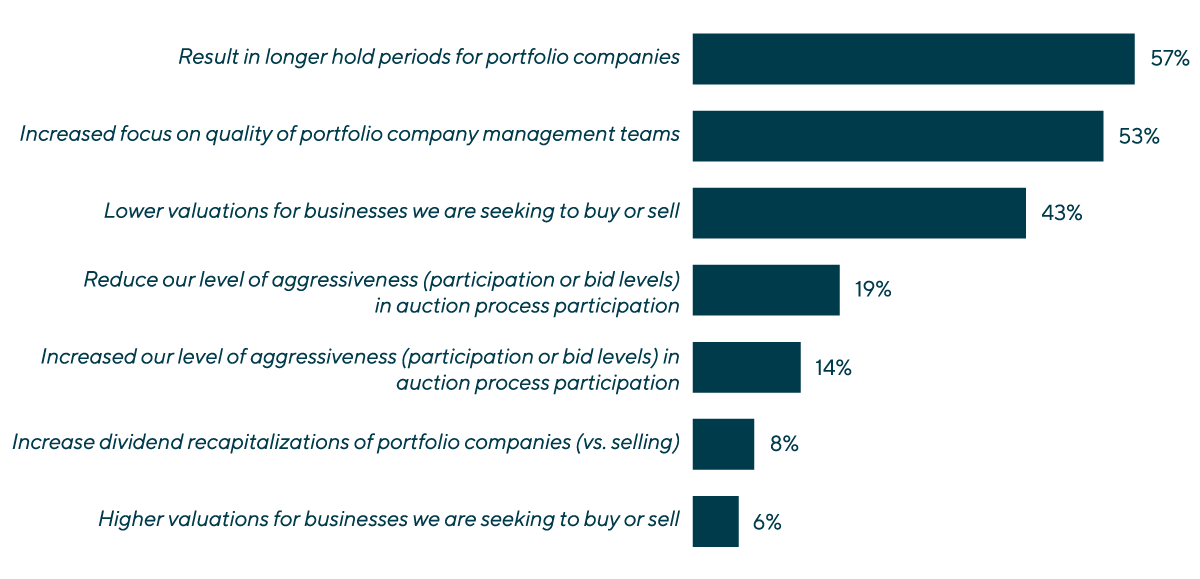

Hold On & Look InwardNearly 60% of respondents to the survey indicated that they will have longer hold periods for their portfolio companies in 2023 as a result of the economic environment. For PE investors in consumer, the challenging economic conditions have caused many to redirect attention that would otherwise be given to M&A toward optimizing performance within their existing portfolio companies. In fact, 53% of respondents reported an increased focus on the quality of management teams, indicating that company leadership is more important than ever in successfully navigating macroeconomic uncertainty and preparing for future growth. Valuations are also down in this environment, creating a misalignment between buyer and seller expectations as companies feel the impact of the inflationary environment on their bottom lines. Buyers are increasingly stretching out the due diligence phase and exercising extra caution to ensure they align their capital with the ripest opportunities—and on the right timeline. |

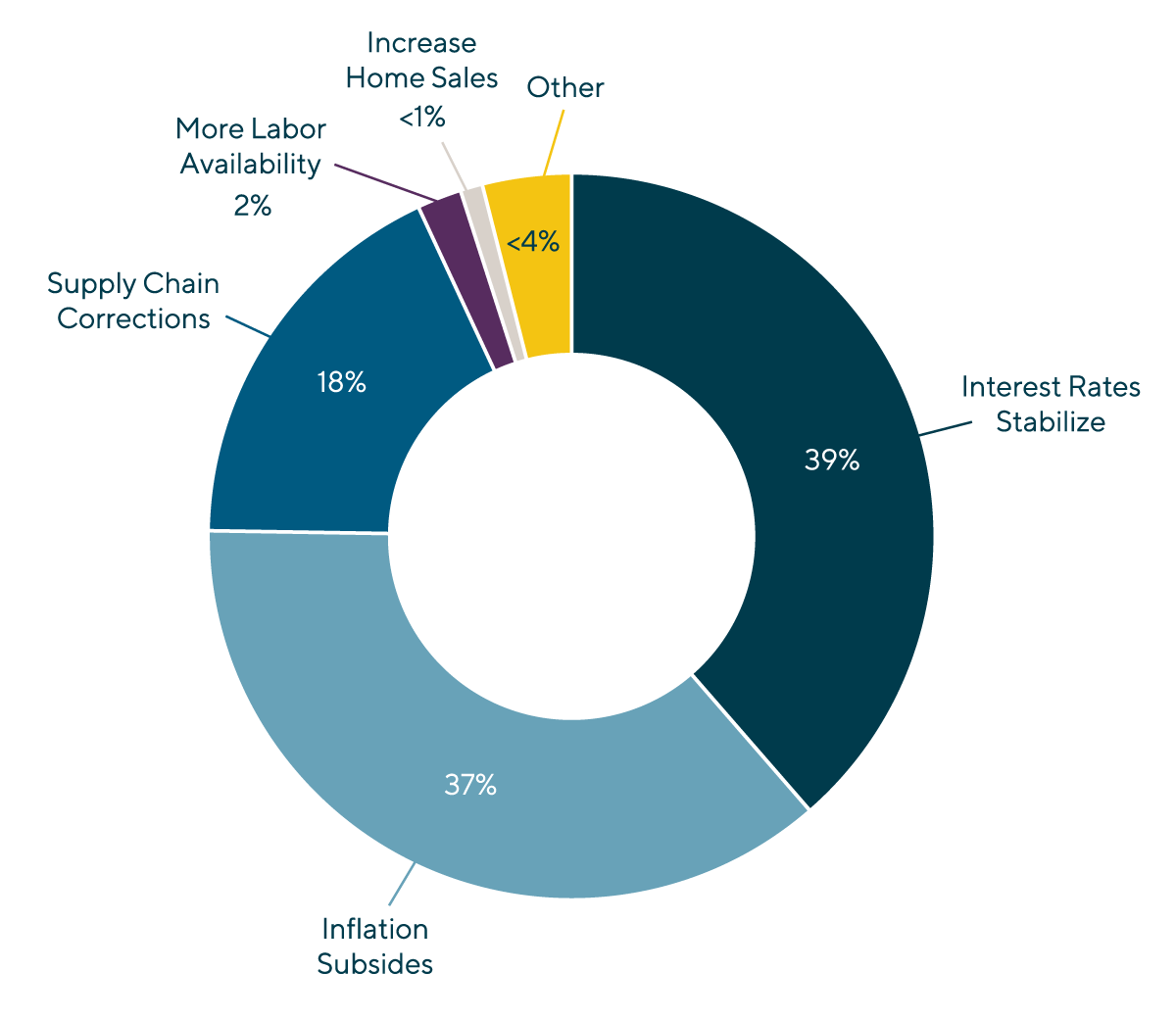

Indicators of an M&A ReboundWhen it comes to factors that can revitalize the M&A market in consumer this year, respondents overwhelmingly agree that interest rate stabilization and inflation subsiding will be the difference makers. Investor eyes remain trained on the Federal Reserve, whose rate hike campaign over the last year has caused delayed deal timelines, decreased debt availability and increased caution across the board. The rising interest rates also put more pressure on companies that were already struggling to make debt service payments. Supply chain issues have been a key concern over the past several years. 18% of surveyed investors agreed that ongoing supply chain corrections post-pandemic will restore confidence around steady state business performance indicators. As companies sell through excess, high-cost inventory purchased at the peak of the supply chain crisis, earnings will continue to show softness. However, we anticipate a meaningful uptick in the profitability of these businesses in Q4 and Q1, which should give sellers and buyers more confidence in transacting. It is clear that there remains a backlog of pent-up demand from both sellers and buyers to transact as soon as the markets support doing so. Sellers that delayed transactions for this past year generally have increased pressure to sell. Many buyers with coffers full of cash for deals are frustrated by the difficulty they see in finding deal flow. Because of these factors, we have confidence in the long-term outlook for the M&A markets. The main unknown is how soon these catalysts will help the market get back to a normalized level. |

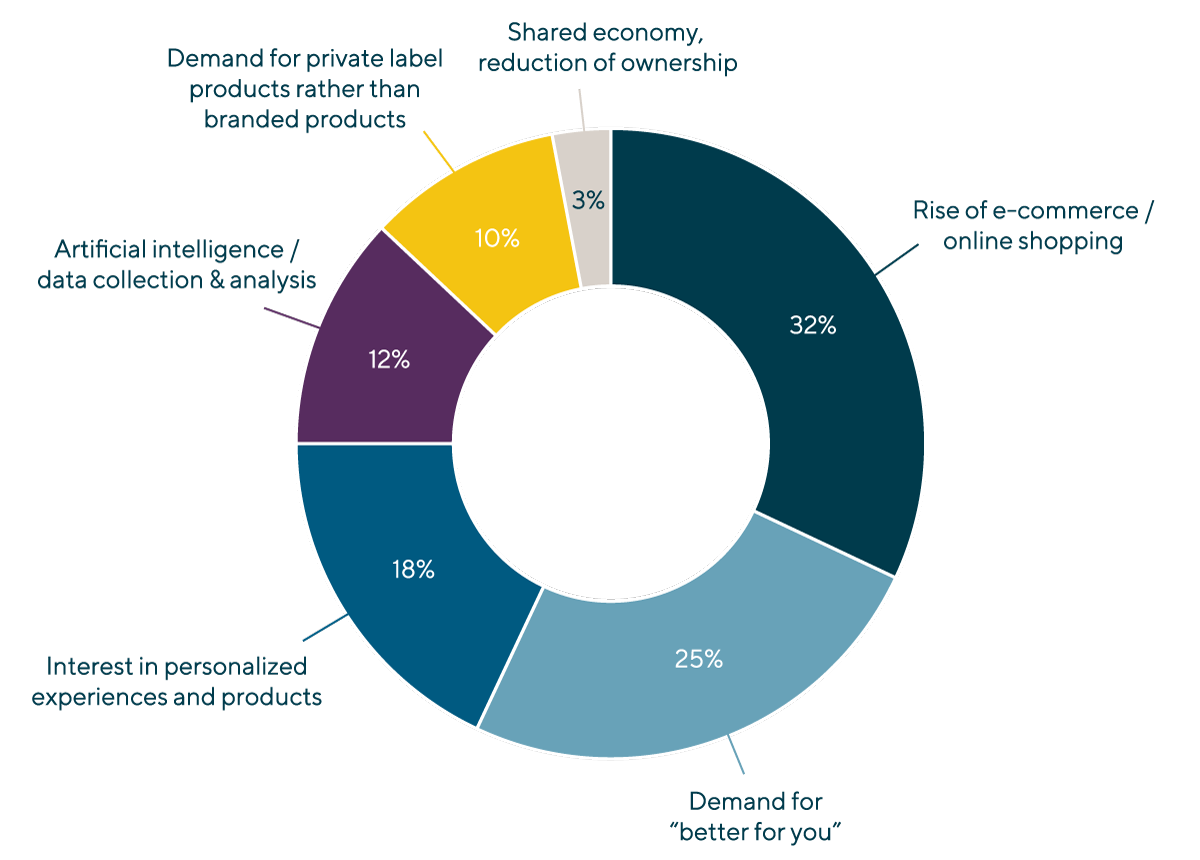

Online Remains On-TrendThe global e-commerce market that experienced spikes in 2020 during pandemic-induced lockdowns continues to grow, albeit at a slower pace. For consumer businesses, a solid and efficient e-commerce strategy has become a non-negotiable attribute for most prospective buyers. More than any other trend, 32% of respondents selected e-commerce and the rise of online shopping as the dynamic causing the most change in the consumer sector. In addition to a move to e-commerce channels, “better for you” products and services continue to be top-of-mind for consumers in the post-pandemic era, with 25% of respondents indicating the trend will continue to drive change across the sector. Consumers prioritizing their health and wellness has translated into new opportunities for investor dollars not just in food and beverage, but across a host of consumer subsectors, such as beauty, that are offering innovative offerings to align with “better for you.” |

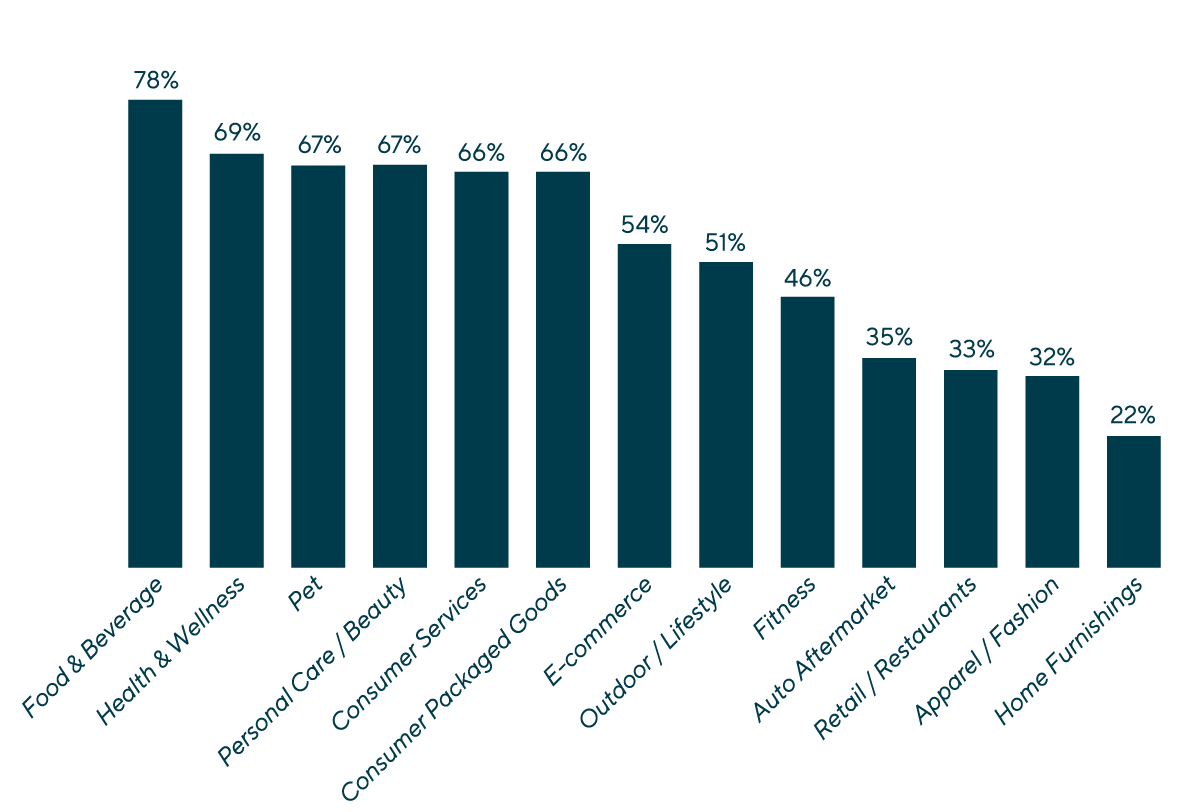

Most Likely Subsectors for InvestmentDealmakers see opportunity in food and beverage, health and wellness, pet and personal care / beauty, all categories that exhibit qualities of recession resilience and steady consumer spending. While the retail / restaurants and auto aftermarket sectors performed well prior to 2020, the pandemic drove shifts across the sector – leading to near-term boosts that have now stabilized, or entire behavior pattern changes that require strategic rethinking to address. That said, dealmakers plan to pursue a wide range of categories in their investment strategies in 2023, with 100 or more respondents selecting each category. |

American & European Consumer Group Heads

Through honest advice, passionate client service and hands-on execution, I strive to deliver outlier results for my clients.

Christopher Petrossian

Managing Director & Co-head of Consumer

Los Angeles

I take a long-term approach to building relationships and understanding clients' businesses in order to provide timely and relevant advice.

Alex Masters

Managing Director & Co-head of Consumer, Europe

LondonMeet Professionals with Complementary Expertise in Consumer

I have a hands-on approach and bring energy, creativity and passion to every client transaction.

Eddie Krule

Managing Director

Chicago

I design strategies and offer solutions that fit the unique ambitions of each client I serve.

Brian Little

Managing Director

Los Angeles

I take a long-term approach to building relationships and understanding clients' businesses in order to provide timely and relevant advice.

Alex Masters

Managing Director & Co-head of Consumer, Europe

LondonRelated Perspectives

Recent Transactions in Consumer

How Consumer Products & Services Companies Are Viewing M&A Outlook for 2023

In today’s dealmaking environment, uncertainty and caution reign supreme. Consumer confidence has seen declines as high inflation and recession fears dominate. At the same time, investors continue to look for… Read More

The Loadstar | Takeover Talk: Mid-sized Deals to Power 2023 M&A Activity

Originally published by The Loadstar on December 23, 2022. Dirk Engelmann and Gaurang Shastri, Managing Directors in Lincoln’s Business Services Group, share their expectations for logistics and transportation mergers and… Read More

Growing Local & Global Private Equity Interest in French Technology

The technology ecosystem in France is booming. In 2021 alone, French startups raised more than €10 billion in venture capital financing, a 2x increase over 2020. To date, the number… Read More

E-commerce, Sustainability and Digital Capabilities Drive Consolidation

Following a rebound in the first half of 2021, the outlook for the economy remains positive for the second half of the year as vaccination rates continue to climb and… Read More

Mergers & Acquisitions | M&A Forecast 2021: Logistics Deals Soar, as Covid Fuels E-Commerce

Gaurang Shastri, Managing Director with focus in Lincoln’s logistics and transportation sector, discusses with Mergers & Acquisitions the factors that will drive M&A activity in 2021. View full article originally… Read More

Cracking the Code: Innovation in Marketing Technology Sector Provides Opportunity for Private Equity Investors

Add to Cart: Pandemic Accelerates Investment in Digital Commerce Technology

Increased E-commerce Sales Generate Opportunities for Material Handling Automation Investors

Rapidly growing e-commerce sales, both in total dollars and as a percentage of total retail sales, is driving demand for more automated warehouse and distribution solutions. This has transformed warehouse… Read More

E-commerce and the Compression of Retail Disruption

In recent years, the consumer shopping experience was already experiencing rapid upheaval with e-commerce growing from 6.5% of total retail sales in 2014 to 11.0% in 2019(1); COVID-19 only accelerated… Read More

Auto Parts E-commerce Continuing to Hit on All Cylinders

Merger and acquisition activity within the auto aftermarket continues to showcase robust growth driven by strong industry fundamentals. The U.S. light vehicles in operation and miles driven continue to increase… Read More