How the Asian Supply Chain is Impacting U.S. Businesses, and What That Means for M&A Activity

Dec 2021

| The COVID-19 crisis highlighted the fragility of supply chains in what has become a highly globalized and complex trade market. It exposed companies’ inability to adjust to demand and multi-faceted supply hurdles. As a result, restarting the manufacturing and logistics machine following lockdowns has proven difficult. For companies considering merger and acquisition opportunities during this time, supply chain questions are important due diligence considerations. Fortunately, there is hope for recovery to a new normal in 2022 through an expected stabilization of supply and demand fundamentals.

Many consumer goods companies have faced pandemic-related system shocks, such as rising logistics costs and falling supplier service levels. In response, retailers and wholesalers often raised prices to offset margin pressure and increased order volumes and inventories to reduce stock outs. While not all participants are equally impacted, most across the entire value chain expect these supply chain difficulties to have lasting effects. Amid the changing consumer world, winners will emerge from the supply chain dilemma; the successful navigation of these challenges in mergers and acquisitions (M&A) processes can be a key differentiator that drives outlier outcomes. |

Summary

-

Lincoln International shares insights on activity within the supply chain sector heading into 2022.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

What is the current state of the supply chain?

American businesses are facing multiple supply chain challenges in real time. To start, freight costs have skyrocketed, with ocean shipping spot rates up 400-600%, relative to 2019 levels, across all main China-U.S. routes.

Compounding the pain of heightened transportation costs are prolonged and uncertain shipping times: the end-to-end transit time for China-U.S. ocean freight has nearly doubled, from approximately 40 days pre-COVID-19-pandemic to almost 80 days as of October 2021. Further, the turnaround time for ships to discharge their cargo at the Port of Los Angeles / Long Beach has increased from a pre-pandemic average of 3.6 days to 6.4 days as of Q3 2021.1

Meanwhile, manufacturing input costs have risen at the fastest rate in a decade, according to the IHS Markit Purchasing Managers’ Index.2 A global chip shortage is impacting household appliances and consumer electronics, as unfilled orders are up between 10-90% since 2019.3 Low retail inventory levels have led to empty shelves and a 250% increase in out-of-stock messages for e-commerce shoppers compared to pre-pandemic levels.4

The U.S Labor Department also reported a severe labor shortage in the trucking and warehouse sectors, with nearly 500,000 job openings. In response to these conditions, many companies are starting to build up their inventory safety stocks. For example, in a sample of 10 large publicly traded, durable consumer goods companies, inventory levels as a percentage of both total assets and revenue have grown consecutively for the past four quarters by over six percentage points or 40-50% in total for each. This translates to increased working capital needs and reduced return on assets.

What caused the supply chain problem?

The supply chain disruption resulted from a multitude of largely interrelated factors that have taken existing logistics infrastructure to a breaking point, including:

- COVID-19-Related Plant Shutdowns and Restrictions: Southeast Asia closed factories and reduced manufacturing output in late Summer 2021 when it experienced a sharp increase in COVID-19 infection rates due to the Delta variant and lagging vaccination rates.5

- Government Intervention / Labor Supply: Legacy zoning rules that limit how many containers can be placed in a stack by warehouses and yards along with labor restrictions contributed to congestion at the Port of Los Angeles / Long Beach when the amount of space and available capacity for new arrivals was capped. Meanwhile, stimulus checks and expanded unemployment benefits both increased demand for products and suppressed the labor supply, a difficult combination.

- Shortage of Shipping Containers: A severe shipping container shortage for transport to the U.S. hampered shipments as only approximately 40% of containers make the return voyage, furthering domestic congestion.6 This is occurring because of downstream bottlenecks: limited chassis availability, warehouse space and trucking capacity. These are all obstacles to clearing the backlog of full containers waiting to be emptied and sent back to Asia.

- Limited Warehouse Capacity: Warehouses near the Port of Los Angeles / Long Beach are practically full, reporting an extremely low vacancy rate of below 1%, as of Q3 2021. While the national vacancy rate was 3.6%, a record low.7 Thus, container contents have nowhere to go when they arrive in the U.S., which causes more congestion at the ports.

Why was the consumer industry vulnerable?

No company is immune to the effects of the recent supply chain climate, but certain factors drive increased exposure and result in even greater challenges for consumer companies. While strategies, including global supply chains and just-in-time inventory were hallmarks of well-run companies pre-pandemic, they have exacerbated issues in the last six to nine months. Companies are faced not just with how to succeed in the current environment, but how to evolve operationally to thrive in a post-pandemic world.

Variables that impacted the consumer industry and its companies include:

| Global Supply Chain Exposure: Whether directly or otherwise, industries and companies reliant on overseas supply chains are seeing materially higher costs and longer delays. Consumer goods companies especially, historically pursued global supply chains compared to other sectors. Pre-pandemic, this strategy drove enhanced margins while still enabling the rapid delivery of goods. Currently, both advantages have been blunted. However, as the wrinkles in the supply chain are solved, the globalization of the consumer goods economy will shift back to being an advantage. In response to the current upheaval, leading consumer businesses will seek to further diversify suppliers across multiple regions and perhaps even expand domestic sourcing. |

Figure 1. Many Consumer goods categories rely on numerous inputs sourced from overseas, illustrating how susceptible the retail economy is to shipping delays and cost increases.

Source: Bloomberg

| Elevated Demand: Through 2020 and 2021, consumer goods experienced increased demand, especially in the consumer electronics, home improvement and sporting goods categories. This is driven by high consumer household income as well as fewer opportunities for consumers to spend money in the entertainment and service sectors. Therefore, demand for consumer products has been rapidly increasing. While the elevated demand will relax broadly over time, winning companies and brands that have captured market share and are capitalizing on these gains will continue to benefit and further distance themselves from the competition. As the supply chain headwinds level off, these leading companies will emerge even better positioned than before. |

Figure 2. Consumers shifted spending away from services and towards consumer products during the pandemic

Note: The index is created from actual figures (seasonally adjusted annual rate) by rebasing February 2020 values to 100.

Sources: United States Department of Commerce (sourced through Haver Analytics); Deloitte Services LP economic analysis. Deloitte

While the consumer sector is broadly impacted by the supply chain disruptions, not all business models and products have been equally affected. In addition to variation within the globalization and demand drivers mentioned above, these key factors below also determine which companies are most vulnerable:

| Company Scale: On the procurement side, larger companies are better positioned to optimize shipping rates, while companies using fewer containers see less favorable rates. On the sales side, those businesses representing greater criticality to their customers (often related to scale, but not always) can pass through price increases more effectively. |

| Product Shipping Efficiency: Bulk products or those in non-standard dimensions are less efficiently shipped and, therefore experience a disproportionate impact from increased freight costs. This is especially true for lower priced, bulky items, whose shipping represents a larger portion of the total delivered cost of the product. |

| Complexity of Manufacturing: Items with longer production cycles or that involve many inputs have greater exposure to delays, a single delayed component can drastically extend production time. Furthermore, many companies accustomed to just-in-time inventory management are still catching up on demand needs and even once the elevated demand abates, the inventory will need time to catch up. |

Spotlight: E-commerceCOVID-19 accelerated the volume shift from brick and mortar to e-commerce at levels not expected until after 2025, driving a digital boom for e-commerce platforms. Yet, the existing infrastructure supporting the e-commerce landscape was caught off guard and overburdened, resulting in short-term growing pains that are expected to dissipate as the underlying infrastructure catches up to the expected continued rapid growth of the channel. Despite the near-term disruption, the long-term shift to e-commerce will continue as consumers increasingly prefer to shop online. As the global supply chain returns to normal and the e-commerce infrastructure catches up to the growth of the channel, winners in the e-commerce space will benefit from the combination of 1) the permanent shift in consumer purchasing behavior favoring online shopping and 2) the catching up of technology, order fulfillment capabilities and logistics capacity requisite to match the demand. Contrary to fears of a “COVID-19 bump,” well-positioned players with differentiated e-commerce capabilities will continue to take market share from brick and mortar-focused companies. The below chart highlights the remarkable growth of e-commerce sales by product category in 2021 and e-commerce penetration rates for each. Those with high growth and low e-commerce penetration rates have significant opportunity for continued long-term category growth in e-commerce. |

Figure 3. COVID-19 rapidly accelerated e-commerce adoption across consumer product categories, especially in staple products

2021E U.S. retail e-commerce sales growth, by product category

Source: eMarketer

LINCOLN PERSPECTIVE

We believe the supply chain will stabilize in coming months. Following the high demand of the holiday season and the Chinese New Year, Lincoln will be watching for the supply chain to adjust and retool itself to support an environment of increased demand, which we anticipate will continue for many years. The impact of the Omicron variant is not yet known, but we remain optimistic with our view unchanged at this time.

There remains significantly elevated demand in several consumer goods categories, but normalization is generally expected in 2022. Supply chains are expected to catchup to demand, as the elevated consumer demand for goods shifts back into services, with a nearly pre-COVID-19 balance of goods to services spend by late 2022, assuming the COVID-19 impact continues to normalize as anticipated. Additionally, given the accelerated consumer pivot to e-commerce due to the pandemic, supply chains will need to be built to support omnichannel models even more, given this growth leap in digital purchasing within the overall consumer spectrum.

While supply chain risk has impacted some sectors of the M&A markets in the very short term, the drivers for acquisition activity remain very strong. Sales synergies, vertical integration and allocation of private capital into the attractive consumer sector will continue for the long term and are expected to drive significant M&A activity in 2022.

Companies that favorably address the below points will be highly attractive in the 2022 M&A market:

Verify long-term consumer demand in the product category and the potential impact of pent-up, short-term demand. E-commerce-focused companies will be better able to establish this as there are many categories that remain underpenetrated in e-commerce. Growth driven by channel shift from B&M to e-commerce will likely compensate for any slowdown in overall product category sales.

Verify price increases have been implemented and are being accepted by the market. This will secure future margins and give future investors in a business confidence in a company’s ability to adapt to a changing supply chain environment. Identify and execute on near-term initiatives to mitigate or offset any expected long-term margin impact that cannot be passed through in price to customers.

Identify and execute on near-term initiatives to mitigate or offset any expected long-term margin impact that cannot be passed through in price to customers.

Clearly define the “moat” around any given business, such as brand, innovation, intellectual property, e-commerce expertise, superior supply chain or any combination of items. It is important for a buyer to have clarity around this so they know going into the investment the levers they can pull to thrive in the changing market.

Proactively address supply chain diligence as a top-of-mind priority with a focus on future risk management. Risk-based, “what-if” scenario analyses can be conducted to identify alternate suppliers, who could be called upon to provide any parts, materials, products or services that might be at risk.

Hire third-party advisors to thoroughly analyze and provide credibility to normalization of marketable EBITDA. Supply chain disruptions can impact performance and business plans, making a reliable purchase price calculation more difficult.

WHILE SUPPLY CHAIN RISK HAS IMPACTED SOME SECTORS OF THE M&A MARKETS IN THE SHORT TERM, THE DRIVERS FOR ACQUISITION ACTIVITY REMAIN VERY STRONG. SALES SYNERGIES, VERTICAL INTEGRATION AND ALLOCATION OF PRIVATE CAPITAL INTO THE ATTRACTIVE CONSUMER SECTOR WILL CONTINUE FOR THE LONG TERM AND ARE EXPECTED TO DRIVE SIGNIFICANT M&A |

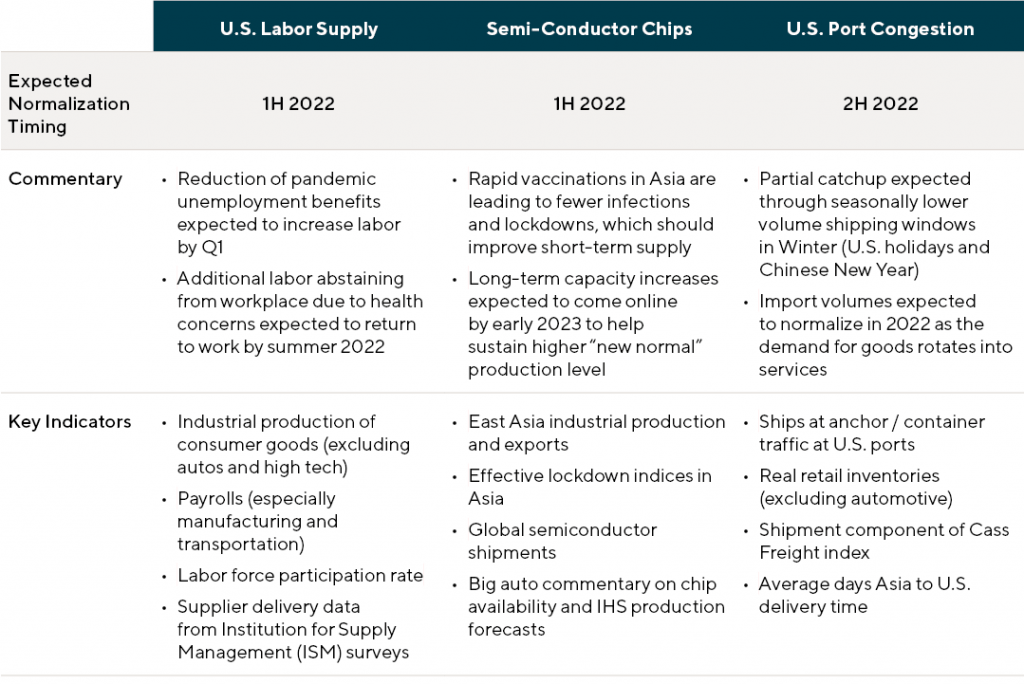

Key Normalization Indicators to Watch8

1 Source: Bloomberg / RBC Capital Markets

2 Source: IHS Markit

3 Source: Goldman Sachs

4 Source: Adobe Digital Economy Index

5 Source: Goldman Sachs

6 Source: Hillebrand (How Covid created shipping’s container shortage – Investment Monitor)

7 Source: CBRE

8 Source: Goldman Sachs and Bloomberg

Contributors

My passion is positioning high-quality businesses for maximum valuation. I thoroughly enjoy partnering with business owners to reach their goals through life-changing transactions.

Christopher Stradling

Managing Director & U.S. Co-head of Consumer

ChicagoMeet Professionals with Complementary Expertise

It’s an exciting time to advise clients in the consumer sector. Major changes in consumer preferences and how products are purchased create a rich environment for business owners and investors to succeed.

Dirk Damegger

Managing Director & European Co-head of Consumer

Frankfurt

I have a hands-on approach and bring energy, creativity and passion to every client transaction.

Eddie Krule

Managing Director

ChicagoRelated Perspectives

Lincoln International Managing Directors Recognized as Emerging Leaders

Lincoln International is pleased to share that The M&A Advisor named Managing Directors Adam Gifford, Brian Goodwin, Eddie Krule and Scott Molinaro as recipients in the Emerging Leaders Awards. These… Read More

Food & Beverage Market Update Q1 2024

The M&A market remained somewhat challenged during the first quarter; however, we experienced improved dealmaking conditions.

Consumer, Business and Economic Trends Align to Drive New Interest in Recommerce

Back in 2021, the recommerce industry seemed to have finally hit its stride, with the sector experiencing a surge in transactions, valuations and deal sizes. At the brink of becoming… Read More

The Fitness Investment Landscape

State of the Fitness Market: presented by L.E.K. Consulting Fitness Market Stabilization and Return to Growth Few industries were as negatively impacted by COVID-19 as the in-person fitness industry. Deemed… Read More