COVID-19 Impact On Auto Industry – How Long Will It Last?

Apr 2020

| The COVID-19 crisis has already had a profound impact on the global automotive industry. OEMs have shuttered assembly plants throughout North America and Europe and this has resulted in virtually all suppliers also ramping down production and furloughing workers. Liquidity is the number one focus for suppliers who are drawing down fully their availability under revolving facilities, implementing measures to reduce costs and capital spending and developing and monitoring 13-week cash flows.

The demand side of the industry has been hit too with March sales in North America down 33% and GM’s US sales in Q1 down 7%; FCA down 10.4% and Ford down 12.5% (all worse than analysts expected). The key question – and undoubtedly a tough one to answer give the current volatility – is how quickly can we expect the crisis to pass and for plants to start up and reach similar levels of capacity utilization as pre-crisis? Will this be a V-shaped recovery or a more U-shaped curve? |

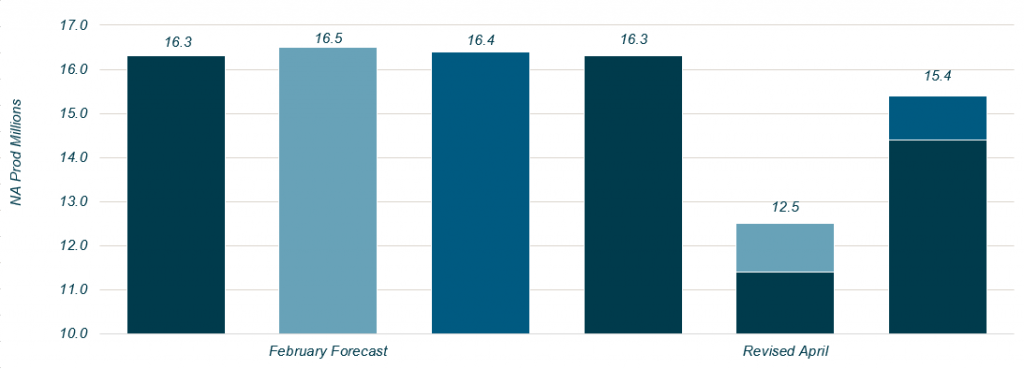

IHS has recently published its latest updates for forecast North American vehicle production, anticipating production in 2020 to be down by between 4-5m vehicles as a result of the impact of COVID-19 – production forecast now to be between 11.6m (pessimistic) and 12.5m (optimistic) vehicles from a previous forecast for 2020 of 16.5m. The pain is spread evenly across both the Detroit Three and the J- and E-OEMs. 2021 forecasts a return to production volume between 14.4m and 15.4m vehicle – back up by close to 25%. A quick bounceback when compared to previous downturns.

NA LV Production

Source: IHS

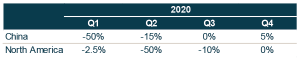

If we look at the latest production forecasts by quarter for 2020 and compare those for North America with the experience of the Chinese auto industry, which was the first vehicle producing region to be significantly impacted by COVID-19, we see the following:

Source: Wall Street Analyst

Production in China fell an estimated 50% in Q1 as the auto industry shut down. 12 weeks on from the first reported cases the industry was back on its feet with our clients now reporting production operating at between 80-100% of pre-COVID-19 levels. Large Chinese cities where manufacturers have operations have also began to offer incentives to revive car sales after COVID-19 hit the market. On March 31st, 2020 the China State Council announced the government will extend both purchase subsidy and 0% purchase tax for EV into 2022.

As lockdowns are extended by governments in North America and Europe so OEMs are extending the initial period of shut downs in these regions: GM & Ford have extended their shutdowns indefinitely in North America after initially setting unrealistic dates to get back up; earlier this week FCA stated they plan to re-open plants in the US and Canada on May 4th; JLR has just extended its shutdown from April 20 ‘for a few more weeks’. But yesterday we also saw the first glimmer of hope in Europe with Austria and Denmark announcing plans to ease their lock downs; Italy and Spain – hot spots in Europe – have seen the rate of increase in new cases slow; Daimler have announced plans to open some facilities in Germany on April 20th. Is the tide turning finally in Europe?

| The industry had to adjust to a collapse in demand in 2008-9 and experienced management teams have learnt how to ramp production down and be in a position to ramp back up effectively as demand returns. Most North American and European lock downs were implemented in March – although measures implemented were not as stringent as those in China – 12 weeks would take us to mid-late June. Hopefully we can see the auto industry starting up plants again in May with production back to more normal levels by not later than the end of Q2. The next question is what will the demand side look like then? |

Summary

-

Lincoln International's automotive & truck team discusses the impact coronavirus (COVID-19) has had on the sector regarding production and manufacturing.

- Click here to download a printable version of this perspective

-

Lincoln International has created a Playbook to support business leaders in documenting and articulating their COVID-19 response. To request a copy, click here. - Sign up to receive Lincoln's perspectives

Contributors

Meet our Senior Team in Automotive & Truck

Related Perspectives

“Leader to Leader” Series

The Leader to Leader video series turns up the dial on rich conversations with prominent leaders – from business owners and entrepreneurs to investors and CEOs – highlighting their stories… Read More

Lincoln’s Latest

Lincoln’s Latest video series features experts from across industries, services and geographies, sharing perspectives on current trends, recent observations and future outlooks.

The Lead Left | Webinar: 2023 M&A Outlook

Lincoln International is pleased to have participated in The Lead Left Presents: 2023 M&A Outlook, a webinar discussing market activity and expectations for the coming year. A few key takeaways… Read More

Lincoln International adds John McClure as Managing Director

Lincoln International, a leading global investment banking advisory firm, is pleased to announce the addition of John McClure as a Managing Director in the firm’s automotive and truck sector, a… Read More