DVZ | Logistics and Transport M&A is on the Up

Jun 2023

Originally published by DVZ on June 20, 2023.

View the original article (German).

Read the article translated to English below:

Against the backdrop of macroeconomic headwinds and the rapid normalization of freight rates, overall mergers and acquisitions (M&A) activity in global logistics and transport (L&T) in the second half of 2022 was relatively muted with mega deals largely absent in freight forwarding, contract logistics and trucking.

In contrast, small- and mid-sized deal activity continued at comparatively stable levels driven by both corporate acquirers and private equity-owned portfolio companies, often in connection with buy-and-build strategies. Specific interest focused on targets with exposure to the healthcare and pharmaceutical sectors (deals included UPS / Bomi and Geodis / ToF), and food logistics (Logista / Carbó Collbatallé, DFDS / McBurney), with M&A appetite in both areas driven by high levels of customer stickiness, resilience of demand towards macroeconomic fluctuations and attractive margin levels, supported by entry barriers from certification, quality and safety requirements. M&A activity also remained healthy in e-commerce logistics (DHL / Monta Services, Geodis / Need it Now). These trends continue in 2023.

Summary

-

Lincoln International shares key logistics and transportation mergers and acquisitions trends with DVZ.

- Sign up to receive Lincoln's perspectives

As western economies, especially in Western Europe, moved through the winter 22 / 23 without the feared electricity blackouts, freight rates retreated from their Covid peaks. Sea rates appear to have now bottomed out around 20% above pre-Covid-levels compared to their peak of approximately 5x pre-Covid levels during the pandemic (source: SCFI). Air freight rates peaked at approximately 3x pre-Covid levels and have pulled back to around 30% of their pre-pandemic level (source: TAC index), albeit with some downward pressure on rates remaining.

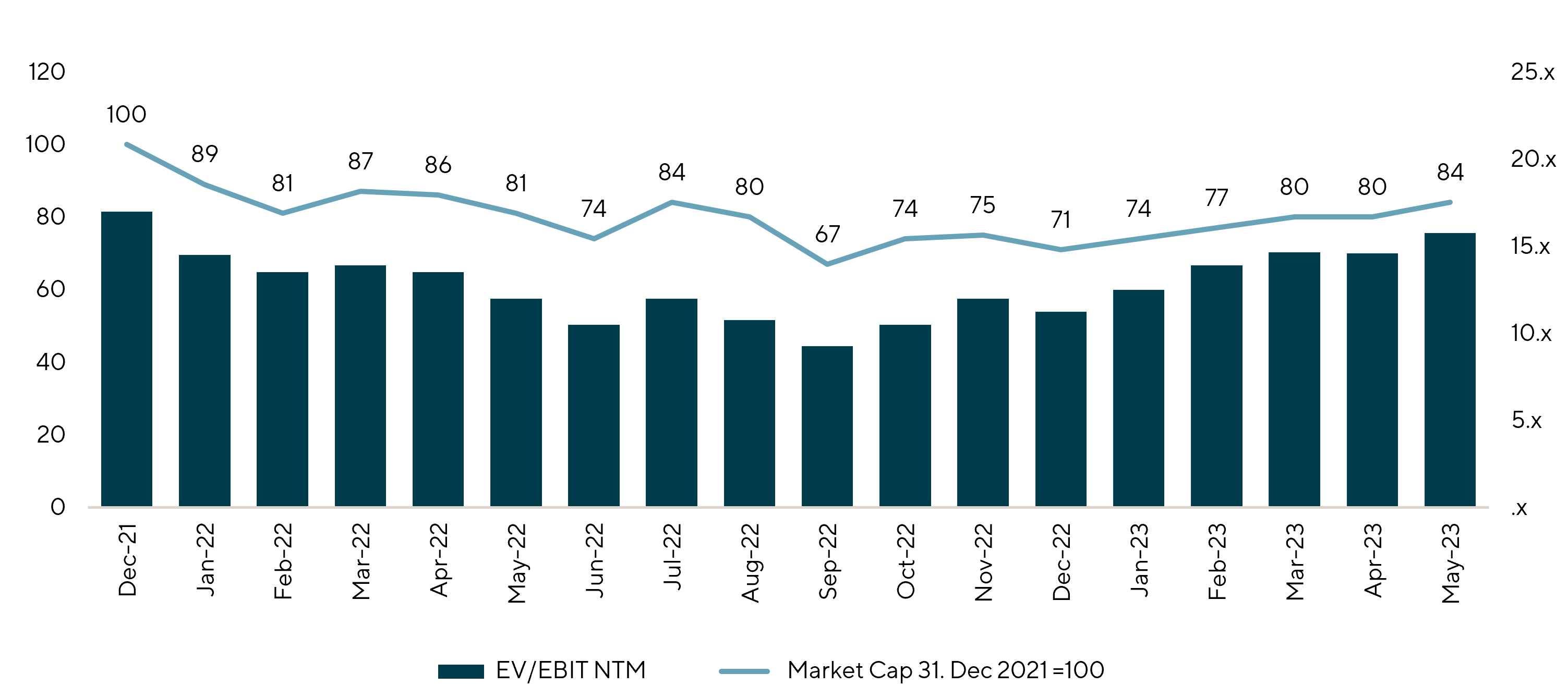

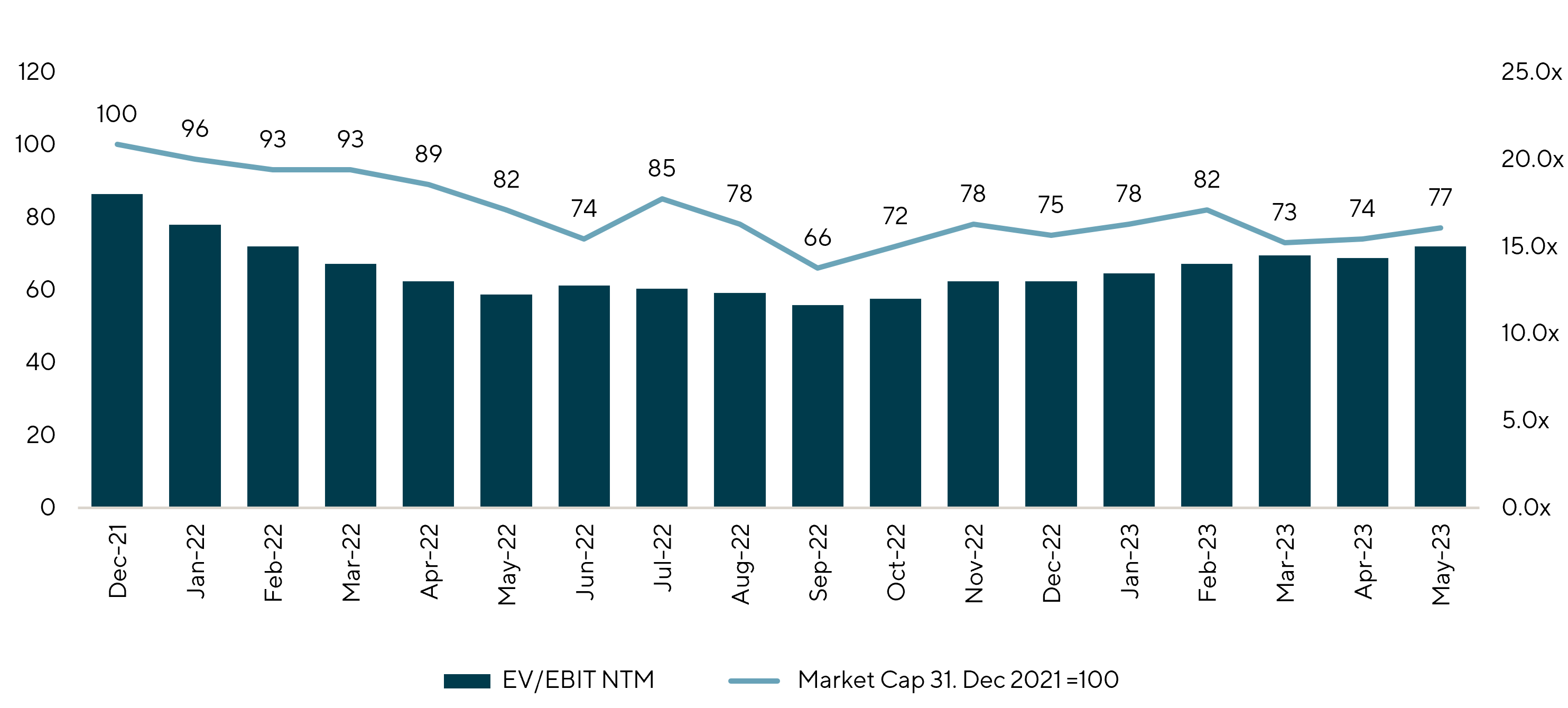

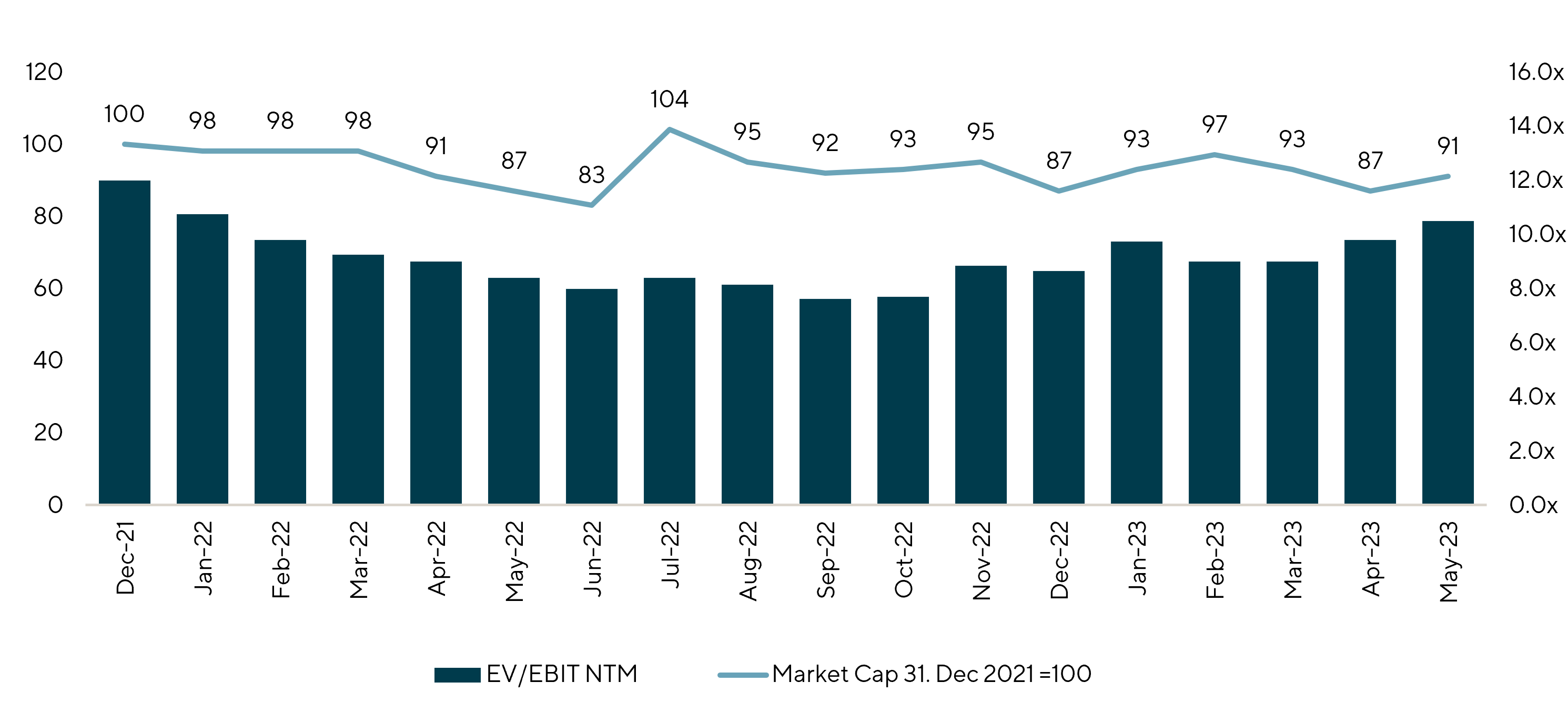

Normalization of freight rates should support dealmaking by reducing uncertainty over the “right level” of earnings for a deal valuation between sellers and buyers. In addition, overall market sentiment seems to have improved significantly versus the lows seen during the second half of last year. This applies in particular to the forwarding segment, where average peer group market capitalization was down by 33% in September (vs. Dec. 2021), but has increased by +25% on average since then. Implied valuation multiples have also recovered and stabilized, further supporting the dealmaking environment as buyers typically cross-check purchase prices against listed peer group valuation multiples.

Forwarding Average Peer Group

Contract Logistics Average Peer Group

Trucking Average Peer Group

Consolidation pressures for logistics service providers (LSPs) are reemerging or being felt much more strongly again as pandemic-induced super normal profitability has all but rescinded. These factors include the growing importance of trade-lane specific scale, the ability to invest in state-of-the-art IT systems, automation and end-to-end service capabilities to support differentiation and customer-lock-in. International expansion also remains important given the demands of large shippers to receive global service from one source.

The recently observed pick-up in M&A activity reflects the combination of these trends:

- The first notable deal was the acquisition of Denmark-based global air and ocean forwarder Scan Global by a consortium led by CVC Capital in February 2023, including a partial financing via a $750 million high-yield bond offering.

- April 2023 saw CMA CGM announce its intention to acquire Bollore Logistics for €5 billion as part of its integration strategy, aiming to offer clients end-to-end transport and logistics services throughout the supply chain. The addition of Bollore Logistics’ air and ocean forwarding volumes and its warehouse network will propel CMA CGM into being a top-five global logistics provider (and follows a string of related transactions, including Ingram Micro’s Commerce & Lifecycle Services, Colis Privé and GEFCO).

- Japan’s Nippon Express’ May 2023 announcement of its €4 billion (including earn-out) acquisition of Austria-headquartered Cargo-Partner further highlighted the improved environment for L&T dealmaking, especially as the process didn’t garner sufficient appetite during the initial launch in the second half of 2022. Cargo-Partner will improve the competitiveness of Nippon Express by adding air and ocean freight volume and expand its position in central and eastern Europe, a strong manufacturing industry region.

- Also in May, family-owned German forwarding and logistics services provider Geis Group announced its largest acquisition to date – a majority stake in Austria-headquartered Quehenberger Logistics. The acquisition will expand Geis Group’s regional presence into Central and Southeastern Europe and add complementary industry solutions and full truckload (FTL) and less-than-truckload (LTL) activities, increasing group revenue to roughly €2 billion.

- A third noteworthy transaction announcement in May was from Flexport, the largest digital forwarder, with its news about the acquisition of Shopify’s logistics business. The deal rationale was based on Flexport’s intention to provide a tech-based, end-to-end solution for omnichannel retail customers, spanning inbound logistics to fulfillment and last mile. The deal includes Deliver, acquired by Shopify for around €2 billion a year ago.

We see similar factors at play in our advisory work. Lincoln recently represented the owners of a European freight forwarder. Strategic bidders entered into a competitive auction process, which gained traction following the bottoming out of freight rates since the start of the year. Bidder motivation was driven by the quest for a trade-lane-specific scale, which primarily related to the target’s longstanding relationships to domestic shippers. We successfully marketed the target company on its “scarcity value” as being one of a limited number of “actionable” (i.e. available for sale) and yet sizeable acquisition opportunities, addressing a well-selected group of international bidders, achieving a successful outcome for our client.

Despite these encouraging signals, it remains to be seen whether the recent trends and flurry of notable L&T deals point towards a sustained level of more active M&A into the second half of 2023 and beyond. Potential risks include macroeconomic headwinds in connection with inflation and monetary policy, and the short-term development of freight volume trends. Signals on retail inventory levels in Europe and the U.S. have been mixed recently with some reports pointing towards an end of the destocking cycle. Consistent with this view, in Hapag Llyod’s May first quarter earnings call, CEO Rolf Habben Jansen projected the return of ocean transport volume growth as early as the third quarter of 2023.

The growing ambitions of Japanese and Korean LSPs looking for targets in Europe and the U.S. to achieve their ambitious growth goals further supports the L&T M&A market outlook. Shipping lines and port operators in particular have indicated their intention to continue expanding their presence in logistics via M&A.

We expect contract logistics and warehousing companies to remain a key focus for potential acquirers, both strategic bidders and private equity. These companies are attractive targets because of their comparatively greater economic resilience, provided by long-term contracts, and their importance for differentiation of LSPs through customized value-added services. Acquirer appetite for contract logistics and warehousing companies will also be boosted as greater competitive pressures force retailers and manufacturers to increase logistics outsourcing to enhance supply chain efficiency.

Contributors

Meet Professionals with Complementary Expertise

I am enthusiastic about creating sustainable growth and the highest value for our clients and strive to leave a positive footprint beyond any successful M&A transaction.

Friedrich Bieselt

Managing Director & Head of Business Services, Europe

Frankfurt

The transactions we work on are often trajectory-altering, with high stakes and pressure to get it right. We know our work, however challenging in the moment, is going to be impactful.

Mike Iannelli

Managing Director & Co-head of Business Services

Chicago