Lincoln Perspective:

| Technology enables E&C services to generally continue uninterrupted, and often with improved utilization

Larger E&C companies with robust IT infrastructure have allowed for more than 90% of their employees to remotely work. These individuals are executing on existing backlog from home or open field environments with little reported challenges. In fact, some companies are experiencing higher technical utilization with remote execution, partly due to less travel, fewer internal meetings and reduced in-office distractions. |

| Business performance / COVID impact is driven by firms’ end market exposure

Sectors driven by non-discretionary spend, such as Infrastructure (Transportation, Water, Utilities), have been less impacted (if at all) in terms of service demand or project delays. Most headwinds have been seen in sectors driven by more discretionary spend, including Oil & Gas, Industrials and Hospitality. Interestingly, one unexpected consequence from COVID has been seen in the healthcare sector – traditionally viewed as resilient – where much non-essential construction spend has been frozen as facilities focus on treating COVID patients. |

| Many smaller E&C firms are seeing little or no financial impact since the emergence of COVID-19

The American Council of Engineering Companies (ACEC) recently polled a group of private firms (primarily sub-200 employees). The survey found that only 37% of companies viewed their firm’s finances as worse on May 8th than two months earlier when the pandemic began, while 42% saw finances unchanged and 20% noted an improvement. This feedback appears to be a “hindsight” view, as over 80% of the same respondents conveyed a negative sentiment towards the general U.S. economy. |

| Most E&C companies, both large and small, have taken a proactive approach to shore up finances

Freezing non-essential purchases has been the most common action to shore up finances. Other common initiatives have included speeding up account receivable collections, freezing pay increases and reducing executive pay. Many larger firms, having adapted to remote working, are taking the opportunity to “right size” office space and lower their fixed cost structure. Few companies have resorted to large-scale downsizing of their technical workforce.

Additionally, many eligible E&C companies have utilized federal stimulus programs – in a recent ACEC survey, 88% of engineering firms under 500 employees applied for the Small Business Administration Paycheck Protection Program and 80% of those companies have received funding as of early May, with most remaining companies approved and waiting funding. |

| It appears most E&C firms are experiencing “demand disruption” rather than “demand destruction”

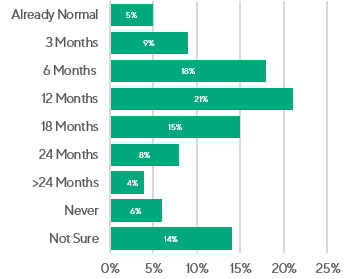

While designating construction as an essential service has allowed for most projects to progress, some geographies and clients are not permitting people onsite given social distancing restrictions. This uncertainty has driven most public E&C companies to suspend guidance for 2020. In addition, about 50% of companies participating in a recent ACEC survey believe it will take at least 12 months before business returns to normal activity levels.

The good news is that existing backlog remains at or near all-time highs for public companies reviewed, indicating a favorable long-term outlook. Accordingly, though projects may continue experiencing timing shifts and delays in the near-term (“demand disruption”), firms are not reporting significant project cancellations (“demand destruction”). This optimism is supported further by the prospect of future government stimulus potentially including a long-awaited Infrastructure bill, which would provide the E&C market with greater stability and even growth. |

|

Source: American Council of Engineering Companies

Source: American Council of Engineering Companies