In Japan, M&A Set To Climb Amidst Low Rates And Regulatory Changes

Nov 2023

Japan is a country with advanced and independent sensibilities in terms of its traditions, aesthetics and, especially, how it does business – demonstrable in a 14 percent increase in mergers and acquisitions (M&A) value year to date.

This contrasts with other major economies which have experienced more muted growth in M&A, or no growth at all, amidst rising interest rates.

Japan’s recent M&A counter-trend shows no signs of slowing. Pent-up demand for acquisitions post-COVID-19 continues to drive activity.

More significantly, recent measures by Japan’s central bank and regulators have set the stage for increased M&A activity through 2023 and beyond.

These measures and the strategic shifts they promote are significant factors behind M&A growth in Japan.

Long-term, they will not just spur increased buying and selling of Japanese companies. They could change how Japanese companies operate and who owns them.

Summary

-

Lincoln opened its Tokyo office in 2008 and has provided a variety of M&A advisory services – including domestic, cross-border, buy-side and sell-side deals – to a wide range of clients, including listed companies, unlisted companies and PE funds.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

High Demand, Low Rates and Record Profits

Part of what is driving the current spike in Japan’s M&A is the continuation of residual, pent-up demand from the COVID-19 pandemic in 2020.

While Japan saw a longer pause in dealmaking amidst the uncertainty brought about by COVID-19, Japanese companies did not move away from M&A. Quite the contrary, many were carefully sweeping for acquisition targets in the lull.

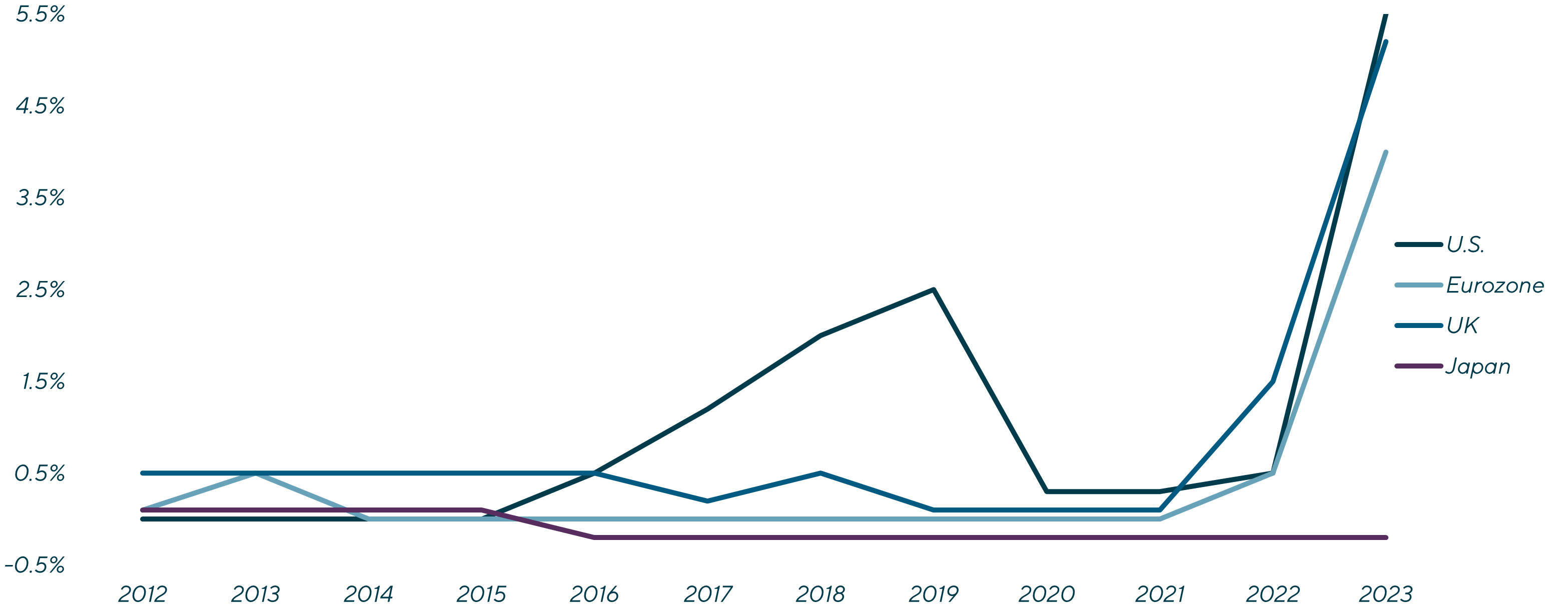

Japan’s central bank has been keeping interest rates low – negative, in real terms – to stimulate growth. Japan’s central bank has stuck to this policy, even as U.S., UK and European central banks have hiked rates to control burgeoning inflation.

This policy has created a more favorable environment for Japanese goods in the short term as exports yield higher profits. This, in turn, has led to record earnings at Japanese companies.

Japanese companies now have a great appetite for acquisition and are sitting on vast quantities of cash, leading to a rebound in M&A enthusiasm.

A Power Player for International Deals

Low rates and record profits also give Japanese acquirers greater access to foreign deals.

Rates in Japan continue to hover near zero, which has created fears that the economy could stagnate. That makes foreign companies attractive acquirers to help Japanese companies insulate themselves from a downturn.

In years past, when interest rates in the rest of the world were low, Japanese companies were priced out of hypercompetitive deals.

Now, with rates rising everywhere but Japan, Japanese acquirers may have an advantage as prospective investors.

It is true that a weakening yen would make foreign acquisitions more expensive.

Still, with many private equity (PE) portfolio companies around the globe facing restricted access to capital, they could create buying opportunities for Japanese acquirers.

That could also make Japanese buyers a new, and much-welcomed source of capital for many promising foreign companies caught off guard when rates rose.

A Tradition of Complexity and Control

To be sure, Japanese companies are not just seeing opportunities to buy. Recent regulatory changes have increased pressure on many Japanese companies to sell or accept foreign investment.

Historically, Japanese firms have contrasted with their U.S. and European counterparts, placing a heavy emphasis on non-investor stakeholder groups, particularly workers.

Traditional shareholder-focused corporate governance originated in the post-World War Two economic recovery and focused on employees, customers and suppliers. It also gave rise to the keiretsu – sprawling industrial conglomerates led by a main bank and made up of interlocking directorships and internecine shareholder structures.

These complex shareholder structures, and the philosophy that drove their creation, gave management protection against hostile takeovers or shareholder activism. Just as important, it protected some of Japan’s largest companies from foreign control.

Together, these factors created a sense of independence from market forces – so much so that many Chief Executive Officers would typically not even communicate acquisition offers to their boards of directors.

Another consequence of the emphasis on stakeholder versus shareholder value is that some listed companies underperformed their cost of capital.

Japanese businesses are starting to move away from their traditional stakeholder- (and non-shareholder) focus because of structural reforms and established codes for stewardship and corporate governance.

Changes In Transparency And Control

Recent changes are pushing companies to become more transparent, spin-off underperforming assets, to take M&A offers seriously and, possibly, to open the door to foreign, inbound M&A activity.

For example, the Tokyo Exchange Group recently issued a request that listed Japanese companies provide an explanation if they are trading below a price-to-book (PB) ratio—that is, the ratio of the company’s total market value over its book value—of 1.0.

The exchange also emphasized the need for reform in the thought processes of management to be more conscious of the cost of capital and stock price to improve corporate value.

The new request really is just a request but, in three years, it becomes a requirement; companies have until 2026 to comply with the proposed ratio or they risk having regulators de-list them from the exchange.

A lot can happen over three years. Still, we think it is likely that this guidance will push Japanese management to seriously consider what is the most effective way of using capital to increase share price. Cross-border acquisitions for growth will certainly be on the menu here, as will selling off underperforming divisions to new buyers.

The Ministry of Economy, Trade and Industry (METI) also recently created guidelines encouraging Japanese companies to earnestly consider all credible M&A proposals, even unsolicited bids.

Although these tangible moves towards liberalization are still in their early stages, this type of change also sets the stage for greater foreign participation, ownership and control of Japanese companies by foreign investors.

It is ironic that Japanese companies may finally be embracing shareholder value at the same moment that many U.S.-, UK-, and European-based companies are embracing new stakeholder-centric strategies that promote sustainability.

Japanese firms are not going to move from a stakeholder orientation to the Friedman Doctrine – a normative theory of business ethics pushed by Nobel-Prize winning economist Milton Friedman – overnight… or, perhaps, ever.

We believe that Japanese companies will find a middle way that puts a greater emphasis on shareholder value, while also adhering to the qualities of sustainability and stability which are uniquely Japanese.

Who We Are

M&A in Japan requires a deep understanding of the country’s business culture, customs and corporate governance system. It also requires management relationships, an understanding of regulation and market insights.

Lincoln opened its Tokyo office in 2008 and has provided a variety of M&A advisory services – including domestic, cross-border, buy-side and sell-side deals – to a wide range of clients, including listed companies, unlisted companies and PE funds.

Contributors

Meet Professionals with Complementary Expertise in Japan

I am driven by the opportunity to globalize Japanese corporations.

Keiji Miyakawa

Senior Advisor

TokyoRelated Perspectives

Packaging Quarterly Review Q2 2024

Over the last several years, the packaging industry has undergone significant transformations driven by rapid advancements in technology. From the introduction of innovative materials and sustainable practices to automation and… Read More

Investors in Healthcare | Q&A with Lincoln Professionals

Originally posted by Investors in Healthcare on July 25, 2024. Lincoln International, the U.S.-headquartered global investment banking advisor, is a well-known name in the European healthcare markets, providing advice to… Read More

Industrials Strength: Acceleration in Global Industrials M&A

Lincoln Industrials closed 28 transactions globally thus far in 2024. Across our industrials offering – from aerospace and defense to mobility, engineered components to building products, and infrastructure to specialty… Read More

Facilities Services Market Update Q2 2024

After a series of declining quarters since 2021, Q2 2024 marks the third consecutive quarter of mergers and acquisitions (M&A) activity growth, with ~7,300 deals closed, according to S&P Global.… Read More