading companies to innovate their products. For example, the safety footwear market has followed the athletic shoe industry in making safety footwear lighter, more breathable and more fashionable. In general, safety workwear is worn by individuals for up to 12 hours a day, so it is important that the items are not only functional and protective, but also comfortable and attractive.

|

|||

| High Value

While the safety workwear market is comprised of products that some would consider less fashionable, protective equipment is a high-margin product that does not run the risk of obsolescence. In addition, there are rarely issues with write-offs or significant overstock as the shelf life of protective equipment is quite long. |

|||

| Fragmented Market

Many safety workwear companies are family-owned businesses that evolved successfully over generations within a market with a high and increasing barrier to entry for newcomers. Since there are ample local regulations that apply to the market, the companies that can distribute products internationally and comply with country-specific standards, are of great value to investors. |

Growing Subsectors

While the safety workwear market itself is quite active, there are several subsectors that investors have turned a keen eye to as they are poised to grow.

PE, in particular, is focusing on safety workwear subsectors where the product is functional. This includes helmets, gloves, footwear, protective hearing and respiratory products. These subsectors are projected to have significant growth compared to the regular workwear segment.

Safety conglomerates tend to focus on complementing their existing product lines, thinking from head to toe across different regions as well as distribution routes

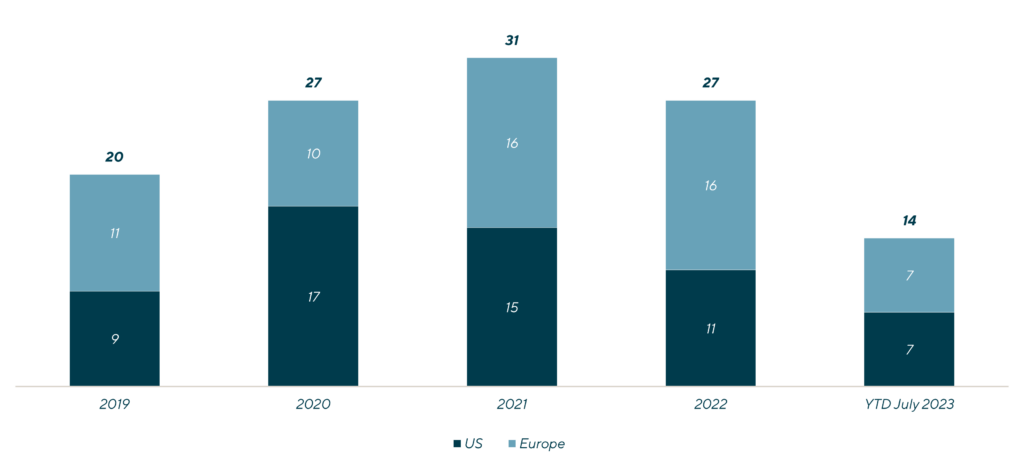

Deal Activity

Safety workwear, as mentioned above, is a resilient market with stable deal activity. Throughout the past, deal activity has been strong, and Lincoln expects it to carry on with great tenacity, supported by a large buyer universe of PE firms as well as private and public strategics. Large strategics continue to look for new opportunities due to local market regulations. Thus, such conglomerates continue to acquire smaller companies in new geographies to scale. Family-owned companies with limited capital and staff resources are starting to evaluate their strategic options for the future and are tending to partner with larger platforms.

From a valuation point of view, safety workwear businesses attract investors due to their resilience, recurring revenue and high margins. Investors are also focused on a company’s ability to expand the use of products to other channels and end users.

Number of Transactions in the PPE Market in Europe and U.S.4 |

Preparing for a Sale

For companies that are considering consolidating, there are several steps they should follow to positively present themselves to a potential buyer.

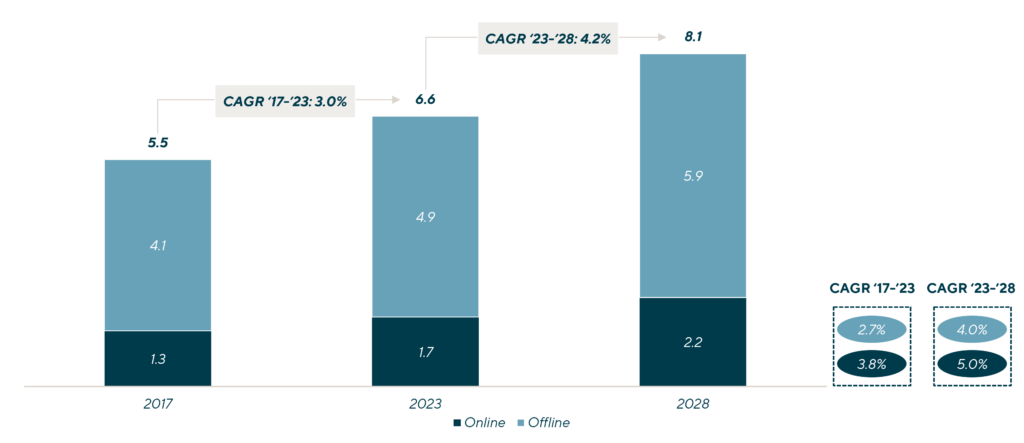

| Route-to-Market Strategy: In the safety segment, the current market is well established by business-to-businesses (B2B) safety product distributors. However, safety workwear companies continue to seek to move into business-to-consumer (B2C), which leads them more aggressively into e-commerce and retail settings. The online distribution channel within the global safety footwear, for example, is forecasted to grow above the market and reach a 27% share by 2028. Therefore, companies that are established in all B2B and B2C channels will attract increased investor interest.

New Business Development Process: Companies should look at their new product development processes including the share sales from new products. Companies with a strong innovation cycle will give investors comfort in the business’ ability to consistently drive growth through new products. As such, it is vital that companies have strong R&D capabilities as well as trademark-protected design, technologies and components (own intellectual property) to ensure their products cannot be copied by a competitor. Sales Volume Analysis: Following the current inflationary environment, performing a sales volume analysis continues to gain more importance as it determines whether a company’s growth is driven through numerous recent price increases or actual higher volume sold. Additionally, companies may examine the potential exposure of each SKU to aggressive price pressures. By focusing on thought-through price increases, robust SKU growth as well as continuous product development and innovation, leading companies will be able to mitigate the current market environment. |

Sources:

- Grand View Research

- Safety footwear: A survey of end-users

- Global Market Vision, Page 56

- Mergermarket, CapitalIQ, Pitchbook

Recent Transactions

Contributors

It’s an exciting time to advise clients in the consumer sector. Major changes in consumer preferences and how products are purchased create a rich environment for business owners and investors to succeed.

Dirk Damegger

Managing Director & European Co-head of Consumer

Frankfurt

My passion is positioning high-quality businesses for maximum valuation. I thoroughly enjoy partnering with business owners to reach their goals through life-changing transactions.

Christopher Stradling

Managing Director & U.S. Co-head of Consumer

ChicagoMeet Professionals with Complementary Expertise in Consumer

It’s an exciting time to advise clients in the consumer sector. Major changes in consumer preferences and how products are purchased create a rich environment for business owners and investors to succeed.

Dirk Damegger

Managing Director & European Co-head of Consumer

Frankfurt

I have a hands-on approach and bring energy, creativity and passion to every client transaction.

Eddie Krule

Managing Director

ChicagoRelated Perspectives in Consumer

Lincoln International Managing Directors Recognized as Emerging Leaders

Lincoln International is pleased to share that The M&A Advisor named Managing Directors Adam Gifford, Brian Goodwin, Eddie Krule and Scott Molinaro as recipients in the Emerging Leaders Awards. These… Read More

Food & Beverage Market Update Q1 2024

The M&A market remained somewhat challenged during the first quarter; however, we experienced improved dealmaking conditions.

Consumer, Business and Economic Trends Align to Drive New Interest in Recommerce

Back in 2021, the recommerce industry seemed to have finally hit its stride, with the sector experiencing a surge in transactions, valuations and deal sizes. At the brink of becoming… Read More

The Fitness Investment Landscape

State of the Fitness Market: presented by L.E.K. Consulting Fitness Market Stabilization and Return to Growth Few industries were as negatively impacted by COVID-19 as the in-person fitness industry. Deemed… Read More