Industry 4.0

Sep 2019

Producing Value for a Growing M&A Market

| Imagine that a production line can gather data, analyze it and predict and correct mishaps before they occur—saving a manufacturer from the downtime required to repair a broken piece of machinery, or the cost of producing faulty product.

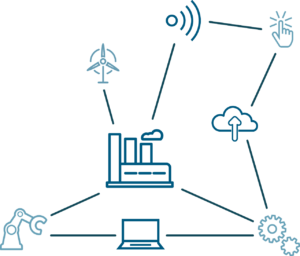

The term Industry 4.0 has been buzzing in the ears of tech providers, industrial giants and PE sponsors alike. But what exactly is the fourth industrial revolution and how will it impact the deal-making landscape? Industry 4.0 pulls together the innovations of the Internet of Things (IoT), big data, cloud computing and machine learning to envision a smarter, more connected and automated future of the manufacturing industry. It is about making processes more efficient through a combination of smart devices and connected machines, coupled with the software to analyze collected data to inform and improve operations. In a world powered by connected devices, manufacturers can now have a more comprehensive, real-time view into the efficiency of factory operations. They can examine various signals from temperature to maintenance intervals, keep tabs on production speed, detect issues before they occur and predict supply chain needs. Either human operators or, ultimately, artificial intelligence (AI), can help manufacturers determine what to do with these signals to improve throughput and optimize operations on the manufacturing floor. |

Summary

-

Lincoln International's Global Industrials Group takes a deep dive into the opportunities resulting from Industry 4.0.

-

- Click here to download a printable version of this perspective.

- Sign up to receive Lincoln's perspectives

Spotlight on Three Industry 4.0 Innovations

Smart PartsIn addition to big machines or big processes getting smarter, small devices are as well. This ultimately enables both the producer and the customer to make use of data. Historically, these devices were “dumb” components, like an actuated valve. Today, these parts are often outfitted with monitoring or automation technology, sending signals on process flow, alerting when maintenance is needed, or allowing remote valve operation. But having a smart component is not enough. Once a company has collected the data, they need capabilities codified in software to be able to teach the machines to interpret the data and make informed decisions. “In the future of Industry 4.0, AI will make machines able to think as humans do. For example, the human brain knows a storm is coming because it sees the sky darken with clouds and can piece together what is likely to happen next due to past experience,” explained Martina Ecker, Managing Director, Industrial Technology, TMT, Frankfurt. “In the same vein, a smart device must not just collect data—it must clean it, process it, analyze the implications and predict what may happen next—recommending a course of action.” |

Transforming Data into ActionWith many companies still in the early stages of technological adoption, collected data often sits idle and is not appropriately leveraged to inform business decisions. “Companies put a lot of sensors on the manufacturing floor to collect data, but systems need to be in place to iterate the loop of analyze, act and review results. This is one of the largest missed opportunities for the industry: figuring out how to make the data actionable,” said Adam Hunia, Director, Industrials, Chicago. Information coming from the production line could predict maintenance needs, increasing availability, reliability and the performance of key manufacturing assets. It could also identify areas for throughput improvement, enhancing profitability materially, minimizing waste and ensuring raw materials are available on time. |

3D PrintingOriginally, 3D printing failed to get traction, only viewed as a tool for prototyping. But today, new actionable daily use-cases have emerged. For example, bottling plants have been leveraging the technology on the factory floor to replace broken machine parts in real-time. This simple but disruptive change to manufacturing processes is a huge cost saver. By printing the damaged component on the spot, rather than ordering a new part and waiting for it to arrive, manufacturers can stay productive. Once they design the model for the broken part in one plant, they can reuse this design across their footprint. |

Case Study: IPG Acquisition of Genesis Systems Shows How Industry 4.0 Can Add Value

|

Genesis Systems Group sold to IPG Photonics Corporation (NASDAQ: IPGP)

Genesis is a leading integrator of robotic welding and automation solutions. For 35 years, they’ve developed innovative robotic system solutions for applications that include welding, non-destructive inspection, machine vision, materials handling, removal and dispensing. Genesis is a qualified robotic systems integrator for 300+ blue-chip customers in the transportation, aerospace and industrial end markets having established more than 6,500 robots in workcells. Genesis helps its customers solve the most difficult production challenges by designing and building solutions using digital design tools, advanced manufacturing technologies and robust tooling. Genesis closely collaborates with its customers from design to installation with innovative ideas and out of the box solutions. IPG Photonics embraced this capability to further bring its laser processing to Genesis’ key end markets and deliver high power laser welding and laser cleaning products. IPG’s laser technology is rapidly growing and customers will be able to rely on Genesis’ proven leadership to offer the best solution to meet their needs. |

Lincoln Perspective: M&A Implications around the Globe

U.S.

|

“The driving force behind Industry 4.0 in the U.S. is a need to grow and a lack of skilled labor to support that growth. How do you free up existing employees to work on new revenue streams? You automate processes and redeploy people to do something else within the facility. This is why we are beginning to see increased interest around integrators in the U.S. These companies help manufacturers examine their processes and find opportunities for automation. That may take the shape of welding, end-of-line packaging or product inspection that used to be done by hand, but is now performed by a machine.”

Adam Hunia, Director, Industrials, Chicago |

|

“Many industrial technology focused corporates have widened the aperture of their acquisition searches. Companies that were traditionally buying other product companies are at least interested in reviewing ideas that push the boundaries of Industry 4.0 and related software solutions.

Ultimately, what makes a mid-market deal attractive continues to be company-specific factors and differentiation—the moat around the product or technology to prevent competition and enable profitable growth. Private equity buyers continue to seek very discreet, specific growth opportunities underpinned by many of these macrotrends. We’re still in the nascent phases of the mid-market positioning their businesses for the future of Industry 4.0. Companies are in the discovery phase, but we expect to see continued interest and investment in this next big trend.” Ben Farris, Managing Director, Industrial Technology, Chicago |

|

“We are still at the early stages of Industry 4.0 with great potential for growth. For many companies, this means simply gaining access to the data flowing through legacy and offline equipment. By gaining access to this data, through edge digitization and cloud connectivity, companies are able to enhance their relationship with the end-user through machine learning, advanced analytics and predictive models (e.g. enabling features such as catastrophic failure analysis and predictive maintenance awareness). In some instances, legacy hardware players are coupling their existing hardware solutions with connectivity software. However, we are also seeing emerging VC and PE-backed players, provide hardware agnostic, horizontal software solutions which provide cloud connectivity and aspire to add advanced analytics.”

Michael Lippert, Managing Director, Technology, Media & Telecom – Hardware, San Francisco |

Japan

|

“Historically, Japan was a global leader in manufacturing hardware, i.e. equipment and components. But these days, clients are looking to transform into solution providers to better position themselves in the Industry 4.0 value chain. We are seeing strong interest in acquiring U.S. or European targets with the software capabilities to implement the transformation. Yet with few good targets available, acquisitions are hard to come by. Partnerships are often the most realistic path forward, and Japanese manufacturers are open to minority investments in early-stage companies if such investments anchor technological partnerships.”

Tetsuya Fujii, Managing Director, CEO Japan |

UK

|

“Those at the forefront of the technology curve will have an accelerated pace to their earnings, driving higher valuations. We expect to see a bifurcation of valuations between those companies that have turbocharged their business as part of the fourth great industrial revolution and those that aren’t on the same trajectory.

As Industry 4.0 progresses, we are going to see a lot more instances of companies building their own innovative solutions, partnering and acquiring. Today, there are more examples of partnering instead of acquisitions because the multiples in pure tech are very high. You need to be a big player with deep pockets to be able to buy into the pure play tech. There are also talent frictions reducing the number of acquisition targets. Programmers are much more interested in working at a tech start-up over an industrial conglomerate. From the PE sponsor perspective, there will be a lot of appetite for buying up tech players that can serve the industrials space.” Phillip McCreanor, Managing Director, Head of Investment Banking, UK & Nordics |

India

|

“As Industry 4.0 sweeps the world, India will become an exporter of software capabilities for Corporates and PE sponsors alike thanks to our strong software and integration base. We see startups emerging with a focus on integrating factory management systems as strong acquisition targets.”

Preet Singh, Managing Director, Mumbai |

Share your thoughts

All responses are anonymous

Contributors

I am resolute in providing honest, insightful and pragmatic advice to clients.

Adam Hunia

Managing Director

ChicagoMeet our Senior Team

I enjoy leading clients and realizing their objectives, while structuring solutions to issues that are both intriguing and challenging.

Øyvind Bjordal

Managing Director | Head of Switzerland

Zurich