The Eventual Normalization of the Housing Market will Create a Busy Period for Building Products M&A

Apr 2023

In late 2022, building products companies were assessing the impact of the flash freeze in the new residential construction market caused by mortgage interest rates more than doubling. However, as the calendar turned to 2023, the residential construction market quickly turned positive as home buyers who delayed home purchases began to adjust to the higher rate environment. During this time, every forward-looking indicator Lincoln International tracks turned materially positive, especially demonstrated by the NAHB / Wells Fargo Housing Market Index which has risen for three consecutive months from 31 at the beginning of the year to 44 in March. But the positivity seen in the first six plus weeks of the year has dissipated as continuing concerns about inflation and recent worries about the global banking system have rattled markets.

Summary

-

Lincoln International reviews the structural factors that will support the building products market in the medium to long-term for investors and strategic parties.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

While the near-term demand and sentiment for residential building products and building products mergers and acquisitions (M&A) will be determined by the path of mortgage rates and interest rate policy set by the Federal Reserve, building products investors and strategic parties are looking to structural factors that will support the market in the medium to long-term. Namely:

| Demographics – Aging millennials will drive an additional 12.7 million new households formed in the 2020s

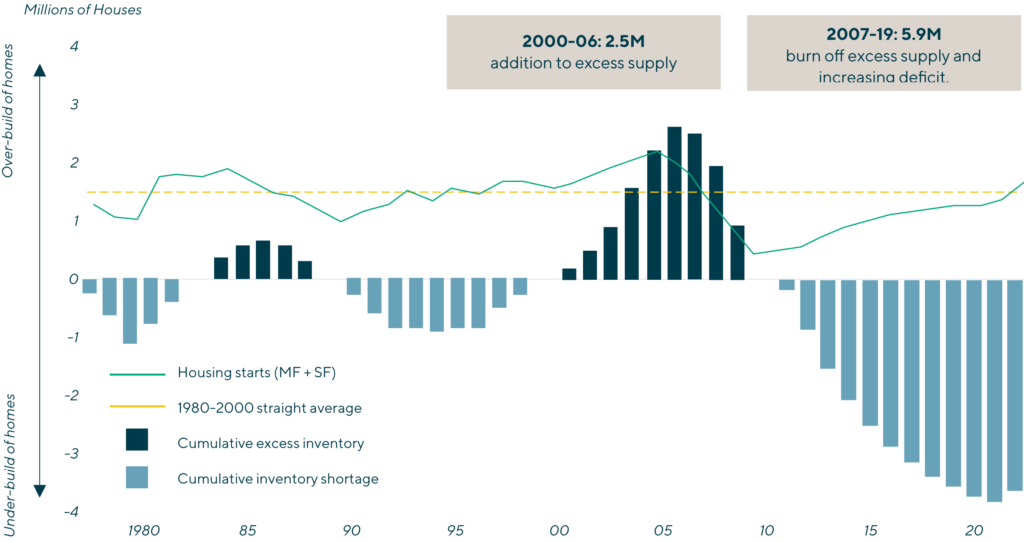

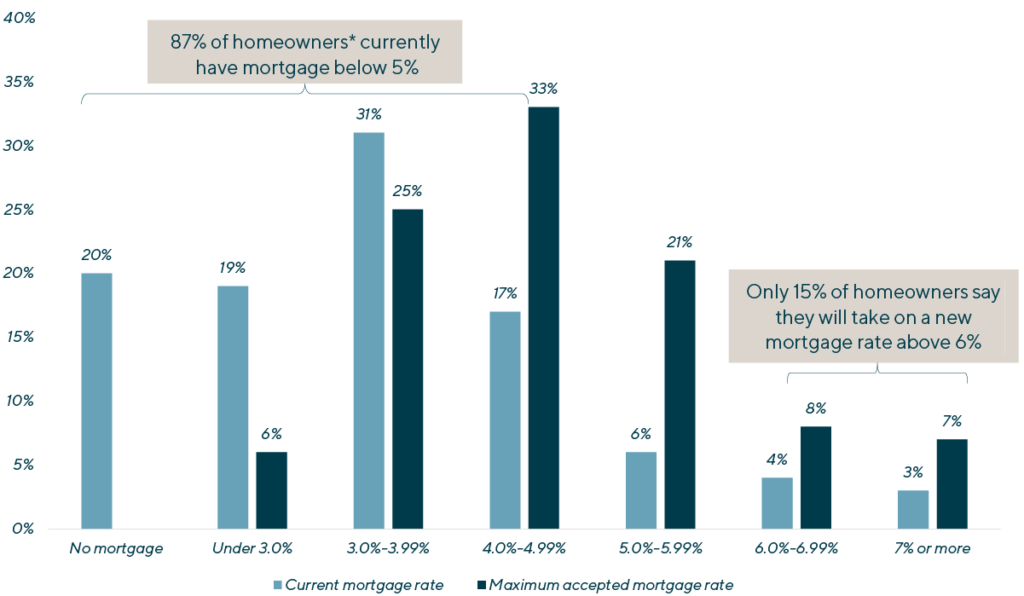

Undersupply – Seven million more new homes needed in the 2020s to meet the above demographic demand and to fill the current two and a half million undersupply of homes Mortgage Rate Normalization – Mortgage rates will normalize as the spread of the 30 year to 10 year treasury rate is currently near all-time highs; this spread plus other factors should result in lower mortgage rates going forward |

Homeowners’ Highest Acceptable Mortgage Rate Willing to Take On for New Home PurchaseSource: New Home Trends Institute by John Burns Real Estate Consulting, LLC

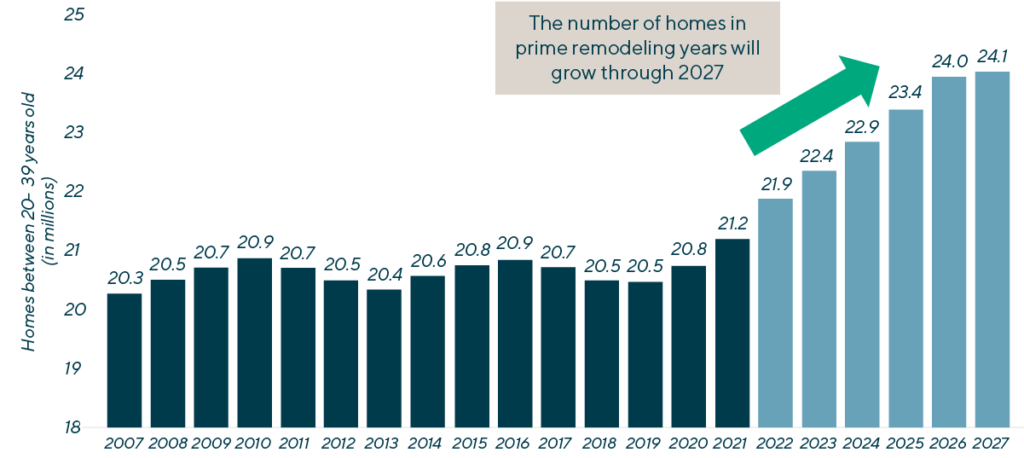

Single-Family Homes in “Prime Remodel” YearsSource: U.S. Census Bureau; John Burns Real Estate Consulting, LLC

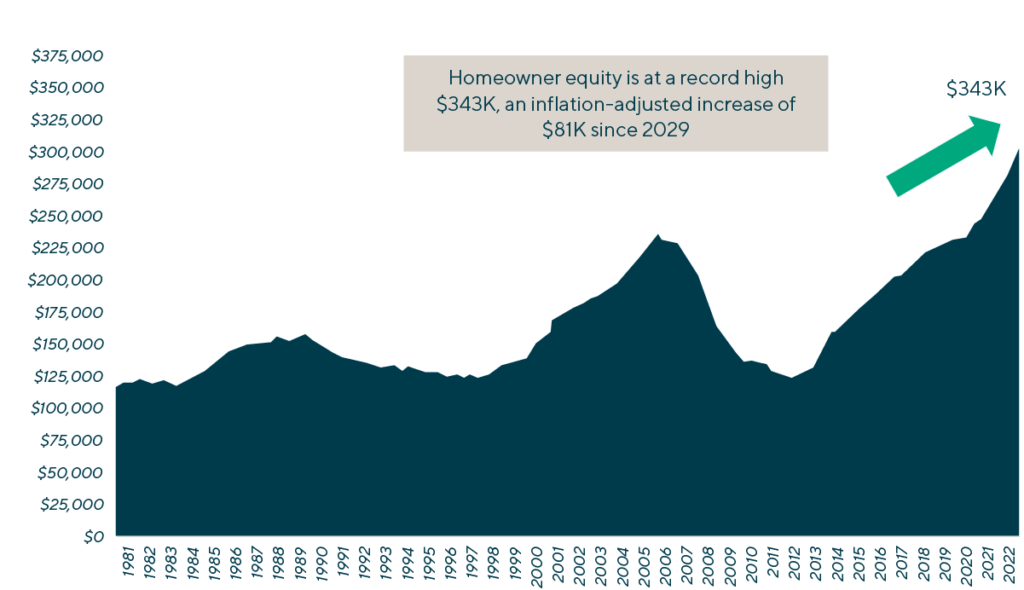

Inflation-Adjusted Homeowner Equity per Owned HouseholdSource: Federal Reserve; Census Bureau; John Burns Real Estate Consulting, LLC |

Contributors

Meet Professionals with Complementary Expertise in Building Products

I strive to deliver value-added advice, leveraging deep industry knowledge and extensive industry relationships.

Guillaume Suizdak

Managing Director & European Co-head of Industrials

ParisRelated Perspectives in Building Products

Lincoln International Managing Directors Recognized as Emerging Leaders

Lincoln International is pleased to share that The M&A Advisor named Managing Directors Adam Gifford, Brian Goodwin, Eddie Krule and Scott Molinaro as recipients in the Emerging Leaders Awards. These… Read More

Building Products M&A Market Finds its Footing

The building products industry gathered at well attended conferences in early 2024. The National Association of Home Builders International Builders’ Show (IBS) and Kitchen and Bath Show (KBIS) attracted its largest crowd… Read More

2021 Building & Infrastructure Conference Recap: Six Trends Impacting the Industry

Published by L.E.K. Consulting on December 16, 2021. L.E.K. Consulting and Lincoln International recently co-hosted the 13th annual Building & Infrastructure Conference in New York City, New York. More than 120 construction… Read More

2020 Building Products Perspectives and Trends

Due to COVID-19, Lincoln International and L.E.K. Consulting had to cancel the annual Building & Infrastructure Conference for 2020. Our hope is that we can host you again in the… Read More