Cost of Capital Slows M&A Activity

It’s no secret that deal flow has waned in 2023, and investor conversations continue to focus on when mergers and acquisitions (M&A) activity will rebound. Private credit markets remain open with ample liquidity, but the cost of capital has increased significantly because of interest rate hikes by the Federal Reserve Bank and the widening of spreads due to the risk of a potential recession.

As a result, leverage multiples are under pressure because companies can no longer support the same amount of debt from the higher interest cost burden, with many companies seeing their all-in interest expense double since early 2022 for the same amount of debt. Accordingly, lenders are now underwriting to a forward-looking FCCR that incorporates expectations for interest rates, which is constraining the amount of debt a company can support and, by extension, depressing leverage multiples. The combination of reduced leverage available for acquisitions and higher interest costs have led buyers to re-examine purchase prices for assets, leading to slowing, uncertain M&A markets and price discovery between buyers and sellers.

When Will M&A Markets Pick Up?

The answer to when M&A will return in earnest resides partially in the credit markets and the broader actions of the Federal Reserve. Base rates are unlikely to fall back to their all-time lows in the near future, and lender appetite is dictated by how many borrowers in their own portfolio are in default or tracking towards default. In the last few years, the healthy state of the economy meant near-zero interest rates and near-zero defaults. Today, those numbers are trending upward in a meaningful way. As lender portfolio performance declines, so does their risk appetite, leading to more risk aversion, lower leverage levels and higher spreads on new loans.

Calculating Lender Portfolio Performance

For a view into lender portfolio performance, many rely on publicly available payment default metrics in the broadly syndicated market. However, Lincoln believes the best leading indicators reside in our proprietary private market database, which includes over 4,750 portfolio companies held by more than 145 sponsors. Lincoln’s proprietary valuation database offers a truly unique snapshot into the health of the private markets.

Within our database, we track two key metrics which serve as a better measure of the future state of loan portfolios:

Financial covenant defaults

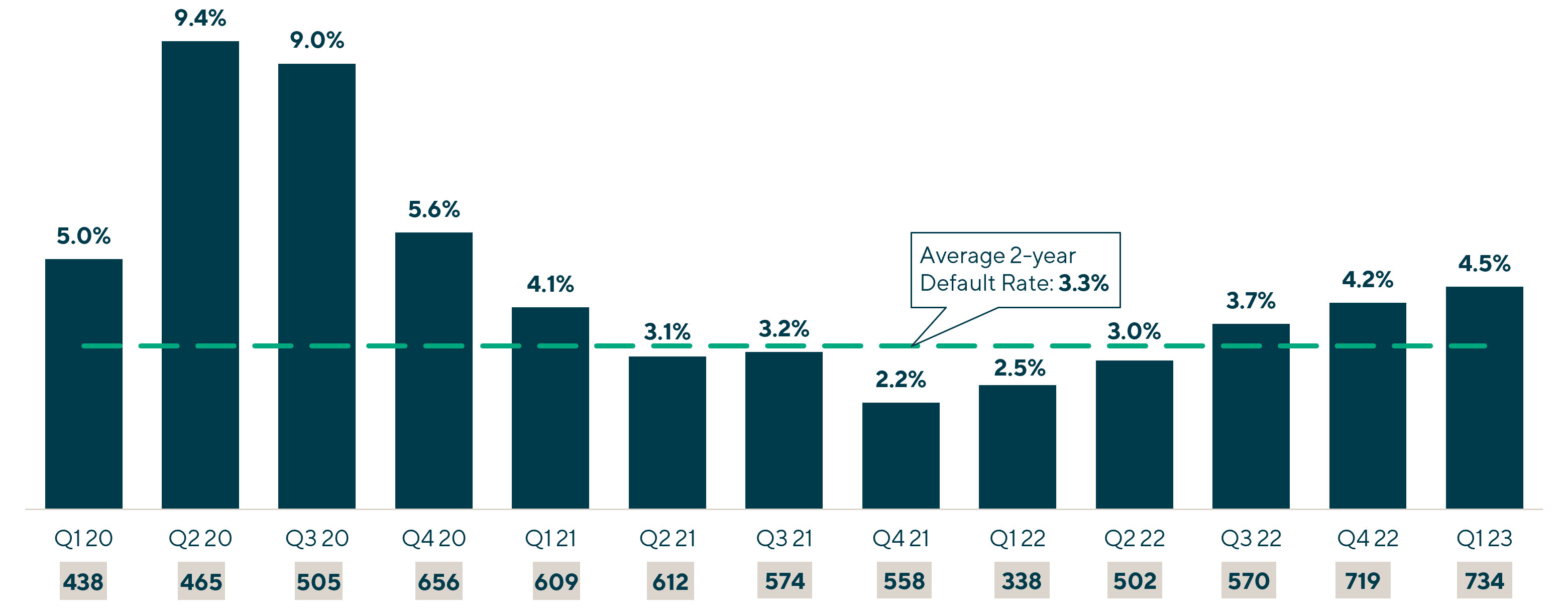

| Covenant Default Rate (Size-Weighted)1 |

We have observed a steady rise in financial covenant defaults for the last five quarters as companies cope with rising interest rates and operating performance pressure. Most borrowers that have triggered covenant defaults have done so on the basis of the total leverage ratio. Further, we believe the data in the chart above understates the number of companies that have breached a leverage covenant due to the pervasiveness of equity cures and the rise in the number of amendments undertaken prior to a default being triggered under the loan agreements.

Forward-looking debt service ratio

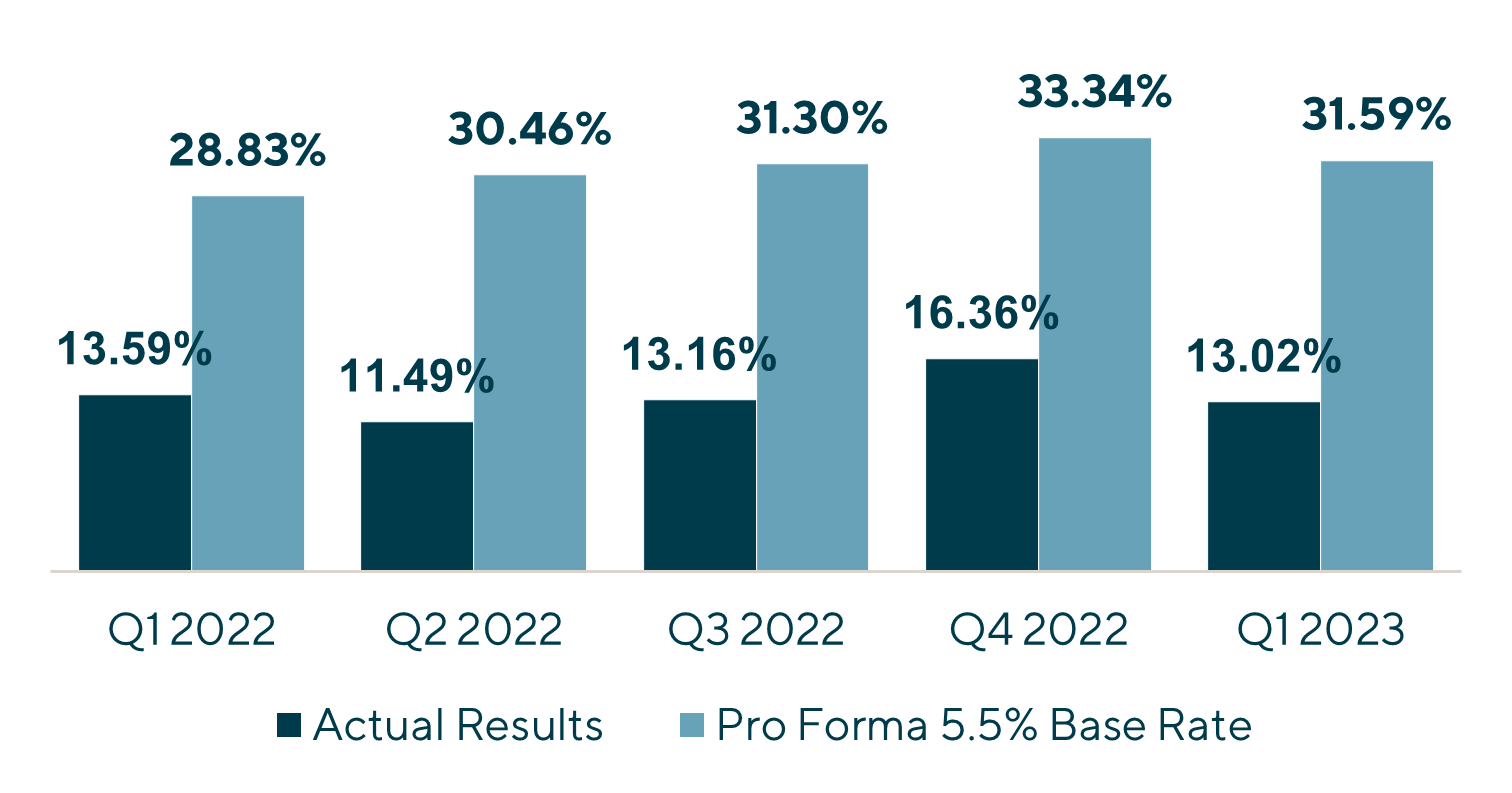

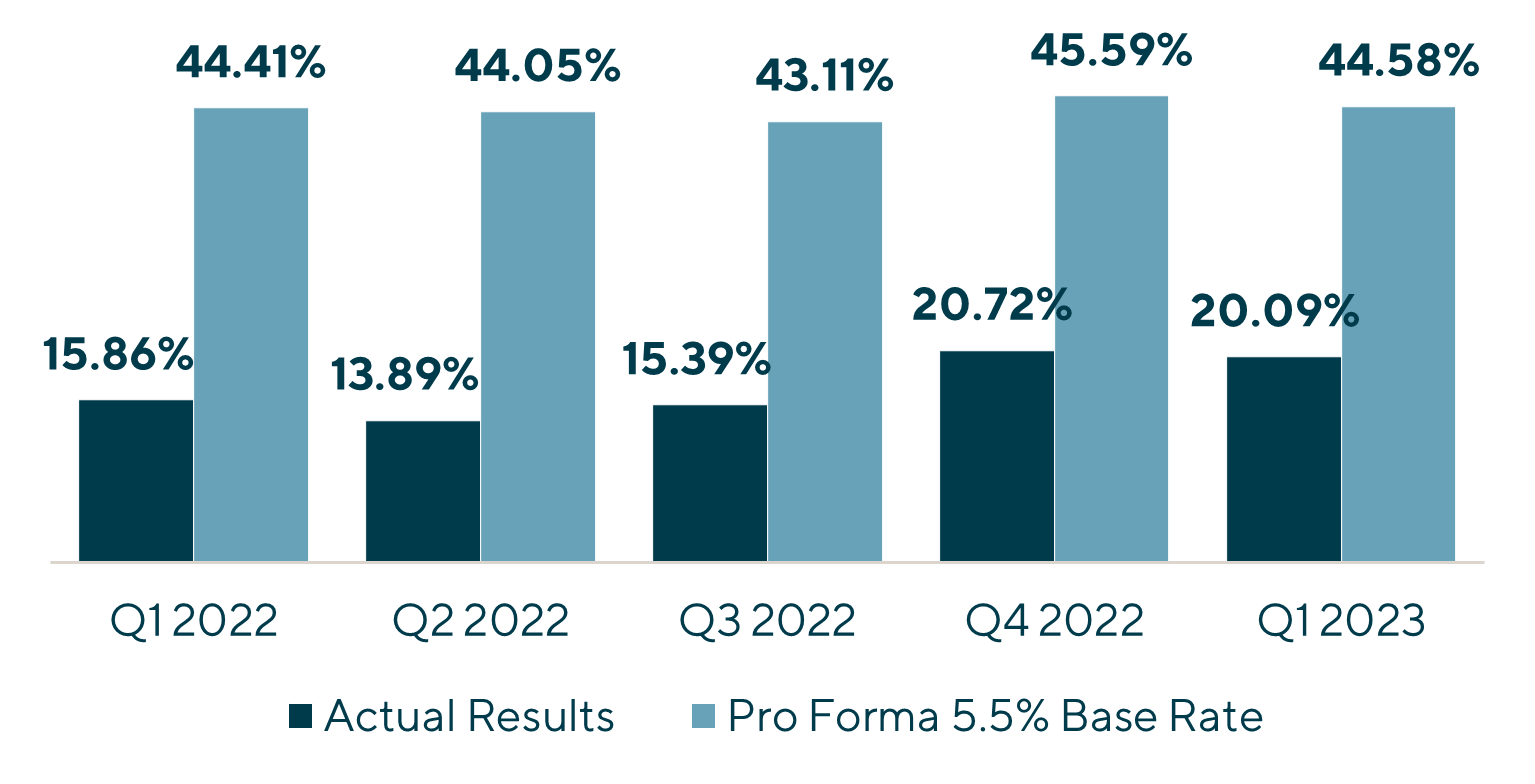

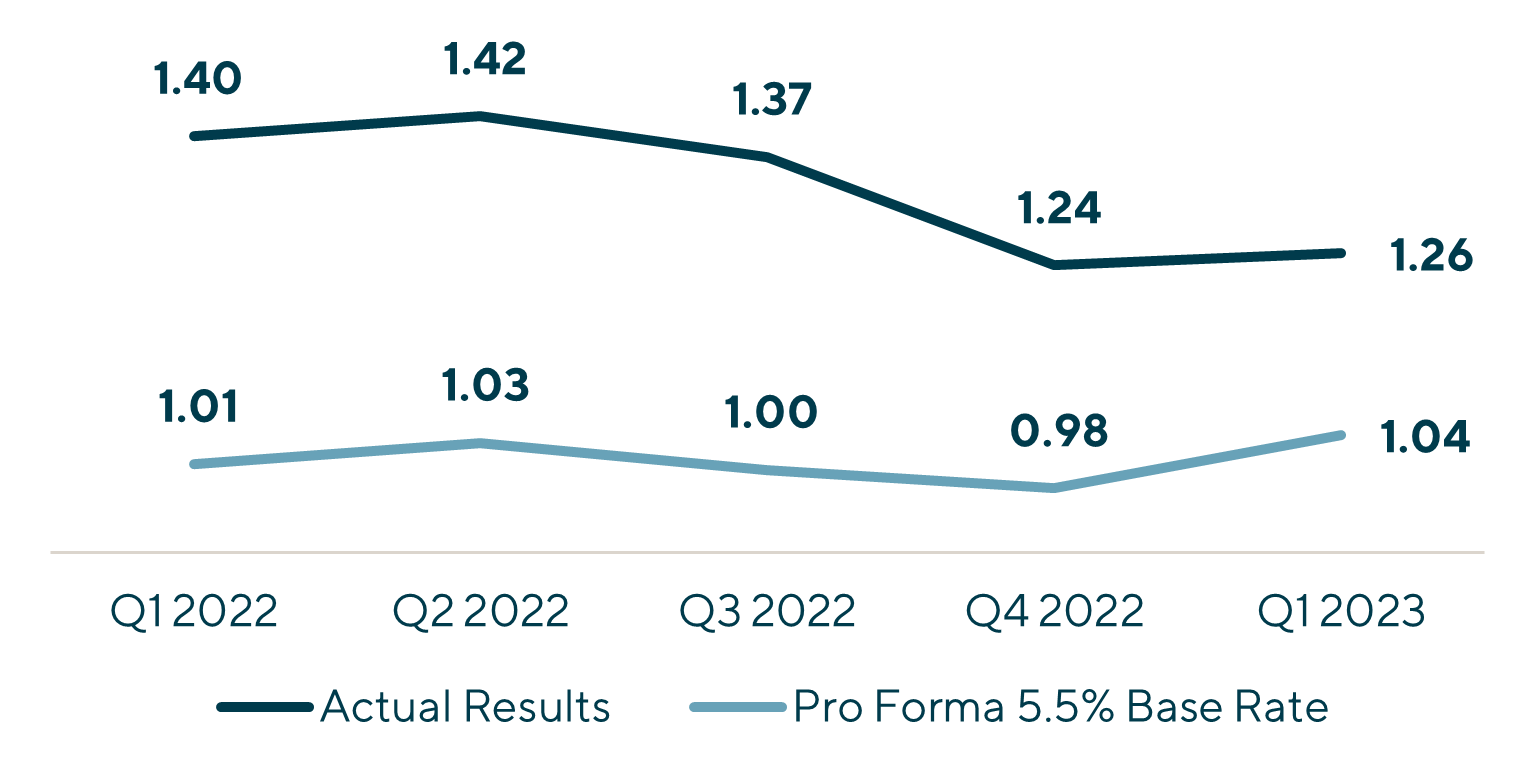

Even more concerning than financial covenant default metrics is the debt servicing outlook. Throughout 2022 and into 2023, interest coverage ratios and FCCRs declined as rising rates began to take hold. When calculating the FCCR using a backward-looking 12-months of interest expense (chart below), the average FCCR, which measures a company’s ability to service its interest and debt amortization, dropped from 1.40x in Q1 2022 to just 1.26x in Q1 2023 (dark blue line). On a more sobering note, Lincoln recalculated this FCCR using the same EBITDA, but looked forward and included 12 full months of base rates above 5%. The result is worrisome – the ratio dropped to 1.04x in Q1 2023, which essentially means companies are “living paycheck to paycheck”. Similarly, when accounting for the current SOFR for a full one-year period, nearly 45% of companies could not cover their debt servicing obligations. This may also understate the reality of the challenges faced by many of these companies. Firstly, the analysis was performed using adjusted EBITDA, with adjustments representing approximately 28% of the total and many of these adjustments being non-cash in nature. Secondly, most debt facilities completed in the past several years do not have a FCCR covenant; therefore, a company could run out of liquidity before it ever trips a financial covenant. Essentially, the market is living on the edge of a payment default cycle.

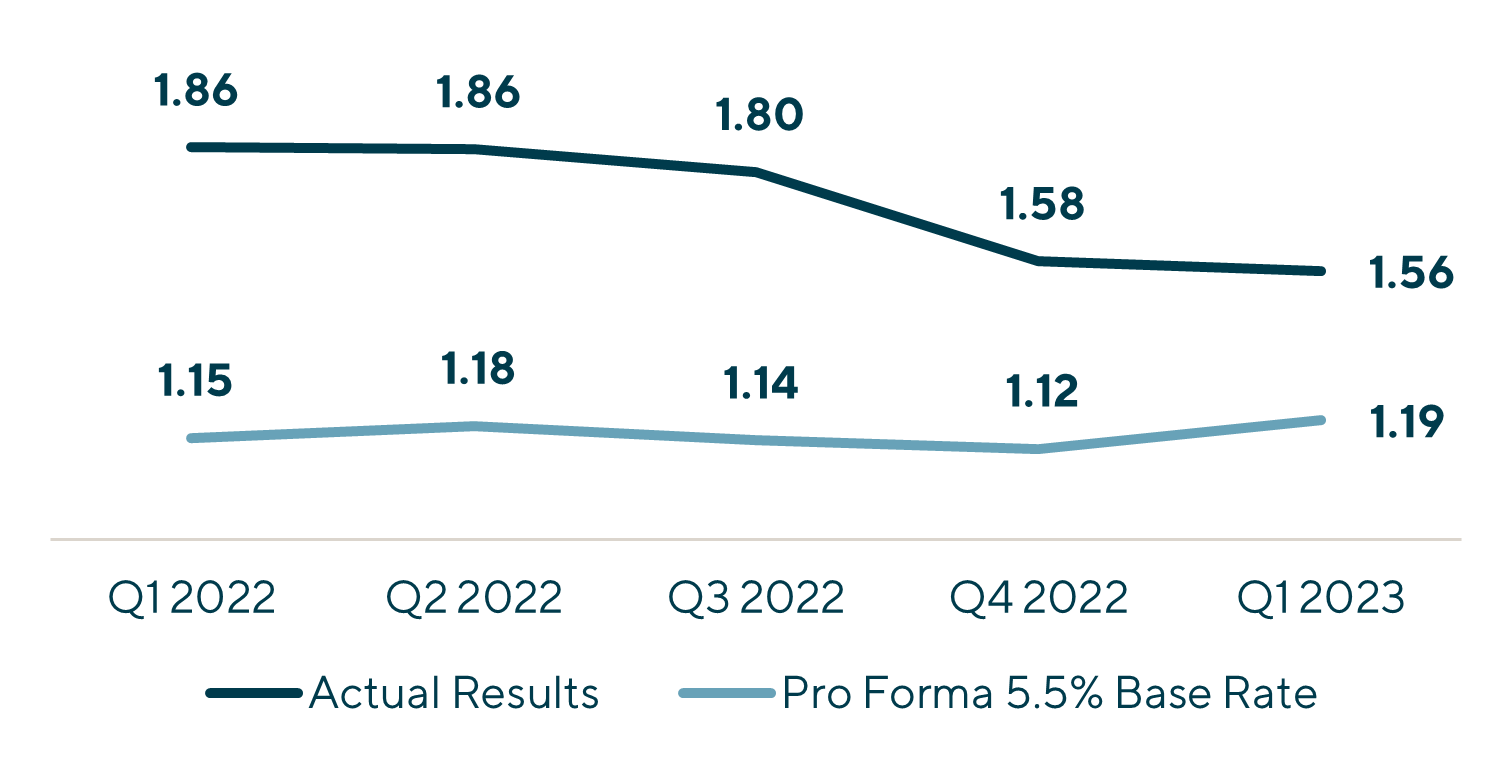

Size-Weighted Actual vs. 5.5% Base Rate2

| Interest Coverage Ratio

|

Fixed Charge Coverage Ratio |

Size-Weighted Percentage of Companies with Interest Coverage and Fixed Charge Ratios under 1.0x2

| Interest Coverage Ratio

|

Fixed Charge Coverage Ratio |

So, to the early question of “when do the M&A markets come back”, the answer rests greatly on the Federal Reserve, the broader economy and company performance against a debt load many companies are struggling to support…you be the judge!

What Action Should Sponsors Take?Sponsors must determine a strategy to bridge the coming months of challenges across their portfolio of companies. As one alternative, sponsors should consider accelerating a refinancing of their debt facilities at a time when the M&A markets are relatively quiet. With a dearth of activity and substantial dry powder, lenders are more willing to consider repaying out fatigued lenders compared to prior years. Further, structured capital solutions (such as holding company payment in kind notes or preferred equity) is one strategy successfully being implemented by Lincoln’s Capital Advisory Group to deleverage a business and put it back on the right footing. In the current market, Lincoln has seen a proliferation of capital raised to support structured capital solutions, and it offers borrowers a lifeline in a rising interest rate environment and declining cash flows. If you are interested in learning more about these securities and how best to use them, our professionals are well-versed and ready to provide sound advice for your situations. |

1) Source: Lincoln Valuation & Opinions Group Proprietary Database

Note: A default is defined as a covenant default and not a monetary default. The analysis was performed based on a size-weighted approach, which considered the total net debt balance for each of the portfolio companies that had a defaulting security in the respective quarter.

2) Source: Lincoln Valuation & Opinions Group Proprietary Database Calculations:

- Interest Coverage Ratio = LTM EBITDA – Capex / Actual LTM Interest

- Fixed Charge Coverage Ratio = LTM EBITDA – Taxes – Capex / LTM Interest Expense + (1% * Total Debt)

- Capital Expenditures (“Capex”) utilizes LTM Capex by default. If LTM Capex is not available, NFY Capex is utilized, and LFY Capex if both LTM Capex and NFY Capex are unavailable.

Meet U.S. Professionals with Complementary Expertise in Capital Advisory

We structure creative financing solutions for complex transactions in order to maximize optionality and value for our clients.

Alexander Stevenson

Managing Director & Co-head of Capital Advisory

Los Angeles

I strive to be a strong advocate for my clients and offer a fresh and creative perspective to financing situations that exceed expectations and provide the flexibility needed to grow their businesses.

Christine Tiseo

Managing Director & Co-head of Capital Advisory

ChicagoMeet Professionals with Complementary Expertise in Valuations & Opinions

I find immense fulfillment in enabling clients to achieve their objectives and navigate the complexities of today's ever-changing landscape.

Chris Croft

Managing Director & Co-head of Transaction Opinions

New York

I enjoy sharing insights about market and valuation trends with my clients, while also leading a differentiated and high-touch process.

Brian Garfield

Managing Director & Head of U.S. Portfolio Valuations

New York

I enhance my clients’ decision making and governance processes by providing independent and objective financial advice in a highly responsive manner.

Chris Gregory

Managing Director & Co-head of Transaction Opinions

New York

I enjoy the opportunity to provide clients with insightful and unbiased advice that will help them make the most informed decisions possible.

Ron Kahn

Managing Director & Co-head of Valuations & Opinions

ChicagoRelated Perspectives

Recent Transactions in Capital Advisory and Valuations & Opinions

Leading Indicators Show Declining Ability to Service Debt

According to Lincoln International’s proprietary private market database, maintained by Lincoln’s Valuations & Opinions Group, highly leveraged, privately-held companies are feeling the pinch as rising interest rates begin to take… Read More