Lincoln International Releases Proprietary Q2 2019 Middle Market Index

Lincoln International, a leading global investment banking advisory firm, today released the Q2 2019 issue of its proprietary Lincoln Middle Market Index (“Lincoln MMI”).

The Lincoln MMI is a first-of-its-kind index measuring changes in the enterprise values of private middle market companies over time—a barometer for the performance of private middle market companies generally. The Lincoln MMI enables private equity firms and other investors to benchmark how private company investments are performing against peers, and how this performance correlates to the public markets (i.e., S&P 500).

Highlights:

- Despite lingering trade frictions and an uncertain monetary policy outlook, the US public and private equity markets continued to trade at or near all-time record highs through Q2 2019.

- Growth in enterprise values varied by industry, with companies in the Consumer and Energy industries lagging their peers in the Healthcare and Technology sectors.

- Industry selection is becoming more important as companies in certain sectors struggle to increase revenue and earnings in what is a challenging growth environment.

Click here to view full report

Lincoln MMI continues to be upward sloping, but enterprise value growth varies across industries

For Q2 2019, the Lincoln MMI grew 2.8%, compared to 3.1% growth for the S&P. For the first half of 2019, 15.0% growth for the S&P far outpaced the Lincoln MMI’s growth of 4.7%. While both indexes since inception show relatively comparable growth in enterprise values, private equity owned companies traditionally have more leverage than public companies and, therefore, generate relatively greater equity gains.

Notably, enterprise value growth varies greatly by industry.

- Healthcare companies saw an average 9.5% growth in the first half of 2019 (5% in Q2);

- Technology companies saw an increase in enterprise values of1% in the first half of 2019 (3.9% in Q2).

Other industries have faced greater challenges, including the repercussions of imposed tariffs on China.

- Middle market consumer businesses experienced declines in enterprise value (5% in Q2).

- Energy industry enterprise value remained relatively flat since the beginning of 2019, as the industry exhibited the lowest enterprise value growth of any of the tracked industry since 2014.

Drivers of enterprise value growth

The data forming the Lincoln MMI comes from a database of approximately 1,100 to 1,500 private equity backed companies valued by Lincoln every quarter. While the overall portfolio of private equity companies continues to show growth, portfolio performance will be impacted by industry selection.

Notably, the trend of increased proforma adjustments to earnings has continued through Q2. According to the Lincoln, 70% of all companies being valued include some pro forma adjustment, with these adjustments accounting for approximately 25% of earnings.

As changes in enterprise values are composed of both changes in earnings and multiples, it is interesting to note the drivers behind the observed increase in enterprise value for both the Lincoln MMI and S&P 500. Professor Steve Kaplan, Neubauer Distinguished Service Professor of Entrepreneurship and Finance at the University of Chicago Booth School of Business, who assists and advises Lincoln on the Lincoln MMI stated, “While multiple expansion drove most of the growth in the S&P 500 in the second quarter, earnings improvement was aided by increases in market multiples for the middle market.”

An analysis of fundamental performance illustrates the average EBITDA of all middle market companies in the database increased by 6.9% in Q2, with stronger performance in the Healthcare, Business Services and Technology industries. Despite this, the average EBITDA over the same period for the Consumer and Industrial industries declined by 5.7% and 10.6%, respectively.

If the public market declines in Q3, will the Lincoln MMI will be negatively impacted?

In the past several weeks, the S&P 500 has declined, begging the question, are enterprise values of middle market companies now also declining? While the enterprise value of middle market companies is correlated to the public markets, the enterprise values for private companies are less volatile and typically adjust on a lag to public market changes. As a result, one would expect declines in middle market companies to be tempered as of today.

However, if the declining environment in the public markets persists, private company enterprise values are likely to decline. Ron Kahn, Managing Director and head of Valuations & Opinions Group stated, “It will be interesting to see how middle market companies perform in what has been a volatile Q3. One would expect middle market portfolio companies within counter cycle industries to weather the current storm, but it begs the question, for how long?”

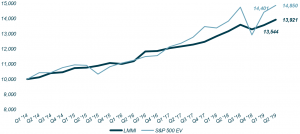

Graph 1: Lincoln MMI vs. S&P 500 (Enterprise Value)

Starting with a value of 10,000 as of March 31, 2014, the Lincoln MMI stands at 13,921 (as of June 30, 2019), reflecting a compound annual growth rate of 6.5%—versus 14,850 for the S&P 500, or a gain of 7.8%.

For more information, visit An Overview of the Lincoln Middle Market Index

About the Lincoln Middle Market Index

The Lincoln MMI is the only index that tracks changes in the enterprise value of U.S. privately held middle market companies—primarily those owned by private equity firms. With the Lincoln MMI, private equity firms and other investors can benchmark private companies’ performance against their peers and the public markets.

This index is differentiated from other indices as it (1) tracks enterprise values of private middle market companies over time; (2) is based on valuations rather than executive surveys; and (3) covers a wide sampling of companies across a range of private equity firms’ portfolios.

The Lincoln MMI seeks to measure the variation in middle market companies’ enterprise values by analyzing the aggregate change in company earnings as well as the prevailing market multiples for approximately 450 middle market companies each generating less than $100 million in annual earnings. The index is calculated using anonymized data on an aggregated basis by Lincoln’s Valuations & Opinions Group, which has distinctive insights into the financial performance of thousands of portfolio investments of financial sponsors, business development companies and private debt funds.

The methodology was determined by Lincoln in collaboration with Professors Steven Kaplan and Michael Minnis of the University of Chicago Booth School of Business. While other indices track changes to a company’s revenue or earnings, the Lincoln MMI is different in that it tracks the total value of these companies. Significantly, the large number of middle market companies used to create the Lincoln MMI helps ensure that the confidentiality of all company-specific information used in the Index is maintained.

Summary

-

Despite lingering trade frictions and an uncertain monetary policy outlook, the US public and private equity markets continued to trade at or near all-time record highs through Q2 2019.

- Click here to download the full LMMI report

Perspectives

Lincoln International launches Europe’s first private credit market quarterly benchmark

Private credit returns in Europe outperform broadly syndicated loan market over last five years London, 10 April, 2024. Lincoln International has launched Europe’s first private credit market quarterly benchmark, the… Read More

The Lead Left | Podcast: Private Capital Call

Originally posted by The Lead Left on April 2, 2024. Ron Kahn, Managing Director and co-head of Lincoln’s Valuations & Opinions Group, shares insights on current market trends, including the positive… Read More

“Leader to Leader” Series

The Leader to Leader video series turns up the dial on rich conversations with prominent leaders – from business owners and entrepreneurs to investors and CEOs – highlighting their stories… Read More

S&P Global | Private Markets 360° Podcast: Valuation Insights

Originally posted by S&P Global on March 21, 2024. Ron Kahn, Managing Director and co-head of Lincoln’s Valuations & Opinions Group, recently delved into the creation of the Lincoln Private… Read More