Lincoln International adds Kensuke Nakatsuka as Managing Director

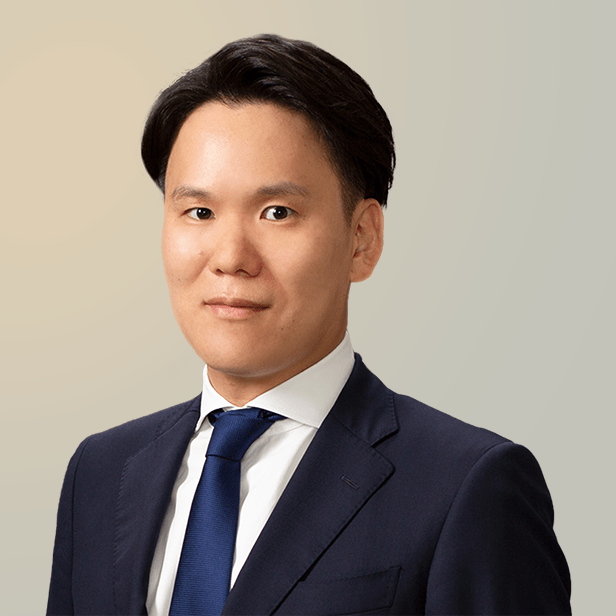

Lincoln International, a global investment banking advisory firm, is pleased to announce that Kensuke Nakatsuka has joined as a Managing Director in the firm’s Tokyo office.

Kensuke has over 20 years of investment banking experience and brings deep transaction expertise and long-standing relationships thanks to his success advising clients primarily in the Consumer, Industrials and TMT sectors. He will focus on advising on domestic and cross-border M&A transactions involving private equity and corporate clients in Japan.

“Lincoln has been active in Japan since 2008, providing investment banking advisory to an array of well-capitalized and highly motivated strategic acquirers,” stated Tetsuya Fujii, Managing Director and head of Lincoln International’s office in Tokyo. “These acquirers have renewed energy around dealmaking and investing, aligning well with the arrival of Kensuke, who is highly respected and well-connected in Japanese market.”

Before joining Lincoln, Kensuke worked in the Tokyo office of Citigroup as Managing Director in the M&A department and served as Head of Sponsor Coverage. Prior to that, he was Head of M&A at Credit Suisse Securities in Tokyo.

“I am thrilled to become a part of the tremendous success story and outstanding partnership culture at Lincoln,” stated Kensuke. “I look forward to contributing my experience and client network for the future growth of the firm.”

Summary

-

Further strengthens advisory expertise in Japan

Contributors

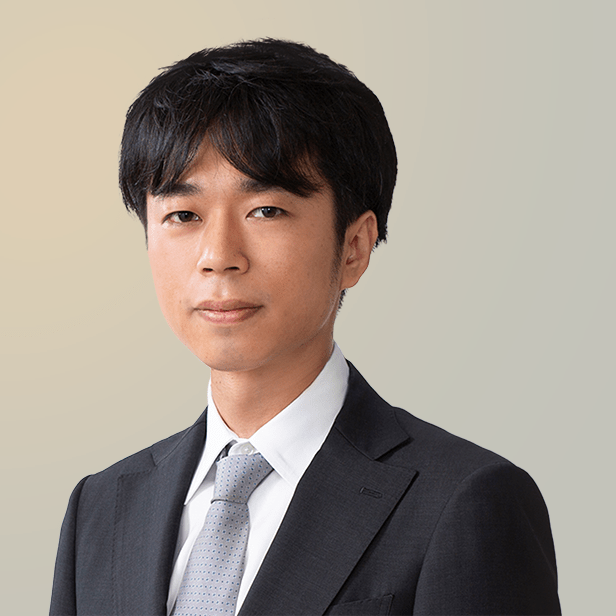

Meet Our Senior Team in Japan

I am driven by the opportunity to globalize Japanese corporations.

Keiji Miyakawa

Senior Advisor

Tokyo