Capital Sources beyond Consumer Spending: Key Considerations for Retail to Thrive in a Challenged Environment

Oct 2020

RETAIL TO CONTINUE TO BE IMPACTED IN A POST-COVID WORLD

In several earlier COVID-19 articles, we addressed a number of topics including how retailers could address COVID-19’s impact on consumer spending, the importance of seamless omni-channel and customer-centric offerings, as well as creative strategies to utilize physical footprints effectively. While select retailers have evolved to meet these challenges, they have mostly been very large, essentials oriented and have substantial access to capital and infrastructure to invest behind their business transformations. Examples include Target’s efficient use of stores as “distribution centers for seamless customer fulfillment” and Wal-Mart’s relentless investment in e-commerce infrastructure and technology to become a credible and thriving competitor vis-à-vis Amazon Prime. Other formats with actual (or perceived) expertise and innovation – think Best Buy, Williams Sonoma, et al – have developed customer-centric models that are also thriving. However, mid-sized and small retailers have not fared nearly as well…

Summary

-

Lincoln International's retail sector professionals explore the future of the industry, implications of the Coronavirus (COVID-19) and provide various strategies and opportunities for small and mid-sized retailers to invest in their business models for long term success.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

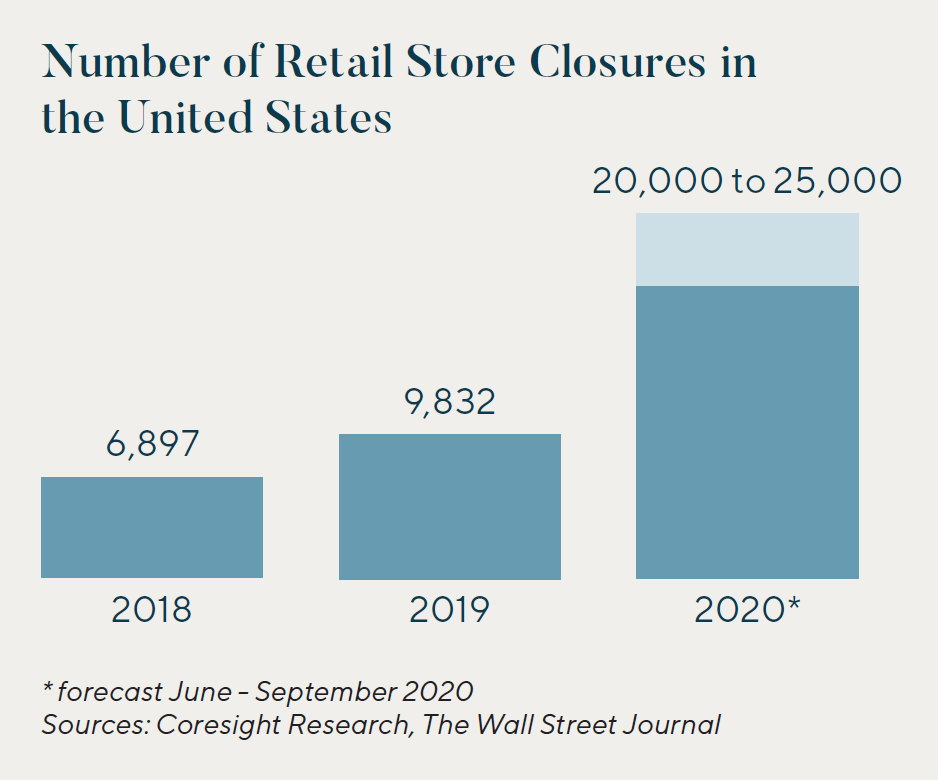

CHALLENGED AND DISTRESSED RETAIL IS A CONTINUING ISSUEThe good news: Consumers are maintaining a strong spending discipline and as various segments of the consumer landscape have ‘opened up’ we have clearly witnessed strong consumer pent-up demand to spend. The bad news: The shift to online; the shift away from malls and the resulting sizeable vacancy rates; the shift of spending to nesting oriented segments; and the migration away from urban environments are all powerful, multi-year trends that will continue to create a challenged environment for less developed and less differentiated retailers. In all of 2019, 17 major retailers filed for bankruptcy and the overall landscape saw approximately 9,800 store closings. During YTD 2020 alone, we have seen bankruptcy filings from 30 major retailers — including well-known brands such as Neiman Marcus, Pier 1 Imports, Brooks Brothers, GNC, and Modell’s Sporting Goods to name a few — and the percentage of store liquidations has been on the rise. |

|

LINCOLN PERSPECTIVE: CAPITAL RAISE, STRATEGIC PARTNERSHIPS, AND OTHER SOLUTIONS CAN BE A KEY COMPONENT OF SMALL AND MID-SIZED RETAILERS OPPORTUNITY TO THRIVE

In an environment where foot traffic is constrained (either by changing consumer preferences or restrictions enforced by the pandemic), scale is important for operating leverage, and consumers expect a seamless omni-channel experience, free cash flow to invest has been challenging despite the key initiatives required for retailers to thrive. We believe retailers in challenging situations need to be able to invest significantly in their business models for long term success, including a variety of strategies such as:

- Investing in proprietary brand development

- Rationalize store base to a productive footprint

- Thinking differently about the utilization of space

- Stores can have multiple purposes including as customer distribution points allowing for rapid delivery to customers

- Integrating differentiated services can create compelling reasons to visit

- Investing in technology to create long-term, sticky, and profitable customer relationships – retailers need to provide products and services to customers whenever and wherever the customer desires

- Running a lean, 21st century operating model

All of the above may require either capital or strategic partnership to accomplish in the rapidly evolving landscape and those who do not evolve will be left behind. We are witnessing increasing demand from both private equity investors through a variety of structured capital alternatives as well as strategic investors that are more actively seeking growth and the opportunity to leverage their large infrastructures.

Through its Full-Service Platform, Lincoln Maintains the Capability to Assist Companies Across the Entire Spectrum of Capital Needs

Lincoln can help companies and sponsors weather the storm while positioning them for long term success.

Select Retail Transactions

Contributor

Meet Professionals with Complementary Expertise

It’s an exciting time to advise clients in the consumer sector. Major changes in consumer preferences and how products are purchased create a rich environment for business owners and investors to succeed.

Dirk Damegger

Managing Director & Co-head of Consumer, Europe

Frankfurt

I have a hands-on approach and bring energy, creativity and passion to every client transaction.

Eddie Krule

Managing Director

Chicago

I design strategies and offer solutions that fit the unique ambitions of each client I serve.

Brian Little

Managing Director

Los Angeles