Echoes of Innovation in Audio Electronics

May 2024

| Lincoln International recently advised Transom Capital Group on its sale of Mackie to RØDE Microphones. Mackie is a leading audio products company that designs and markets solutions for creators, whether for live sound, studio and recording, podcasts or streams.

In our latest Q&A, Lincoln Managing Directors Harry Kalmanowicz and Eddie Krule discuss the transaction, trends in the audio electronics industry and key considerations for buyers and sellers. |

Summary

-

In our latest Q&A, Lincoln International discusses the transaction, audio electronics industry trends and key considerations for buyers and sellers.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

What Makes Audio Electronics an Attractive Market?

Harry: The audio electronics industry is truly global and travels well across borders. Products are similar from country to country, with only limited local variations such as those related to specific consumer aesthetic tastes. It is also subject to relatively standardized value chains with most equipment produced in Asia, making it easier for buyers and sellers to understand the business models and attribute value.

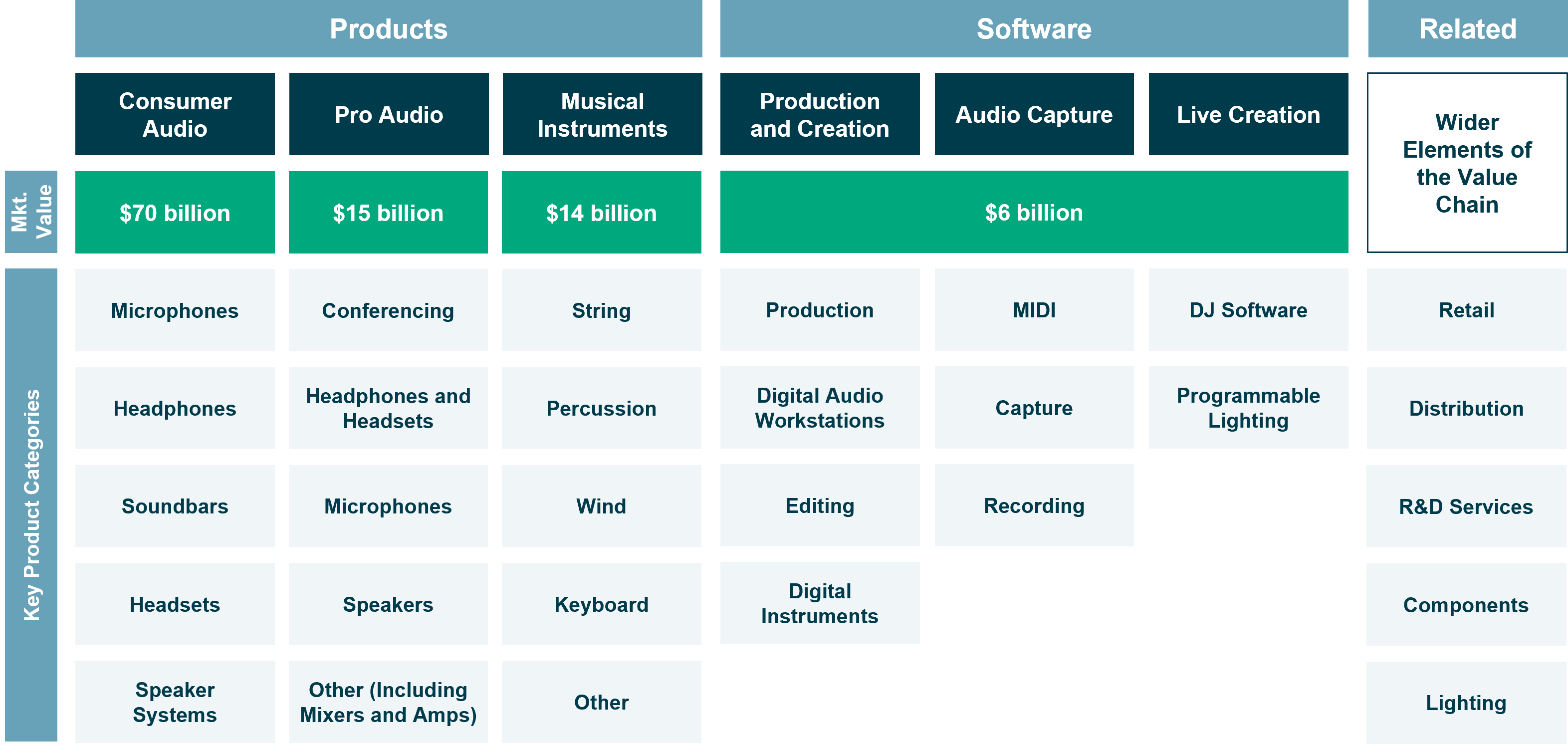

The industry is very broad at c$100bn, with great growth prospects across its diverse end markets. There is a consumer audience that purchases headphones and Hi-Fi or home theatre systems, but also encompasses musical instruments or podcasting equipment like microphones. There is also the professional audience which ranges from retail and hospitality to musicians and the entertainment industry, broadcast and TV production all the way to the car industry and sports stadiums.

This diversification provides protection across the economic cycle, with different end markets subject to discrete growth drivers. For example, live music shut down during COVID-19 but is now a booming, hot sector. On the other hand, products supporting music and audio creation at home accelerated significantly during the pandemic, as musicians and podcasters set up their home studios. However, this end market currently suffers the aftereffects of industry-wide overstocking and the impact of price pressures.

Eddie: The user spectrum for audio electronics cannot be understated. There are large-scale professionals such as Taylor Swift, professional consumer (“pro-sumer”) artists who use the equipment as part of their job (sound engineers, music studios, etc.). Additionally, there is a growing base of modern content creators (think YouTubers, twitch streamers, etc.) as well as retail consumers who leverage this equipment for leisure and upgrade their home stereo systems for gaming or movie / TV watching.

The total addressable market is massive. Investors’ focus on demand drivers and use-case is paramount, originating from various segments of the value chain at diverse price levels.

Vast Audio Industry Spans Distinct Subsectors

Sources: Lincoln International, Grand View Research, Market Research Future, AVIXA, iCrowdNewswire

| The audio products market is estimated to be worth $99 billion globally. The audio market reaches nearly $106bn if value when including software |

Audio electronics could be viewed as discretionary; however, we have seen this as a necessary product for a large base of users and resilient to market downturns. There is both a professional and an enthusiast element to audio electronics, especially on the consumer side.

What was Mackie’s Compelling Business Story that Fueled Investor Interest?

Eddie: The company has a proven success story as it is an iconic brand, holds a solid reputation for producing innovative products and is uniquely positioned at the intersection of the professional and prosumer markets.

Access to both the prosumer and modern creator space positioned Mackie as an outlier. As Harry mentioned, COVID-19 created a new demand for the consumer audio space. This increased the size of the creator space and prosumer markets. Mackie is a massive success story for showing how a heritage brand can move into a new market space and capture mindshare. This amplified Mackie’s brand visibility with a growing, young and outgoing segment of the population.

Harry: Mackie’s price positioning was compelling, as it tapped into the trend of offering high-quality equipment at varying, including budget-friendly, price points. It was an exciting investment opportunity for both strategic buyers and private equity investors (PE).

For PE investors, Mackie offered a strong financial profile and an attractive growth plan, supported by actionable near-term growth opportunities.

For strategic buyers, Mackie provided an offering with real depth that could expand and complement an existing product lineup. This is where RØDE, the company that acquired Mackie, became interested.

RØDE is a particularly strong brand within the microphone and microphone technology space. Combining RØDE’s heritage with Mackie’s mixer and loudspeaker heritage, the deal provided a natural story to tell about how these brands belonged together, fully embracing this shift into the new modern creator market.

What are the Emerging Consumer Electronics Trends?

Harry: There are several trends we have seen. The first is consolidation: platforms are bringing brands in-house to complement their ecosystems. Companies are looking for products that connect and enhance one another as well as complementary distribution channels across geography and specialism. Thus, niche market leaders are being absorbed by larger brands to reach a wider audience with more products.

A second observation is the continuous evolution of many well-known audio-electronic businesses that started as passion projects and focused on specific niches from the 1960s onwards. Over time, we have seen founders transition out of the businesses they built, through a sale or a public listing. Others have independently, or with PE backing, become acquirers and created ever larger and successful businesses. RØDE is an example of the latter, having evolved from a focus on the Australian audio industry and the microphone market to become one of the most well-rounded pro audio companies in the world, with ambition for further growth. Hence why it acquired Mackie.

A third trend that I mentioned earlier is that live music is back with great strength. This is driving a lot of M&A interest in the space.

Eddie: The fourth trend is a trickledown effect from professional-level audio technology users to consumers. Items that were once primarily used only by professionals, like mixer boards or high-end microphones, are now available and priced at a level that consumers can access. Consumers are growing into creators, making YouTube videos or recording songs or podcasts at home, creating a new market of higher-end audio equipment for consumer creators.

What Factors Should Buyers and Sellers Contemplate When Pursuing or Considering a Transaction in this Market?

Eddie: Buyers and sellers should conduct a detailed review of the end markets and demand drivers. What is the split of sales, by application and channel, who is the end user and how do they behave in different markets? Another detail to review is the new product development pipeline and audience expansions. What is the longevity of the product portfolio? Is there new technology coming that would lead to the redundancy of existing products? Are there new customer and distribution partner wins? What are the organic and inorganic growth plans?

Harry: As in any sector, it is important and value-enhancing to engage with an experienced advisor early on to properly prepare and maximize readiness. Through early engagement, we can help position the business for maximum impact with the most likely strategic and financial buyers. At Lincoln, our global team of experienced sector professionals stands ready to assist both buyers and sellers throughout every step of the process.

Contributors

I have a hands-on approach and bring energy, creativity and passion to every client transaction.

Eddie Krule

Managing Director

ChicagoMeet Professionals with Complementary Expertise in Consumer

I have a hands-on approach and bring energy, creativity and passion to every client transaction.

Eddie Krule

Managing Director

Chicago

I design strategies and offer solutions that fit the unique ambitions of each client I serve.

Brian Little

Managing Director

Los Angeles

I take a long-term approach to building relationships and understanding clients' businesses in order to provide timely and relevant advice.

Alex Masters

Managing Director & Co-head of Consumer, Europe

London