Outlook for Industrials

Sep 2018

Strong industrials company performance and deal activity will continue to drive success in 2019, despite some uncertainty around tariffs and ongoing trade negotiations. Here are the trends we’re watching.

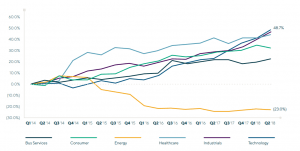

- M&A Market – 2018 has been a banner year for M&A. In the first half of 2018, $2.35 trillion of deals were announced globally, up 57% from the first half of 2017. Industrials has been a top performing sector in the Lincoln Middle Market Index:

Looking ahead, based on our deal pipeline, we expect the second half of 2018 to be stronger than the first half, putting companies on solid footing heading into 2019.

- Demand Drivers – Largely positive economic indicators in Q2 and Q3 bolster the outlook for current industrials:

- The U.S. economy remains on strong footing, with 4.2% GDP growth reported in Q2.

- In August, The Manufacturing Purchasing Managers’ Index (PMI) from the Institute for Supply Management registered the highest reading since 2004.

- Industrial production increased 0.4% in August and output increased 4.9% over the last 12 months, according to the Board of Governors of the Federal Reserve System.

- The Wall Street Journal reports that housing starts increased 6.9% over the first eight months of 2018, compared to the previous year, but builder confidence levels remain steady as building permits dipped in August and rising costs and labor challenges posed concerns.

On the other hand, the AIA Consensus Construction Forecast projects 4.7% growth in nonresidential construction spending, and a 4.0% increase for 2019. These numbers suggest cautious optimism for 2019 demand.

While agriculture, auto, and metals have been in the hot seat due to potential tariff impact, there are several bright spots in the outlook for the coming year. Industrial technology has shown solid growth and earnings during all cycles and has been very robust. Electronics and aerospace have also been outperforming.

- Operations Optionality – For years, industrial manufacturers have built up global supply chains, and suppliers want to preserve those relationships. We expect companies will try to negotiate to secure price reductions and avoid passing along costs of tariffs to consumers, but the hard truth is some companies with sophisticated supply chains may need to look at different markets. If a company impacted by tariffs is competing with one who is not, it is likely to impact sourcing Agility and flexibility are ideal. Companies want optionality in their supply chain, but generally these types of changes can’t be done quickly.

- Valuation Volatility – If tariffs or other economic changes impact the timing of orders, then that would naturally impact profitability and valuations. We have seen some deals where clients rushed orders to get ahead of tariffs, and others where they slowed production in anticipation of reduced demand. Private equity firms are watching this closely, but it’s not the only factor impacting valuations. We expect that continued strong interest in Industrial deals and continued positive economic indicators will keep any potential valuation swings in check.

Lincoln Perspective

Industrials is a resilient sector, and we see continued opportunity for growth and investment even amid trade uncertainty. Companies considering expansion or an exit in the coming year should connect with advisors to ensure their business strategy is aligned with economic indicators and covers potential changes to their supply chain, to be in the best position for growth that outperforms expectations.

Summary

-

Lincoln International industrials professionals discuss M&A in 2018 and beyond.

- Several trends are driving an even stronger second half of the year.

- Click here to download a printable version of this perspective

- Sign up to receive Lincoln's perspectives

Contributors

Meet our Senior Team in Industrials

I enjoy leading clients and realizing their objectives, while structuring solutions to issues that are both intriguing and challenging.

Øyvind Bjordal

Managing Director | Head of Switzerland

Zurich

Building long-term relationships is key for me personally – I want to be the advisor of trust for my clients.

Dr. Michael Drill

Managing Director | Head of Germany

FrankfurtRelated Perspectives

Packaging Quarterly Review Q1 2024

Supply chain constraints stemming from COVID-19 triggered significant shifts in demand, and access to, packaging supplies across various industries, as well as inventory management strategies. Over the course of the… Read More

“Leader to Leader” Series

The Leader to Leader video series turns up the dial on rich conversations with prominent leaders – from business owners and entrepreneurs to investors and CEOs – highlighting their stories… Read More

Building Products M&A Market Finds its Footing

The building products industry gathered at well attended conferences in early 2024. The National Association of Home Builders International Builders’ Show (IBS) and Kitchen and Bath Show (KBIS) attracted its largest crowd… Read More

Chemicals Quarterly Review Q4 2023

Expectations were low heading into the final three months of the year as stubbornly high interest rates caused a late summer downturn in the S&P 500. Despite a continued decline… Read More