From Handbags to Athleisure, European Private Equity Investors Splurge on Luxury

Aug 2020

Twenty years ago, Net-a-Porter (now YNAP following merger with Italy’s Yoox) started selling high-end fashion online. While its entrance to the luxury goods market was met with reluctance, it paved the way for other luxury brands, founded on in-person experiences, to embrace e-commerce.

Originally considered a Millennial experience, older generations have adopted similar online shopping habits. As a result, many brands developed e-commerce platforms over the years, but the pandemic accelerated the trend as shopping at retail locations ceased.

Online shopping is not only convenient for customers, but also it creates opportunities for brands to engage with new customers in new ways. It also allows brands to reach shoppers anywhere worldwide while travel is at a standstill. Looking ahead, e-commerce capabilities will be critical to success, but in-store experiences will not lose their luster when in-person shopping returns. This especially holds true for when tourism, and the resulting shopping, begin again in earnest.

Shoppers Turn to Comfortable Luxury to Stay at Home In

Like many industries, luxury goods companies struggled in 2020, but at the same time new—and promising—trends emerged during lockdown. As people stay home and seek comfortable, yet stylish, items there has been an uptick in sales of activewear, loungewear and homewares, according to a recent Vogue article. Additionally, shoppers are willing to purchase “investment pieces” that have lasting value.

Notable Transactions in the space

Golden GooseFounded in 2000, Golden Goose Deluxe is an Italian high fashion company producing mainly footwear, as well as apparel and accessories

In 2013 the Company was acquired by Riello Investimenti and Style Capital for an undisclosed consideration Ergon Capital had acquired the company in 2015 for Euro 130 million (EV / EBITDA ~12.4x) and sold it to Carlyle in 2017 for ca. Euro 440 million (EV / EVITDA ~14.5x) In 2020 Carlyle sold Golden Goose to Permira for an approximate consideration of Euro 1.2 billion Deal rationale:

|

MonclerMoncler, founded in France in 1952, is now an Italian luxury apparel and lifestyle company, most known for its down jackets and sportswear

In 2003, Moncler was at the brink of bankruptcy and was bought by Remo Ruffini Ruffini managed to transform the brand’s apparel from a niche and functional piece of clothing for adventurers, to a trendy, yet luxury fashion product During the recent years, Moncler received multiple investments from several financial investors, including Progressio SGR in 2005, Carlyle (2008) and Eurazeo (2011) In December 2013, the company completed an IPO to gain major visibility among the leaders in the luxury apparel Today, the market values Moncler at:

|

These trends are expected to remain post-pandemic—more individuals are joining the trend towards high-end sneakers and comfortable footwear while also wearing outfits that can transition from the office to happy hour or even a yoga class. These garments are relatively easier to produce and can be sourced globally—creating cheaper and higher margins for brands. They are also easier to restock, which allows brands to quickly place the products in the hands of their customers to enjoy emerging fashion trends. However, customers will only purchase items if the brand “allure” and the fashion content are preserved. A sweatshirt from a top-notch designer and one from a mainstream brand have lot in common except for the exclusive feeling that comes from owning a luxury item, which is a mixture of brand strength, shopping experience and a scarcity factor.

Size Matters in Luxury

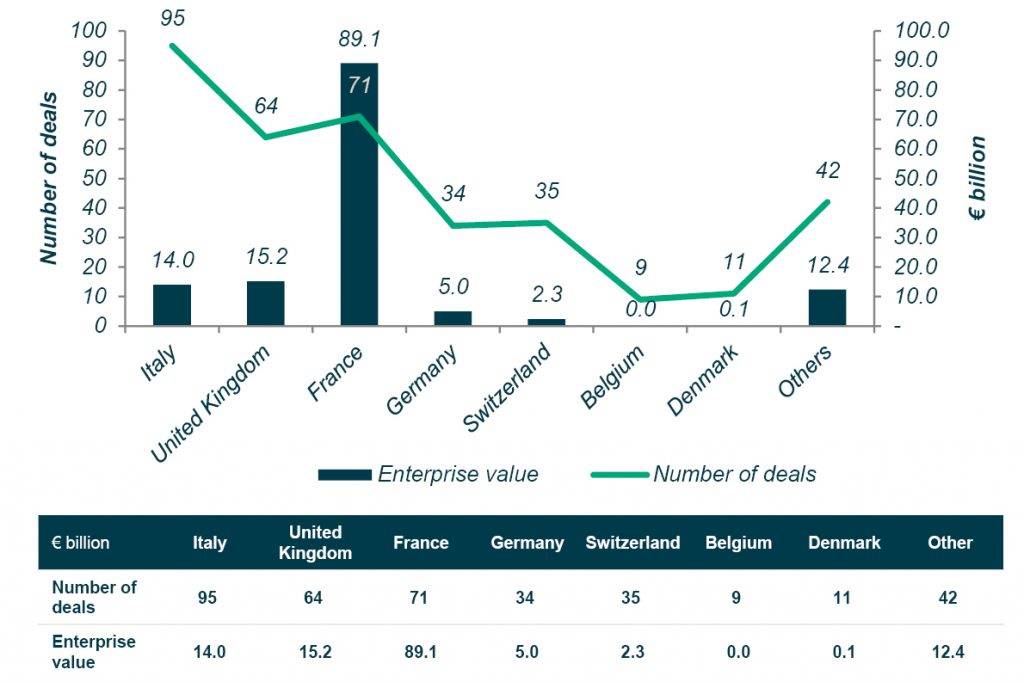

The luxury goods industry has been in a period of consolidation over the past 10 years because M&A can help create economies of scale—opening the door to prime physical locations, the latest technology and top-notch talent.

| Physical locations: Retail locations and flagship stores only found on 5th Avenue, the Champs- Élysées and Via Montenapoleone will flourish, even in a digital world, because people seek in-person, white-glove service and shopping experiences that cannot be fully replicated online. Access to this coveted real estate is much more feasible for corporate conglomerates in the luxury space. |

| Technology: Access to the latest technology can create and strengthen a brand’s digital presence by offering visibility into the product lifecycle from the designer’s desk to the moment the piece arrives perfectly packaged at a customer’s home. By leveraging technology to track the sourcing of every piece of leather or zipper all way through to last-mile logistics, brands can guarantee a high-quality, seamless e-commerce experience. Furthermore, digitalization of the supply chain will create a greener and more sustainable product footprint, especially for personalized items. This is important as Millennials are demanding eco-friendly products that are sourced form labor friendly locales. It will also lead to destocking, will take away price pressure and potential issues with reselling, discounts and brand dilution on a global scale while also strengthening the new affluent, yet sustainability conscious, customer relationship. Conglomerates can achieve this because they can afford the necessary strict controls across a very complex supply chain. |

| Talent: As part of a larger company, brands have access to the very best talent. Often, brands can leverage the expertise of designers outside of their line to ensure their creativity stays fresh and they are in front of the latest trends. |

Additionally, diversity created through consolidation allows luxury goods companies to create financial resilience—enabling them to better withstand dips in sales. Even after the 2008 Financial Crisis, luxury goods spending continued and brands that offered diverse items, from a high-priced handbag to a T-shirt, excelled in the following years.

Lincoln Perspective:

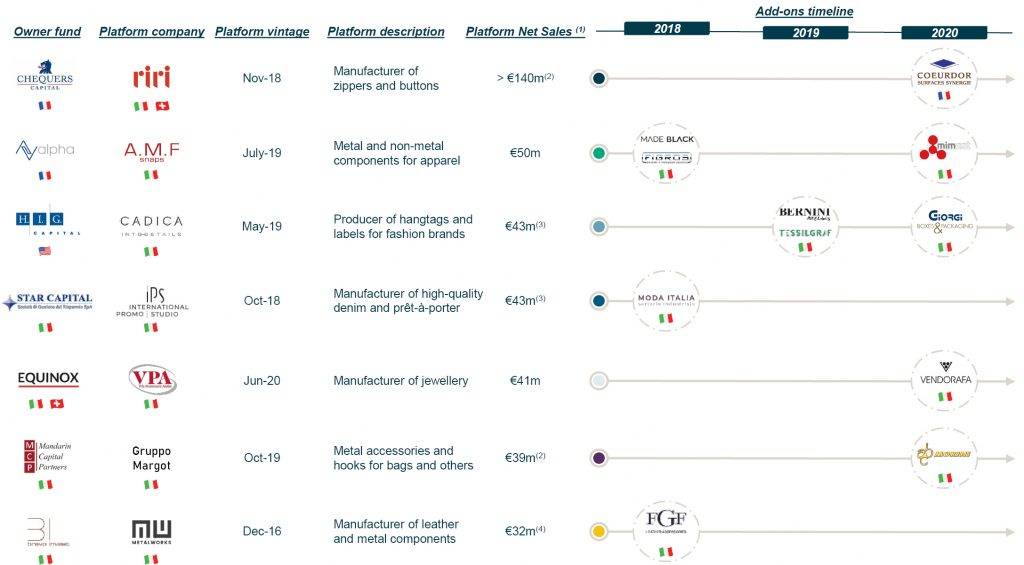

Consolidation of medium-sized luxury over the next three years will be driven by the cash flow pressures placed on them following larger players’ investments in digitalization and an overall omnichannel experience to create global scale and ubiquitous brand appeal. Larger conglomerates are well positioned to purchase these medium-sized companies, further benefiting from economies of scale. The opportunity for private equity investors, especially in Italy and France, is to purchase, grow and sell luxury suppliers, luxury services companies, and up-and-coming brands. For emerging brands, this can be through a “plug and play” strategy, where PE can sell to larger luxury conglomerates, filling a gap in their brand families and realizing the brand’s potential through the buyer’s global reach. When evaluating potential targets, Lincoln International identified three factors to keep in mind:

|

A fashion-tech example: Temera

|

Temera is active in the development of solutions based on innovative use of IoT technologies like RFID (UHF NFC) and BlockChain, specifically designed for Fashion & Luxury industry

The Company has an own software platform that powers various applications ranging from production/digitization, supply chain automation to retail store management, product authenticity & warranty management incl. interfaces to enterprise software |

Key Facts:

Main Clients:

Summary

-

Lincoln International details what private equity investors should keep in mind when evaluating potential targets in the luxury goods sector.

- Click here to download a printable version of this perspective.

-

Lincoln International has created a Playbook to support business leaders in documenting and articulating their COVID-19 response. To request a copy, click here. - Sign up to receive Lincoln's perspectives

Contributors

It’s an exciting time to advise clients in the consumer sector. Major changes in consumer preferences and how products are purchased create a rich environment for business owners and investors to succeed.

Dirk Damegger

Managing Director & European Co-head of Consumer

FrankfurtMeet our Senior Team in Consumer

It’s an exciting time to advise clients in the consumer sector. Major changes in consumer preferences and how products are purchased create a rich environment for business owners and investors to succeed.

Dirk Damegger

Managing Director & European Co-head of Consumer

Frankfurt

I have a hands-on approach and bring energy, creativity and passion to every client transaction.

Eddie Krule

Managing Director

Chicago