Thinking Outside the Box

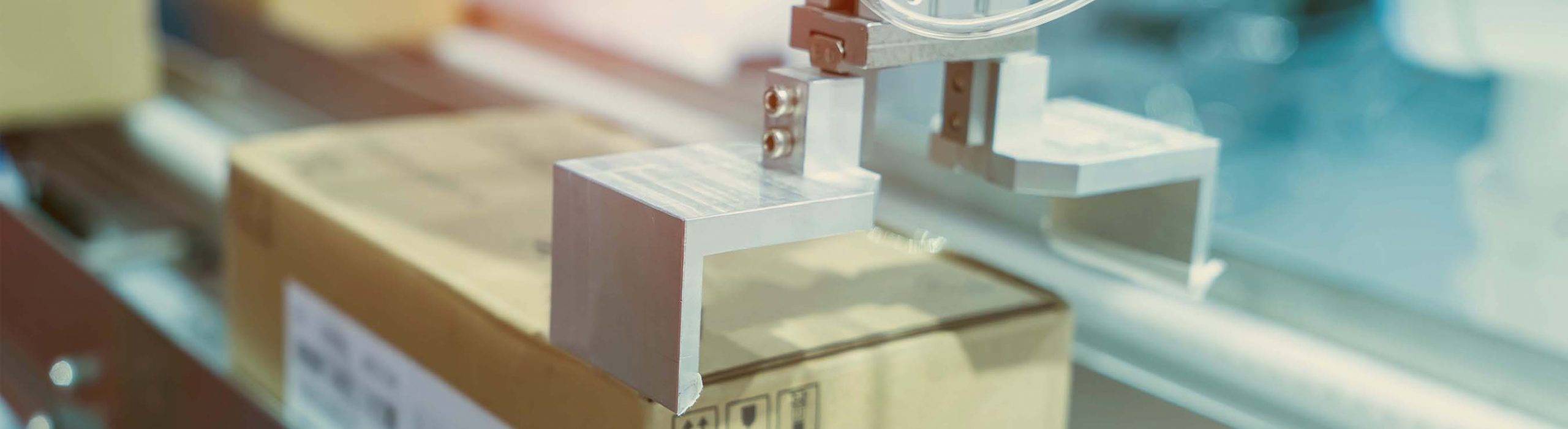

“Technology” and “evolutionary” are typically not the first words that come to mind when thinking about the packaging industry. For those within the industry, innovation is as top-of-mind as ever as the sector continues to transform, resulting from changing market dynamics, regulations and customer demand.

The definition of “smart” packaging is often up for debate and can be considered more broadly as any technology, either active or passive, that enables a package to serve a further function beyond a vessel for goods. This could be as simple as radio frequency identification (RFID) codes scanned to provide further information of the contents via the internet, pads that prolong the life of raw foods or tamper-activated sensors that track the opening and closing of a container.

Smart packaging solutions continue to revolutionize the industry by incorporating electronic and sensing devices into packaging materials to provide added functionality beyond containing and protecting products. Nowhere has this been most evident than in e-commerce, where “next-day” delivery has turned into “next hour,” and ordering groceries online has become as commonplace as buying books. Smart packaging innovations can help reduce waste and improve the efficiency of the supply chain by providing real-time data on the location and condition of products in transit.

In areas such as healthcare, smart packaging enables providers to monitor what and when prescriptions are removed from a container, connecting patients directly with their personal care providers. Rising medical costs and more personalized care have created an opportunity for innovations in medication adherence, such as tamper-evident packaging, which have become a cost-effective solution for real-time patient monitoring in an ever-changing healthcare and regulatory environment.

Enhancements in packaging are not only transforming the way products are packaged and shipped, but also impacting how acquirers think about M&A. As newer market entrants commercialize technologies, traditional packaging companies are looking to expand their capabilities and offer more value-added services to their customers through M&A. This has led to an increase in acquisition activity within the industry focused on technology-specific interests versus more historical pursuits such as geographic and customer expansion. For example, after years of very large, transformational acquisitions, paper-based manufacturer WestRock has announced its intention to look toward smaller, “tuck-in” acquisitions focused on targeted technologies such as materials science and digital. Financial acquirers, such as private equity and venture capital firms also have similar interests in “non-traditional” packaging businesses as they look to fund emerging companies disrupting the industry.

Packaging Technology: An Active and Passive Approach

There are typically two main categories to consider across the smart packaging landscape: active and passive. Active packaging systems are designed to interact with the packaged product or the environment, while passive packaging systems are designed to monitor and report on the condition of the product itself versus directly interacting with it. Examples of active packaging include oxygen scavengers, moisture absorbers and antimicrobial agents. Passive packaging technologies include temperature labels, RFID tags and printed sensors.

Smart packaging technology is driving efficiency in the food safety space. Innovations in food packaging can detect and prevent food spoilage by providing real-time data on the condition of the product. For example, smart packaging, such as Zebra Technologies’ Temptime sensors (acquired by Zebra in January 2019), can monitor the temperature and humidity of fresh produce during transportation and storage, and alert suppliers and consumers when the product is approaching its expiration date. Technologies such as these can lower food waste and improve food protection, greatly reducing cost while also emphasizing sustainability.

Healthcare is another area where smart packaging applications are having an impact. Smart packaging can advance the security and efficacy of pharmaceutical products by monitoring the temperature and humidity of the product during transport and storage, preventing spoilage and product loss. Packaging temperature sensors became quite abundant during the onset of COVID-19 due to the strict requirement of vaccines to remain at a constant temperature during transport. Due to the rapid scaling of these sensors, costs were further reduced, opening the door to many other applications outside of healthcare including consumer goods and food and beverage.

In addition to improving safety and quality, smart packaging also provides valuable insights into the supply chain, which became most evident by disruptions following the COVID-19 pandemic. Smart packaging solutions such as location-enabled sensors can identify bottlenecks and inefficiencies by tracking the location and condition of products in real-time, allowing companies to digitize supply chains and reduce costs. A recent example includes Wiliot’s “Pixel”, a battery-free RFID label that provides real-time insights into goods, such as location, without expensive, material-heavy batteries. Smart packaging also supports inventory management, ensuring product availability when and where needed in the production or sales cycle. Customers can leverage data collected by the package and software enabled by enterprise resource planning (ERP) and business intelligence systems, gaining valuable insights into their inventory and products including the movement of goods, ship times and environmental impacts such as temperature and humidity.

A Smart Deal for Buyers and Sellers

Companies with innovative packaging technologies bring forth a number of benefits for both buyers and sellers. Strategic buyers have the opportunity to acquire companies that specializes in smart packaging or other advanced solutions, providing access to new markets, increased capabilities and improved efficiencies. Additionally, the acquisition of a company with a strong intellectual property portfolio provides a competitive advantage and creates further barriers to entry for other market participants. Owners and sellers of innovative packaging companies can also benefit in being acquired by a larger packaging player who can provide access to greater resources, increased distribution networks and the ability to rapidly scale their technology. A successful acquisition provides a significant return on investment for shareholders, while also allowing the company to continue to enhance and develop new technologies. In March 2022, Sealed Air acquired Foxpak Flexibles, a developer of digital printing and flexible packaging which leverages its digital printing capabilities to print directly on its flexible packaging materials to empower customers’ brands. This aligned with Sealed Air’s $100 million investment into digital offerings through its prismiq™ business line, which includes a portfolio of solutions that combine the best of digital printing, smart packaging and package design services. Financial acquirers also benefit by investing early in emerging companies who could utilize additional capital as they seek to scale up and commercialize their products.

The Future of Packaging

Advancements in packaging will continue to transform the landscape and have a significant impact on M&A activity within the sector as new solutions are introduced and technology becomes more cost favorable. Strategic players will look to expand their capabilities and offer more value-added services to customers, resulting in greater interest for smart packaging technologies and an increase in M&A activity. As competition for differentiation heats up and customer demand for tech-enabled packaging solutions rises, we can expect to see more innovative partnerships and acquisitions in the years to come.

Contributors

Meet Professionals with Complementary Expertise

I strive to deliver value-added advice, leveraging deep industry knowledge and extensive industry relationships.

Guillaume Suizdak

Managing Director & Co-head of Industrials, Europe

ParisRelated Perspectives

Recent Transactions in Packaging

Innovation and Advancements in Packaging Technology

Advancements in packaging across both active and passive technologies continue to revolutionize the industry as new features, functionality and capabilities broadly become more available. Packaging companies have an increased emphasis… Read More

Beauty Outlook: Optimism for an Attractive 2023

Many investors are eyeing the year ahead for the beauty and personal care industry as it is ripe for accelerated growth due to several factors. 2022 had a key focus… Read More

UK Hospitality: Unlocking Hidden Value

The hospitality industry has experienced several challenges over the last few years, which at times has led to valuation concerns amongst investors. However, an opportunity presents for businesses to attract… Read More

Art of the Deal-by-Deal Fund

Deal-by-deal investing has become an increasingly popular strategy for financial sponsors in Europe. Unlike the traditional private equity (PE) approach of raising a fund and deploying it over the course… Read More

Automated Storage and Retrieval Systems – Combining Efficiency, Speed, Accuracy and Safety

E-commerce sales are currently approximately 22% of retail sales and are expected to increase to approximately 30% by 2025.[1] Increasing order volume, combined with an expectation of fast delivery and… Read More

Adopting Alternative Strategies – How Partnering Expertise Can Help

Company leaders around the globe are facing uncertain business conditions, including geopolitical tensions, inflation, continuing supply chain problems and raw materials shortages. Economies are only just beginning to recover from… Read More

M&A Trends in Japan: Q&A with Director Kenji Uemura

Lincoln International recently welcomed Kenji Uemura, a Tokyo-based Director, to the firm. With unique experience heading the India-Japan mergers and acquisitions (M&A) business in Mumbai and his extensive work in… Read More

Business Leaders Adjust Investment Strategy in Light of CO2 Emissions Standards

As governments and company stakeholders continue to increase their focus on reducing emissions, the shift from fossil fuels to green energy is shaking up almost every sector—resulting in energy efficiency… Read More

Private Equity Pursues Investments in Engineering and Manufacturing Software Sector

Engineering, simulation and manufacturing software is in high demand as companies across industries shift toward digitizing processes. From the early stages of product design and simulation to manufacturing and usage… Read More

Long-Term Trends Underpinning Utility Services M&A

Investor interest in utility services will remain high given the numerous attractive tailwinds that underpin the sector’s resiliency and growth potential. For telecom, power, gas and water/wastewater, regulatory and public… Read More

Growing Local & Global Private Equity Interest in French Technology

The technology ecosystem in France is booming. In 2021 alone, French startups raised more than €10 billion in venture capital financing, a 2x increase over 2020. To date, the number… Read More

M&A Activity Remains Strong for Companies Supporting Employer-Sponsored Health Benefits

Employer-sponsored, self-funded medical plans have grown in popularity since the implementation of ERISA in the 1970s and now cover nearly two-thirds of all employees and one-third of all Americans. Medical… Read More

While Automotive Supply Chain Headaches Drag On, Buyers & Sellers Prepare for a Busy Year of Dealmaking in 2022

Automakers and suppliers were forced to cope with unique supply chain challenges in 2021, driving significant disruption to production and resulting in levels of inventory at unseen historic lows. These… Read More

Data Center Download: Accelerating Growth, Record Interest in the Space and Transformational Opportunities

Our world has become more reliant than ever on data. As technological innovation stretches from the smartphones in our pockets to wearables, self-driving cars, cloud computing, artificial intelligence, Industry 4.0… Read More

Cybersecurity M&A Momentum: Digitalization to Drive Accelerated Demand and Total Available Market Expansion

As C-suite executives focus intensely on corporate digital transformation efforts, cybercriminals are following suit and adjusting tactics to exploit the resulting massively broader cloud attack surface. This big new challenge… Read More

“Play On” – Investing in the Post-COVID-19 Pandemic Experience Economy

As we come to terms with the lasting impacts of the COVID-19 pandemic, it’s fair to say we have entered a new age in the consumer economy. While nearly all… Read More

Animal Health Players Pursue Vertical Integration as a Path to Growth

Animal health businesses that have established a strong presence within their area of expertise, may be considering where the next best path to growth lies. While cross-border expansion and consolidation… Read More

E-commerce, Sustainability and Digital Capabilities Drive Consolidation

Following a rebound in the first half of 2021, the outlook for the economy remains positive for the second half of the year as vaccination rates continue to climb and… Read More

Race Toward Electrification: Automotive Players Define Investment Strategy for the Future

In 2020, global electric vehicle (EV) sales rose by 38%, despite a decline of 20% in total car sales around the world during the pandemic. In May 2021, IHS Markit… Read More

Our Economy Runs on Digital: Fueling Infrastructure Software Investment

As companies continue to move to the cloud and provide high-quality, global-scale cloud solutions, infrastructure software has seen a material increase in investment and consolidation, as evidenced by recent sponsor-led… Read More

Fleet, Field and Asset Management Software: Convergence Creates Investment Opportunities

Maintaining equipment, vehicles and other assets while also optimizing performance of employees and the work they do is a daunting task for any organization. To address this challenge, both large… Read More

Q&A with Lincoln TMT Managing Director Don More: Hacking Cybersecurity Investment

Lincoln International recently welcomed Don More as Managing Director focused on Cybersecurity on the Technology, Media & Telecom team. Don brings to Lincoln 20+ years of deal experience in cybersecurity,… Read More

Doing Well While Doing Good: Profiting from Non-Profit Tech

Non-profit organizations (NPOs) are increasingly adopting new technology solutions as they aim to provide efficient services, spawn innovation and attract the donations that are critical to their existence. The NPO… Read More

Bright Spot: The Sun Shines on Solar Energy Investment

Renewable energy generation is a growing priority for countries across the globe. In 2015, 196 parties adopted the Paris Climate Agreement and in 2021 the United Nations Framework Convention on… Read More

No EBITDA, No Problem: Software Financing and the Rise of the Non-Bank Lender Market

The technology sector has been a bright spot for years. Even during the challenges created by the pandemic, our Lincoln International M&A bankers are seeing record levels of software investments… Read More