Recycled Plastics Market Draws Investor Attention

Nov 2023

| Not a day goes by without the announcement of a new regulatory, industrial, or commercial initiative relating to the European circular economy, making it a major topic for corporates and investors that must adapt their strategy to meet regulations or take these initiatives into account when evaluating future investments. Recycling of plastic packaging, in particular, stands out as one of the most important initiatives and is drawing particular investor attention because of its fossil origin, its waste is the most visible to society, its treatment is the most complex and its targets are constantly increasing to help reduce waste.

In our latest perspective, Lincoln International examines the market dynamics in the recycled plastics industry. |

Summary

-

Lincoln International examines the market dynamics in the recycled plastics industry.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Recycled Plastics Overview

Recycling of plastic packaging is a dynamic market given the increasing waste volumes following the continuous expansion of plastic packaging volumes and higher recycling rates. According to the European Commission, “Packaging is one of the main users of virgin materials as 40% of plastics and 50% of paper used in the EU is destined for packaging. Without action, the EU would see a further 19% increase in packaging waste by 2030, and for plastic packaging waste even a 46% increase.” From a regulatory perspective, recycling targets are constantly increasing as political decision-makers across the world are pressed to tackle plastic packaging pollution.

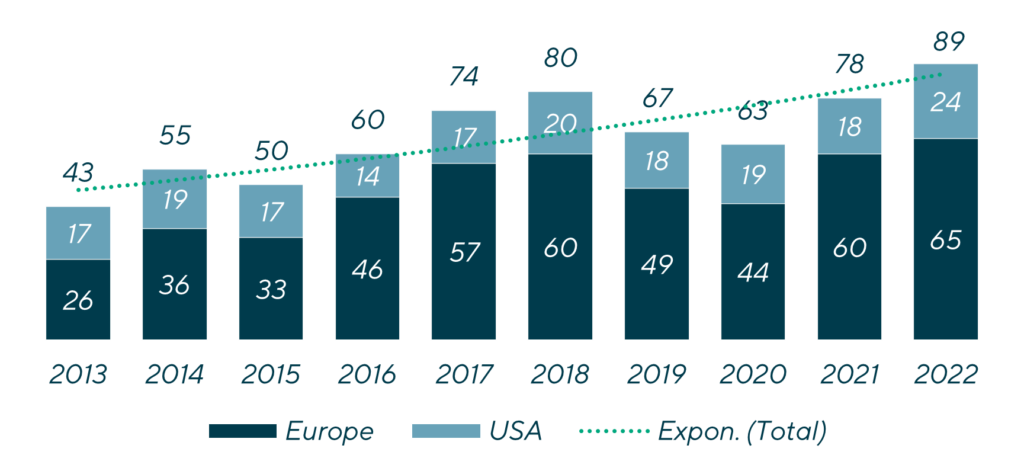

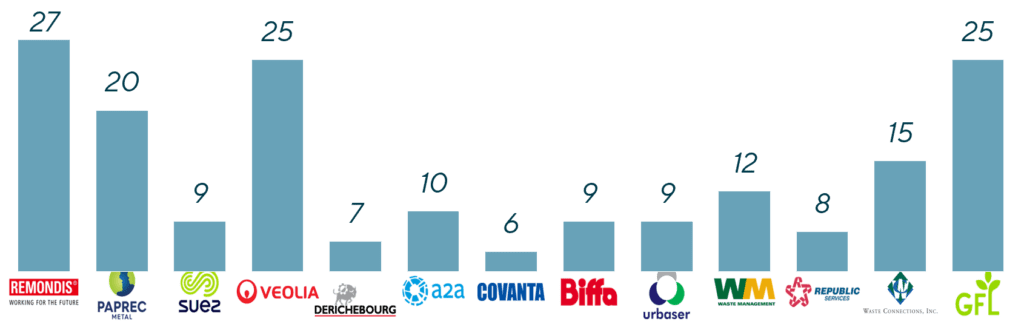

Large recycling groups dominate the market, having built or having been associated with building the national recycling infrastructures in their home countries over the past several decades. Benefitting from their legacy market position, these groups actively consolidate the market and can finance the required investments to capture significant market growth.

| Evolution of the number of strategic deals in Europe and the US

|

Key consolidators’ deals number since 2013

|

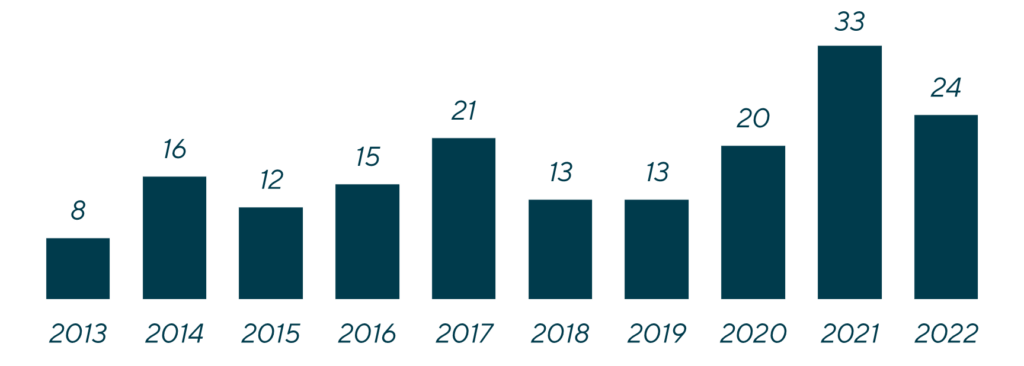

Infrastructure funds have been well identified and have invested in the sector for many years as these recycling groups perfectly fit their criteria of a large installed base of assets providing recurring revenue streams, a supportive regulatory environment, long-term growing demand and favorable pricing trends for recycled material.

| Evolution of PE deal number since 2013

|

Landmark transactions led by infrastructure funds |

The market is not limited to such large players; meeting the ambitious recycling targets will require the involvement of all stakeholders involved. A vivid ecosystem of innovative companies is active across the value chain from artificial intelligence (AI)-based systems to better sort and collect waste, advanced recycling technologies to increase operating efficiency, material cleaning and preparation solutions to improve processing quality, packaging companies offering circular solutions to specialized advisory firms helping companies in their environmental transition. With the support of early investors and benefit from the favorable market environment, these companies are growing fast and can represent interesting opportunities for strategics willing to acquire new skills or for middle market private equity (PE) firms to take over and support them into their next development stage.

Lincoln Perspective

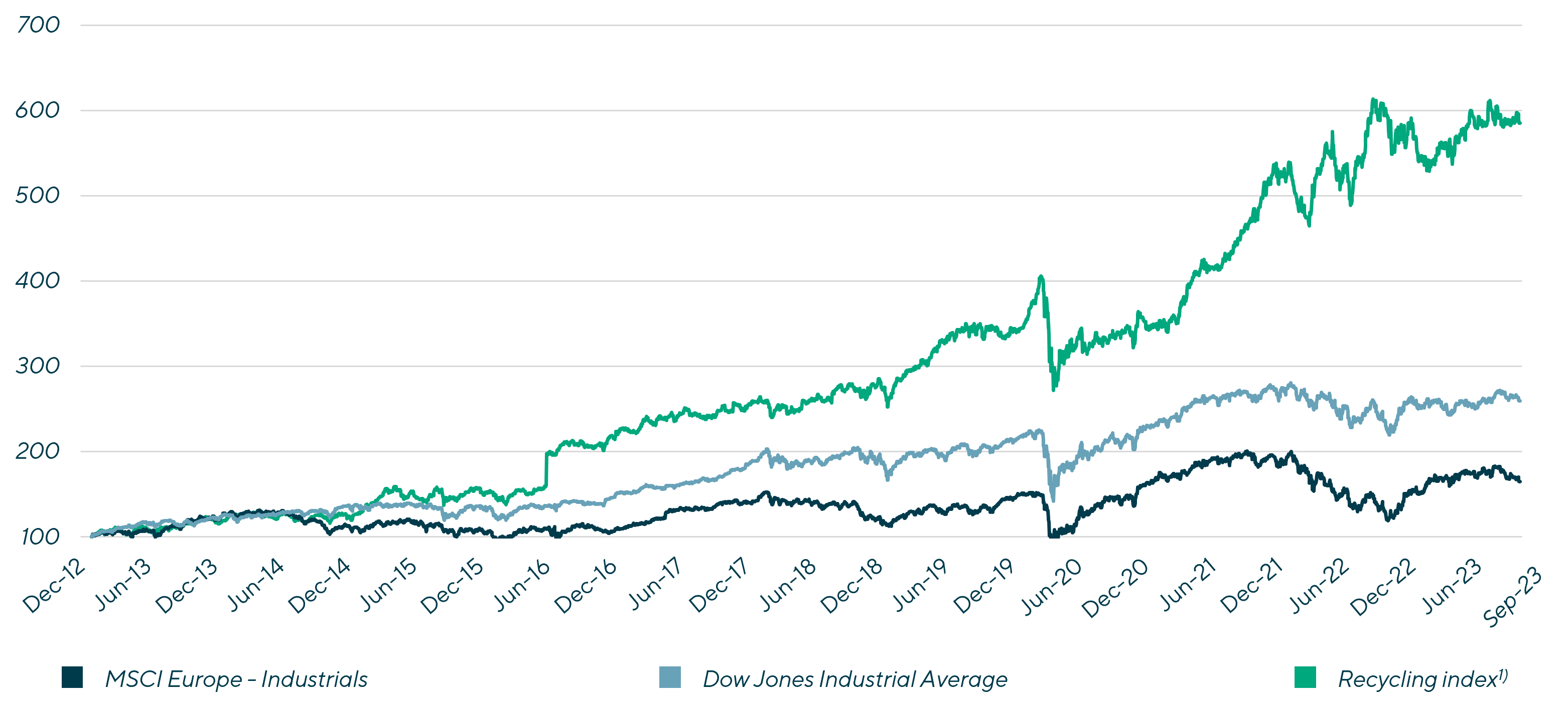

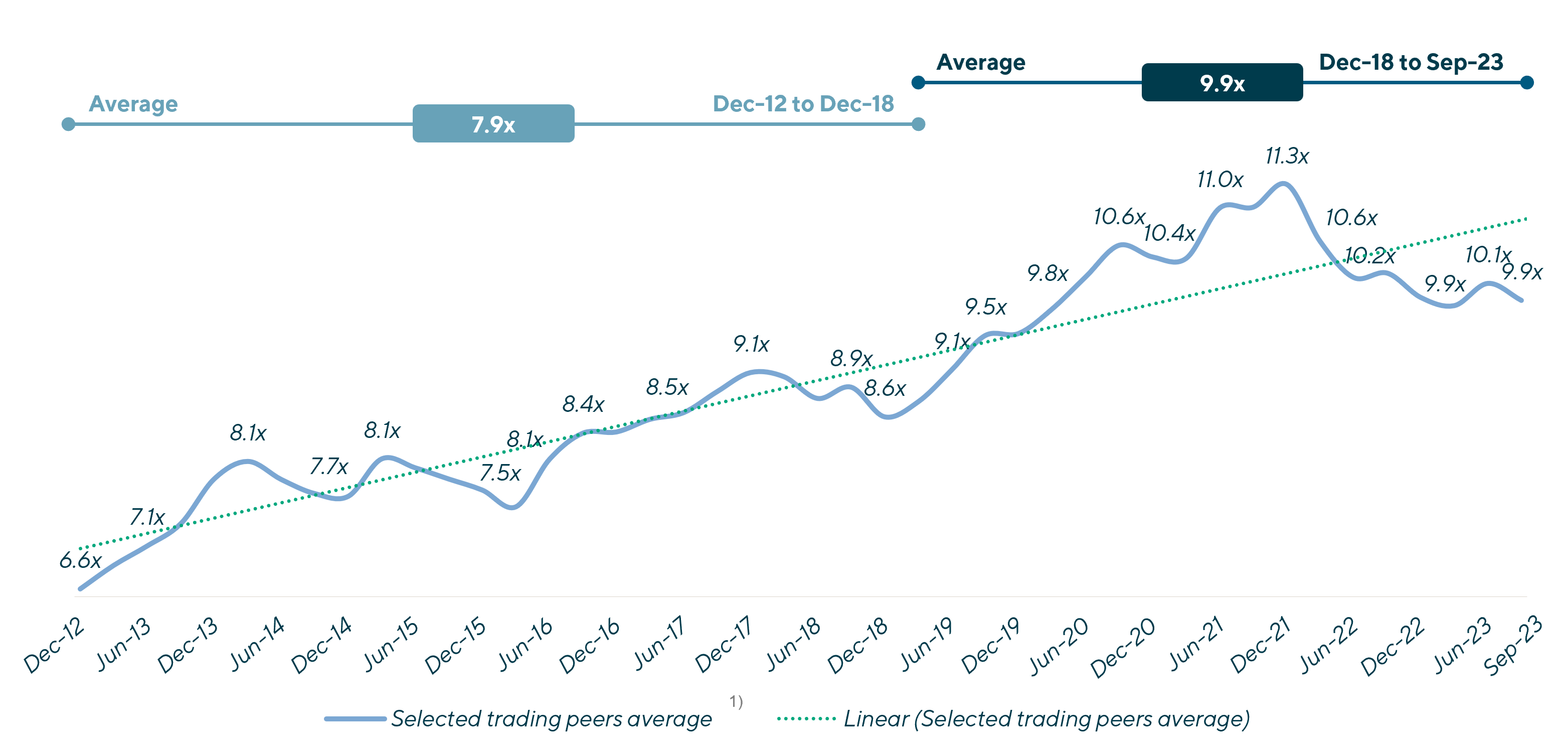

Illustrating the favorable market environment, publicly listed companies in the sector are trading at an all-time high.

From a transaction perspective, companies in the sector with a differentiated positioning and technology are highly desirable and scarce assets coveted by both financial and strategic investors can receive superior valuation multiples.

PE firms have ranked environmental transition investment themes as one of their top priorities and strategies, many of which are controlled by infrastructure funds, and are more than ever active in consolidating the market. Especially in the middle market transaction range, activity is poised to increase as companies in the sector become more mature and develop from start-ups to profitable and sizeable companies. |

Recent Transactions

Contributors

I strive to deliver value-added advice, leveraging deep industry knowledge and extensive industry relationships.

Guillaume Suizdak

Managing Director & European Co-head of Industrials

ParisRelated Perspectives

Packaging Quarterly Review Q2 2024

Over the last several years, the packaging industry has undergone significant transformations driven by rapid advancements in technology. From the introduction of innovative materials and sustainable practices to automation and… Read More

De-Stocking has Subsided, Pricing has Normalized and Demand is Returning in Packaging

As supply chain disruptions ease and consumer demand stabilizes, the prolonged period of de-stocking, within packaging and the broader economy, is ending, as supported by the most recent Monthly Wholesale… Read More

Packaging Quarterly Review Q1 2024

Supply chain constraints stemming from COVID-19 triggered significant shifts in demand, and access to, packaging supplies across various industries, as well as inventory management strategies. Over the course of the… Read More

Packaging Quarterly Review Q4 2023

Mergers and acquisitions (M&A) markets closed Q4 2023 in a similar vein to previous quarters, with a decline in completed deals. The packaging market closely followed suit, also experiencing a… Read More