Investing in U.S. Food Remains Competitive

Jun 2022

Financial and strategic investors often mention the competition to acquire a food company. Investors frequently ask Lincoln International for ideas and perspectives on approaching the food mergers and acquisitions (M&A) market differently — to enhance their prospects of prevailing in a sale process. The following provides thoughts on the food M&A landscape, including perspectives on valuations, notable categories, themes where we see attractive investment opportunities and tactical steps that investors can take to win in a competitive M&A process.

Summary

-

Lincoln International provides perspectives on the food M&A landscape, including valuations, notable categories, themes where we see attractive investment opportunities and tactical steps that investors can take to win in a competitive M&A process.

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Why is competition intense in food M&A?

Structural factors in the M&A market are keeping valuations across multiple sectors — not just food — at healthy levels. These factors include record fund commitments, low (but rising) cost of capital and corporate buyers flush with cash and prioritizing acquisitions to support their growth objectives.

In addition, food is generally a defensive investment — we all need to eat. This stability makes the sector more attractive. This is especially true with recession concerns on the mind of many investors. Despite the inflationary environment (e.g., higher costs for food, labor, packaging, freight etc.), supply chain disruptions and global geopolitical conflicts, food remains an attractive sector for investment.

Where are the opportunities in the food sector?

Based on Lincoln’s food deals and regular dialogue with strategic and financial buyers, several categories and themes resonate with investors, as outlined below:

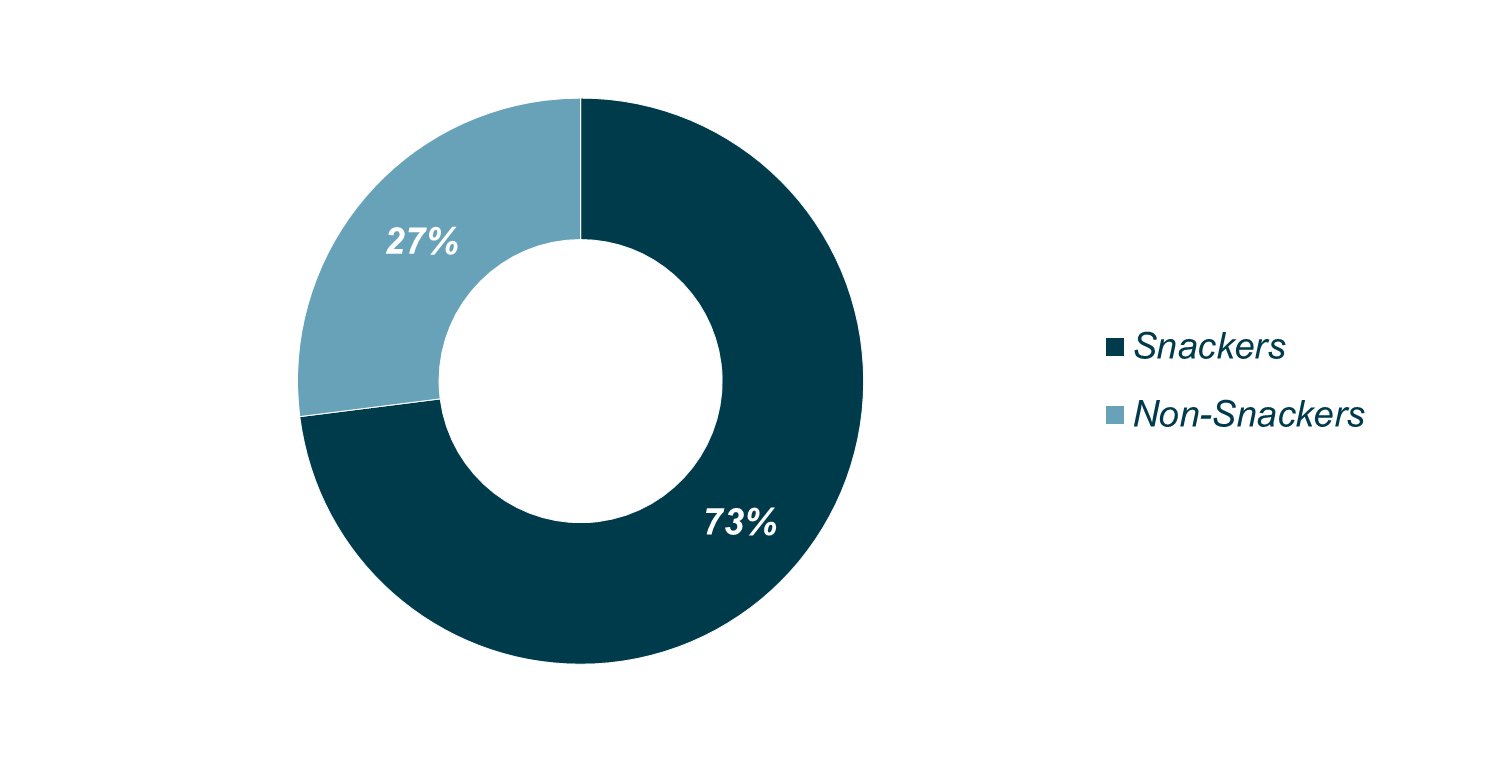

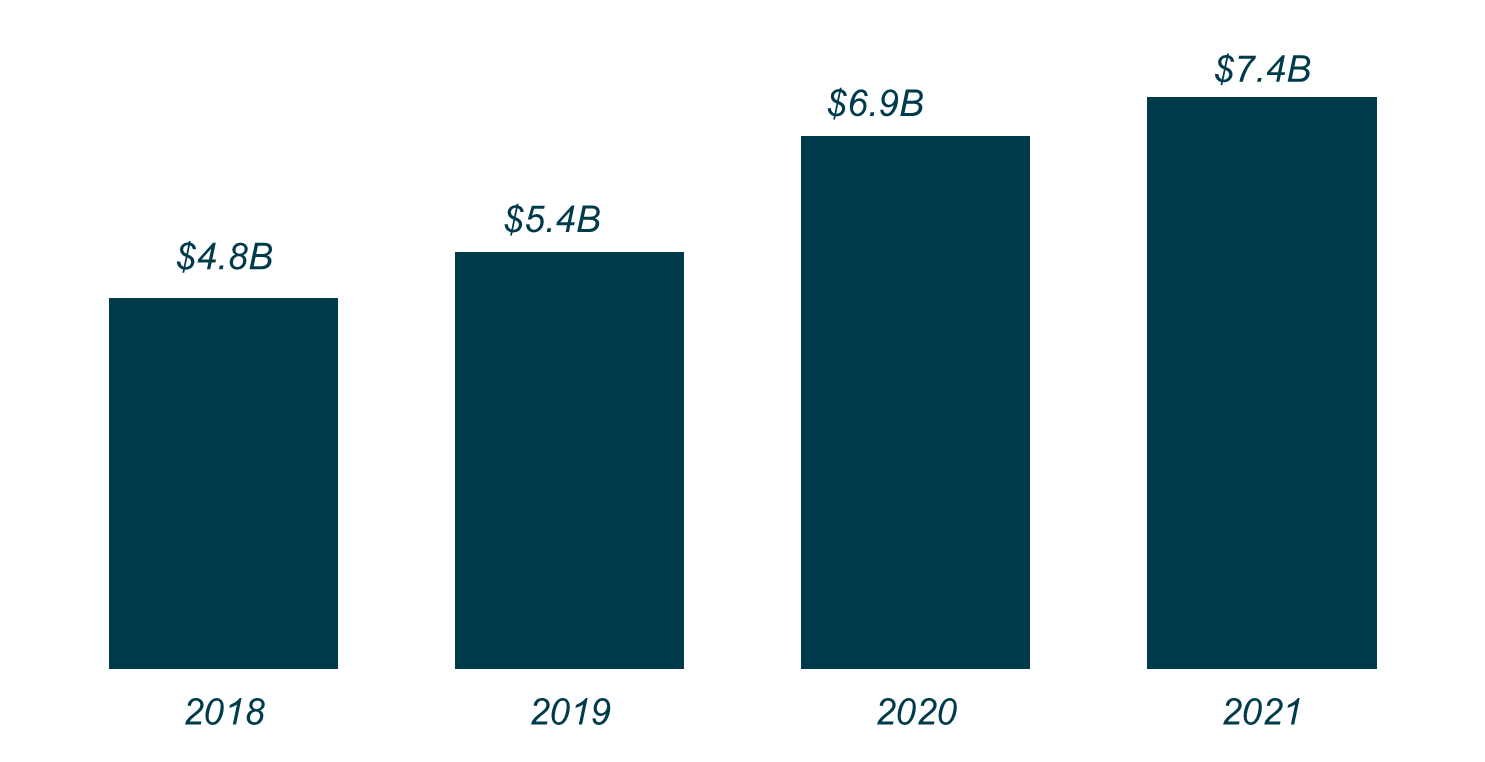

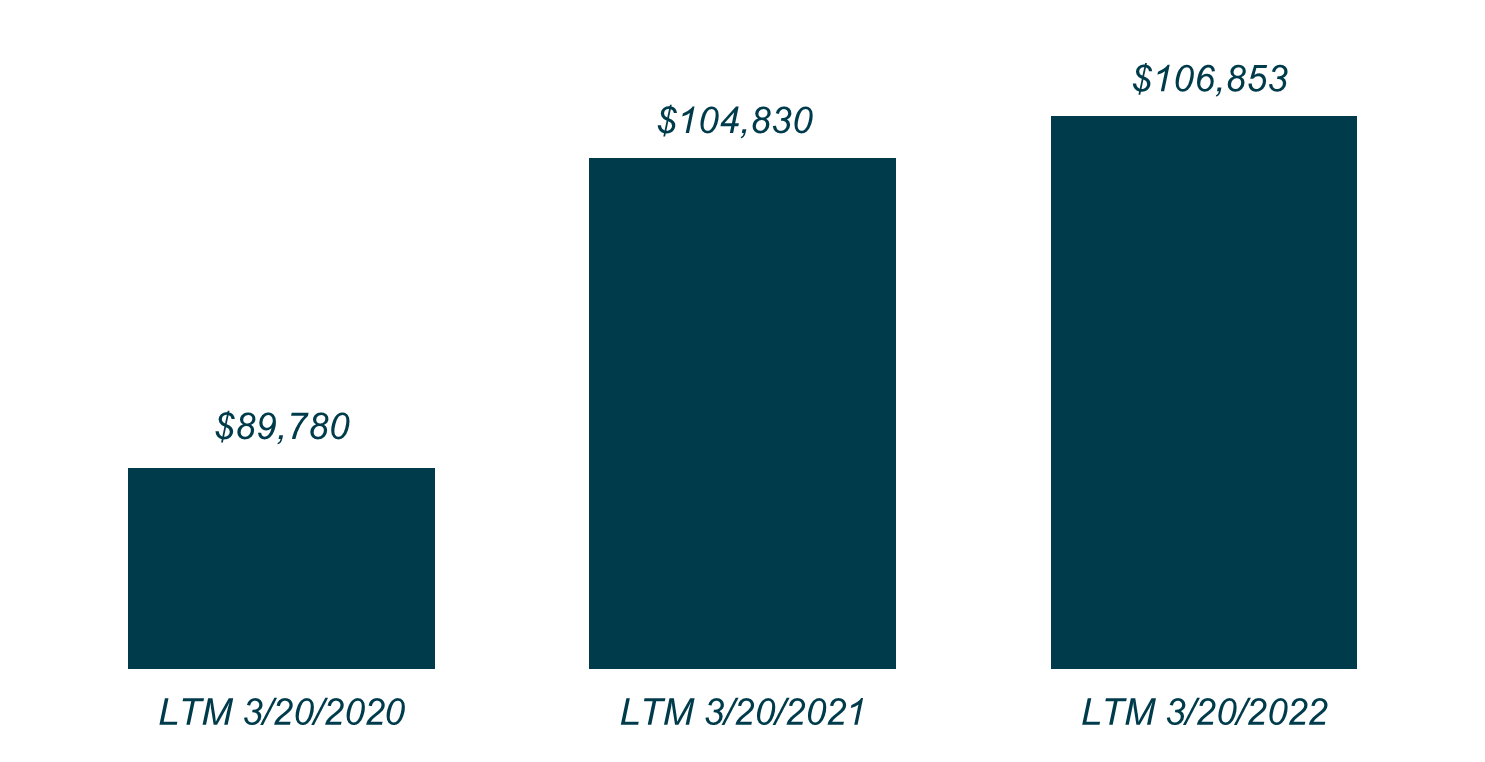

Snacking

|

|

| Snackers in 2015

|

Snackers in 2021

|

|

|

| Snack Frequency 2015, 2018 and 2021

|

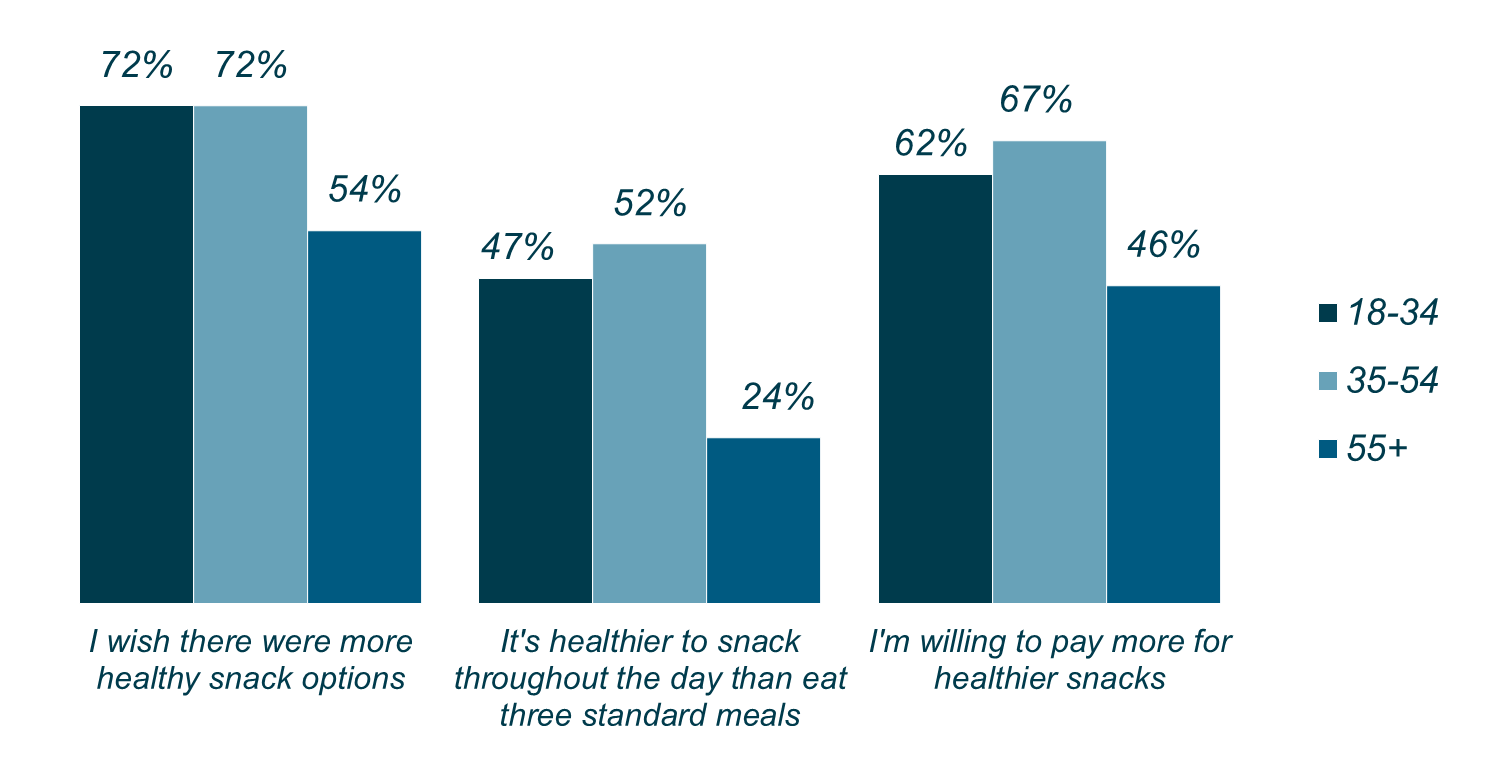

Attitudes Toward Snacking, By Age, 2021

|

| Source: Mintel Snacking Motivations and Attitudes, US 2022 | |

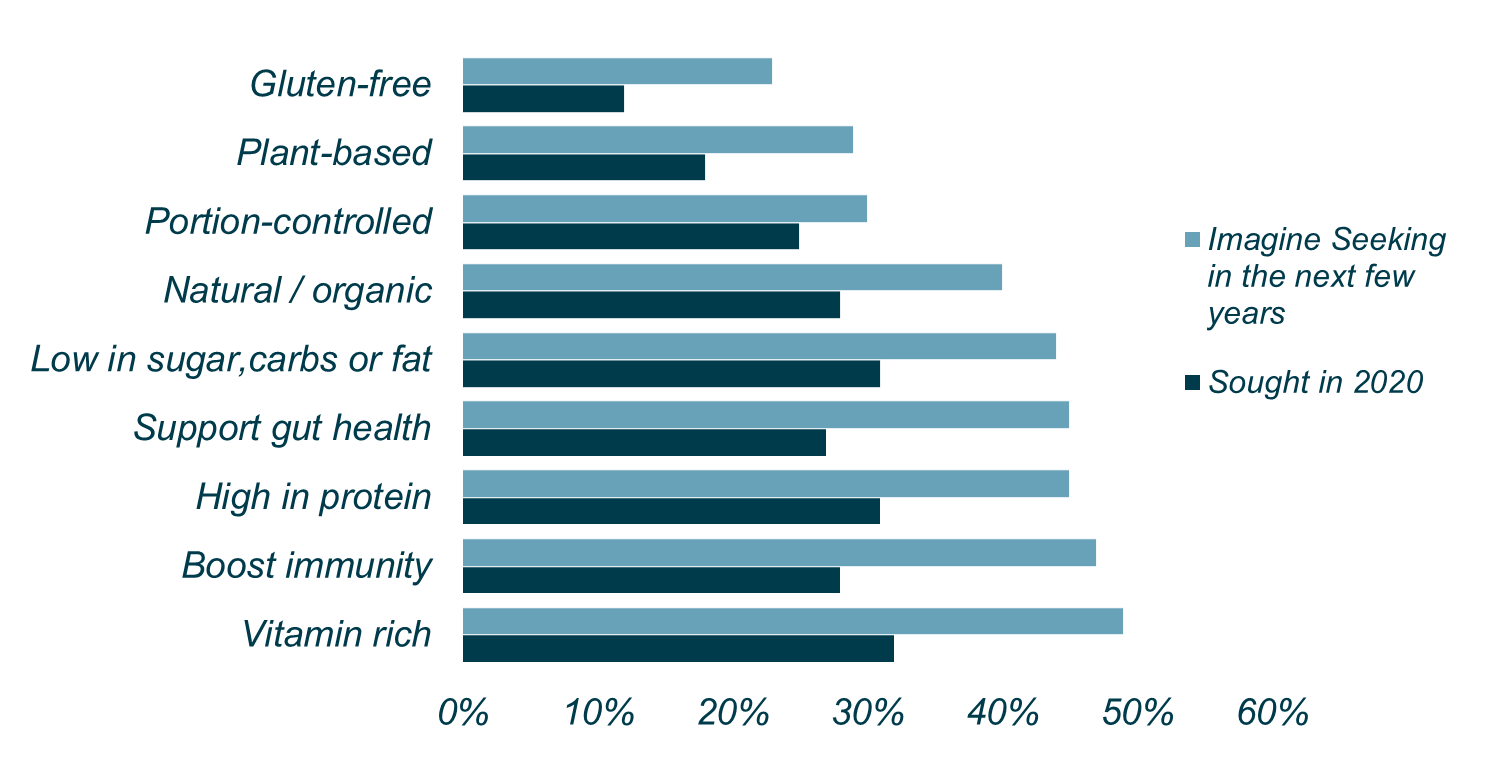

Better-For-You (BFY) / Health and Wellness

- Growth tailwinds favor food companies offering healthier options

- There are a wide range of BFY attributes attracting interest, such as reduced or zero sugar, low carb / keto / paleo, clean label, organic and gluten-free / allergen-free, among others

- The pandemic has accelerated demand for products featuring functional benefits (e.g., immunity) and supporting overall health and wellness

Plant-Based Foods / Ingredients

- Strong, growing consumer demand for plant-based foods, linked to healthy eating trends

- Only one in ten Americans eats their recommended daily amount of vegetables, according to the CDC

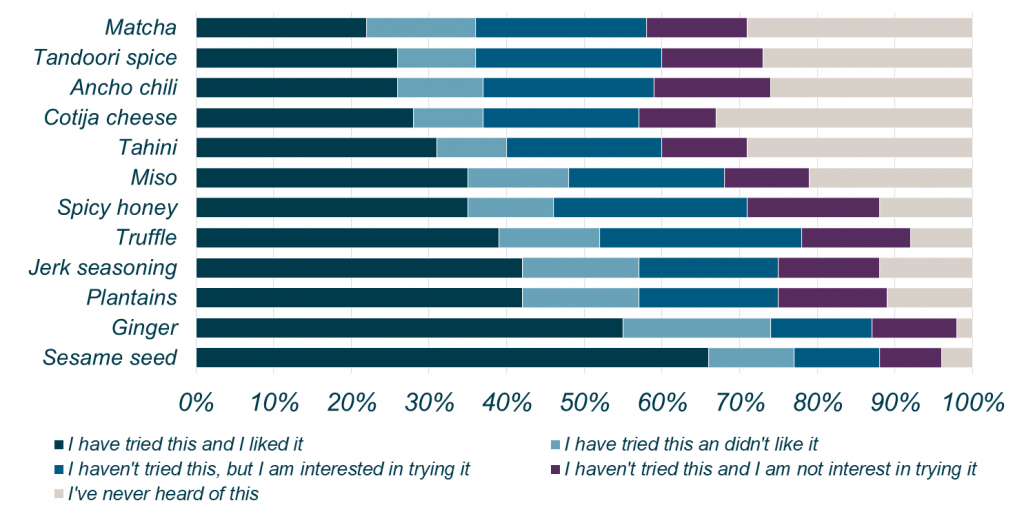

Flavor

- Consumers are increasingly seeking bolder flavors, including ethnic foods from around the world

- Relatedly, consumers are seeking food as an experience, which is reflected by interest in different flavors and ingredients in restaurants

Interest in Flavors and Ingredients on Menu

Source: Mintel – Flavor and Ingredient Innovation on the Menu, US 2022 |

Frozen Food

- Frozen food has been experiencing a renaissance for several years

- The category features higher quality products with cleaner labels than in the past

- Frozen food aligns with consumer preferences for convenience

30% of shoppers have increased their freezer capacity since the onset of the pandemic

Source: AFFI “The power of Frozen”

Bakery

- Bakery is a fragmented category with opportunities for investors to explore a roll-up strategy

- There are numerous bakery executives with whom to partner

- Although the bakery category is capital intensive, demand remains strong

- Tight industry supply in certain product categories, may require investment in capacity expansion to support accelerated future growth

Convenience / Solutions

- Chefs — whether in a restaurant or at home — are seeking time- and step-saving solutions in meal preparation

- With rising labor costs, foodservice operators are responding favorably to opportunities to outsource certain steps / processes so they can maintain a thinner “back of house”

- For consumers tired of cooking at home, any solutions that make meal preparation faster and more convenient are in demand

Where are the opportunities of scale?

Scale matters. But assets of scale trade at a premium due to scarcity. If you can’t find a platform of scale, consider creating one. Consider a roll-up strategy to build the platform you envision. Look at smaller opportunities and grow into it. Alternatively, consider corporate divestitures.

Where are there opportunities for multiple arbitrage?

Look where strategic buyers are temporarily distracted. Perhaps the relevant corporate buyers are in divestiture mode. Maybe they are over-leveraged and need to focus on paying down debt. Did a logical strategic buyer recently announce a large acquisition? Perhaps they need to integrate that target and deleverage their business over the next year before resuming their acquisition focus.

These situations create a temporary opportunity to buy without as much concern of being outbid by a strategic buyer, and then when you go to sell in three-to-five years, those strategic buyers may be back in an acquisition mindset, potentially unlocking multiple expansion on your exit.

What does it take to win?

To win in a competitive sale process, you have to play to win. A few strategies to consider include:

| Develop an angle: Financial investors should develop an angle, but preparation is key. Research a product category or theme and develop an investment thesis. Partner with an experienced food executive. Do the research. Unlock unique insights through your network or through access to data. Capitalize on this preparation when the right opportunity is actionable.

Get aggressive: Despite macroeconomic concerns mentioned previously, in the current M&A market, “A” assets are commanding premium valuations and buyers need to step-up to win. Beyond the valuation, buyers should consider other aspects of their proposal that might be attractive to the seller. For example, buyers should secure committed financing (if needed), accept seller friendly terms, provide a full markup of the purchase agreement and differentiate on speed and certainty. Win over the seller: Just like dating, chemistry is important. From the initial management meeting to subsequent dinners, visits and diligence calls, buyers should treat each interaction as an opportunity to develop a rapport with the seller and the management team. Demonstrate how you would be a great partner who can take a food business to the next level. Don’t forget to provide examples from your relevant experience to prove your track record and demonstrate your ability to add value. Encourage the seller and / or management to ask questions. Part of demonstrating that fit is first listening. Understand what is important to the seller and the management team and ensure you address those considerations in your discussions as well as in your proposal. Purchase price is often the deciding factor but when it is close, chemistry and fit can influence the seller’s decision on which buyer to select. |

Contributors

Meet Professionals with Complementary Expertise in Consumer

Related Perspectives

Packaging Quarterly Review Q2 2024

Over the last several years, the packaging industry has undergone significant transformations driven by rapid advancements in technology. From the introduction of innovative materials and sustainable practices to automation and… Read More

Investors in Healthcare | Q&A with Lincoln Professionals

Originally posted by Investors in Healthcare on July 25, 2024. Lincoln International, the U.S.-headquartered global investment banking advisor, is a well-known name in the European healthcare markets, providing advice to… Read More

Industrials Strength: Acceleration in Global Industrials M&A

Lincoln Industrials closed 28 transactions globally thus far in 2024. Across our industrials offering – from aerospace and defense to mobility, engineered components to building products, and infrastructure to specialty… Read More

Facilities Services Market Update Q2 2024

After a series of declining quarters since 2021, Q2 2024 marks the third consecutive quarter of mergers and acquisitions (M&A) activity growth, with ~7,300 deals closed, according to S&P Global.… Read More