Recycled Plastics Overview

Recycling of plastic packaging is a dynamic market given the increasing waste volumes following the continuous expansion of plastic packaging volumes and higher recycling rates. According to the European Commission, “Packaging is one of the main users of virgin materials as 40% of plastics and 50% of paper used in the EU is destined for packaging. Without action, the EU would see a further 19% increase in packaging waste by 2030, and for plastic packaging waste even a 46% increase.” From a regulatory perspective, recycling targets are constantly increasing as political decision-makers across the world are pressed to tackle plastic packaging pollution.

Large recycling groups dominate the market, having built or having been associated with building the national recycling infrastructures in their home countries over the past several decades. Benefitting from their legacy market position, these groups actively consolidate the market and can finance the required investments to capture significant market growth.

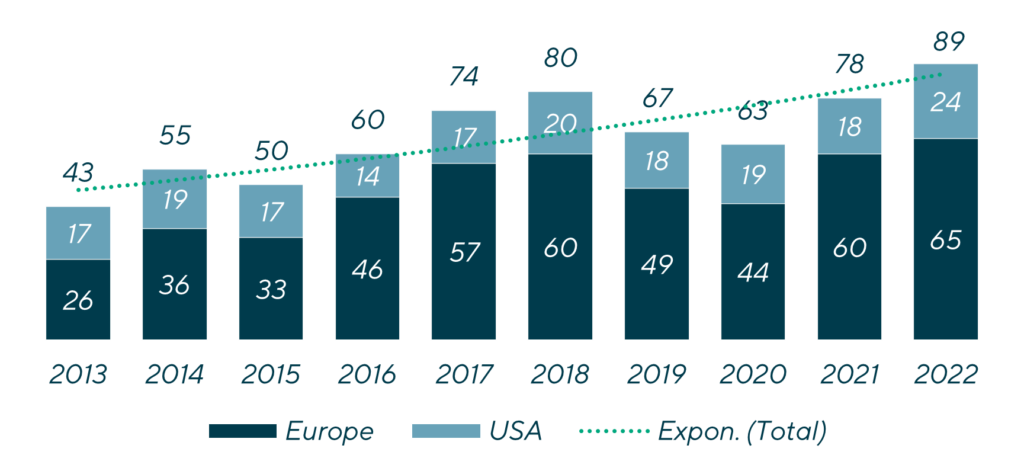

| Evolution of the number of strategic deals in Europe and the US

|

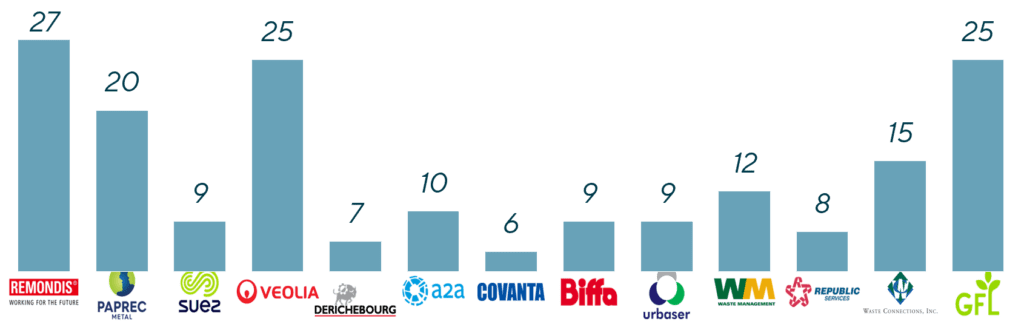

Key consolidators’ deals number since 2013

|

Infrastructure funds have been well identified and have invested in the sector for many years as these recycling groups perfectly fit their criteria of a large installed base of assets providing recurring revenue streams, a supportive regulatory environment, long-term growing demand and favorable pricing trends for recycled material.

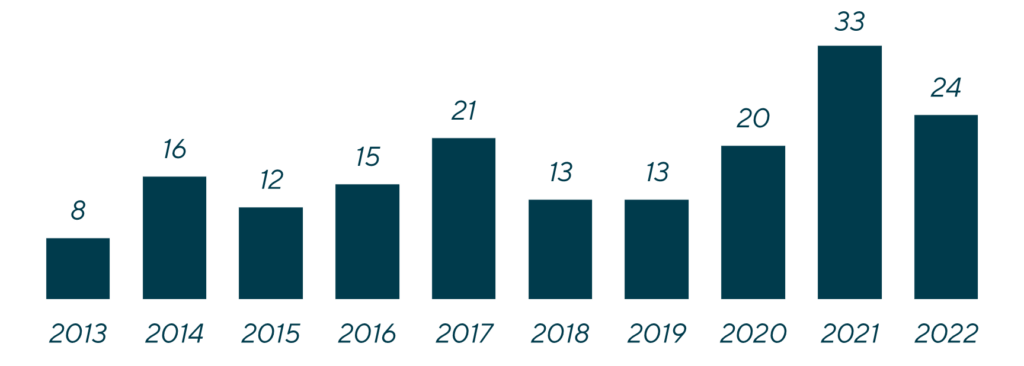

| Evolution of PE deal number since 2013

|

Landmark transactions led by infrastructure funds |

The market is not limited to such large players; meeting the ambitious recycling targets will require the involvement of all stakeholders involved. A vivid ecosystem of innovative companies is active across the value chain from artificial intelligence (AI)-based systems to better sort and collect waste, advanced recycling technologies to increase operating efficiency, material cleaning and preparation solutions to improve processing quality, packaging companies offering circular solutions to specialized advisory firms helping companies in their environmental transition. With the support of early investors and benefit from the favorable market environment, these companies are growing fast and can represent interesting opportunities for strategics willing to acquire new skills or for middle market private equity (PE) firms to take over and support them into their next development stage.

Lincoln Perspective

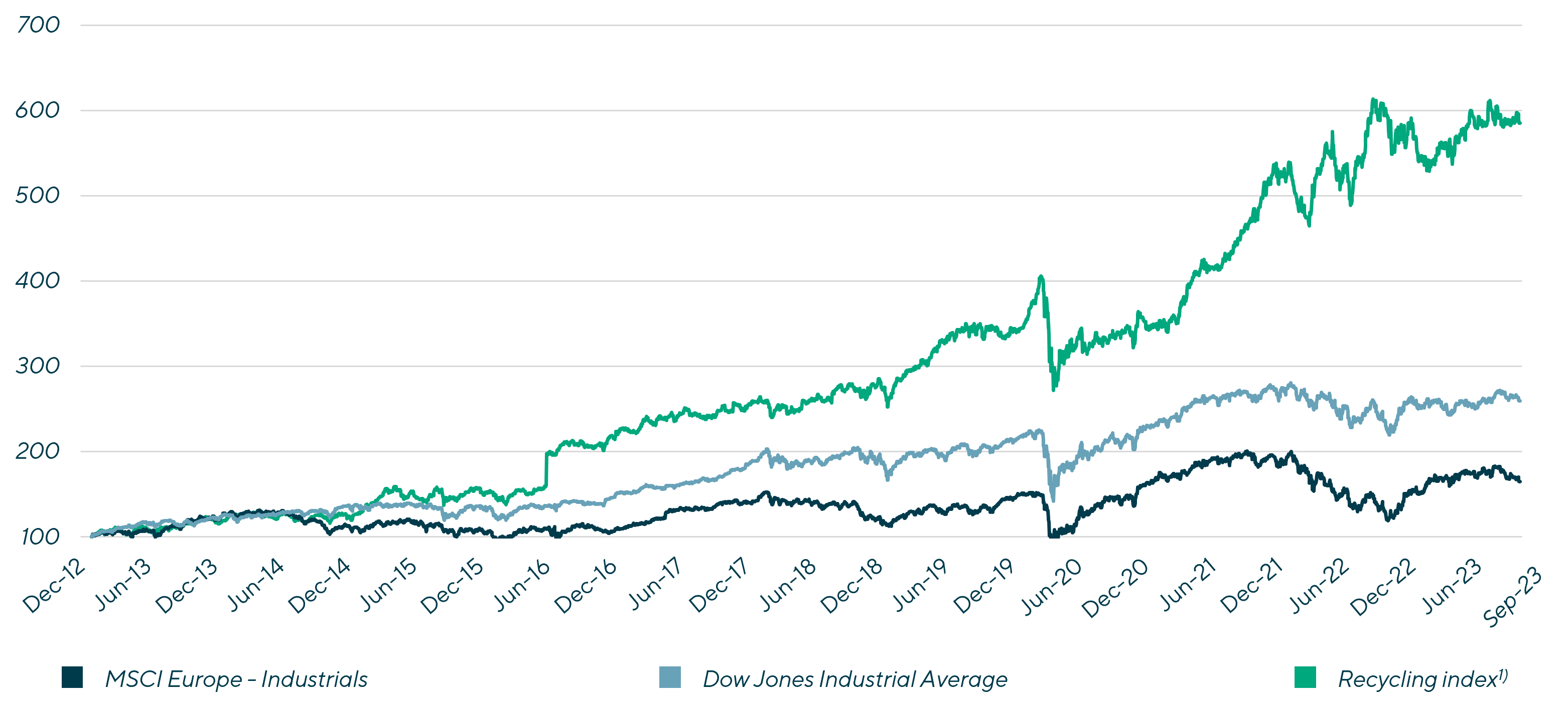

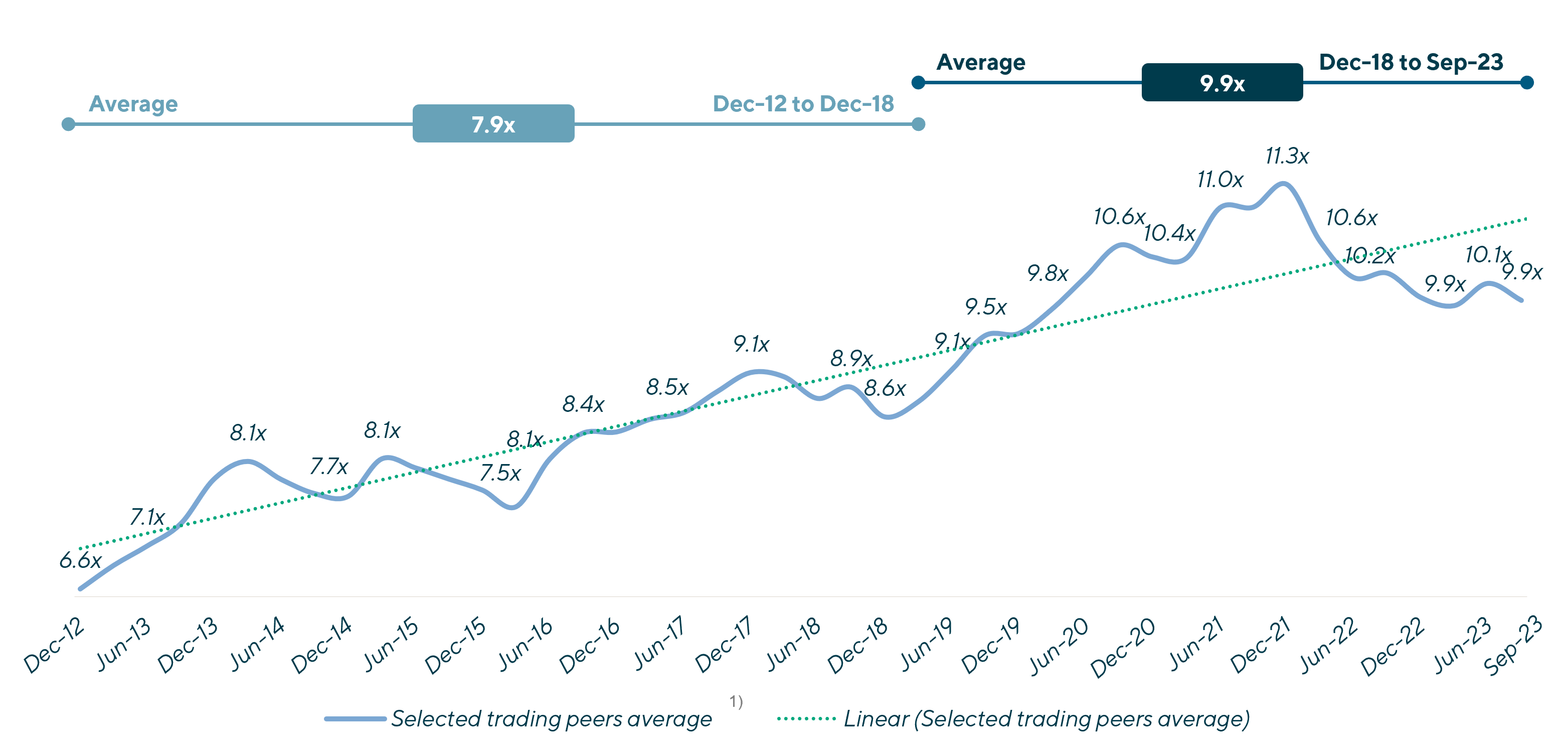

Illustrating the favorable market environment, publicly listed companies in the sector are trading at an all-time high.

From a transaction perspective, companies in the sector with a differentiated positioning and technology are highly desirable and scarce assets coveted by both financial and strategic investors can receive superior valuation multiples.

PE firms have ranked environmental transition investment themes as one of their top priorities and strategies, many of which are controlled by infrastructure funds, and are more than ever active in consolidating the market. Especially in the middle market transaction range, activity is poised to increase as companies in the sector become more mature and develop from start-ups to profitable and sizeable companies. |

Recent Transactions

Contributors

I strive to deliver value-added advice, leveraging deep industry knowledge and extensive industry relationships.

Guillaume Suizdak

Managing Director & Co-head of Industrials, Europe

ParisRelated Perspectives

Recycled Plastics Market Draws Investor Attention

Not a day goes by without the announcement of a new regulatory, industrial, or commercial initiative relating to the European circular economy, making it a major topic for corporates and… Read More

German Broadband Infrastructure Market Set for Further Consolidation

It is no longer a surprise that access to high-speed internet is a necessity for individuals, businesses and governments worldwide. In Germany, the federal government has recognized this and set… Read More

Investor Appetite for Frozen Food Grows

In the U.S. and in Europe the frozen food market continues to grow. The overall mega themes of products that are high-quality, clean, convenient, fresh, long-lasting, less wasteful and flavorful… Read More

The Loadstar | Takeover Talk: Mid-sized Deals to Power 2023 M&A Activity

Originally published by The Loadstar on December 23, 2022. Dirk Engelmann and Gaurang Shastri, Managing Directors in Lincoln’s Business Services Group, share their expectations for logistics and transportation mergers and… Read More

Long-Term Trends Underpinning Utility Services M&A

Investor interest in utility services will remain high given the numerous attractive tailwinds that underpin the sector’s resiliency and growth potential. For telecom, power, gas and water/wastewater, regulatory and public… Read More

Growing Local & Global Private Equity Interest in French Technology

The technology ecosystem in France is booming. In 2021 alone, French startups raised more than €10 billion in venture capital financing, a 2x increase over 2020. To date, the number… Read More

M&A Activity Remains Strong for Companies Supporting Employer-Sponsored Health Benefits

Employer-sponsored, self-funded medical plans have grown in popularity since the implementation of ERISA in the 1970s and now cover nearly two-thirds of all employees and one-third of all Americans. Medical… Read More

Animal Health Players Pursue Vertical Integration as a Path to Growth

Animal health businesses that have established a strong presence within their area of expertise, may be considering where the next best path to growth lies. While cross-border expansion and consolidation… Read More

E-commerce, Sustainability and Digital Capabilities Drive Consolidation

Following a rebound in the first half of 2021, the outlook for the economy remains positive for the second half of the year as vaccination rates continue to climb and… Read More

Race Toward Electrification: Automotive Players Define Investment Strategy for the Future

In 2020, global electric vehicle (EV) sales rose by 38%, despite a decline of 20% in total car sales around the world during the pandemic. In May 2021, IHS Markit… Read More

Our Economy Runs on Digital: Fueling Infrastructure Software Investment

As companies continue to move to the cloud and provide high-quality, global-scale cloud solutions, infrastructure software has seen a material increase in investment and consolidation, as evidenced by recent sponsor-led… Read More

Fleet, Field and Asset Management Software: Convergence Creates Investment Opportunities

Maintaining equipment, vehicles and other assets while also optimizing performance of employees and the work they do is a daunting task for any organization. To address this challenge, both large… Read More

Fragmented Product Lifecycle Management Technologies Present Investors with Opportunity to Consolidate Across the Digital Thread

Emerging IoT Innovations Attract Corporate and Private Equity Investment

The Internet of Things (IoT) has experienced steady uptake in recent years, offering businesses a range of cost-saving benefits including improved productivity, enhanced situational awareness and a reduction in human… Read More

Trading Places: CMS Policy Changes Flip the Script on Home Care Investment Options

By Barry Freeman, Co-Head, Managing Director, Healthcare Investment Banking and Michael Weber, Managing Director, Healthcare M&A Everyday 10,000 Baby Boomers in the US turn 65. Independent of market movements, demand… Read More